At the beginning of each year, as is our tradition, we collaborate with Enterprise Technology Research to dig through the latest data and craft 10 predictions for the coming year.

This year’s batch follows some annual favorites and new territory. In this Breaking Analysis, we put forth our top 10 predictions for enterprise tech in 2025 with our usual data-heavy opinions and prognostications.

Security leads inbound predictions from the community

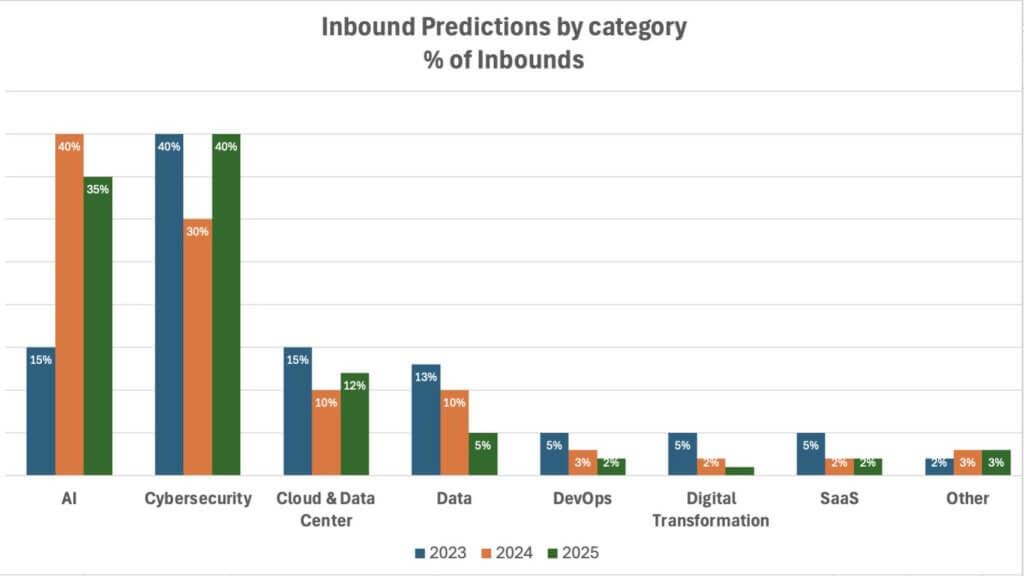

Every year we get thousands of inbound predictions from tech companies and thought leaders. We go through each one and we categorize them. The picture below gives you a sense of how many inbound predictions we review. Each year the folder gets larger.

Below we show the change in topic areas over the past three years. Remarkably, artificial intelligence, while still prominent, was second this year after cybersecurity. Now in fairness, many of the security predictions involved AI, but it’s notable that generative AI last year propelled AI to the top category with 40% of the inbounds and cyber, which dropped as a percentage of the total last year, has shot back to regain the top spot it held in 2023. As well, cloud and data center grew after last year’s decline and, surprisingly, data continued its downward trend — surprising because there’s not much AI you can do without data.

We had several inbound predictions around DevOps but fewer than in past years, and digital transformation, once the buzzword of the day, has all but disappeared from the predictions narrative. Software as a service is still showing some life and, as with cybersecurity, the SaaS inbounds were sprinkled with AI throughout. And the “Other” category remained noticeable with topics around edge, public policy, jobs, social issues and the like.

Most of the inbounds were more trends than predictions but there were a few that stood out. Just to give you a taste:

The email subject line on predictions from Kevin Cochrane, the chief marketing officer of Vultr Inc., was Vendor Predictions that Don’t Suck. Cochrane predicts the following two items:

- Cloud innovation will die unless walled gardens are broken.

- All hail the sovereign cloud.

We’ll see. The hyperscalers are likely to remain fairly walled with massive ecosystems that will allow them to claim openness through choice. And in our view they will get their piece of the sovereign AI pie.

Another standout was from Zencoder Chief Executive Andrew Filev, who predicted massive coder productivity increases via agents culminating in the following prediction:

- Andrew’s mom will write her first software program in 2025.

And one more from Tarun Desikan of SonicWall Inc., who predicts:

- There will be a major cyberattack that uses Mission Impossible-style impersonation enabled by modern AI. Think 3D face masks, voice modulators, adaptive contact lenses and more to impersonate people.

We hope this last prediction misses the mark!

As a reminder, last week we hosted the “Data Gang” with a number of predictions around data platforms and related topics. OK, let’s move on to this year’s predictions from theCUBE Research and ETR.

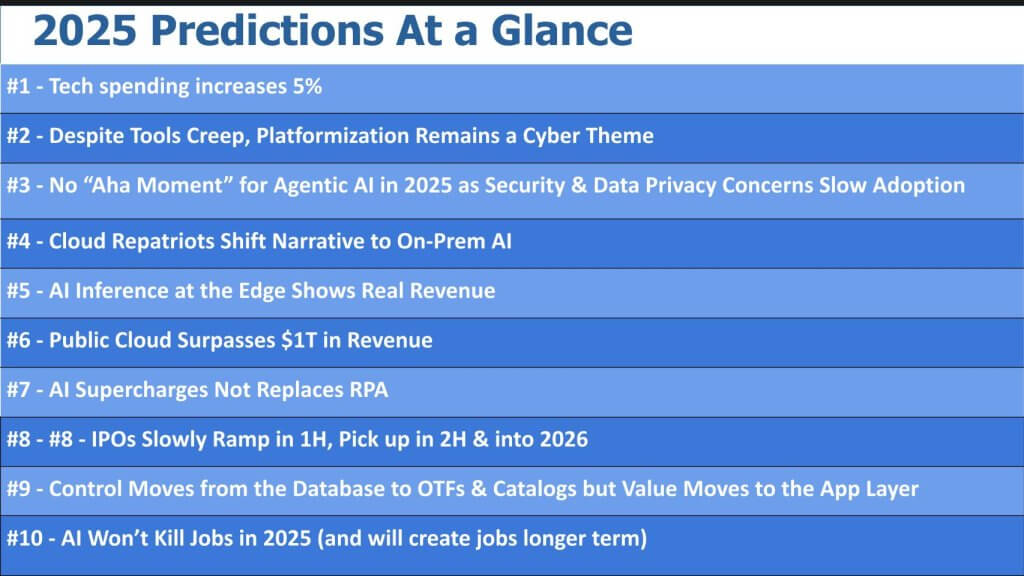

Quick scan of 10 predictions for 2025

Above is a glance at all our predictions for this episode on one chart. They span macro tech spending, security, agentic AI, cloud computing, edge, intelligent automation, initial public offerings, data and jobs. We won’t spend too much time on this graphic, but it will give you a quick overview of this year’s menu.

