Last year was the third-strongest on record for global venture funding, trailing only the peaks in 2021 and 2022. It was also a surprisingly strong year for IPOs and we saw an uptick in startup M&A numbers.

All that sets the stage for what the industry insiders we spoke with expect will be another robust year for startup investment, acquisitions and new public-market listings. At the same time, there’s growing concern about capital concentration as venture dollars accumulate in a relatively small cohort of companies, many of them based in the San Francisco Bay Area.

With that, here’s a closer look at six trends we expect to see unfold in 2026.

1. A strong showing from the IPO market

Although the IPO window didn’t stay open the whole year, 2025 turned into an unexpectedly strong one for new offerings. At least 23 U.S.-based companies listed above $1 billion in value in 2025 compared to nine in 2024. Total valuations at IPO price for those billion-dollar listings reached at least $125 billion — more than doubling year over year.

This year, experts we spoke with expect that momentum to continue. In this market, “a profitable company — particularly one that either is an AI play or has a good story of how AI will be a tailwind for their business — are good candidates for a 2026 IPO,” Aman Singh, a corporate partner at Fenwick & West who was involved with the CoreWeave, Figma and Navan IPOs, told my colleague Gené Teare in late December.

Among the companies most closely watched for potential offerings this year are fintech unicorns such as Plaid and Revolut, and buzzy AI companies including OpenAI, Databricks and Cohere.

Still, in the first month of this year, some of that enthusiasm has tempered. As contributing reporter Joanna Glasner notes, even when open, the IPO window is always just a quick market turn from slamming shut once again.

So while a new offering from a buzzy company like SpaceX or OpenAI would help prop the window open, more humdrum IPOs from run-of-the-mill enterprise SaaS startups probably won’t be enough to fuel a new IPO boom.

2. A flurry of M&A activity

Startup acquisitions are also expected to become more common this year, especially if the IPO market does gain steam.

“A healthy IPO market tends to increase M&A activity rather than reduce it,” Anuj Bahal, technology, media and telecoms deal advisory and strategy leader for KPMG US, told contributing reporter Mary Ann Azevedo. “Many companies pursue dual-track strategies, simultaneously preparing for an IPO while exploring M&A, which gives them greater flexibility and leverage in negotiations. The threat of a public offering can be used as a bargaining chip to drive up a startup’s sale price.”

Last year, there were around 2,300 M&A deals for venture-backed startups, per Crunchbase data. Industry insiders we spoke with said they expect dealmaking to continue at a steady pace in 2026, in part as larger companies make strategic buys for startup talent, and as startups last funded in the boom five years ago look for exit opportunities.

“On the one hand, big corporates are snapping up seed/Series A startups for talent and tech — we can call that the AI acqui-hire trend. Many teams with fewer than 100 employees have landed $100 million-plus exits,” Lukas Hoebarth, EY-Parthenon Americas technology sector leader, told us. “On the other hand, a cohort of 3- to 6-year-old unicorns that stalled on IPO plans is finally selling.”

3. Strong funding, especially for these sectors

Four investors who spoke with Mary Ann all concurred that they expect another uptick in venture funding this year, with predictions ranging from a 10% to 25% year-over-year increase.

Those investors expect funding in 2026 will continue to concentrate into AI-related companies and adjacent sectors such as robotics and defense tech, at the expense of areas like climate tech, crypto and vertical AI that doesn’t have a strong differentiation or moat.

“Last year demonstrated that it’s difficult to survive as an AI wrapper company,” George Mathew, managing director at Insight Partners told Mary Ann last month. “Even the vertical AI providers have to be deeply embedded into industry workflows to differentiate themselves from a foundation model doing more of the repetitive work in the market.”

Many of the investors also said they expect capital to concentrate on two ends of the startup spectrum: big growth rounds for established players to maintain a market lead, and larger seed and early-stage deals to promising startups that look poised to disrupt.

“I expect net new dollars to concentrate more in seed and growth deals, primarily because the seed rounds are getting quite large thanks to fundraises by the likes of neolabs, neoclouds, and others. Furthermore, the capital needs of existing high-growth companies will continue to grow due to dependencies on frontier lab and hardware spend,” Menlo Ventures partner Tim Tully told us.

Already, we’re seeing those predictions about the rise in early-stage megarounds pan out.

