Table of Links

Abstract and 1. Introduction

-

Bitcoin and the Blockchain

2.1 The Origins

2.2 Bitcoin in a nutshell

2.3 Basic Concepts

-

Crypto Exchanges

-

Source of Value of crypto assets and Bootstrapping

-

Initial Coin Offerings

-

Airdrops

-

Ethereum

7.1 Proof-of-Stake based consensus in Ethereum

7.2 Smart Contracts

7.3 Tokens

7.4 Non-Fungible Tokens

-

Decentralized Finance and 8.1 MakerDAO

8.2 Uniswap

8.3 Taxable events in DeFi ecosystem

8.4 Maximal Extractable Value (MEV) on Ethereum

-

Decentralized Autonomous Organizations – DAOs

9.1 Legal Entity Status of DAOs

9.2 Taxation issues of DAOs

-

International Cooperation and Exchange of Information

10.1 FATF Standards on VAs and VASPs

10.2 Crypto-Asset Reporting Framework

10.3 Need for Global Public Digital Infrastructure

10.4 The Challenge of Anonymity Enhancing Crypto Assets

-

Conclusion and References

10.3 Need for Global Public Digital Infrastructure

Pseudonymity and extra-territoriality are two key aspects of crypto assets which are a major hurdle for tax administrations across the world to realize the full potential of taxes due on crypto assets. Most crypto asset service providers and law enforcement agencies rely on blockchain analytics solutions which attribute crypto asset addresses to a natural or legal person. Such attribution would not be required for off-chain transactions undertaken by an individual or entity with a Reporting Crypto-Asset Service Provider as the information can be obtained through CRS. The accurate determination of such information for on-chain transactions i.e. P2P transactions is essential for levying taxes as the ownership of private keys corresponding to the wallet would be required to be established before the levy of tax. As the blockchain analytics-based attribution is mainly obtained through clustering techniques and transaction behaviours, it might not establish legal ownership or control of the private keys beyond doubt[162].

One example of such attribute of a crypto asset address is its jurisdictional tax administration. Accurate information about the originator and beneficiary tax jurisdiction is essential for addressing multiple issues related to taxation in a transaction, like:

a) Percentage of amount to be withheld, if at all

b) Attribution of profits to a jurisdiction

c) Preparation and submission of information returns of an entity for a jurisdiction

d) Application of Double Taxation Avoidance Agreements

e) Determining tax treatment of a DAO and its members

The information related to off-chain transactions would be collected and retained for the prescribed periods by the Reporting Crypto-Asset Service Provider. Information related to the transfer of crypto assets from a Reporting Crypto-Asset Service Provider needs to be obtained from the user, which might require a cryptographic process similar to the Address Ownership Proof Protocol[163]. As the transaction information is already stored on the blockchain it might be more prudent for tax administrations to attribute crypto asset addresses to TINs using cryptographic methods and then use the blockchain information about P2P transactions to determine tax liability of the taxpayer.

Presently the CRS information is exchanged through secure networks established by the participating countries’ tax authorities or the Common Transmission System (CTS) provided by the OECD which are designed to ensure the confidentiality, integrity, and privacy of the exchanged data. However, this data is exchanged annually after a lag and is not designed to provide real-time information which might be the requirement for many tax jurisdictions to attribute the crypto asset address to a tax jurisdiction and TIN. To meet this requirement tax administrations across the globe would require a global public digital infrastructure for obtaining, maintaining, and facilitating the access to such attribution data ensuring the confidentiality, integrity, and privacy of the data, where exchange of data can take place in accordance to policies based on Exchange of Information Agreements between tax jurisdictions. The tax administration might use measures like prescribing higher withholding tax rates for transactions with wallets for which such attribution information could not be obtained from any tax jurisdiction in real time.

