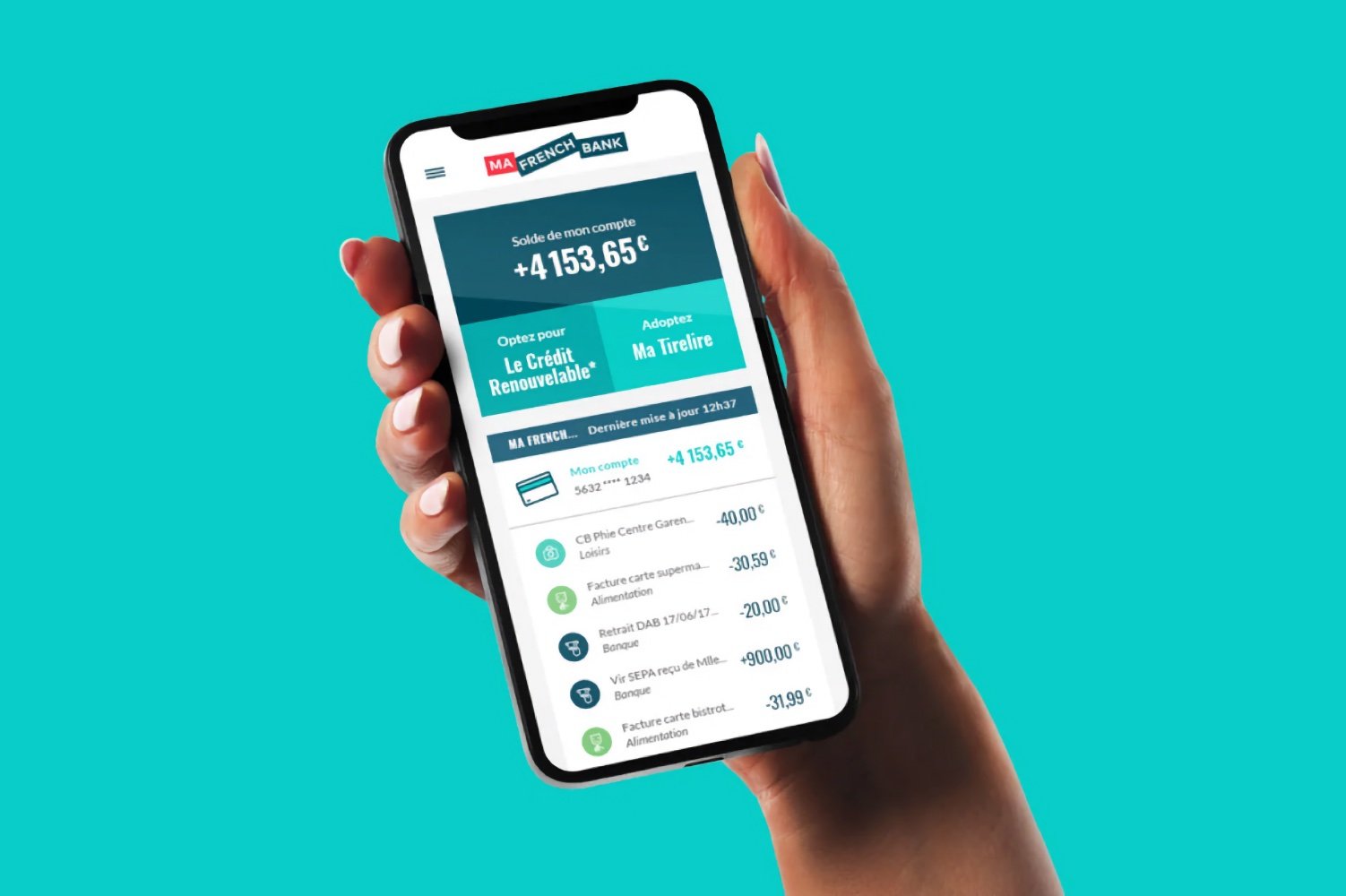

The curtain will close on Ma French Bank. The establishment, which was a pioneer when it was launched in 2019, will not survive for long in the fierce competition in the online banking market. Created to offer a 100% web alternative with costs reduced to 2 euros per month, it attracted a large audience at the start of its activity, in particular thanks to its simplicity and attractive prices. But, in December 2023, La Banque Postale announced that this adventure would end for financial reasons. Customers, informed gradually since June 2024, have until summer 2025 to transfer their money to new accounts.

675,000 customers affected by the closure of Ma French Bank

This withdrawal occurs in a context of saturation of the online banking market in France. Before Ma French Bank, it was Orange Bank which threw in the towel in 2024, and ING in 2022. Despite everything, neobanks continue to attract, with players like Revolut, N26 and Boursorama dominating the market, especially among young people, attracted by mobile services and low banking fees.

Ma French Bank customers must anticipate several steps to close their accounts with peace of mind. First thing, they will need to have an alternative account in another bank to transfer their funds there. Whether in a physical branch or in another online bank, opening a bank account can be facilitated by mentioning the closure of Ma French Bank as the reason for change. Customers can then transfer their money, either by a manual transfer, or by using the “banking mobility” service which allows all recurring direct debits and transfers to be automatically transferred to the new bank.

Ma French Bank customer service recommends carrying out these steps upon receipt of the closing letter to avoid any interruption of service. Once the funds have been transferred, the account can be closed from the Ma French Bank mobile application or through an online form. It will take up to 30 days for the account to be completely closed, but the associated credit card will be deactivated within 24 hours of this process. Customers are also encouraged to download their bank statements before the final closure, as these documents will no longer be accessible afterward.

To facilitate the transition, La Banque Postale, parent company of Ma French Bank, hopes to attract a portion of the customers left orphaned by this closure. It therefore offers a welcome bonus of 50 euros to former customers of Ma French Bank who choose to open an account with it. Another advantage: free fees on payments and withdrawals abroad, in effect until the end of 2024.

The shutdown of Ma French Bank also marks the end of associated mobile payment services, such as Apple Pay and Google Wallet, which will be deactivated as of December 4. A measure that forces users to review their habits. Customers using Ma French Bank as a secondary account will also need to update their banking information with their creditors to avoid any interruption in their automatic payments.

🟣 To not miss any news on the WorldOfSoftware, , .