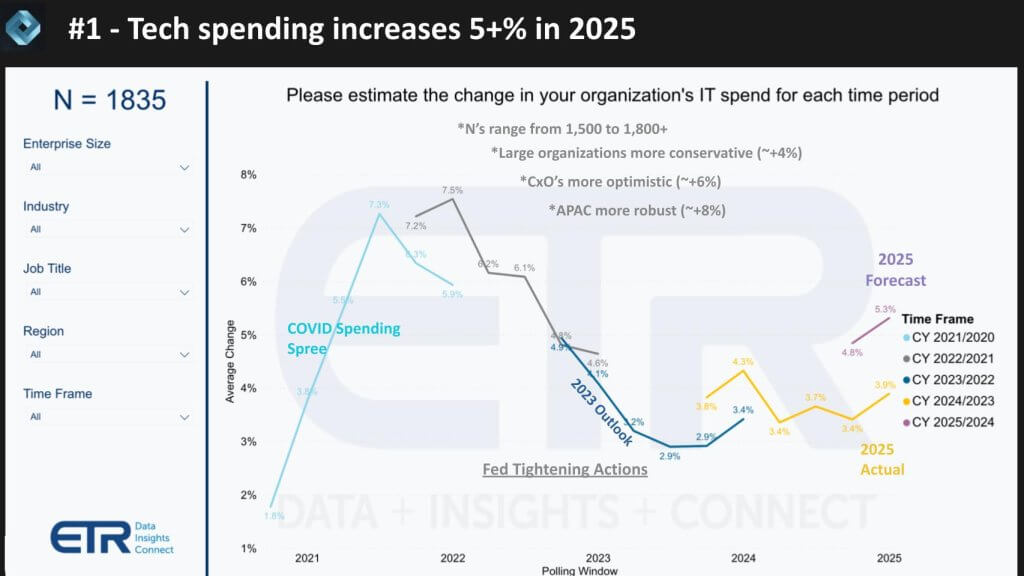

N0. 1: Tech spending will increase by just over 5% this year

Each quarter ETR conducts its TSIS survey with Ns ranging from 1,500 to more than 1,800 on the above chart that measures expectations all the way back to the COVID era. As shown above, we came out of the isolation economy with very high expectations of 7.5% growth and that steadily decelerated as the war in Ukraine and the Fed tightening actions kicked in. We finished 2024 at just around 4%, which was a little lower than we predicted last year, and we enter 2025 with a 5.3% growth expectation from information technology decision makers.

The following provides additional context for this prediction:

Enterprise IT spending has shown signs of recovery following a period of uncertainty tied to macroeconomic and geopolitical concerns. Though headlines warned of an impending recession, technical indicators never confirmed it, and new IT projects are now re-emerging. Our research indicates that overall budgets are on the rise, buoyed in part by a generally business-friendly environment and easing regulatory concerns, though a degree of unpredictability remains. In particular, small and medium-sized businesses are outpacing larger enterprises in spending, and optimism among C-suite executives is running higher than that of front-line practitioners.

- Spending rebound: After peaking above 7.5% growth toward the end of lockdown, spending slowed on recessionary fears. However, recent data suggests that activity has picked up again, with an average of just above 5% growth. Of concern, larger firms have somewhat softer expectations below 5%, while SMBs expect over 6% increases in tech spending.

- Sector discrepancies: Financial services and insurance are showing the highest growth rates, while retail and consumer-facing businesses remain cautious on inflationary concerns.

- Budget increases and projects: Many organizations have resumed or initiated new IT projects, reflecting renewed confidence despite persistent geopolitical uncertainties.

- Executive optimism: The C-suite and management layers are notably more bullish on spending and future technology initiatives, while frontline practitioners maintain a more conservative outlook.

- Regional nuances: Asia-Pacific appears especially strong, with spending growth approaching 8%. However, recent developments — such as new regulations — inject uncertainty in some Asia-Pacific countries. Not just China but countries such as Malaysia may be at risk of U.S. protectionism. This adds a layer of complexity and potential risk to the region’s momentum.

Bottom line:

We believe the data points to a gradual but genuine revival of enterprise IT investment and an underlying tone of positivity given the new administration in the United States. Nonetheless, pockets of uncertainty remain — particularly around inflation, regulatory shifts and geopolitical dynamics. Over the coming quarters, we expect organizations will revise forecasts to reflect evolving market signals. The past three years have shown actuals coming in below expectations although the delta is compressing in what remains an unpredictable macro environment.

No. 2: Platformization remains a theme in cyber and gains traction despite tools creep

Our second prediction goes right to the top topic of our inbounds, security.

We’re predicting that despite the fact that organizations tell us they struggle to reduce the number of tools in their security stack, the idea of platformization will continue to gain traction in 2025 and become a more prominent theme amongst buyers.

