On one random Wednesday morning recently, a dispatch rider called to confirm my availability. He had a parcel for me, which surprised me; I wasn’t expecting a delivery from anywhere that week.

Unfortunately, I was unavailable to pick up this mystery package, and we rescheduled the delivery for the following week. A week dragged into a month, and after periods of scheduling misfires, I finally managed to pick up the package.

It was a crypto debit card.

That’s when I remembered. Back in May, I had replied, on the spur of the moment, to a video post asking to demo the product. The video simply shows someone withdrawing cash from an automated teller machine (ATM) with a crypto card.

A few DMs later, Damilare Aregbesola, West Africa Lead for Base, reached out. He oversaw the region’s Base Batches Build-a-thon, a mentorship and product development programme for Web3 builders. The crypto debit card project demoed in the video was part of its portfolio. It claims to be the first crypto card built for Africans.

Aregbesola made the arrangements, and the card was delivered to me at no cost. When I glanced at the delivery receipt, the total cost of the card and delivery was a little over ₦11,000 ($7.2).

It came in a matte-black sleeve. Inside was a black card—minimalistic but rough around some edges. The packaging was peppered with the confident crypto marketing lingo that many startups seem to have borrowed recklessly: “Spend crypto like cash.”

The product was Zerocard’s, a startup still in beta that issues crypto debit cards, allowing users to spend stablecoins (USDC) directly from their wallet. It runs on Base, a blockchain network developed by Coinbase, with traditional payment infrastructure handling the backend.

I had never seen or used a crypto debit card before this one, so I wasn’t sure what to expect. It sounded slick. But I wasn’t sold yet. I slotted the card into my wallet, making a mental note to test it afterward.

Setting up my Zerocard account

To test the card, I needed to be onboarded on the platform to activate the card. Aregbesola introduced me to Temidayo Folajin, a product designer and CEO of Zerocard, who patiently guided me through the setup. It took about two weeks due to issues navigating the app.

First, I was added to an exclusive group of beta testers. Then, after Folajin granted me access to the Android Package Kit (APK) version of the app, I installed it on my phone (iOS users could join the test via TestFlight).

I completed a Know Your Customer (KYC) check using my full name, date of birth, Bank Verification Number (BVN), and uploaded a valid means of national identification. In a few minutes, my account was verified and ready.

Then came the first real bump: activating the card. Since I already had the physical card in hand, I needed to tie it to my account. It felt a bit like putting the cart before the horse, because I received my card before ordering it on the app. On the app, I clicked “Order Card”, filled in details printed on the physical card I already owned, and linked it to my account.

After that, I walked to the closest ATM, slotted in my card, and reset the default personal identification number (PIN). That was it. The card was now active.

There were bugs along the way—minor, but persistent. Like small guards stationed in front of a castle, they wouldn’t let me through without a fight. But the Zerocard team was always a message away, jumping in to help each time I hit a wall.

Now that the card was active, I had to fund my wallet and find out if this crypto card could actually keep up in the real world.

Funding my Zerocard wallet

Zerocard’s crypto debit card lets users spend only USDC stablecoin like real cash. For now, the app does not support other stablecoins, like USDT, or cryptocurrencies. Since I didn’t already have USDC, I had to buy some before I could use the card.