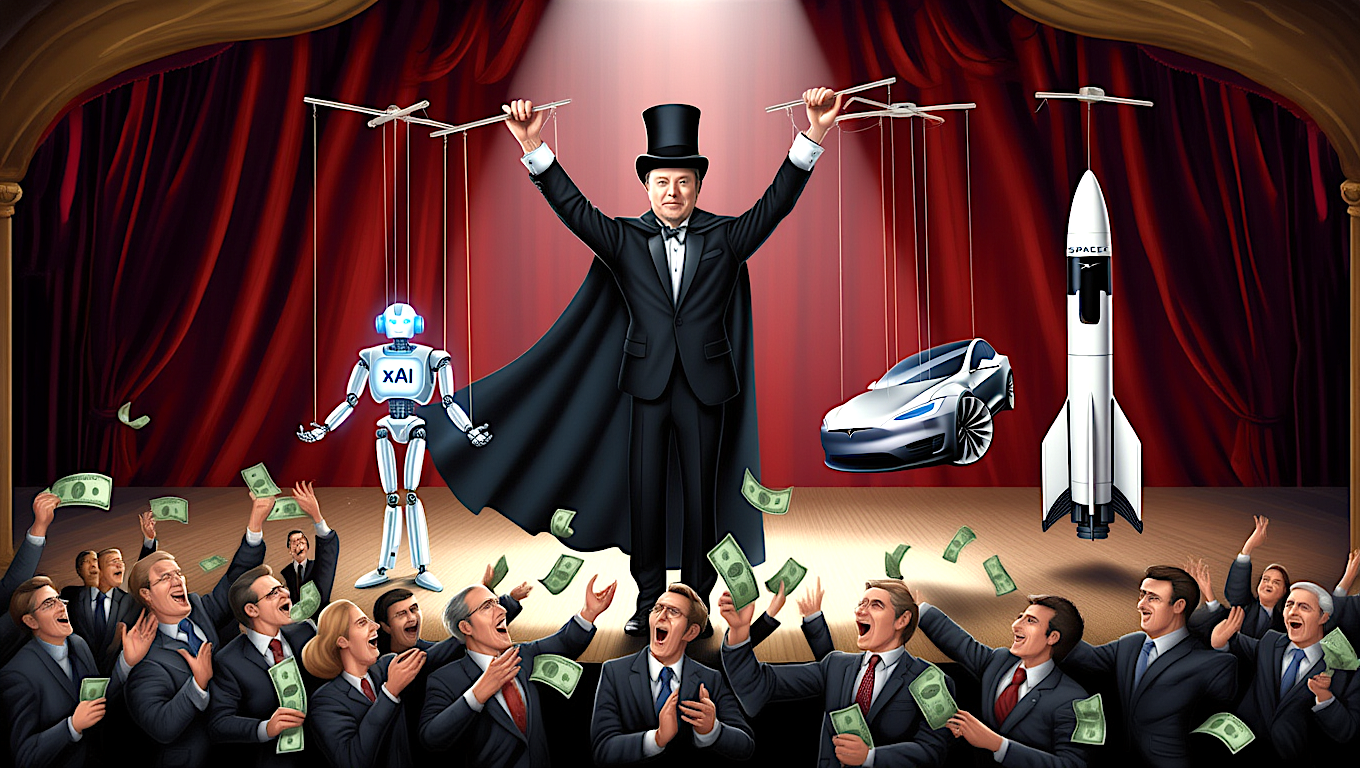

4. Capital concentration and heightened AI bubble fears

Last year’s venture funding disproportionately went to a select group of companies. OpenAI, Scale AI, Anthropic, Project Prometheus and xAI each raised more than $5 billion in 2025. Altogether, those five companies raised $84 billion, or 20% of all venture funding last year — an unprecedented amount for the largest fundings in any given year, an analysis of our data shows.

Last year was also defined by new startup records: the largest private funding round of all time ($40 billion to OpenAI), the largest private valuation ever recorded (SpaceX’s $800 billion valuation), and the largest venture-backed acquisition on record (Wiz’s $32 billion purchase by Google).

All that’s to say: Investors placed bigger, bolder and riskier bets on a smaller cohort of companies. That capital concentration — along with the circular nature of the deals between companies such as OpenAI, Nvidia and Oracle — have heightened concerns about an AI bubble that could have far-reaching fallout for both private and public tech companies, and the global economy overall.

5. More tech layoffs due to AI

AI has also prompted mass layoffs. Last year, we saw job cuts at companies including Salesforce, Microsoft and Amazon blamed at least in part on artificial intelligence.

“I’ve reduced it from 9,000 heads to about 5,000, because I need less heads,” Salesforce CEO Marc Benioff said last fall, explaining the San Francisco-based company’s decision to slash its customer-service headcount.

All told, around 55,000 U.S. layoffs in 2025 cited AI as a factor, according to staffing firm Challenger, Gray & Christmas.

Unfortunately, we expect to see more tech employers make similar moves this year as companies focus on cutting costs and replacing some portion of their human workers with cheaper AI substitutes.

6. Fintech’s rebound

One of the startup sectors that experienced a particularly healthy bounce last year was fintech, with funding to the sector jumping 27% year over year to $51.8 billion. Investors in the space are bullish on 2026 as well.

Fintech VCs told Mary Ann they expect funding growth in 2026 to continue to concentrate into pre-IPO companies, for M&A to tick up, and to see robust investment into startups that add value to their fintech offerings with AI.

Norwest Vice President Jordan Leites said he expects stablecoins, agentic payments and AI-native tools to be particularly strong areas for fintech investment this year.

The underlying growth and performance of companies in the age of AI is “astounding and unlike anything we’ve seen before,” even relative to 2020 and 2021, Amias Gerety, partner and head of U.S. investments at QED Investors, told us.

“Absent a broader recession, we expect some pullback and return to rationality in the funding market,” he said, “but we believe funding in fintech and at the AI application layer should remain quite strong.”

Related reading:

Illustration: Dom Guzman

Stay up to date with recent funding rounds, acquisitions, and more with the

Crunchbase Daily.