Table of Links

Abstract and 1. Introduction

-

Background

2.1 Rollup

2.2 EIP-4844

2.3 VAR(Vector Autoregression)

-

Data

3.1 Consensus security data

3.2 Ethereum usage data

3.3 Rollup Transactions Data

3.4 Blob gas fee data

-

Empirical Results

4.1 Consensus security

4.2 Ethereum usage

4.3 Rollup transactions

4.4 Blob gas fee market

-

Conclusion and References

A. Consensus Security Data

B. Rollup Data Collection

C. Detailed Var Model Results for Blob Gas Base Fee and Gas Fee

D. Detailed Var Model Results for Blob Gas Base Fee and Blob Gas Priority Fee

E. Rollup Transaction Dynamics

3.3 Rollup Transactions Data

To assess the impact of EIP-4844 on rollup transaction dynamics, we conducted a comprehensive analysis focusing on the changes in rollup transaction volumes and delays between rollup and Ethereum blocks. The analysis period spans 100,000 blocks before and after the implementation of EIP-4844.

Our data were sourced from transactions sent by recognized rollup addresses on the Ethereum network. Among the various transaction types initiated by rollups, we specifically collected batch transactions, which compress all individual rollup transactions. These transactions are crucial for ensuring user security by mitigating operator risk and safeguarding user funds. Batch transactions typically precede other transaction types such as proving and finalizing transactions, reflecting their foundational role in securing user interactions on rollups. We regard the timestamp of batch transaction sent to Ethereum as the settlement of rollup transactions, and calculate the delay by getting the time difference from rollup block timestamp.

The following common process was employed to extract data on rollup transactions and user delays:

(1) Filter rollup transactions from the Ethereum mainnet using known rollup sender addresses.

(2) Decode the data from rollup batch transactions.

(3) Acquire rollup block data from external sources and integrate this data with (2) to analyze user delays and transaction metrics.

Figure 4 illustrates an example of the process of our data collection and preprocessing for Arbitrum blocks.

Each rollup employs unique encoding mechanisms, often modified by updates such as span-batch mechanisms[37], which posed significant decoding challenges. Additionally, the rapid block times and large data volumes of rollups like Arbitrum (0.26 seconds) and Optimism (2 seconds) necessitated the use of specialized tools and methods for data collection and analysis, as maintaining full nodes for all monitored rollups was infeasible.

We utilized a variety of rollup explorers and batch decoding tools tailored to each rollup’s specific needs. Details on the specific tools and data sources used are provided in Appendix Table 9. Our analysis concentrated on six rollups—Arbitrum One, Optimism, Base, Starknet, zkSync Era, and Linea—where we were able to obtain decoded batch transaction data.