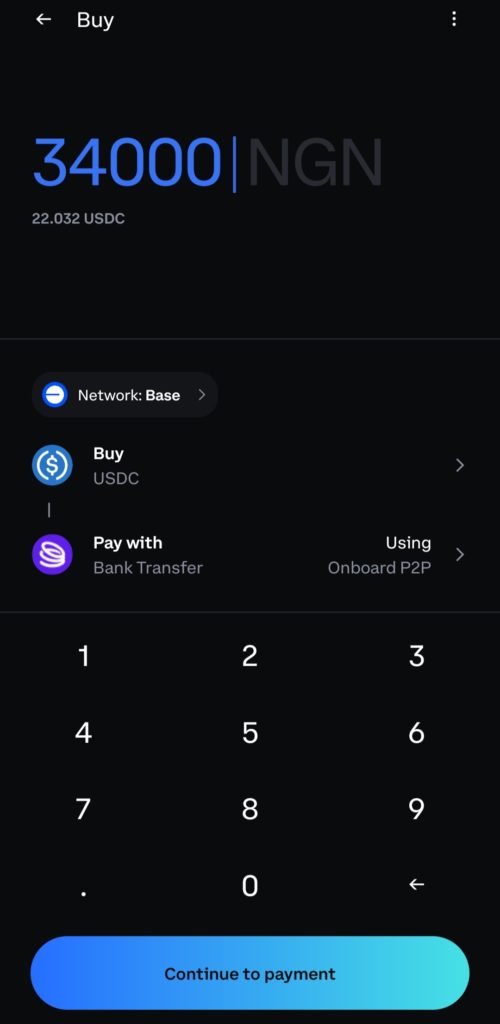

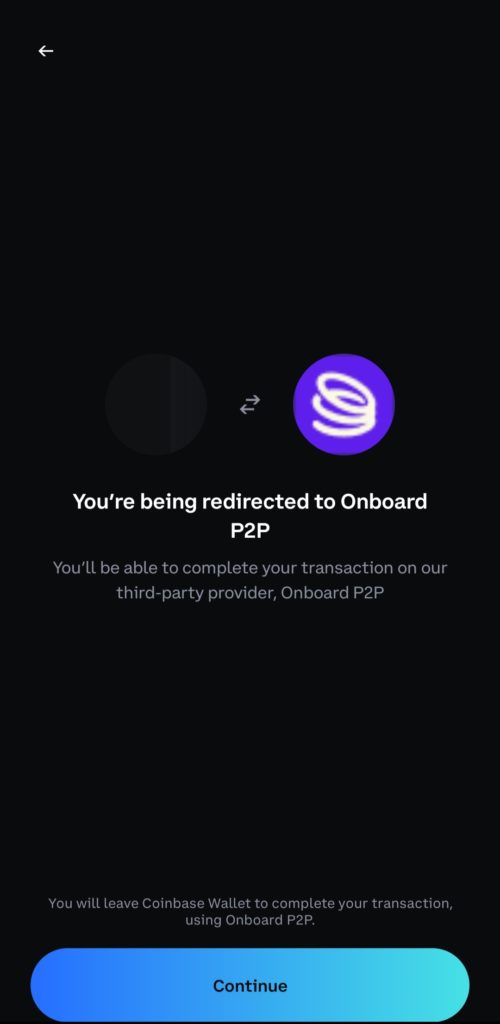

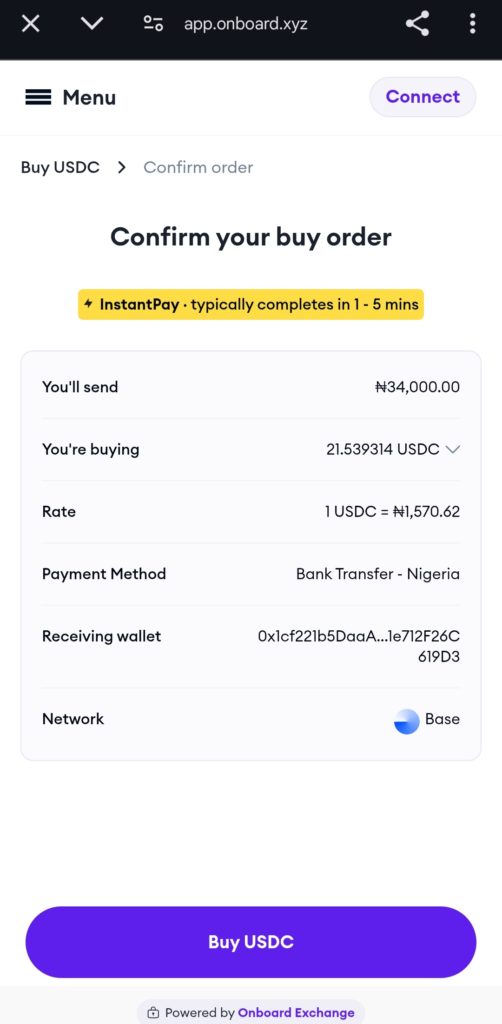

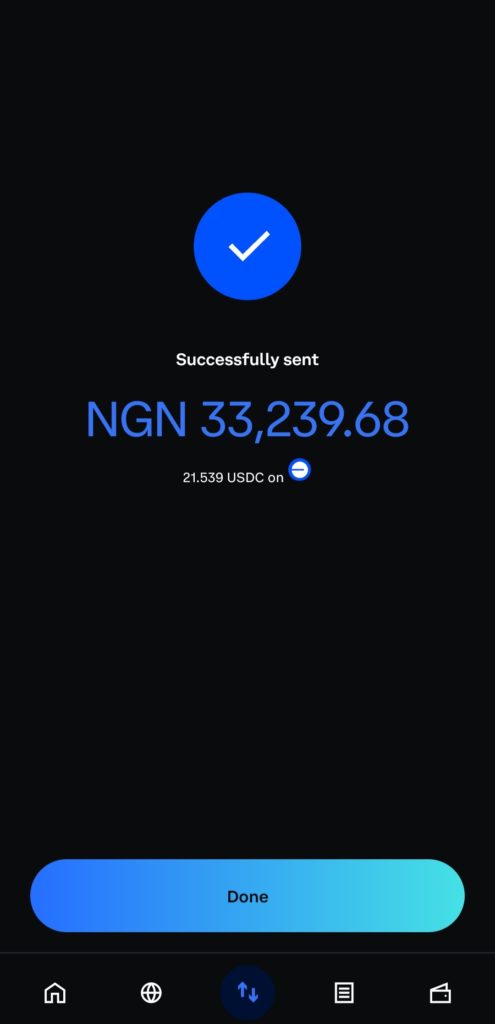

Zerocard doesn’t let you buy crypto directly in the app, so I used Coinbase Wallet, which has a built-in Onboard peer-to-peer (P2P) feature. In February, Coinbase partnered with Nigeria’s Onboard Global to allow users to buy crypto through verified P2P merchants. I started with ₦34,000 ($24.03) and bought just enough USDC to fund my Zerocard wallet.

