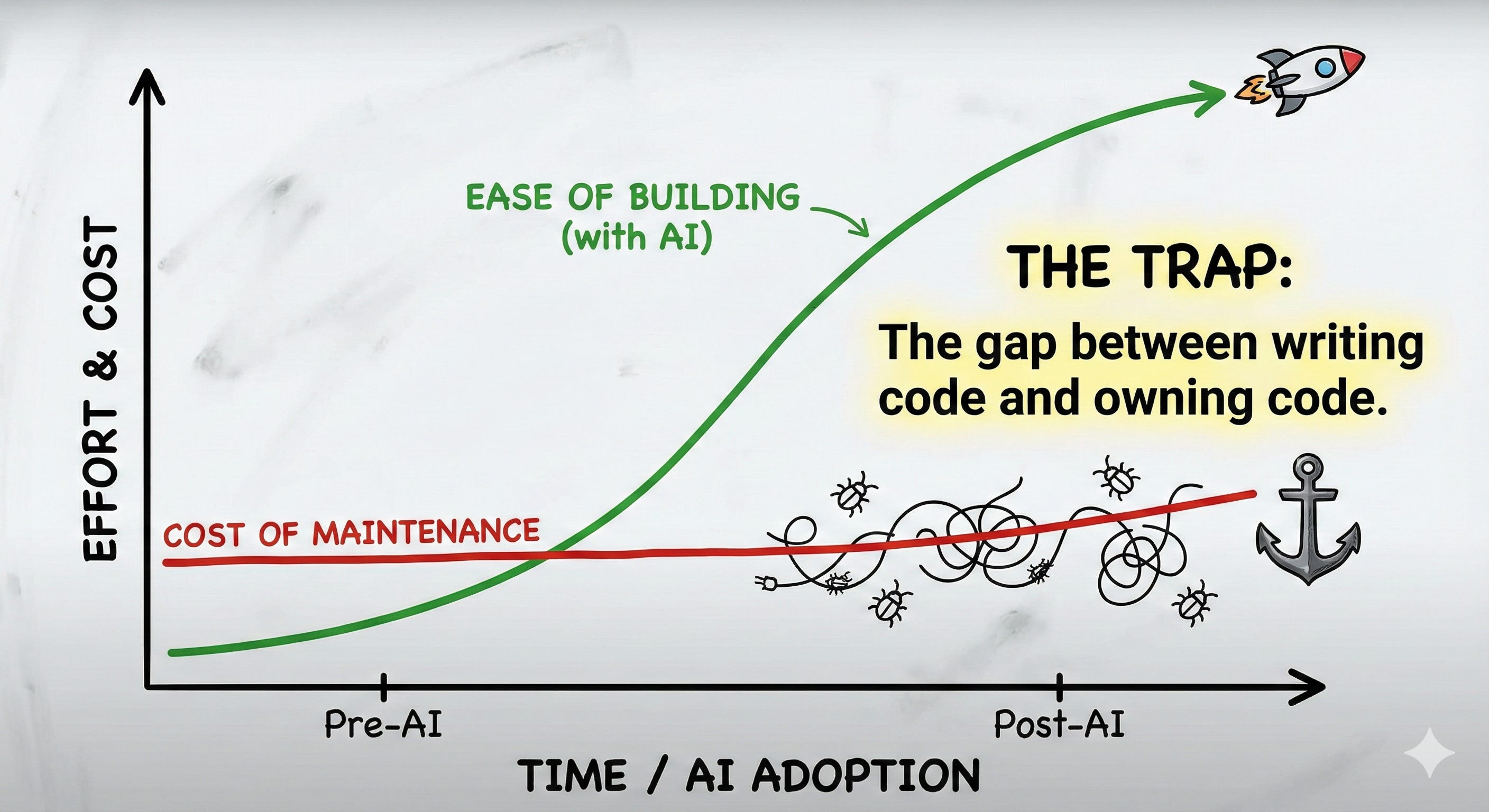

It’s no secret that software has undergone a profound shift. Much of the value users receive no longer comes from seats or licenses. Increasingly, the value is created behind the scenes—in background jobs, automated workflows, streaming events, and, now, AI models acting on a customer’s behalf.