3.4 Blob gas fee data

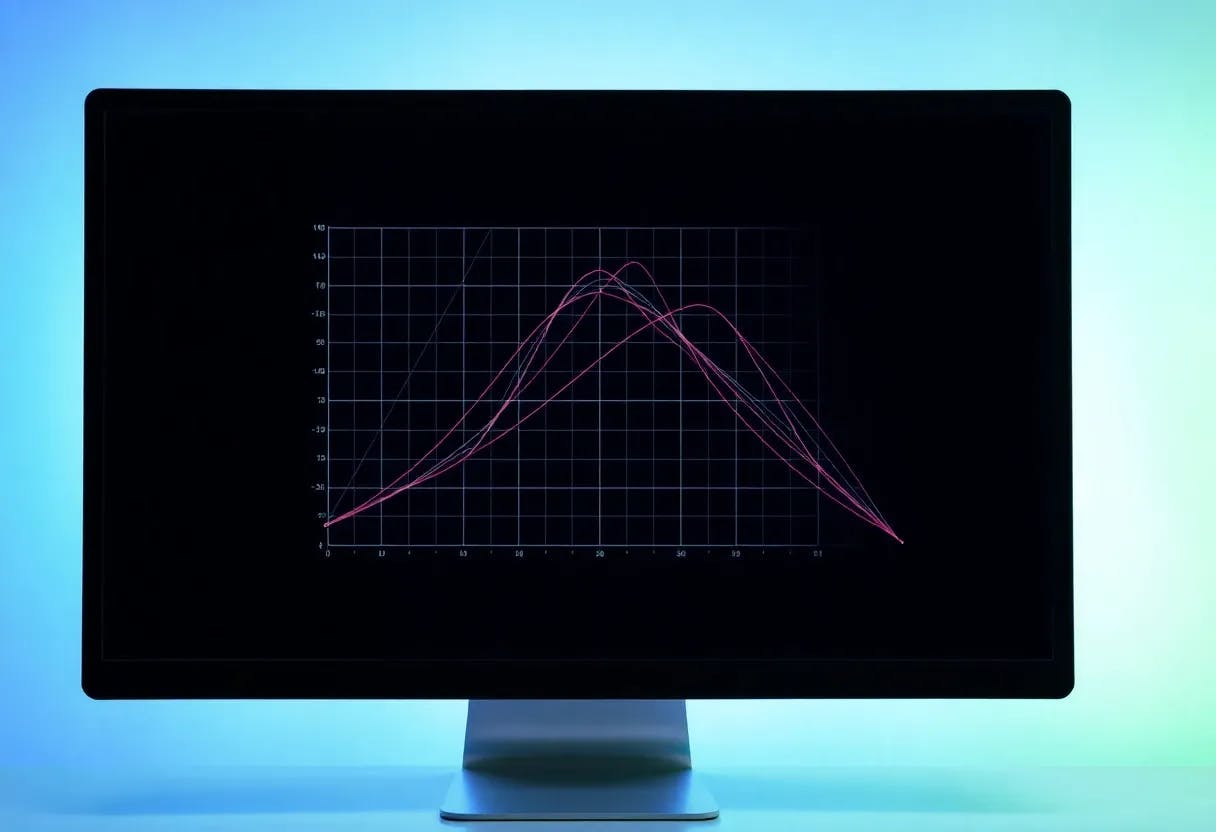

To conduct a comprehensive analysis of the blob gas fee mechanism, we collected data from our Erigon archive node on the base fees for blob gas, as well as the gas and blob gas usage for each transaction within selected blocks. To explore the new blob gas market, we specifically analyzed data from blocks 19,518,097 to 19,587,588, during which the blob gas base fee exceeded 0.1 Gwei.

Blob gas market period The blob gas base fee update rule adjusts the base fee upward when average usage surpasses three blobs per block. Given the gradual uptake of blobs by rollups and their limited use by DApps, the blob gas base fee typically hovered around 1 wei for a considerable duration.

Our analysis concentrates on the period during which base fees rose above 0.1 Gwei, corresponding with heightened blob activity. This period commenced at block 19,518,097, triggered by the activation of blob submission services that briefly elevated the blob base fee. Although demand receded and the base fee reverted to 1 wei by block 19,587,588, the fluctuations within this interval are crucial for comprehending potential reactions of the blob gas fee market to increased DApp engagement. Focusing on this period allows for a detailed examination of the blob gas fee market’s behavior under conditions of active blob utilization.

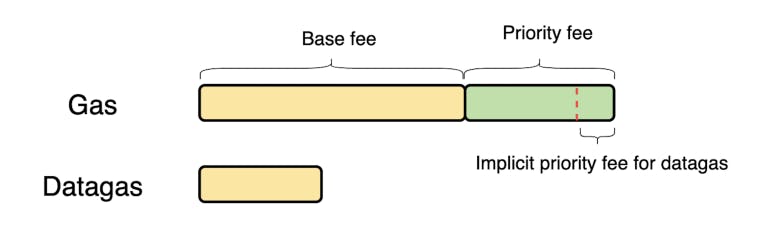

Blob gas priority fee. Unlike the gas fee update rule, where users can set a maximum priority fee per gas unit, the blob gas fee mechanism lacks this functionality. In the blob gas market, there is only a base fee, which is automatically adjusted based on network congestion. Users must implicitly set a blob gas priority fee, as illustrated in Figure 5.

To effectively evaluate the blob gas base fee update rule, it is crucial to quantify the excess demand for blob gas. In the traditional gas market, the priority fee of a transaction serves as an indicator of how well the base fee reflects actual user demand. Consequently, we have developed a new metric to represent the blob gas priority fee using the following formula:

For each 𝑘-th block containing multiple transactions, we define the following parameters:

The blob gas priority for each transaction can be expressed as:

To find implicit priority fee for blob gas, we used median priority fee of other transactions in the same block as a proxy for gas priority fee, and subtracted it from the total fee paid.

Authors:

(1) Seongwan Park, this author contributed equally to the paper from Seoul National University, Seoul, Republic of Korea ([email protected]);

(2) Bosul Mun, this author contributed equally to the paper from Seoul National University, Seoul, Republic of Korea ([email protected]);

(3) Seungyun Lee, Seoul National University, Seoul, Repulic of Korea;

(4) Woojin Jeong, Seoul National University, Seoul, Repulic of Korea;

(5) Jaewook Lee, Seoul National University, Seoul, Repulic of Korea;

(6) Hyeonsang Eom, Seoul National University, Seoul, Repulic of Korea;

(7) Huisu Jang (Corresponding author), Soongsil University, Seoul, Republic of Korea.

This paper is