I bought USDC on the Base blockchain—also called Base USDC—because Zerocard assigns each user a non-custodial wallet on the Base network. If I had sent tokens on another network (TRON or Ethereum blockchain), the funds would’ve been lost forever.

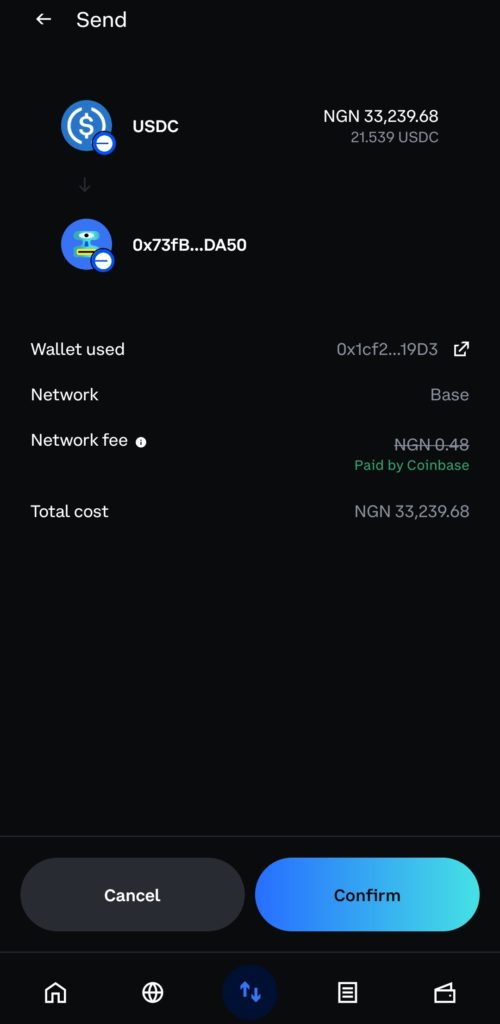

Once I found a trusted P2P merchant, I made a bank transfer. In under two minutes, my Base USDC landed in my Coinbase Wallet. But by the time the transaction was complete, the value had dropped to ₦33,239.68 ($23.54). The loss came from the spread on the exchange rate, which is not unusual, but still something to watch.

