The world’s largest asset manager, BlackRock, is exploring the tokenization of exchange-traded funds (ETFs). Anonymous sources familiar with the confidential discussions indicate the firm is investigating methods to transform traditional ETFs into tokens that would operate on public blockchains. The core idea is straightforward: create a digital version of an ETF that can move freely across blockchain networks while maintaining its connection to the underlying fund.

This shift to tokenized ETFs promises to unlock 24/7 trading, minimize settlement delays, and dramatically simplify cross-border transactions, effectively liberating these investment vehicles from the constraints of the U.S. market’s operating hours. The potential benefits extend to enhanced liquidity, broader accessibility, and the introduction of new features like programmability, instant settlements, and seamless integration with other cryptocurrency instruments. In practical terms, it means an investor could eventually hold a BlackRock Bitcoin ETF token in their own digital wallet or trade it on a crypto exchange like Coinbase.

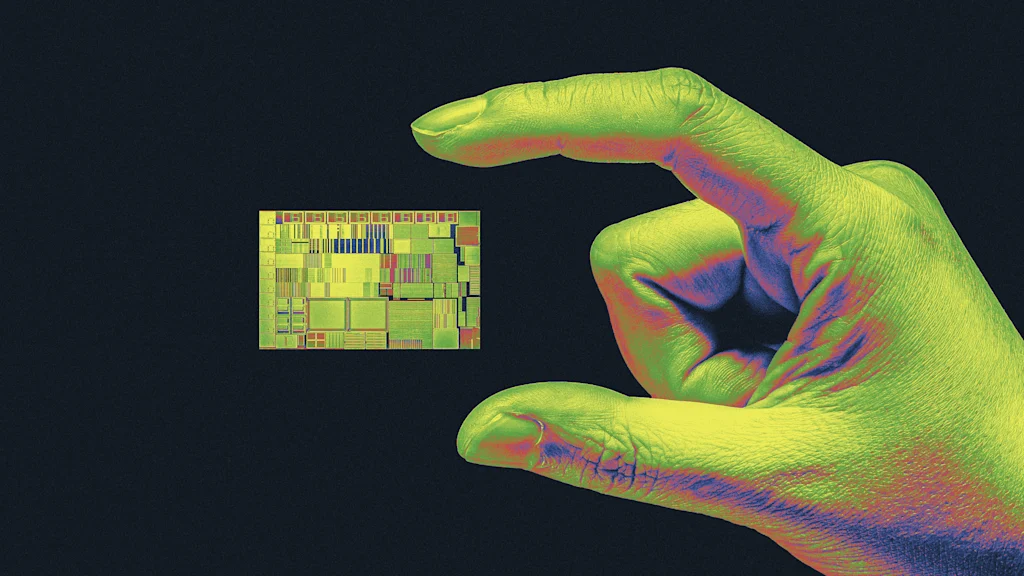

To understand the magnitude of this move, we must first look at what BlackRock has already built. Take their IBIT fund, for example. IBIT is a spot Bitcoin ETF that tracks the price of Bitcoin by holding the actual cryptocurrency in cold storage (with Coinbase Custody). Investors buy and sell shares of this ETF on a traditional exchange like NASDAQ, much like they would trade a stock. This structure provides exposure to Bitcoin’s price movements without the complexities of direct ownership—no need to worry about private keys, self-custody, taxes, or security. These ETF shares are not individually redeemable for bitcoin; retail investors simply trade them on the secondary market for U.S. dollars, gaining or losing fiat value based on BTC’s price.

Now, follow the sleight of hand. First, the world’s largest asset manager created a crypto surrogate like IBIT, cleverly navigating regulatory hurdles to offer institutions and investors a way to gain exposure without actually owning the asset. They aren’t buying Bitcoin itself; they are buying a receipt for Bitcoin—a Bitcoin surrogate. The actual Bitcoin is held by BlackRock and will never be accessible to the clients who bought these shares.

And now, BlackRock is preparing to go a step further. It is proposing to take these highly regulated stock market shares and transform them into tokens—digital assets whose very nature exists largely outside the traditional regulatory framework. There is no inherent, embedded contractual obligation within a token’s code that guarantees its price is pegged to Bitcoin. If this new token were to crash or become unpegged from the value of its underlying asset, who would be held responsible? The market would simply be left to sort it out.

In doing so, BlackRock can effectively flood the market with yet another layer of Bitcoin surrogates, this time with the potential for a practically uncontrolled emission that simply dissolves into the total market capitalization of the crypto space, inflating it with synthetic derivatives.

This is the modern playbook. You cannot stop or seize Bitcoin itself, but as we learned with paper gold, it is remarkably easy to flood the market with its substitutes. The irony is palpable: why would anyone choose to buy a tokenized version of a surrogate share for Bitcoin on a crypto exchange when, on that very same exchange, they could just buy the real thing—actual bitcoin that cannot be confiscated or devalued by an intermediary? The genuine asset, the actual Bitcoin, remains forever locked away in BlackRock’s vault, while investors are left trading its ever-more abstract representations.