When Uber Kenya announced plans to lower the maximum age of vehicles allowed on its platform—capping Uber ChapChap cars at 10 years and Uber Comfort cars at eight—it seemed like a routine update. In a market where customer experience is a differentiator, ensuring newer, more reliable vehicles makes commercial sense.

But timing, as it turns out, is everything.

Starting July 1, Kenya Revenue Authority (KRA) will begin taxing imported vehicles using a revised valuation formula that has stunned importers and motorists. The tax on popular ride-hailing models like the Suzuki Swift, Mazda Demio, and Toyota Vitz is set to more than double. For instance, a 1.2-litre petrol-powered Swift manufactured in 2018 will attract a total tax of $4,825 (KES 623,503), up from $1,962 (KES 253,574)—a nearly 146% jump, pushing retail prices above $15,479 (KES 2 million).

In theory, KRA’s move to increase taxes on imported used cars and Uber’s push to upgrade its fleet should be aligned. Both aim to improve road safety, reduce emissions, and offer better experiences to passengers. In practice, they may be about to break the country’s ride-hailing business.

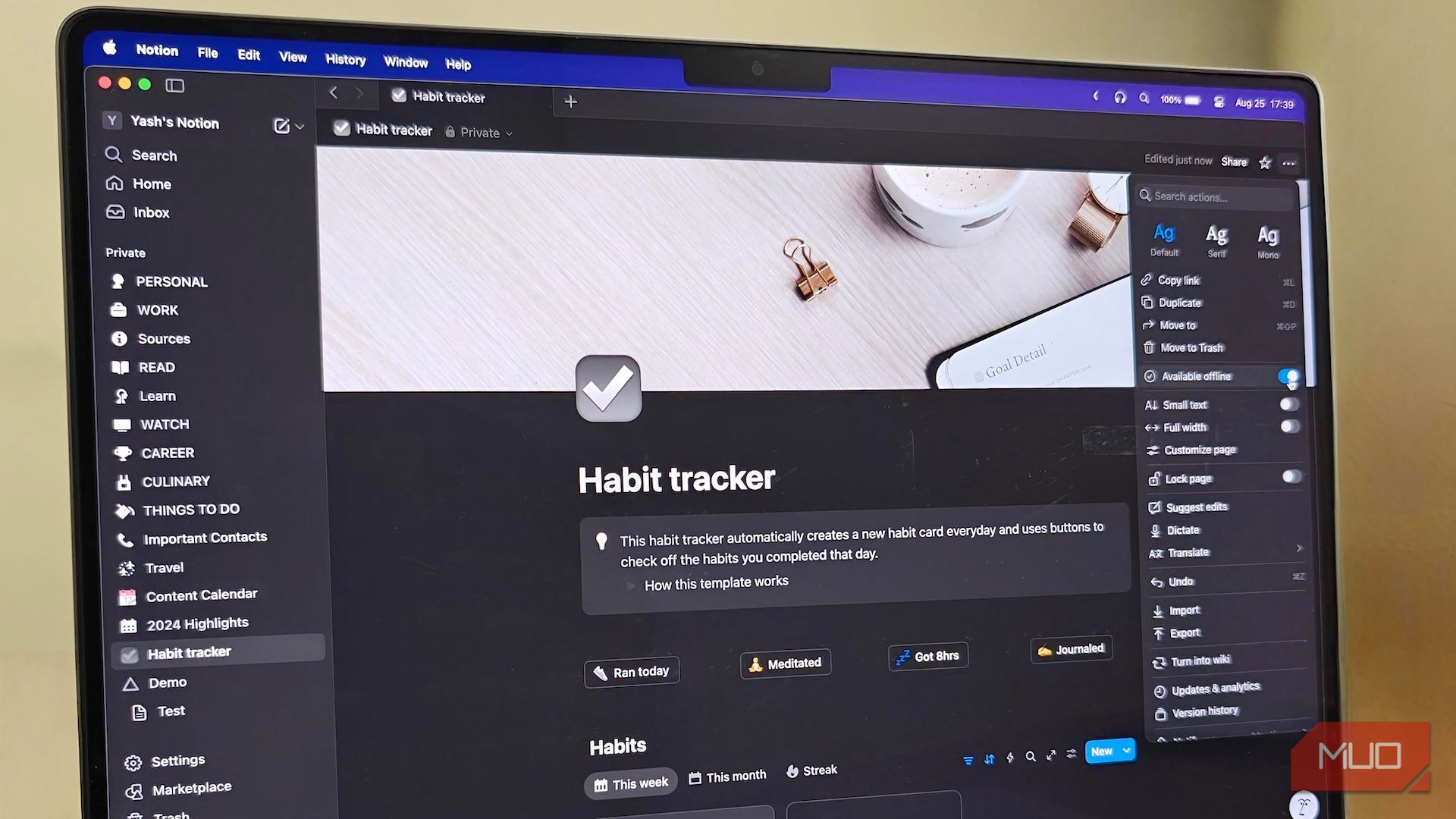

“Where your vehicle will operate on the platform for the first time on Uber Comfort, only vehicles that are 8 years old or newer will be eligible to join the Uber platform,” a notice sent to Uber drivers reads. “Please note that this means: From Jan 2025 only 2017 and newer vehicles will be eligible to join. From Jan 2026 only 2018 and newer vehicles will be eligible to join.”

Nairobi’s ride-hailing apps are flooded with ageing, second-hand cars—most imported from Japan and already near the end of their useful lives by the time they arrive. Uber’s case for modernising the fleet is strong.

Harsh reality

Uber says the new age caps are designed to improve quality. The policy is part of a global push to standardise ride quality and safety benchmarks across its markets. Nairobi, where Uber launched in 2015, remains one of the app’s most active cities in Africa.

But Uber’s decision comes when the government has made upgrading expensive for most drivers. Car imports already carry six different levies—from import duty to excise to the controversial Railway Development Levy. The new valuation formula means that even the smallest, most fuel-efficient models—favoured by gig drivers—will now face tax bills that wipe out their affordability.