One probable design of such a system may use digital signature certificates issued to every TIN holder from its respective tax authority. Using the digital signature certificate issued by the tax authority and digital signatures from their wallet addresses the tax jurisdiction of the TIN can obtain a cryptographic proof of the ownership of the crypto asset private keys by the TIN holder. The tax jurisdiction would be required to maintain a record of all public addresses of its TIN holders for which it holds the cryptographic proof, and in real time, respond to queries from other jurisdictions about the ownership of a Crypto address by a TIN holder in the jurisdiction. As the number of unique Ethereum addresses which have been used for transactions till date is in tens of Millions and the number of unique Bitcoin addresses that have been used for transactions till date is in few billions, using appropriate data structures and search methods, the tax administrations can respond to requests from other jurisdictions about a TIN holder in real-time.

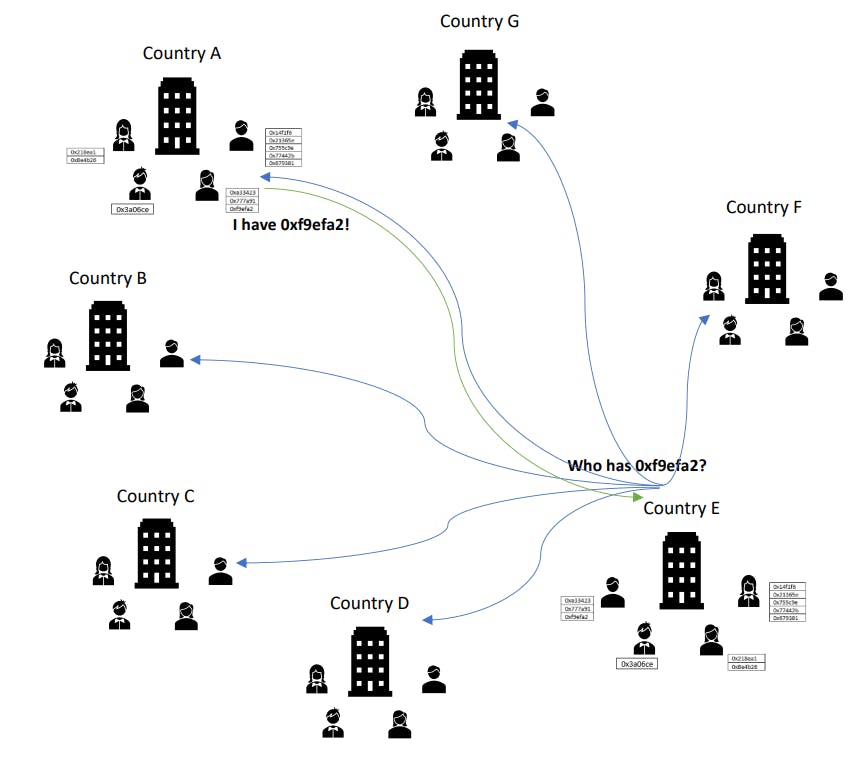

Whenever a new transaction is to be carried out, the wallet software can broadcast a message signed with the digital signature issued by the originating jurisdiction enquiring about the tax jurisdiction of the beneficiary crypto address as depicted in Fig. 57. Depending upon the EOI agreements some or no tax jurisdiction may respond to the broadcast about the presence of the TIN of the beneficiary crypto asset address owner in the affirmative. In case a response is received the transaction can be carried out as usual on the blockchain, as the jurisdictions, by virtue of processing requests based on cryptographic proofs, would automatically obtain the visibility of the transactions, and may also exchange the personal information related to the TINs. In case no response is received broadcast about the presence of the TIN of the beneficiary crypto asset address from any tax jurisdiction, the originator may be obligated by its tax jurisdiction to withhold taxes at a higher rate to safeguard the interest of the tax administration of the transaction originator. This design may also enable tax administrations to perform their own analytics on on-chain transaction data and the beneficial ownership and controlled entity information captured in the tax returns filed by their taxpayers.

