-

BigBear.AI makes adapted software, mainly for military customers and government -bound companies.

-

The income fell in Q2.

-

BigBear.AIs Marge profile is different from that of typical AI software companies.

-

10 shares that we like more than Bigbear.ai ›

Bigbear.ai (NYSE: BBAI) Is one of the more popular Small-Cap Artificial Intelligence (AI) shares on the market, and with a market capitalization of only $ 2.6 billion it has a lot of room to grow.

The dream for every AI stock is the duplicate of the performance of Palantir (Nasdaq: PLTR)that has yielded an impressive revenue growth and outstanding rating of share price. Palantir now has a market capitalization of $ 400 billion, so to surpass Bigbear.AI, it would require incredible returns in the coming decade.

Are such a profit feasible, or is BigBear.AI too far behind to catch up?

BigBear.AI and Palantir work in comparable industries. Palantir sells AI-driven data analysis software that it originally developed to meet the needs of government customers. BigBear.AI also makes software that is mainly intended for the use of the government, although it offers customized solutions instead of a software platform.

The largest contract of Bigbear.Ai is with the US Army and develops its Global Force Information Management System. This system will ensure that the US Army “well staffed, rested, trained and resources” for whatever the current mission is.

Bigbear.AI recently announced that it will help the American navy to improve coordination and decision-making opportunities during a large multinational training exercise. This could open a path to the company to win another military contract, which desperately needs.

Unlike most of his AI colleagues, BigBear.AI does not grow. In the second quarter, sales fell by 18% to $ 32.5 million. This is an obvious red flag. If the company cannot produce respectable growth in the Golden Age of AI expenditure, when is it possible?

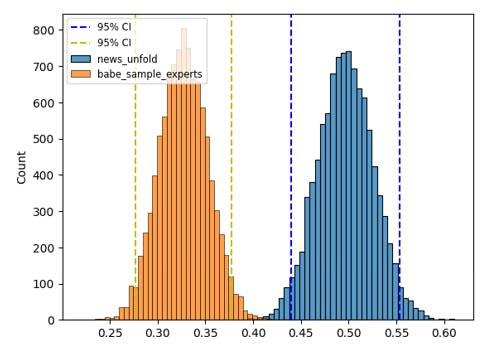

Moreover, because it does not develop a software platform to base other products, it must develop adjusted solutions for every customer. This expensive process eats in Bigbear.ai’s gross margin. Most software companies (such as Palantir) have gross margins in the range of 70% to 90%. BigBear.AIs is in the range of 20% to 30%. This limits the benefit for his profit for the near future.

That second red flag makes it even more difficult to compare Bigbear.ai with a successful company such as Palantir.