Software has become continuous, dynamic, and often autonomous. But the business systems behind it just haven’t kept up.

Many companies still rely on tools built for a world where pricing was fixed, usage was predictable, and billing happened once a month. In today’s AI-driven environment, where products adjust and learn in real time, these old systems struggle. They can’t capture what’s happening quickly enough or reliably translate it into revenue.

This gap has led to a new class of problems. Finance chases discrepancies. Product delays launches. Leaders lose confidence in forecasts. And as companies invest more heavily in AI, these strains only intensify.

More and more, the issue isn’t the software. It’s the infrastructure that monetizes the software. Or in worse cases, the lack of it.

Why traditional billing systems are buckling

Consider the operational reality of AI products:

- Usage flows in continuously through APIs and event streams.

- Costs fluctuate with model load, customer behavior, and inference volume.

- New features ship quickly, often with new units of value attached.

- Customers expect visibility right now, not at month’s end.

Legacy billing systems weren’t built for this environment. They rely on batches, manual interventions, and rigid data models built for discrete usage. When confronted with AI-scale usage or hybrid pricing models, they often fall out of sync with the product itself.

This is why companies find themselves wrestling with familiar symptoms: delayed launches, broken forecasts, support tickets about billing accuracy, and revenue that doesn’t match usage data.

The root cause is structural. Modern software needs a way to connect product behavior with financial outcomes, continuously and reliably.

The emergence of monetization infrastructure

More leaders are adopting monetization infrastructure: a unified system that links product usage to pricing, billing, and revenue recognition in real time.

Unlike traditional billing tools that sit at the end of the process, monetization infrastructure spans the entire lifecycle of how value is defined, measured, and ultimately turned into revenue. In practice, that means:

- Product usage is captured as it happens, not hours or days later.

- Pricing logic is centralized and flexible enough to support both experimental models and enterprise agreements.

- Bills, credits, and forecasts update continuously.

- Finance teams see revenue tied directly to actual customer behavior.

In short, monetization infrastructure ensures that the business systems evolve at the speed of the product, and not the reverse.

How leading companies are using it

Look at the companies operating on the frontier of AI. Their ability to integrate new pricing models quickly isn’t just a function of product innovation. It reflects the infrastructure underneath.

Some of the most advanced AI platforms now launch new pricing constructs within weeks, and it’s not because they rush, but because their systems are designed to support rapid iteration. When they introduce a new model or adjust a rate, the update flows through their pricing engine, billing layer, and revenue reporting automatically.

Similarly, forward-thinking SaaS companies are shifting from pure subscriptions to hybrid models that blend seats, usage, credits, and outcomes. This is a shift that demands deeper connections between product data and financial systems. Without unified infrastructure, these models collapse under operational complexity. With it, they become a competitive advantage.

What ties these examples together isn’t a specific pricing strategy. It’s the ability to change pricing safely and continuously.

A strategic priority hiding in plain sight

As AI reshapes what software can do, monetization is no longer a back-office concern. It’s part of the product experience. Customers expect the same precision in their bills that they experience in the product itself. Investors expect clearer visibility into usage-driven revenue. Executives expect models they can forecast against with confidence.

Monetization infrastructure strengthens all three.

It gives product teams the freedom to evolve quickly. It gives finance teams accurate, real-time data. And it gives leaders a way to scale pricing strategies without re-architecting the business every time the product changes. The shift toward this infrastructure is still early, but it’s accelerating—specifically among companies building or adopting AI.

The next frontier of competitive advantage

Over the next decade, pricing innovation will separate market leaders from everyone else. But sustainable pricing innovation demands stable operational infrastructure. Companies that invest here won’t just move faster; they’ll monetize more accurately, build deeper customer trust, and create more robust financial models that reflect the value their products actually deliver.

In short: Software has evolved. The monetization systems powering it now need to evolve, too.