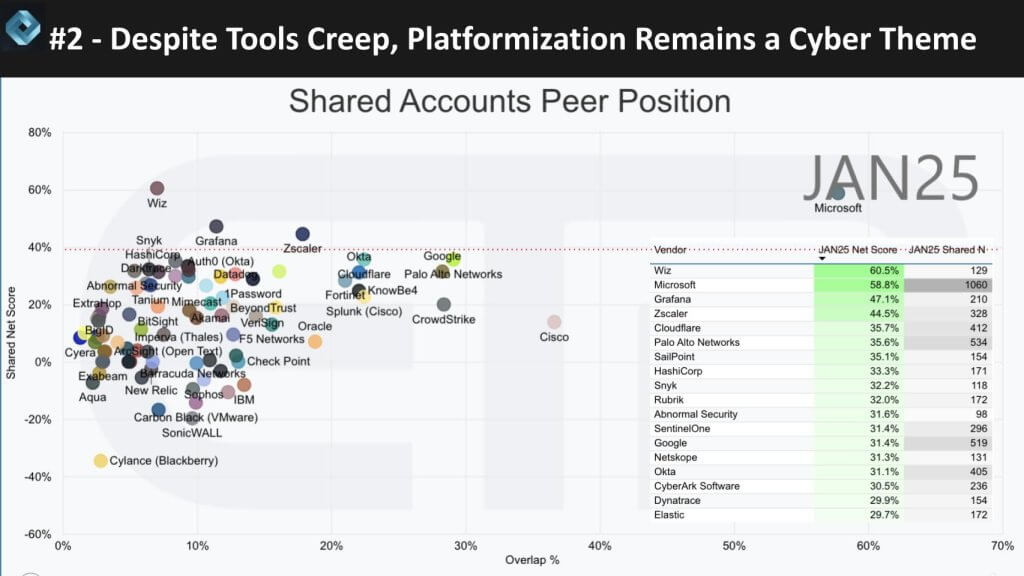

Above we show a graph that compares the spending profiles of dozens of security platforms. Net Score or spending momentum is shown on the vertical axis, with Overlap or presence in the data on the horizontal plane. The table inserted in the bottom right informs how the dots are plotted (Net Score by Ns in the survey for each vendor). Note that the graphic is both crowded and there’s lots of green, meaning spending on many vendors’ tool sets continues. Microsoft Corp. stands out in the upper right, and Wiz Inc. is well above the 40% line which we consider highly elevated. Zscaler Inc. and Snyk Ltd. are also above that line

The following provides additional context for this prediction:

Our research indicates that by 2025, organizations will gravitate toward consolidated cybersecurity platforms, as intensifying threats and mounting complexity make best-of-breed approaches increasingly unsustainable. Nation-state actors now have access to compute at scale and AI capabilities, resulting in continuous, more sophisticated attacks that demand tighter integration and simplified management.

- Growing threat landscape: Heightened geopolitical tensions and advances in AI have led to an anticipated all-time high in cyber threats. Chief information security officers are under intense pressure to protect against an escalating volume and sophistication of attacks.

- Platform consolidation: Best-of-breed solutions require significant operational resources, making an all-in-one approach attractive to many enterprises. Microsoft, Palo Alto Networks Inc., Zscaler, Cloudflare Inc., and emerging players such as Wiz are capitalizing on this shift by expanding their portfolios and becoming “one-stop shops.”

- Case in point: Microsoft gains: Incidents such as the recent kernel-level exploit affecting CrowdStrike Holdings Inc. are driving organizations to reassess solutions. Our survey data suggests Microsoft’s integrated security capabilities, once deemed insufficient, are now considered viable — and even preferable — for many buyers. This despite the fact that CrowdStrike has seemingly recovered and weathered the storm from last year’s incident.

- Impact on AI: Some experts (e.g. Brad Shimmin on last week’s Breaking Analysis) predict that security lapses, especially in emerging AI agents and platforms, could derail progress. Though we believe AI adoption will continue, the importance of robust cybersecurity frameworks cannot be overstated.

Bottom line:

We believe that by 2025, the intensity of cybersecurity threats will drive a widespread shift toward consolidated, platform-centric solutions. Although specialized tools will persist where differentiation is critical, the data suggests that simplicity, integration and ease of management will be the guiding principles for CISOs looking to reduce risk and maintain agile, secure environments.

No. 3: No ‘aha moment’ for agentic AI in 2025 as security and data privacy remain adoption headwinds

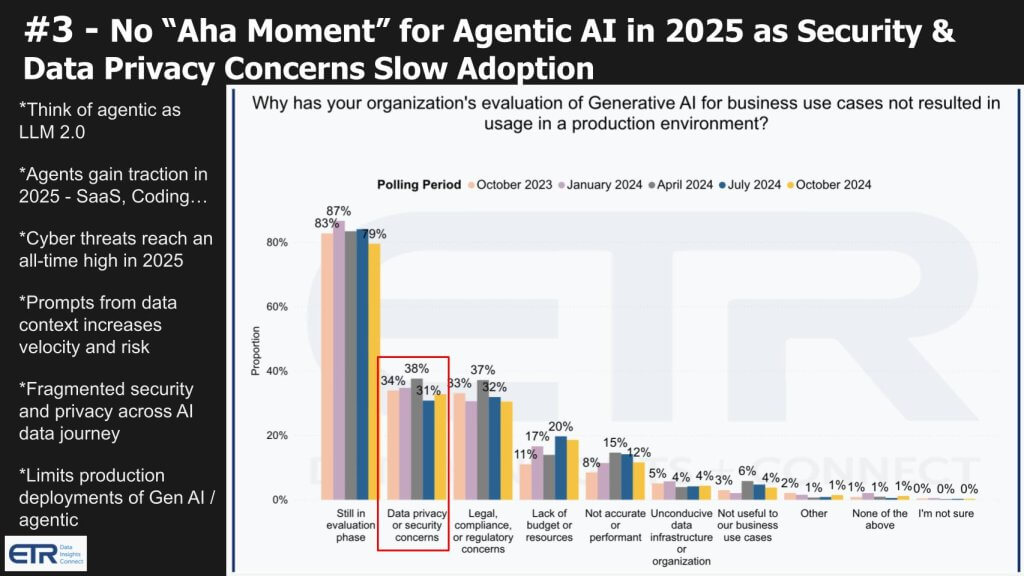

Our next prediction focuses on the buzzword of the day: agentic AI. We predict that there will be no “aha moment” foagentic AI in 2025 because security and data privacy concerns will be a headwind.

Now, to be clear, we are excited about agentic. We just feel the hype is a bit ahead of reality. There are clear successes taking shape in companies such as Salesforce Inc., ServiceNow Inc., Palantir Technologies Inc. and Workday Inc. Admittedly, there are mixed reviews around Microsoft copilots. Nonetheless, agents are being infused into all SaaS products.

We look at agents as the next instantiation of large language models. Rather than prompts from just humans, agents will be pounding LLMs, enabling them to take action based on data context. This will increase the velocity of prompts by orders of magnitude and, as the AI stack evolves, multiple components of the AI stack will need to be secured and managed. Stitching these pieces of the stack together involves risks, creates seams and will be a blocker that needs to be addressed.