For drivers, the economics are brutal. Earnings from ride-hailing have mainly remained stagnant, even as fuel prices rise to historic highs of $1.36 (KES 176) per litre and spare parts become more expensive. Few drivers have access to financing from banks, and most rely on savings, informal loans, or second-hand purchases.

“Uber is asking us to spend $15,479 (KES 2 million) to buy a car that will be making $15.48 (KES 2,000) per day. There’s no way you can stay in business with such earnings, no way,” says George Kiambi, an Uber driver in Nairobi.

Ride-hailing drivers, like most informal workers, have no access to formal credit. They operate in a legal and financial grey zone, treated as independent contractors for tax purposes, but with no protections, incentives, or targeted support.

Other countries have tried to bridge that gap. In Egypt, Uber has partnered with local banks to offer vehicle financing. In South Africa, ride-hailing drivers can access credit through selected lenders. In India, government subsidies have helped gig workers transition to electric vehicles.

By contrast, Kenya offers little beyond policy announcements.

Rising competition

Drivers shut out from the Uber platform could opt for other ride-hailing apps. The company has faced growing competition since it launched in Nairobi in 2015. The market now includes at least 13 different operators, including Bolt, Little, Farasi, Yego, and InDriver. Many of these platforms are more flexible on vehicle age or commission rates. Some even allow drivers to switch between passenger transport and parcel delivery gigs.

Kenya’s ride-hailing sector depends on cheap vehicles, affordable fares, and low operating costs. If these elements are not aligned, the entire system becomes unstable. Therefore, Uber’s vehicle upgrade policy carries risks. Squeeze too hard, and drivers may leave.

“We are being squeezed from all sides, the taxes, the companies and fuel. Some people have left the platforms, and more will do,” says Dennis Odhiambo, a Nairobi ride-hailing driver.

The combined effect of new taxes and stricter platform rules could shrink the ride-hailing driver pool, increase trip prices, and push passengers back to public transport or unregulated taxis.

Mark your calendars! Moonshot by is back in Lagos on October 15–16! Join Africa’s top founders, creatives & tech leaders for 2 days of keynotes, mixers & future-forward ideas. Early bird tickets now 20% off—don’t snooze! moonshot..com