With income tax season just weeks away, the IRS says millions of taxpayers will qualify for the IRS Free File, which, as the name implies, is free.

For taxpayers who have used and paid for commercial tax preparation software, the process should be very familiar. You answer questions about your income and deductions and the software fills in the tax forms. The service is intended for people with an adjusted gross income of $79,000 or less. That includes a large part of the population.

Adjusted gross income, also called AGI, is defined as total income minus deductions, or “adjustments,” to the income you qualify for.

-

Gross income includes wages, dividends, capital gains, business and pension income, as well as all other forms of income.

-

Examples of income include tips, rent, interest, stock dividends, etc

-

Adjustments to income are deductions that reduce total income to arrive at AGI.

-

Examples of adjustments include half of the self-employment tax you pay; health insurance premiums for the self-employed; contributions to certain retirement accounts (such as a traditional IRA); interest paid on student loans; education costs etc.

-

You can find your previous AGI on your 2022 federal tax return and use it as a guide. If you filed a Form 1040, take a look at Line 11.

Two ways to archive

The IRS Free File Program is a public-private partnership between the IRS and many companies in the tax preparation and filing software industry that offer their online tax preparation and filing services for free. It offers taxpayers two ways to prepare and file their federal income taxes online for free:

-

Guided Tax Software offers free online tax preparation and filing with an IRS partner site. These companies provide this service at no cost to eligible taxpayers. Again, taxpayers with an AGI of $79,000 or less are eligible for a free federal tax return.

-

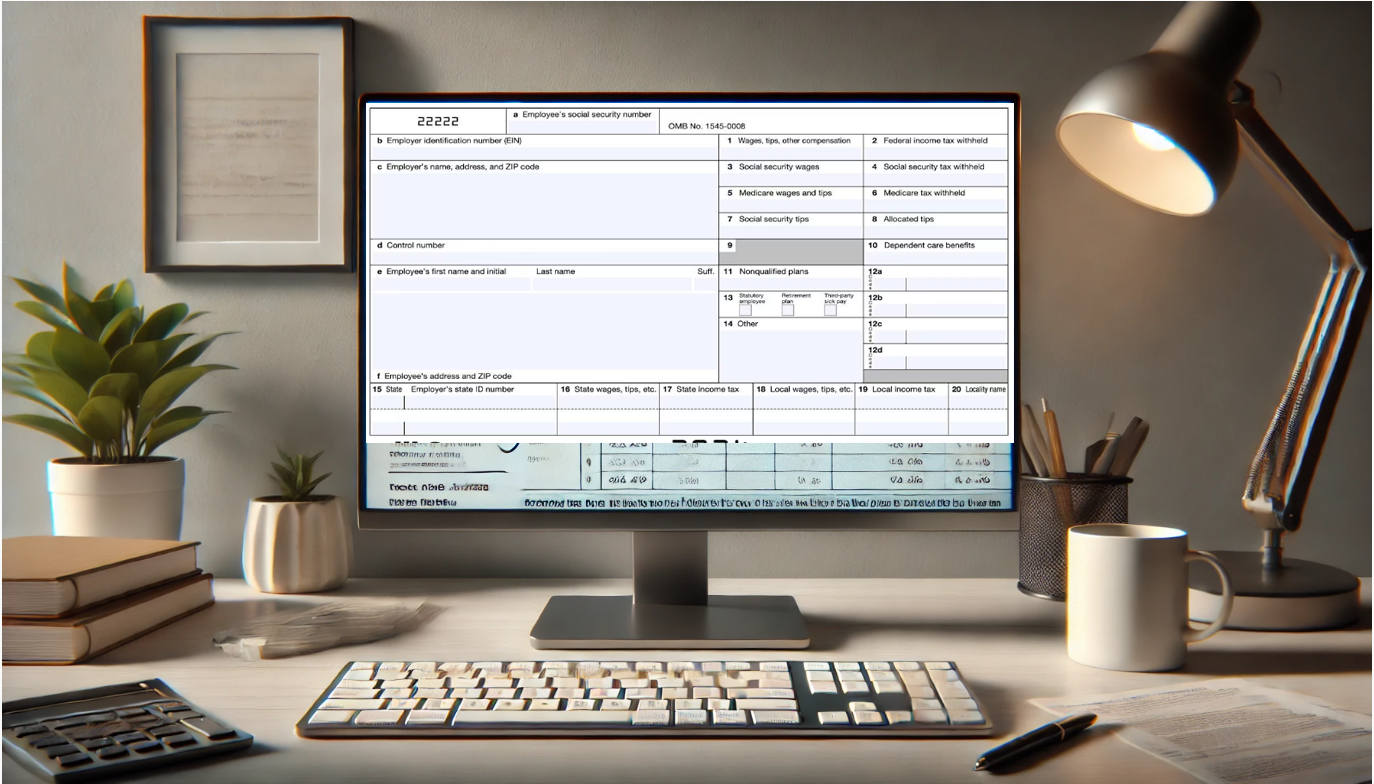

Free-fillable forms are electronic federal tax forms, equivalent to a paper 1040 form. You should know how to prepare your own tax return using form instructions and IRS publications, if necessary. It offers a no-fee option to taxpayers with an income (AGI) greater than $79,000.

Make sure you start the process on the IRS website. If you go to a commercial software company’s website, you will not be able to access Free File.

Currently, the official Free File site is closed, but will reopen in early 2025 when the IRS is ready to receive 2024 federal tax returns.