The following provides additional context for this prediction:

We see a growing yet cautious embrace of agentic AI across the enterprise. The positives in the data are that nearly half of surveyed organizations report some level of return on investment, and more than 86% plan to boost AI spending in the coming year. But notable hurdles exist. Specifically, organizations must address security, privacy and intellectual property concerns before AI-based agents achieve broader traction and deliver transformative impact.

- Investment and ROI: More than 46% of respondents in our recent survey have achieved tangible ROI from AI deployments, reflecting a steadily growing confidence in AI-driven solutions.

- Security and privacy Issues: Persistent fears regarding data governance, IP rights and potential misuse of sensitive information remain significant barriers to mainstream adoption.

- User adoption challenges: Tools such as Copilot offer promise but often suffer from inconsistent results, limited user training and a lack of clear guidance. Many end users abandon these tools after initial trials, inhibiting organization-wide uptake.

- Internal versus external use cases: Most reported AI successes center on internal productivity improvements, with fewer examples of outward- or customer-facing deployments. This discrepancy indicates that while organizations recognize AI’s value, they have yet to fully exploit external opportunities.

Bottom line:

We believe that enterprise interest in agentic AI is genuine and growing, but organizations will not in 2025 experience a broad-based “aha moment” where these technologies become indispensable and trusted. Addressing security concerns, improving user training and refining real-world applications will be critical factors in driving AI from pockets of success to pervasive, transformative use.

No. 4: Cloud ‘repatriots’ shift narratives to on-premises AI

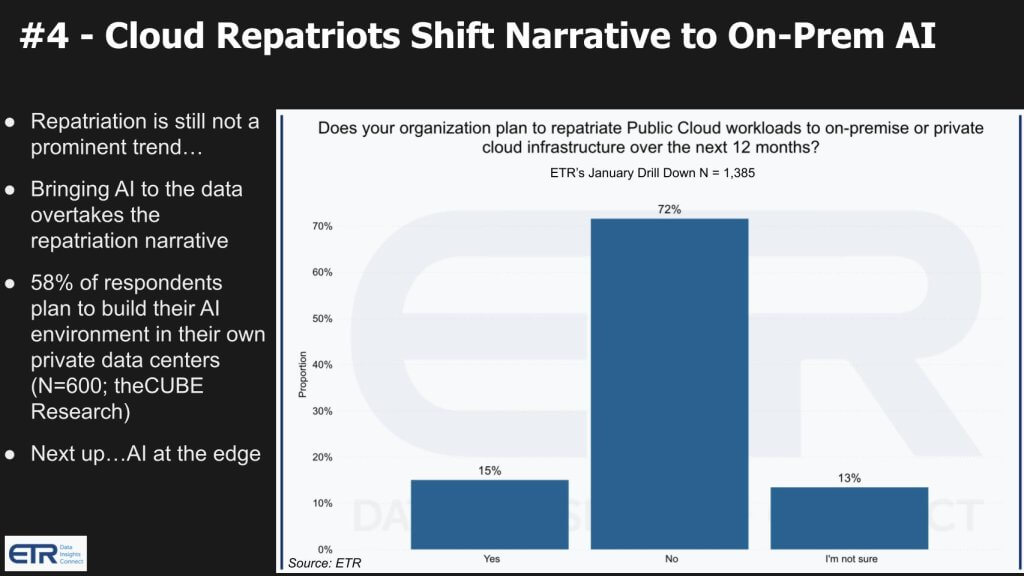

Our next prediction relates to the narrative around cloud repatriation. We think that the so-called cloud re-patriots are going to shift their marketing and focus instead on bringing AI to the data on-premises.

The data we’re showing above underscores that cloud repatriation is really not a massive trend. Sure, 15% of the customers in this survey are repatriating some workloads, but it’s not an overwhelming revenue generator. A more viable approach in our view is a narrative around bringing AI to the data. And we think that will overtake the repatriation narrative.

In a recent CUBE Research survey, we found that 58% of respondents plan to build their AI in their own private data centers. Customers tell us they love Amazon Web Services, they love Bedrock, they love Google LLC’s AI and they’re all Microsoft users. And when we ask why then are you building your own on-prem AI capabilities, they say: 1) That’s where much of our data lives; and 2) The cloud is expensive.

And this all will lead to a discussion on edge which we’ll address in our next prediction.

The following provides additional context for this prediction:

Our research indicates that the trend toward large-scale “cloud repatriation” remains more of a vendor marketing point than a significant market shift. While approximately 15% of organizations report moving some workloads back on-premises, the bulk of enterprise workloads that reside in the cloud will grow in the cloud.

- Minimal repatriation rates: Only about 15% of respondents are repatriatriating workloads, suggesting that the majority see greater value in remaining on cloud platforms.

- Drivers for repatriation: Organizations that do bring workloads back on-prem most often cite cost control, security compliance, performance and latency concerns as key factors.

- Marketing versus reality: Despite the occasional headline or vendor messaging, cloud repatriation appears to be a niche phenomenon rather than a broad industry trend.

Bottom line:

We believe that, while certain targeted workloads may move back on-prem for specific business or technical reasons, the cloud continues to dominate infrastructure strategies. The data suggests that repatriation is largely an edge case rather than a widespread reversal of the cloud adoption wave.

No. 5: AI inference at the edge shows meaningful revenue in 2025

Our next prediction is around the edge.

We see AI inference at the edge showing measurable revenue progress in 2025. Edge computing will be a significant trend in 2025 that will shape and evolve the AI narrative.

The following provides additional context for this prediction:

We anticipate a surge in edge computing adoption by 2025, driven by the growing need to process data in real time, directly at the source. This trend underpins industries like robotics, manufacturing (Industry 4.0), full self-driving vehicles and retail, all of which demand low latency and rapid decision-making. Our research indicates that edge will not replace or detract from public clouds or on-premises environments. Instead, we expect edge to function as a complementary layer, feeding data to centralized locations for broader analytics and AI training.

- Real-time demand: Proximity of data and compute is critical for reducing latency in advanced use cases such as robotics and automation, enabling real-time insights.