Another such secure information sharing mechanism that can be used by virtual asset service providers can be XMTP Protocol[164] based messaging. This messaging protocol provides a wallet-towallet messaging functionality provided both the wallets on-board to an XMTP protocol-based application. This service can provide a VASP with technically proven means of identifying the VASP that manages the beneficiary wallet exhaustively, precisely, and accurately in all circumstances and from the VA address alone, if the beneficiary VASP also uses an XMTP protocol-based application. The onward and backward communication between two wallets is depicted in Fig. 58 and 59. Multiple applications built on the protocol would be interoperable. An application can be developed as a global public digital infrastructure like the SWIFT network for exchanging Travel Rule information between VASPs, ensuring the adherence to Data Privacy and Protection. As most VASPs follow the interVASP Messaging Standard 101 (IVMS 101)[165], which is a data format for exchanging travel rule information, like the XML scheme in CARF, a standard protocol for communication can solve the problem of interoperability. Just as the protocols approved by the Internet Engineering Task Force like the Hypertext Transfer Protocol[166] (HTTP) and Transport Layer Security[167] (TLS) Protocol provide the broad framework which needs to be adhered to by developers, similar adoption of standards would be required to overcome the problem of interoperability. The SWIFT network used by financial institutions for the rapid, precise, and secure transmission of transaction information is another such example.

10.4 The Challenge of Anonymity Enhancing Crypto Assets

Tracing anonymity-enhancing crypto assets, particularly those like Monero, presents multifaceted challenges due to the sophisticated technological features embedded within these cryptocurrencies. Monero leverages cutting-edge cryptographic techniques such as ring signatures, stealth addresses, and confidential transactions to provide users with unparalleled privacy and fungibility. One of the primary hurdles in tracing Monero transactions lies in its use of ring signatures, which obfuscate the sender’s identity by mixing the sender’s transaction with those of other users, making it virtually impossible to determine the true source of a transaction.

![Fig. 58 XMTP: Onward communication between two wallets[168]](https://cdn.hackernoon.com/images/null-3j0329b.png)

![Fig. 59 XMTP: Backward communication between two wallets[169]](https://cdn.hackernoon.com/images/null-8n132ux.png)

Unlike Bitcoin, where transactions can be traced through a transparent ledger, Monero’s blockchain obscures transaction details, including sender, recipient, and transaction amount, thereby thwarting traditional tracing methods. Additionally, Monero employs stealth addresses to enhance privacy by generating unique, one-time addresses for each transaction, making it challenging for external observers to link transactions to specific recipients. Furthermore, Monero’s integration of confidential transactions encrypts transaction amounts, adding another layer of complexity to tracing efforts. These technological innovations collectively render Monero transactions highly opaque and resistant to external scrutiny, posing significant challenges for tax authorities and law enforcement agencies seeking to enforce taxation laws and tracing illicit activities. Blockchain mixers and tumblers also pose similar challenges.

Addressing these challenges necessitates the development of novel investigative techniques and regulatory frameworks tailored to the unique characteristics of privacy-centric cryptocurrencies like Monero, as well as collaboration between public and private sectors as well as governments on a global scale. Various blockchain intelligence and analytics solution providers claim the ability to trace Monero. However, it remains extremely difficult, if not impossible, to trace Monero purely through conventional methods used for other crypto assets like Bitcoin and some other conventional investigative inputs might be required.

:::info

Author:

(1) Arindam Misra.

:::

:::info

This paper is available on arxiv under CC BY 4.0 DEED license.

:::

-

https://finance.yahoo.com/news/crypto-tracing-revolutionizing-crime-fighting-124050120.html

-

https://www.21analytics.ch/what-is-aopp/

-

https://xmtp.org/.

-

https://www.intervasp.org/

-

https://www.ietf.org/rfc/rfc2616.txt

-

https://www.ietf.org/rfc/rfc5246.txt

-

https://xmtp.org/ Portions of this page are modifications based on work created and shared by XMTP and used according to terms described in the Creative Commons 4.0 Attribution License

-

https://xmtp.org/ Portions of this page are modifications based on work created and shared by XMTP and used according to terms described in the Creative Commons 4.0 Attribution License