I read recently that Indonesia is planning to make Bitcoin a national reserve asset.For most Bitcoin enthusiasts, that probably sounds positive. But to me, it’s like letting a beetle fly a plane while we’re inside it.

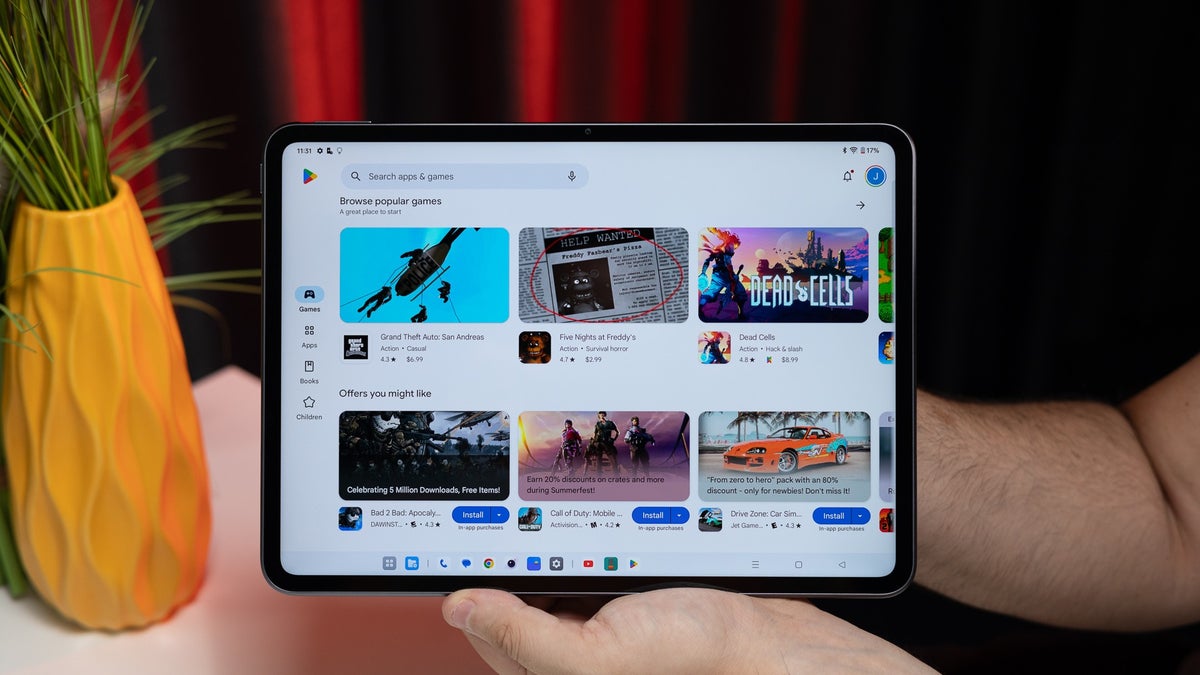

Bitcoin is often called “digital gold” and praised for its ability to store value in the long term. Some countries have tried holding it in their reserves, either by deliberate purchase or simply because law enforcement seized it. El Salvador famously adopted Bitcoin as legal tender, and the United States holds a significant amount through seizures. However, their stories reveal one truth: holding Bitcoin successfully as a country is far from simple.

Now, imagine Indonesia taking that leap.

Understanding What “National Reserve Asset” Really Means

A national reserve asset is like a country’s emergency wallet. It’s there to stabilize the economy during crises, maintain trust with international investors, and protect the currency’s value. Traditionally, this wallet is filled with gold, foreign currency, or government bonds. These assets are chosen because they are stable, predictable, and easy to use when trouble strikes.

Bitcoin, on the other hand, is highly volatile. Its value can swing like a roller coaster in just a day. For individuals, that can be exciting or scary, depending on your investment style. But for a country’s reserve, stability is everything. You don’t want your emergency wallet losing 20% of its value overnight because of a tweet or a sudden market panic.

Indonesia’s Economic Reality

Indonesia’s economy has its strengths, but it also has some deep challenges. Corruption remains a serious issue, and transparency in government financial decisions is often lacking. Many policymakers still have little to no understanding of how cryptocurrencies work. Even within the central bank, knowledge of blockchain and digital assets is limited to a small group of experts.

Our currency, the rupiah, is not among the world’s strongest, but it is backed by a system the government can control. If we replace a part of our reserves with Bitcoin, we are essentially tying our economic safety net to a global market we cannot control or influence.

That’s like replacing your home’s concrete foundation with bamboo, It might look unique, but will it survive the next storm?

Lessons from Other Countries

El Salvador jumped into Bitcoin adoption with big dreams. The result? Mixed. While they gained global attention and some tourism benefits, their economy did not suddenly become stronger. Many citizens still prefer using the US dollar. The US, on the other hand, holds Bitcoin mainly from legal seizures, and they treat it differently from gold or official reserves. Their BTC is “untouchable” in some cases, but it was never meant to replace traditional reserve assets.

These examples show that Bitcoin in a national vault is not automatically a magic ticket to economic growth. Without strong financial management, clear legal frameworks, and deep understanding, it can become more of a burden than a benefit.

The Risks for Indonesia

-

Price Volatility

Bitcoin can jump or drop thousands of dollars in a day. For a country that needs predictable assets for stability, this is a huge risk. Imagine trying to pay for emergency imports during a crisis, only to find that your reserves have lost value overnight.

-

Lack of Policy Knowledge

In Indonesia, crypto adoption is still at an early stage. If very few people in the government understand how to manage Bitcoin strategically, the asset can be mishandled or poorly integrated into financial plans.

-

Corruption and Transparency Issues

Adding a digital asset into national reserves without strong anti-corruption measures could open doors for misuse. Unlike gold stored in a vault, Bitcoin is digital and can be moved in seconds. Without proper oversight, that’s a dangerous temptation.

-

No Direct Economic Benefit

Simply holding Bitcoin doesn’t create jobs, improve infrastructure, or fix inflation. It’s a store of value, not a magic economic booster.

What Indonesia Needs First

Before even considering Bitcoin as a national reserve asset, Indonesia should:

- Educate policymakers and central bank staff about blockchain and crypto economics.

- Create strict transparency rules for handling any digital assets.

- Strengthen anti-corruption systems to prevent misuse.

- Test crypto adoption in smaller, controlled environments (like city-level projects or state-owned enterprises) before scaling to national reserves.

So..

Bitcoin can be powerful when used in the right context, but it’s not a one-size-fits-all solution. For Indonesia, jumping straight into making it a national reserve asset could create more problems than it solves. We need stability, trust, and strong governance before we can safely hold something as volatile as Bitcoin in our economic safety net.

Until then, keeping our reserves in traditional, stable assets may be the wiser choice, because in national finance, it’s better to be the experienced pilot than the beetle in the cockpit.

If there’s something you want me to cover next, just let me know. You can follow me here on my website to get my latest updates as soon as they drop! You can also contact me through X @AskaraJr and Linkedin