- Cloud plus edge synergy: The value proposition of edge computing is largely additive. Data processed at the edge can then be transferred back to the cloud or on-prem data centers for further analysis, machine learning model training and long-term storage.

- Silicon opportunities: We believe Nvidia Corp. is well-positioned to thrive at the edge, but the market is also opening doors for Advanced Micro Devices Inc., Intel Corp., RISC-V, and AI-centric startups such as Halo, Mythic, Brainship, Horizon Robotics, Grok and others. These companies are racing to deliver specialized silicon optimized for edge deployments. Though not all will survive as independent entities, the race is on to get a foothold in AI inference and it will accelerate in 2025.

- Survey confirmation: Recent data from over 1,800 IT decision makers underscores that edge computing is considered one of the top trends for 2025. Respondents cite the challenges of compute latency and surging data volumes as key drivers for adopting edge solutions.

- Future outlook: As organizations strive for even more agile models, we expect a rise in serverless architectures, further bridging cloud and edge environments.

Bottom line:

We believe edge computing will see strong momentum in 2025 as enterprises seek to speed up real-time insights while preserving the ability to leverage the cloud for large-scale analytics. The data suggests that this “cloud plus edge” model offers the best of both worlds: ultra-low latency for time-sensitive operations and centralized infrastructure for advanced AI workloads.

No. 6: Public cloud revenue surpasses $1T in 2025

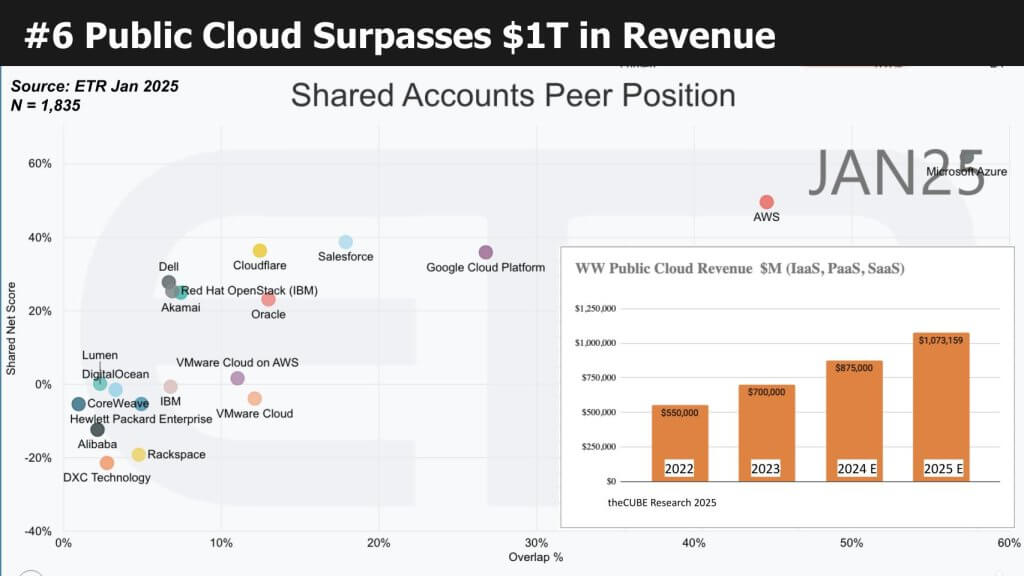

Above we show ETR’s XY data format, Net Score by Overlap or penetration in the data set. Microsoft is in the upper right of this chart and will hit close to $200 billion in cloud revenue this year, all in. AWS will surpass $130 billion and Google will come in at about half of that. But as you see on this ETR chart, Salesforce will contribute $50 billion or so. It’s interesting to see CoreWeave Inc. on this. It’s a new name on the survey and it doesn’t appear to be setting the enterprise world on fire. Perhaps this is a case where model trainers rather than enterprises are using its stack at this point.

The bar chart insert shows the all-in cloud revenue for infrastructure as a service, platform as a service and SaaS from theCUBE Research over time and is projected to surpass $1 trillion in 2025.

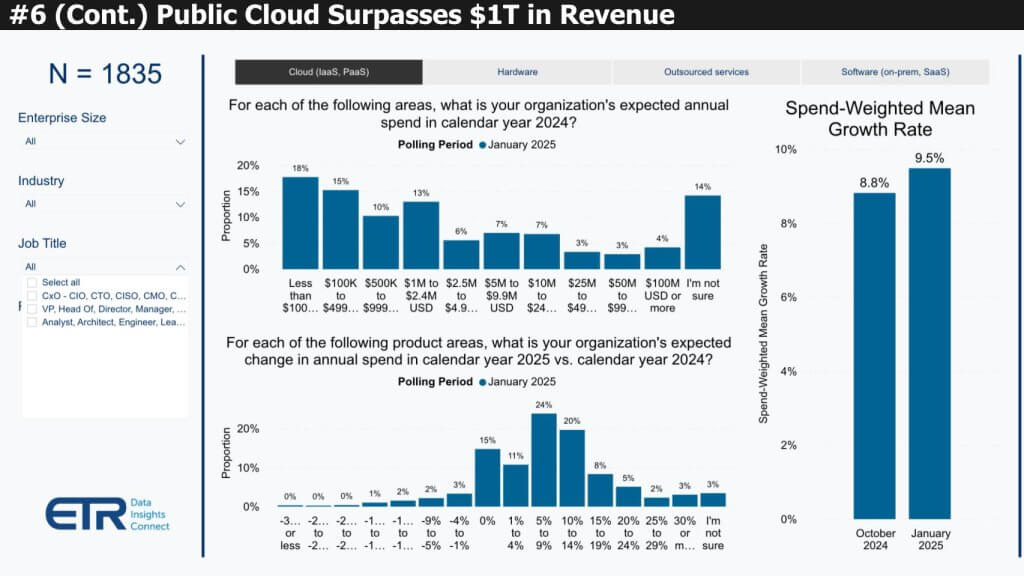

The chart below provides additional survey detail and suggests that cloud spending is outpacing overall spending.

