In crypto, nothing sounds more appealing than the word “decentralization.” It’s used as a badge of honor, a signal that no single company, government, or group can pull the strings. You see it plastered across whitepapers, websites, and press releases as if it were a stamp of authenticity. New projects often go out of their way to tell you they are “fully decentralized” from day one. It sounds powerful, but the truth is there’s no such thing as instant decentralization.

This concept isn’t a switch you flip. It’s more like building a city. If one person puts up a sign that says “Welcome to our democracy,” but they’re the only resident, that’s not real democracy or decentralization —it’s marketing. The word itself may have different meanings, but none of them support the idea that a project can be born decentralized overnight.

What Decentralization Really Means

Everyone in crypto loves to toss around the word “decentralization,” but it doesn’t always mean the same thing. As Vitalik Buterin explained, the concept comes in three different flavors: architectural, political, and logical. Each one describes a separate dimension of how control is distributed, and only looking at one of them can give a false or incomplete picture.

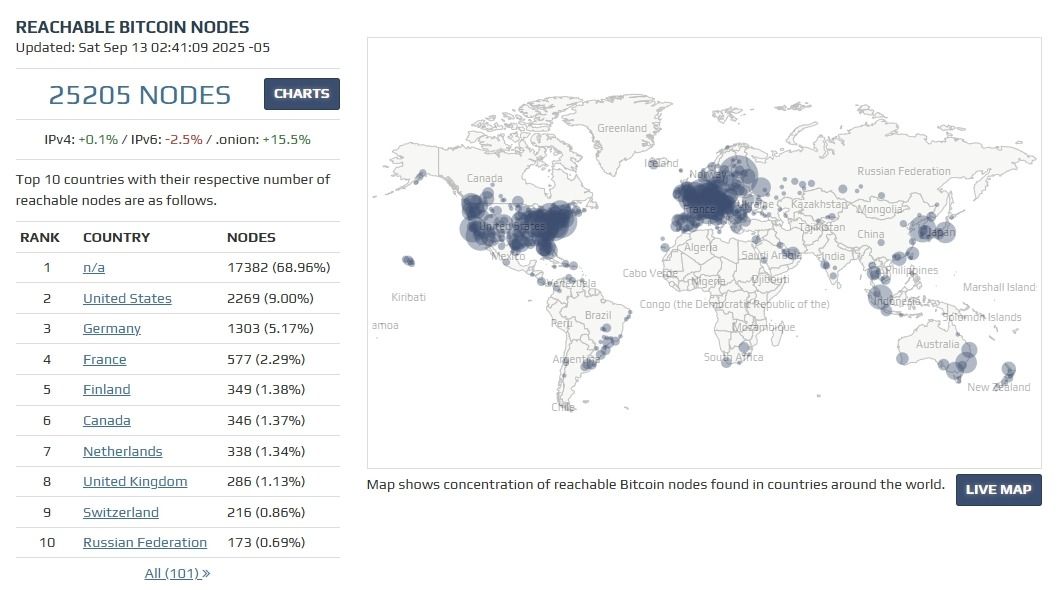

Architectural decentralization is about the nuts and bolts. It looks at how many computers are running the system and whether it could survive if some of them fail. A network with thousands of independent nodes scattered worldwide is harder to shut down than one that depends on a few data centers.

Logical decentralization deals with how the system behaves as a whole. If you split it into two, would both parts still work? Crypto networks aren’t usually logically decentralized, since everyone shares one state. That’s what lets them function as a single, global ledger we all can rely on.

Political decentralization is about power. Who gets to make decisions, steer development, or change the rules? In crypto marketing, this is the most common version pushed: “no single party in charge.” The problem is that early on, many projects rely heavily on a small founding group, so the promise can be more of a sales pitch than reality.

Even Bitcoin, the first cryptocurrency ever, didn’t begin with thousands of miners spread across the globe. It started with just a handful of enthusiasts and a tiny development team. Over time, it grew into a network of thousands of nodes, making it stronger against censorship or unilateral changes.

Why “Instant” Decentralization Doesn’t Exist

If you hear someone claiming a brand-new network is fully decentralized from the get-go, you should raise an eyebrow. In the early days of any project, the circle of developers and validators is small. A bug or decision in those first stages is often resolved by the founding team. That’s not a failure —it’s the natural way software grows.

Token distribution is another weak spot. Most launches concentrate ownership in a small group of insiders, even if marketing language suggests otherwise. That concentration matters because token holders often control governance, voting, and influence over upgrades. When insiders dominate token ownership, decentralization is more of a promise than a fact.

Code updates in the early months are also centralized. Projects depend heavily on their core developers to patch vulnerabilities or introduce new features. Without that central authority, a young network could collapse. Over time, decentralization matures as more independent participants get involved, and decision-making becomes harder to capture.

History is full of projects that claimed to be decentralized from day one, only to collapse under scrutiny. The Initial Coin Offering (ICO) boom in 2017 featured countless tokens promising community-driven ecosystems. Many turned out to be scams, some were abandoned or hacked, and others faced regulatory challenges for being more centralized than they admitted.

One of the highest-profile examples is EOS, which raised over US$4 billion in its ICO in 2018 and marketed itself as a highly scalable, decentralized platform with distributed governance. In reality, many of the power levers remained concentrated in the hands of Block.one (the company behind EOS), which controlled key decisions, funding allocations, and development path; promises for community-driven project funding often depended heavily on Block.one’s discretion. And those promises weren’t fulfilled.