Next, I copied my non-custodial wallet address from the Zerocard app and sent my freshly bought Base USDC there. This part cost me nothing—Coinbase waived the gas fees.

With my Zerocard wallet funded, I thought I was finally ready to start spending.

Turns out, not quite.

My first attempt to withdraw cash at a local Point of Sale (POS) machine was a gaffe. The transaction failed. After reaching out to the Zerocard team, I learned I needed to have at least $0.10 worth of Base Ether (ETH) in my wallet.

Though I had already funded the card with USDC, I also needed a small amount of ETH to cover the “gas fee,” which is the cost of processing transactions on the blockchain. Without this, the system cannot authorise the transaction. I also hadn’t set a spending limit inside the app, which blocked the card from working.

The team sent me a small amount of Base ETH using the same non-custodial wallet. Under normal circumstances, sending tokens to a wallet address not configured for that token could result in a permanent loss.

For example, sending USDT on the Base network to an ETH wallet address on TRON is game over. But in this case, the transaction worked because it happened within the same network (Base), and Base supports bridging across tokens.

In crypto, “bridging” lets two different coins talk to each other on the same wallet. In traditional banking, it is how you send money from a GTBank account to someone using Zenith. The NIBSS Instant Payment (NIP) makes interbank transfer possible in legacy systems. In crypto, bridges make these token-to-token transactions possible on the same network.

Once the ETH was in, the final step was to set a spending limit. I set mine at 100% of my available balance so I could run multiple tests across payment centres and merchant types.

Now I was ready.

“Spending crypto like cash”