The following provides additional context for this prediction:

Our customer survey research shows cloud spending (IaaS and Paas) growing at nearly double digits — around 9.5% — while SaaS, the second-highest category, lags behind at roughly 4.5%. Despite incremental price increases from cloud providers (averaging around 3%), the insatiable need for compute continues to push organizations to invest more heavily in cloud services. This trend underscores our view that large-scale repatriation remains a limited phenomenon.

- Strong cloud growth: Cloud spending stands out at approximately 9.5% growth, driven by rising customer demand for compute.

- SaaS growth lags but remains healthy: SaaS spending at 4.5% growth still reflects a meaningful uptick, albeit tempered compared to IaaS/PaaS investments.

- Price increases: Vendor-driven price hikes of roughly 3% are contributing to overall cloud growth but are not the primary driver. The bigger factor is robust demand for compute resources to support AI and other data-intensive workloads.

- Rising high-end spenders: Our data shows more respondents joining the ranks of “high rollers,” with annual cloud spend surpassing $25 million — and even $100 million — an indication that enterprise-scale cloud adoption is accelerating.

- Ecosystem impact: From semiconductor manufacturers to data center construction and hardware testing, the entire lifecycle of the cloud supply chain is benefiting from these increased investments.

Bottom line:

We believe the continued double-digit cloud growth and climbing levels of high-end spending confirm that organizations remain deeply committed to cloud infrastructure. Despite concerns about pricing or sporadic examples of repatriation, the data suggests that companies’ appetite for compute resources—in a large part fueled by AI—will keep the cloud market on a steady upward trajectory and all-in will surpass $1T in 2025.

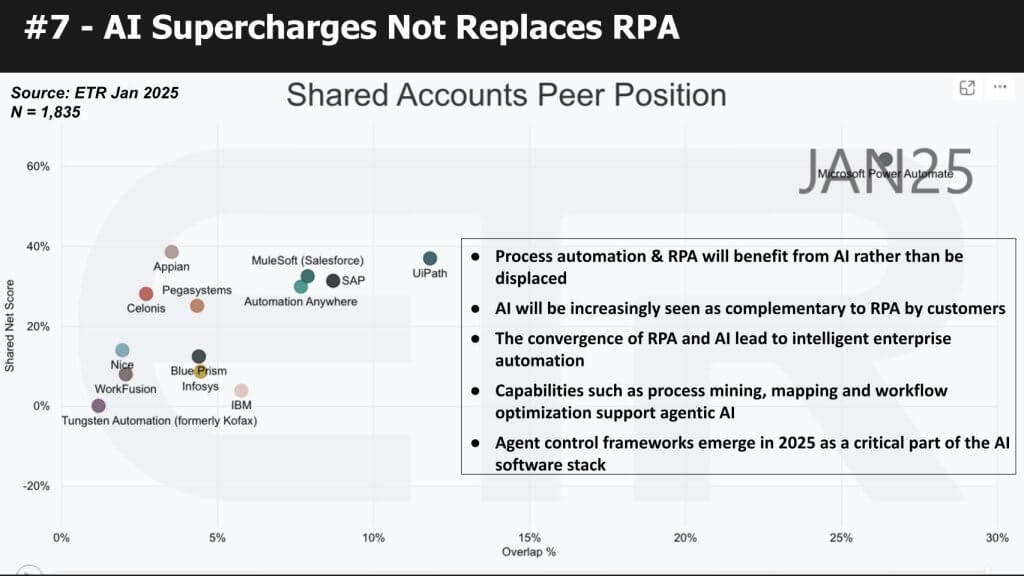

No. 7: AI is not a replacement for, rather it supercharges RPA

Next up is a prediction that is maybe a bit counterintuitive.

Specifically, we think AI supercharges robotic process automation and is not a replacement. Early on, customers were thinking that gen AI in particular could do what RPA does but we don’t see it that way. In fact in many ways we look at RPA as very useful plumbing for enterprise AI and automation. Customer data suggests that they see AI as complementing RPA and capabilities such as process mining, process mapping, workflow optimization and the like will support agentic workflows.

In the ETR XY chart above, you can see Microsoft Power Automate in the upper right and a number of other firms such as UiPath Inc., which is positioning for agentic with agent management frameworks and strong process knowledge. Others on this chart are positioning for agentic AI as well and we’re particularly excited about Celonis SE, which we’ve covered quite extensively on this program.

The following provides additional context for this prediction:

We see a resurgence in RPA spending and business process automation initiatives, despite initial concerns that AI would render traditional RPA obsolete. Rather than displacing RPA, emerging AI capabilities are proving complementary, giving rise to “intelligent automation” solutions that enhance the breadth and depth of what can be automated.

- Sharp rebound in RPA spending: Recent ETR survey data shows a noticeable uptick in RPA investment following a period of decline, signaling renewed confidence in process automation tools.

- AI as a complement: Far from replacing RPA, AI-driven capabilities such as process mining, workflow optimization and enhanced decision-making are extending RPA’s value in areas like business process mapping and process orchestration.

- Terminology and market shifts: Despite earlier attempts by some vendors to distance themselves from the “RPA” label, customer sentiment now validates the term’s importance. RPA is increasingly seen as a fundamental automation layer, especially when enriched by AI.

- Industry adoption: As enterprises look for efficiency gains and faster cycle times, the union of AI and RPA — intelligent automation — stands to deliver greater accuracy, flexibility and scale across industries.

Bottom line:

We believe that RPA’s return to favor reflects its evolving role within a broader automation strategy. Rather than being displaced by AI, RPA is bolstered by these new capabilities, creating powerful, end-to-end automation solutions that promise enhanced efficiency and agility for organizations that embrace the synergy.

No. 8: IPOs slowly ramp in the first half of 2025, kick up in second half and accelerate into 2026

Our next prediction is that IPOs will begin to come back in the first half, but really those companies that need the money will go out. We think others will wait to see the impact of the Trump administration, what happens with interest rates and the like. Above we’re showing a sit-down we had at our NYSE studio with Veeam Inc. CEO Anand Esweran. Veeam is owned by Insight Partners, which just did a private raise to prepare for what we believe will be an IPO later this year or more likely in 2026. Veeam doesn’t need the cash so it isn’t in a rush. Blue Yonder Group Inc., Snyk and the well-funded Databricks are other candidates. In addition, we’re watching firms such as Cohesity Inc., Cerberus Systems Inc., Klarna Bank AB, CoreWeave, Chime Financial Inc., Netskope Inc., Neo4j Inc., Stripe Inc. and Celonis.

