China has established itself as one of the driving forces of artificial intelligence, both in adoption and integration of new functions, but the economic balance tells a different story. Its ecosystem grows outward, not upward: it accumulates use, but not income. This divergence between scale and return, increasingly visible in the compared data, explains why the main challenge for Chinese AI is not how much it invests, but how much it manages to earn.

The figures and trends we use come from sources that work with updated data series: Stanford University’s global investment tracker and the Tech Buzz China report together with Unique Research, which examines the performance of Chinese products and companies during 2024 and 2025. Their combination allows us to understand not only how much China is progressing in AI, but also how it is positioned compared to other markets.

The contrast between powers. Stanford University figures for 2024 place global corporate investment in AI at $252.3 billion, in a context of growing demand for these technologies. The United States led with 109.1 billion in private investment, a volume almost twelve times greater than that of China, which stood at 9.3 billion. The data illustrates the magnitude of the gap and the determining weight that American private financing has in the development of AI on an international scale.

AI business metrics. To understand the performance of any AI application, it is worth looking at the ARR. This metric reflects the recurring income that a company obtains in a year, a key indicator to evaluate the solidity of its economic model.

Unique Research places only four Chinese firms among the 100 private AI companies with the highest ARR: Glority reaches 173 million dollars, PLAUD 125 million, ByteDance 116 million and Zuoyebang 33 million. Together they add up to 447 million dollars, 1.23% of the total list, which amounts to 36.4 billion. Compared to that figure, American companies concentrate practically all of the recurring income, which marks a clear difference in scale and commercial maturity.

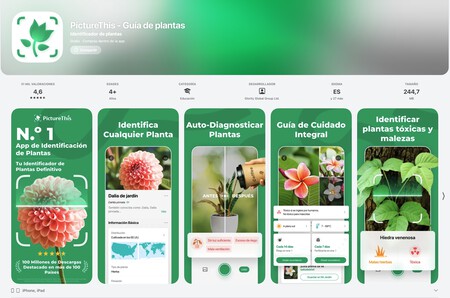

Glority and the piece that fits the context. The name Glority may not sound familiar to you, and that’s completely normal. Most likely, you have ever seen PictureThis, their plant identification application that has become the reference in its category. The company was born in 2009 and began working with computer vision models long before the recent rise of AI after 2022. Its trajectory helps to understand how some Chinese companies have grown by combining everyday utility and a technical base developed long in advance.

PLAUD and its double anchor: Shenzhen and the United States. Although it appears on the Unique Research list within the Chinese group, its founder assures that PLAUD operates as an American company. Xu opened an office in San Francisco in 2023, works from there with part of the team and registered the company in Delaware, storing data in Amazon centers in the United States. He himself summarizes its structure like this: “we have the best talent in Shenzhen for hardware design and the best engineers in San Francisco for AI development.”

A huge user base. The report estimates the aggregate monthly active users of the top 100 AI companies as of August 2025 at 4.78 billion. Of these, about 2.2 billion belong to Chinese platforms, around 46% of the total. Baidu, ByteDance, DeepSeek, Meitu and Zuoyebang top that list thanks to their presence on multiple daily services. The breadth of its portfolios and continuous integration of AI tools allow its reach to be significantly greater than other markets.

Predominance of the visual. In China, many of the most widely used AI applications revolve around the creation and editing of content, from video to photography, including retouching and digital makeup tools. This orientation responds to deeply rooted habits in the country. The result is a powerful visual ecosystem, although less present in business or productivity services, which usually provide more stable income.

Where opportunities are concentrated outside China. The report indicates that, on an international scale, the growth of AI is divided into categories linked to daily work: support, development, infrastructure, productivity and improved search. This group includes products developed outside China, such as ChatGPT, Cursor, Suno or Perplexity, which are integrated into professional processes where continuity and recurring payment are common. Faced with this diversity, the visual specialization of the Chinese ecosystem occupies a more limited space.

An obvious commercial paradox. The Chinese AI ecosystem is built on a huge domestic market, and most companies develop their products with that audience in mind. The report identifies hundreds of startups focused primarily on local users, a strategy that takes advantage of both the country’s scale and its pace of technological adoption.

However, when the products that generate the most recurring income are analyzed, those that invoice in international markets predominate. Of the 23 Chinese products present in the top 100 by ARR, 19 earn their main income outside of China. The conclusion is clear: use is concentrated within the country, but the capacity for sustained monetization continues to come from abroad.

Achilles heel. By relying on foreign markets to sustain their recurring revenues, Chinese AI companies operate under a higher level of uncertainty than their global competitors. Restrictions associated with “national security,” app bans, and trade measures between countries have become more common, and each of them can limit your international presence. If any of these barriers affected products that are currently monetized abroad, the drop in income would be difficult to avoid.

The picture left by the figures is clear: China has built a broad ecosystem, although its income structure continues to depend enormously on foreign sources. The question is no longer how much you invest, but how you convert that effort into lasting results inside and outside the country. The challenge is to consolidate a model that can be sustained beyond reach and that resists an international environment marked by tensions and changing regulations.

Images | WorldOfSoftware with Gemini 2.5

In WorldOfSoftware | DeepSeek has broken its silence after months without appearing: its chief researcher has warned about the impact of AI on employment