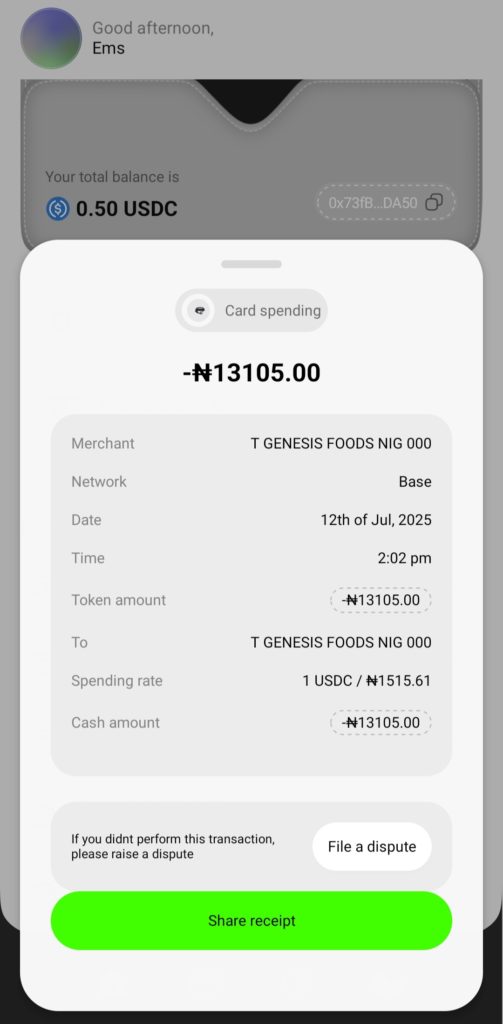

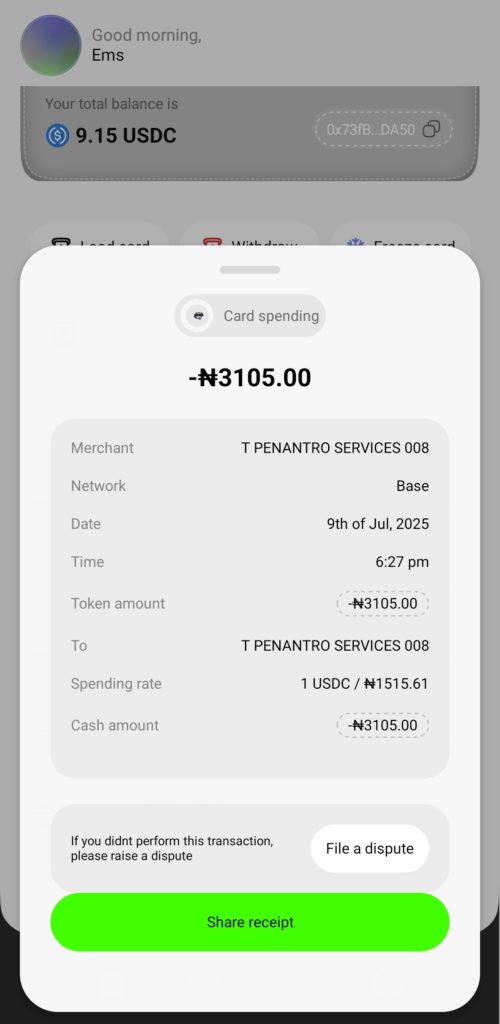

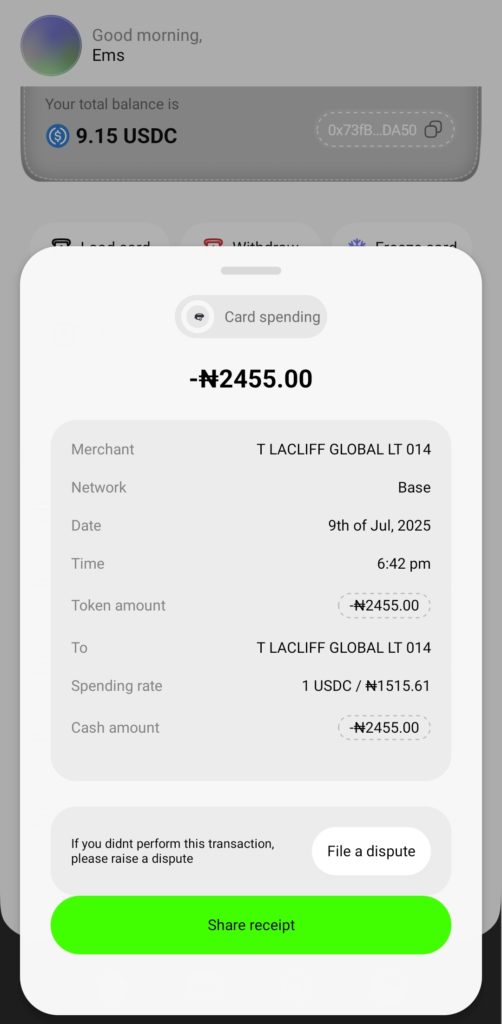

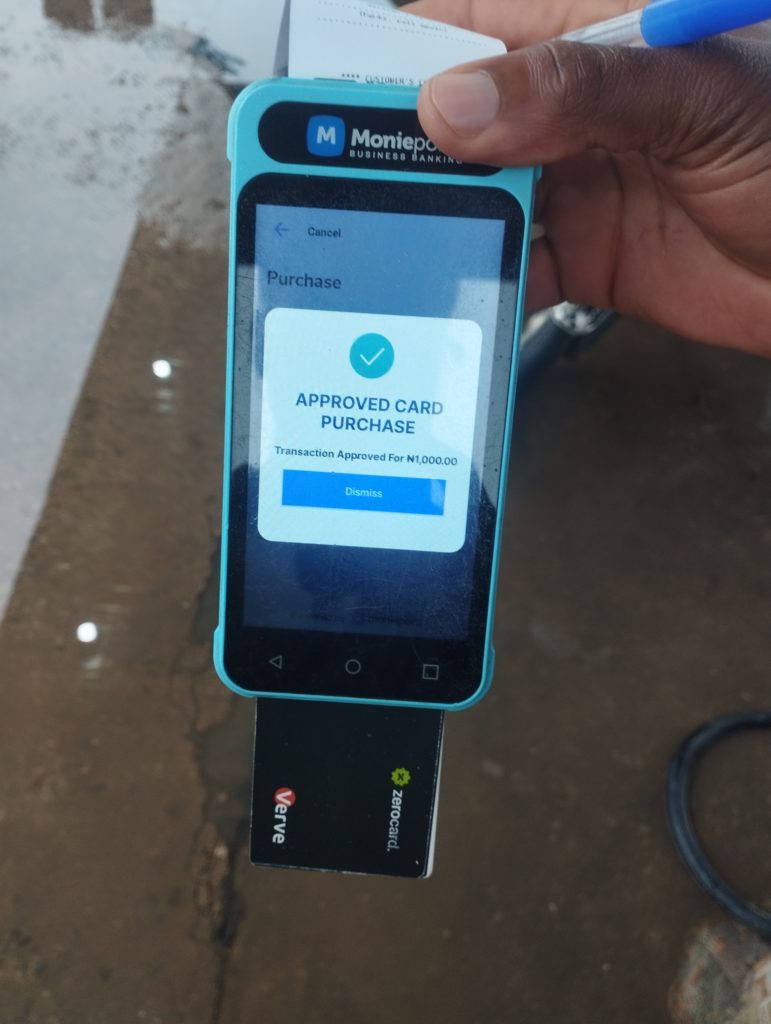

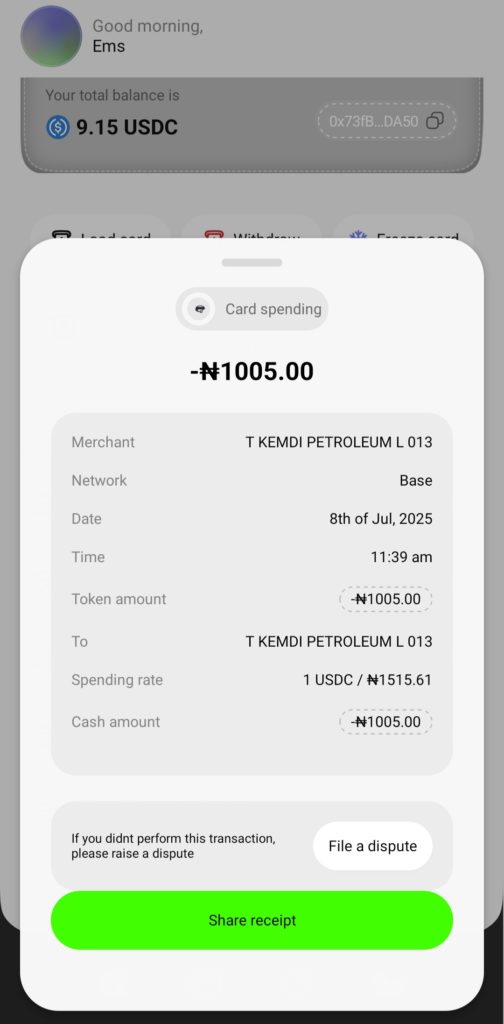

I began testing my crypto debit card at a POS machine, starting with low-value transactions. Cash withdrawals went through without any hitch.

, I tested it again during a last-minute supermarket run to pick up something