The following provides additional context for this prediction:

We foresee a surge in IPO activity among technology firms that have been taken private in recent years or have remained in the private domain. Rising interest rates, lofty private valuations and the eventual need for liquidity events are converging to create a ripe environment for public offerings. Major private equity players such as Thoma Bravo and Vista, which acquired numerous software companies, are now incentivized to return these assets to public markets, much like the recent announcement involving SailPoint Technologies Inc.

- Liquidity pressures: Private equity firms can only sustain cashflow businesses for so long; ultimately, investors demand exits, especially after years of inflated late-stage valuations.

- Interest rate environment: Higher rates increase the cost of capital, spurring firms to seek alternative financing or exit strategies, often via IPO.

- Notable candidates: Companies such as Wiz, which reportedly declined a $23 billion valuation, are strong IPO contenders, as are high-profile private firms such as Databricks Inc. and others in the AI/data market.

- Competitive dynamics: Some private companies may prefer remaining private to avoid publicly disclosing financials — particularly when competing with publicly traded peers. Nevertheless, we see increasing market pressures likely pushing them toward an IPO window.

Bottom line:

We believe that the combination of liquidity needs, rising interest rates, and sustained investor appetite for innovative tech solutions will drive an uptick in IPOs. Expect many of the names previously taken private or still in private hands to test the public markets as they seek funding for expansion, returns for backers, and the chance to better compete in an evolving landscape.

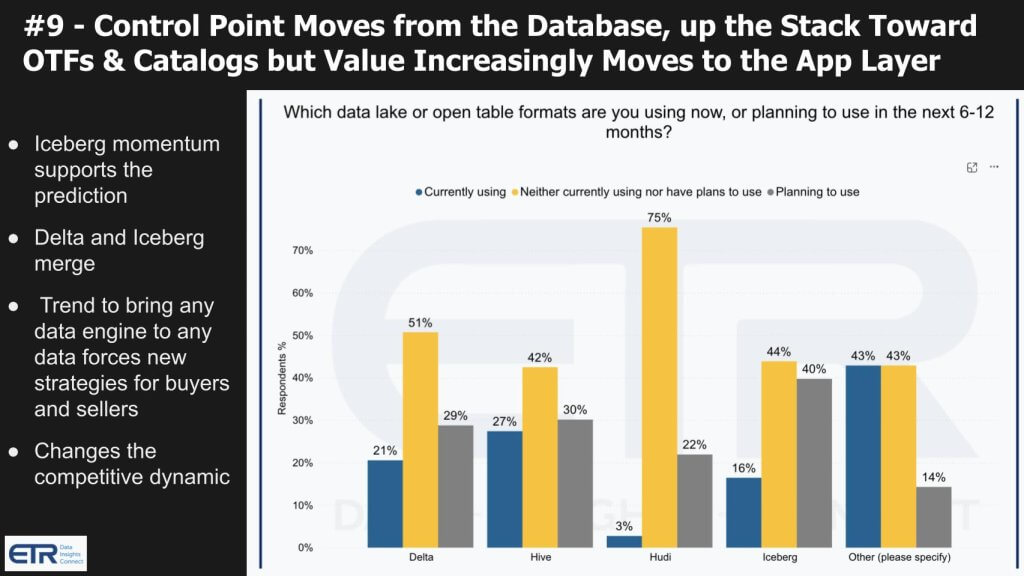

No. 9: The control point in the data stack moves from the database to catalogs, but value leapfrogs to intelligent apps

We believe the point of control will clearly shift from the database up the stack towards governance catalogs that control open table formats. But the value will we think leapfrog that layer further up into the application stack, with agentic AI taking center stage, notwithstanding the security challenges we cited earlier.

Above we show data from an August ETR. The gray bar is the one that is relevant where Iceberg, despite its newness, leads with 40% of customers at that time planning to use Iceberg. We think this trend will dramatically accelerate in 2025 with Delta and Iceberg merging via Databricks’ acquisition of Tabular. As the point of control shifts up the stack, the data platform players such as Snowflake Inc. and Databricks will increasingly run into the likes of Salesforce, ServiceNow and other SaaS players that are taking greater control over the data that lives within their application stacks. These SaaS platforms not only have data but they have process knowledge, business logic and metadata, and are in a strong position to vie for control of the data.

The following provides additional context for this prediction:

We believe the next phase of data and AI evolution will move beyond separating compute from storage and cloud scalability. Increasingly, we believe the emphasis will be on how organizations refine, harmonize and govern data — rather than just where that data resides. In recent years, enterprises have focused heavily on laying foundational infrastructure for real-time analytics and AI. Now, our research suggests investment is shifting toward customer-facing applications and sophisticated data management layers, including semantic solutions that harmonize data, data catalogs and governance frameworks.

- Shifting investment priorities: After multiple years of backend build-outs — for example, cloud data warehousing and streaming analytics — the spending needle is moving toward front-end AI-driven, data rich, applications, reflecting a growing need for user-centric tools and insights.

- Semantic layer and data control: As more compute engines interact with potentially any data source, questions arise around who owns the “knowledge graph” or semantic layer. This contested space could be critical to delivering consistent, meaningful context across AI and analytics pipelines.

- Emerging leaders: Our data shows Databricks and Snowflake now rank first and second in key database and data warehousing categories, surpassing even hyperscalers in certain areas. Meanwhile, AWS, Microsoft and Google continue to enhance their own abstraction and open table formats, ensuring they capture revenue no matter which platform customers choose.

- Governance and discovery: Data catalogs and workflow tools that enable discovery, sharing, and reuse of data are gaining momentum. As the era of “self-service BI” evolves into “self-service AI,” organizations want easy-to-use solutions that marry the right data with real-time analytics.

- Ecosystem opportunities: Similar to how extract/transform/load or ETL once occupied a distinct middleware layer before being absorbed by broader platforms, the semantic and governance layers may also consolidate under dominant players — unless disruptive entrants move faster to capture this lucrative position.