Against all decentralization claims, the funds raised in the ICO remained in the hands of a few who mismanaged it, as it often happened with most ICOs. That contradiction exposed the gap between marketing and functioning decentralization, and this is barely one example among many.

Risks of Believing the Myth

So why should regular users care if a project isn’t as decentralized as it claims? The biggest danger is the concentration of power. When founders hold the keys, investors risk a rug pull, where developers drain funds and walk away. Even without outright scams, central control means governance capture. A few actors can dominate decisions, leaving users without much of a say.

Overreliance on founders also makes networks fragile. If one team handles all the upgrades, what happens when they burn out, disagree internally, or get pressured by outside forces? That’s not a network run by its community; it’s a startup with a token. Regulators are aware of this and tend to focus on projects that start with a central entity steering everything. The US SEC’s case against Kik’s ICO started because Kik’s founders marketed their tokens as an investment opportunity, precisely.

Concentration can even break technical resilience. Bitcoin Gold, launched in 2017 to “re-decentralize” Bitcoin mining, is an example of this issue. In 2018 and 2020, some malicious parties pulled off 51% attacks (where a group of miners attack the network for profit, if they’re the majority), double-spending millions. The problem wasn’t just a lack of maturity; it was the concentration of hashing power in too few hands. It’s a cautionary tale that calling a project “decentralized from day one” doesn’t mean it’s safe or resilient. n

Building Real Decentralization Takes Time

If there is one lesson to take away, it’s that decentralization is a marathon, not a sprint. More nodes joining the network, wider token distribution, and stronger governance processes all take time to develop. Open-source code is crucial since it lets anyone review and improve the project without needing permission. Permissionless participation is equally important, so anyone can become part of the network without gatekeepers. On-chain governance adds another layer, allowing users themselves to influence changes directly.

There are practical ways to check whether a network is progressing in the right direction. Ask yourself: Is one central organization controlling everything? Could that entity stop or censor transactions if pressured? Is most of the supply still sitting in insider wallets? These questions reveal whether decentralization is happening or just being advertised.

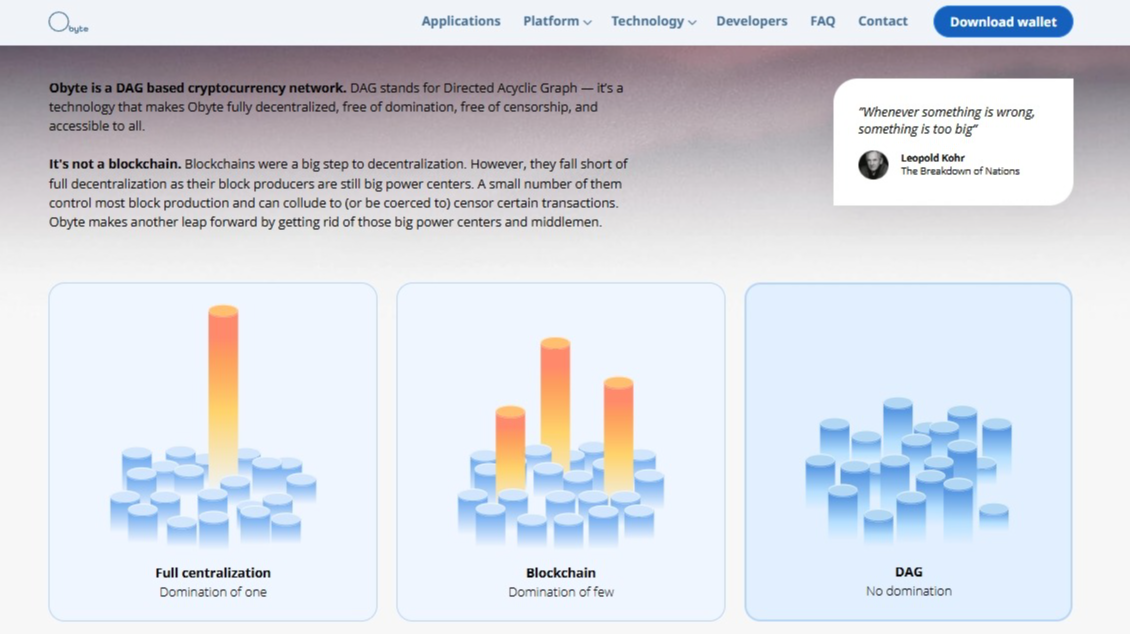

A useful example is Obyte, a network built with decentralization in mind. It runs on a Directed Acyclic Graph (DAG) structure rather than a blockchain, meaning there are no miners or “validators” who could block or censor transactions. Users themselves add their own entries. Over time, it has also added mechanisms like on-chain governance, so users can vote directly on technical changes.

Distribution also followed another path in this network. Instead of an ICO, the first 64.5% of native tokens (GBYTE) went to Bitcoin holders who opted in. Today, distribution continues through contributions: grants, development work, services for the community, contests, and the free market. Over 89.7% of its native coin supply is already circulating, which increases the diversity of ownership.

In any case, achieving robust decentralization takes patient growth, transparent practices, and consistent participation. The future can be bright for projects that embrace this slower, steadier approach. Quick fixes and bold claims might sell tokens, but real decentralization is earned step by step, and that’s what makes networks resilient.

Featured Vector Image by iconicbestiary / Freepik