I’d forgotten over the weekend. I had other payment options in case the card didn’t work, but the transaction went through.

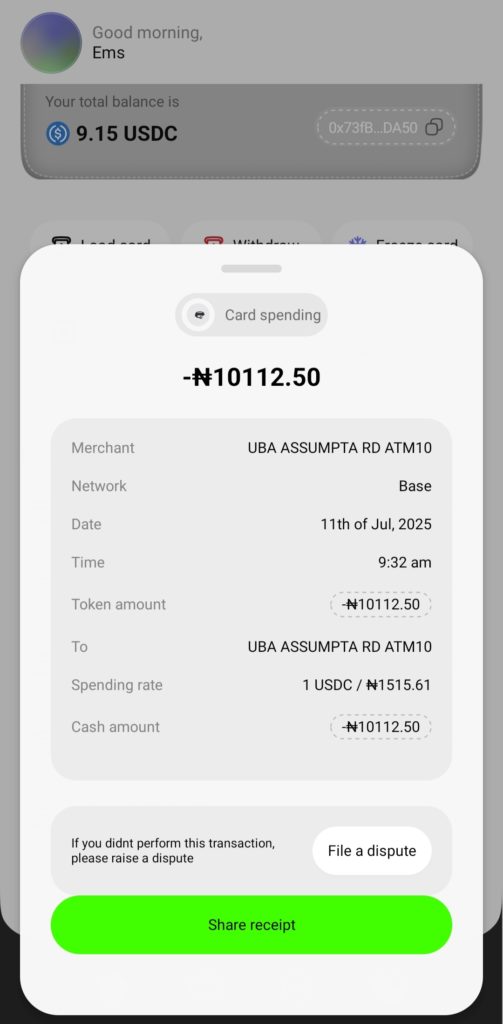

The next stop was an ATM. I slotted in the card, entered my PIN, and requested a withdrawal. The machine took around 40 seconds to process, so I assumed a settlement was happening between the card issuer and the bank operating the ATM. Eventually, the cash came out.