Bottom line:

We believe that as enterprise data ecosystems become more fluid — where any compute engine can tap into any data source — governance, discoverability and semantic consistency will define market winners. Though Databricks and Snowflake appear to be leading the charge, hyperscalers remain well-positioned thanks to their scale and go-to-market muscle. Ultimately, organizations seeking to stay competitive must invest in advanced data management and semantic tooling that aligns real-time processing with broader AI objectives.

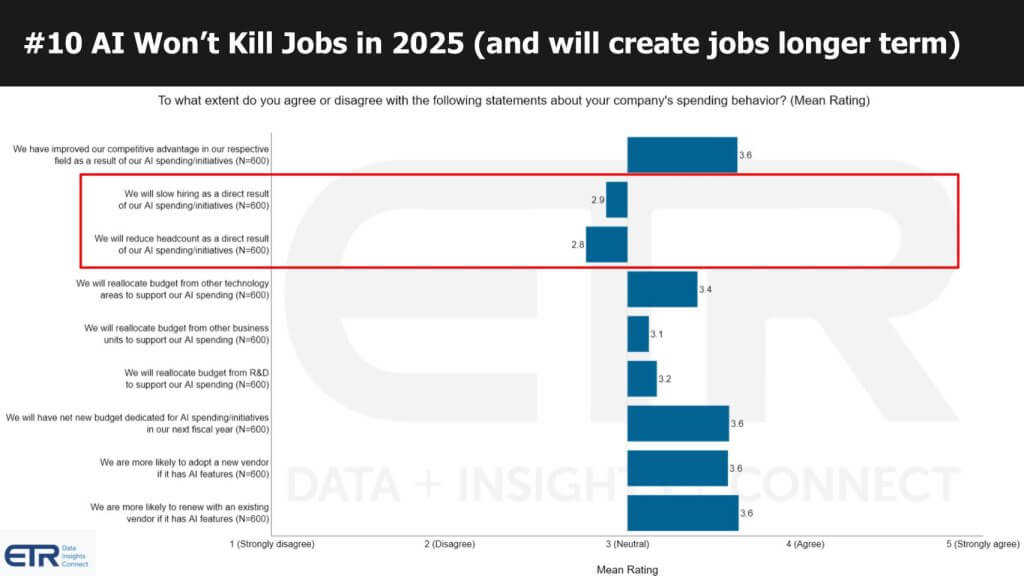

No. 10: AI won’t kill jobs in 2025

Our last prediction is one that addresses some of the media hype around jobs.

We don’t believe AI will dramatically kill jobs in 2025 and spike unemployment. And we think that longer-term, AI will create more jobs that require different skill sets. This data we’re showing above is from an ETR survey and a new feature they’ve announced. We’ve highlighted in red the salient responses where 600 customers say they’re not slowing hiring because of AI and they’re not reducing headcount.

The following provides additional context for this prediction:

Our most recent AI product survey data suggests that, contrary to popular headlines, AI initiatives are not yet displacing jobs at large scale. Though a handful of organizations have blamed layoffs on new AI-driven productivity gains, the overwhelming majority of survey respondents do not anticipate reducing headcount or slowing hiring because of AI this year. Notably, many organizations are not yet measuring AI’s return on investment in strictly financial terms; instead, they perceive its value in less quantifiable ways — such as improved quality, speed and productivity.

- Limited job impact: Despite a few high-profile announcements attributing layoffs to AI, our data shows this is far from the norm. Survey participants largely expect to maintain or increase staffing in 2025.

- ROI measurement challenges: Formal dollar-based ROI metrics are rare at present, with most organizations relying on anecdotal or perception-based assessments of AI benefits (for example, perceived productivity gains or better product quality).

- Productivity versus revenue: Though some industry surveys claim AI will drive immediate revenue gains, we see most current use cases focused on internal process improvements rather than customer-facing revenue streams.

- Future implications: Over time, AI-driven productivity could lead to shifts in hiring practices (for example, fewer lower-skilled roles, increased demand for advanced AI expertise). For now, however, the data suggests AI is far more likely to augment the workforce than replace it.

Bottom line:

We believe that, at least in the near term, AI will not significantly reduce enterprise headcount. Instead, organizations are investing in people who can design, deploy and manage AI systems. Over the longer run, better measurement of ROI and further technological maturity may change the equation, but for 2025, AI appears more poised to create new opportunities than to eliminate jobs.

Bonus prediction on Intel

One last added prediction. We’ve been outspoken about Intel and predict it will have no choice but to spin out its foundry business in 2025. Our concern is that Intel’s design business will be acquired in this process, but we most certainly hope not. We believe it’s in the industry’s and country’s best interests for Intel to remain independent. The contributions Intel has made to the technology industry are enormous. Intel was the IBM of its day, an iconic innovator that supported two decades of innovation, the mainspring of which was microprocessor-based computing. For Intel to be subsumed by a firm with a higher market cap or inflated valuations from AI expectations would be a shame.

Read our plan to save Intel and maintain its independence, while securing the long-term interests of the United States. We call on the current administration and the spate of tech CEOs who have come out of the woodwork to support President Trump to deeply consider how Intel enabled today’s tech companies to thrive and do your part to help Intel make an Apple-like comeback.

What do you think? How do you see 2025 shaping up? What are your predictions for the year? Please let us know.

Image: theCUBE Research/DALL-E

Disclaimer: All statements made regarding companies or securities are strictly beliefs, points of view and opinions held by News Media, Enterprise Technology Research, other guests on theCUBE and guest writers. Such statements are not recommendations by these individuals to buy, sell or hold any security. The content presented does not constitute investment advice and should not be used as the basis for any investment decision. You and only you are responsible for your investment decisions.

Disclosure: Many of the companies cited in Breaking Analysis are sponsors of theCUBE and/or clients of Wikibon. None of these firms or other companies have any editorial control over or advanced viewing of what’s published in Breaking Analysis.

Your vote of support is important to us and it helps us keep the content FREE.

One click below supports our mission to provide free, deep, and relevant content.

Join our community on YouTube

Join the community that includes more than 15,000 #CubeAlumni experts, including Amazon.com CEO Andy Jassy, Dell Technologies founder and CEO Michael Dell, Intel CEO Pat Gelsinger, and many more luminaries and experts.

THANK YOU