Accelerating investment in AI infrastructure will remain a strong tailwind for chip stocks – and not just the GPU specialists.

We’re only a month into 2026 and it already looks like artificial intelligence (AI) stocks are poised for another year of strong gains. As hyperscalers continue to expand their data center capacity, investors understand that semiconductor stocks in particular will benefit.

However, the smartest investors are realizing that AI budgets are no longer just about buying GPUs and networking equipment. With that in mind, Micron technology (MU 4.80%) looks like a top AI chip stock to buy for 2026.

Image source: Micron Technology.

The new bottleneck of AI is memory and storage

According to a prediction by Goldman Sachsthe big tech sector will spend more than $500 billion on AI investments by 2026. If you just listened to the headlines, you’d think every penny of that went to the coffers of Nvidia, Advanced micro devicesAnd Broadcom. Right now, it seems like these three chip designers are announcing new deals or strategic partnerships just about every day.

Here’s what most investors miss: As more GPU clusters are built, AI developers are pushing their training and inference capabilities to the limit. Those expanding AI workloads face bottlenecks when it comes to memory and storage.

Micron specializes in high bandwidth memory chips (HBM). To drive home how important this niche of the chip world is, consider that the company predicts that the total addressable market for HBM solutions will grow at a compound annual rate of 40% in the coming years and reach $100 billion by 2028.

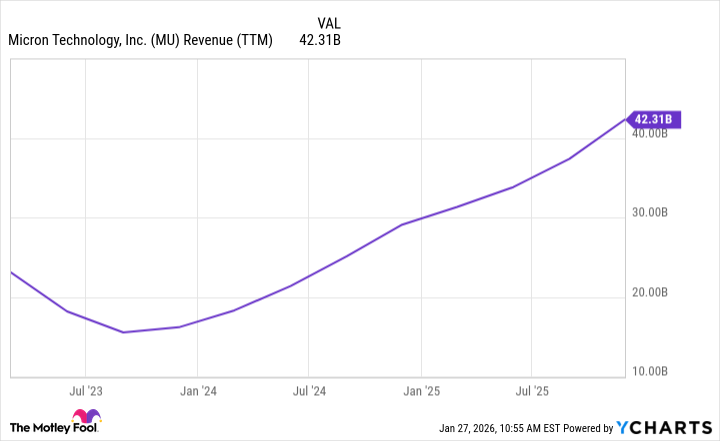

MU Earnings Data (TTM) according to YCharts.

Considering Micron’s last twelve month revenue isn’t even half the expected size of the HBM market, I think the company could be on the cusp of an epic growth arc.

Against this backdrop, and with demand for memory already far exceeding supply, Micron has enough leverage to raise prices for its memory and storage chips. As such, the company should be able to complement its revenue acceleration with healthy profit margins.

Is it too late to buy Micron stock?

Over the past year, Micron’s stock has skyrocketed nearly 300%. After that kind of gain, you might think it’s too late to buy the stock.

While a rise of that magnitude in such a short time frame would generally leave a stock overbought, Micron is a rare exception to that principle.

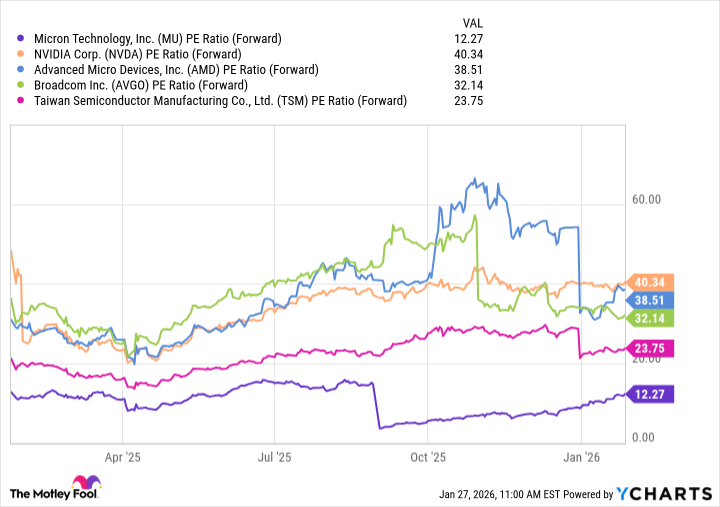

MU PE ratio (forward) data according to YCharts.

Micron’s forward price-to-earnings (P/E) ratio is significantly lower than other leading semiconductor companies. Even after the stock’s meteoric rise, Micron’s valuation pales when compared to other mission-critical chip players.

By 2026, Wall Street analysts who follow Micron expect earnings per share to triple to about $33. Should the stock price continue to rise and reach a price-to-earnings ratio of, say, 25 — slightly more in line with other must-have chip makers — Micron shares would double by the end of the year.

But don’t focus too much on specific implied price targets. The key takeaway from this analysis is that Micron is poised for explosive growth both in 2026 and beyond, with both earnings growth and valuation expansion on the horizon. As such, buying the shares now with the intention of holding them for the long term should lead to significant gains.

Adam Spatacco has positions at Nvidia. The Motley Fool holds positions in and recommends Advanced Micro Devices, Goldman Sachs Group, Micron Technology, and Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.