Feeling more confident, I tested the card again at a local mall. I paid for a movie ticket and just like the earlier attempts, the transaction completed without delay. I still had backup payment methods, but I didn’t need them again.

Throughout these tests, I monitored the charges. For transactions above or under ₦10,000 ($6.54), I was charged ₦5 ($0.0033). However, for ATM cash withdrawals, the fee rose to ₦12.5 ($0.0082). I also paid an additional ₦100 ($0.065) at the ATM—the standard fee for using a card on another bank’s machine, per Central Bank of Nigeria (CBN) rules.

So far, the crypto card has worked in every retail purchase I’ve tested it for.

How Zerocard’s crypto debit card works

Crypto debit cards are not mainstream in Africa. Even globally, few startups are building similar products. For example, Cardlink’s crypto cards allow users to spend Dogecoin, a cryptocurrency coin born out of a meme, on real-world purchases. At least two other startups are building crypto debit cards in Nigeria.

These physical cards are different from multi-currency virtual cards, which let you spend a mix of fiat and crypto across online checkouts, automatically matching the currency required for payment. Several crypto startups offer this option.

Intrigued by this product, I decided to investigate its workings and set up a call with Folajin.

Folajin built Zerocard alongside longtime friend and partner Seyi Idowu, the startup’s COO. Damilare Ibiyemi, a senior software engineer, is also joining Zerocard as CTO.

At the core of Zerocard’s infrastructure is something it calls the settlement engine, explains Folajin. This system links crypto transactions with naira settlements in near real-time.

“Once you swipe your card, we debit your USDC and hold it in an automatic escrow [smart contract],” Folajin said. “Then we instantly settle the merchant in naira. The merchant isn’t even touching crypto. We handle the conversion and release the crypto to our liquidity provider.”

So while the user is paying in crypto, the merchant sees naira as if it were a regular card transaction. The escrow contract, which Folajin said is publicly verifiable, temporarily holds the crypto until the fiat side of the settlement is complete.

According to him, settlement takes around ten seconds, but it could take slightly longer if there are issues with liquidity or system errors. That would explain the short lag I experienced at the ATM; somewhere in those seconds, crypto was being debited, held, converted, and naira was being settled.

Behind the scenes, Zerocard relies on liquidity providers. These are third-party service providers with deep reserves willing to execute instant swaps.

“We have a few we work with, and we also keep a small reserve just in case,” Folajin said. “If there isn’t enough liquidity at the time, the transaction just declines.”

And when a transaction fails, the app doesn’t leave you in the dark.

“If it’s a case of insufficient funds, that’s on the user. But if it’s on our end, we’ve built in failover systems. The user sees why it failed and can retry,” he added.

Integrating with a card provider

Zerocard’s backend infrastructure rests on two Nigerian financial service providers: Sudo Africa, which handles card issuance and application programming interfaces (API) integrations, and Safe Haven Microfinance Bank, which processes fiat transactions. Both companies are strictly fiat-only.

“Sudo is a card issuing company. We provide businesses with our API,” said Kennisha Donatus, business development manager at Sudo Africa. “We don’t handle crypto. That’s on Zerocard’s end.”

Zerocard handles everything crypto-related—wallet management and stablecoin liquidity—while Sudo facilitates card creation and webhook responses. Safe Haven, a licenced microfinance bank and Sudo’s sister company, manages naira inflows and outflows.

“They [Zerocard] fund their users and create cards with us. Safe Haven is used to make and collect payments, and that’s still all in naira,” Donatus said, reinforcing the card issuer’s non-involvement with crypto.

This separation allows Sudo and Safe Haven to stay fully compliant with local financial regulations while giving Zerocard room to operate at the crypto frontier. It also gives the crypto startup a regulated, bank-compliant surface for the traditional financial ecosystem.

When a user requests a card on Zerocard, Sudo directly charges the startup’s settlement account to process the card requests automatically through webhooks.

Sudo’s naira cards incur a ₦50,000 monthly access fee, while USD cards cost $500 monthly, which is handled by startups using its API. They can charge markups on transaction fees, provided they do not exceed CBN’s ₦50 ($0.03) threshold for electronic payments, said Donatus.

Yet, getting here wasn’t straightforward. Folajin described early conversations with card service providers who quoted fees so high he assumed it was a tactic to scare them off.

“I don’t know if they were doing it to chase us away,” he said. “But the fees some of them quoted were just outrageous. Eventually, we found a setup that worked.”

One compromise the startup didn’t make was in wallet architecture. The Zerocard app uses a non-custodial wallet model, powered by Blockradar. This allows users to control their wallet privacy and move funds outside the app as they choose.

The startup also works with a Nigerian fintech law firm to ensure regulatory compliance as it scales. Folajin was light on specifics, but clear on intent.

“We’re not skipping steps. We’re working with legal partners to make sure everything is clean, end to end,” he said.

The system they’ve built stitches together several moving parts—smart contracts, liquidity bridges, local bank partners, and card networks—into a single product that lets people spend crypto in everyday life. It does not replace fiat but integrates with it in a way that’s invisible to the merchant and seamless for the crypto user.

For the first time, stablecoins didn’t feel like a solution waiting for problems to happen. Without a crypto debit card, spending crypto or stablecoins meant that at some point, you’d have to convert them to fiat money. This significantly reduces the value users get in local currency as they battle exchange rate losses and gas fees.

How Zerocard makes money

Zerocard makes money in two ways: its card product and a percentage from settlement transactions.

A crypto debit card costs $4, which is already more expensive than a regular naira debit card, but still within the range of some virtual cards issued by fintechs. After splitting fees with service providers, Folajin said Zerocard earns about $1.5 on each card sold. But since these cards are issued physically, a significant portion of that money goes into logistics.

Shipping one card anywhere within Lagos costs at least ₦6,000 ($3.93). That figure jumps even higher for deliveries outside the state.

The second revenue stream comes from every transaction that flows through Zerocard’s settlement engine. When a user authorises a payment, Zerocard settles the merchant in naira by converting USDC at a slightly adjusted rate. That spread—typically within 1% of the market rate—is where Zerocard earns.

“We’re not using the general rate,” Folajin said. “We have our sources where we get better rates than the market. That gives us enough margin to keep the business running.”

It’s a small cut, but one that scales with usage.

The promise still falls short

Despite its utility, a crypto debit card is not for everyone. Some Nigerians still earn and spend in naira. Converting local currency to USDC just to spend it in naira again is an unnecessary loop.

The power users for a product like this are those already holding crypto. People who get paid in USDC or prefer to store value in stablecoins are more likely to find this useful. Folajin acknowledges this. Zerocard is building for crypto-native users first, not the everyday user, he said.

Yet, there’s still a big market here. Around 25 million Nigerians use crypto in some form. Capturing a fraction of that number could give Zerocard the scale it needs.

The future outlook for Zerocard

Zerocard is building a second version of the product this quarter. The upcoming release will eliminate the need for users to hold Base ETH just to cover gas fees, one of the initial friction points I encountered. With improved wallet infrastructure, users only need to load USDC to spend.

According to Folajin, the goal is to reduce friction, cut transaction times to under four seconds, and ensure that users’ wallet balances remain secure even if a card is compromised.

Zerocard’s debit cards perfectly balance crypto and traditional finance, as they work like regular debit cards. However, I couldn’t shake the thought that we’re still some ways away from “spending crypto like cash.”

Mark your calendars! Moonshot by is back in Lagos on October 15–16! Join Africa’s top founders, creatives & tech leaders for 2 days of keynotes, mixers & future-forward ideas. Early bird tickets now 20% off—don’t snooze! moonshot..com