The hoarding of components by gigantic artificial intelligence infrastructures threatens to cause a reversal of the PC market not seen in recent decades. This will result in a drop in computer sales that can reach double digits and the return to the use of older standards, chips and technologies in a worrying technological backslide.

The PC market experienced a strong recovery in 2025, with a total of 284.7 million devices shipped, according to IDC. The data confirms the great growth of the semiconductor sector published by other consulting companies. The fourth quarter was particularly strong, with 76.4 million devices shipped, up 9.6% year over year. For the full year, 2025 saw an 8.1% increase in global PC shipments.

But everything indicates that the memory crisis will change the dynamics of the market in the next two years and there are already estimates that the PC market is heading towards a variation of the positive trend with drops that could reach double digits and total pre-COVID pandemic values.

The involution of the PC market

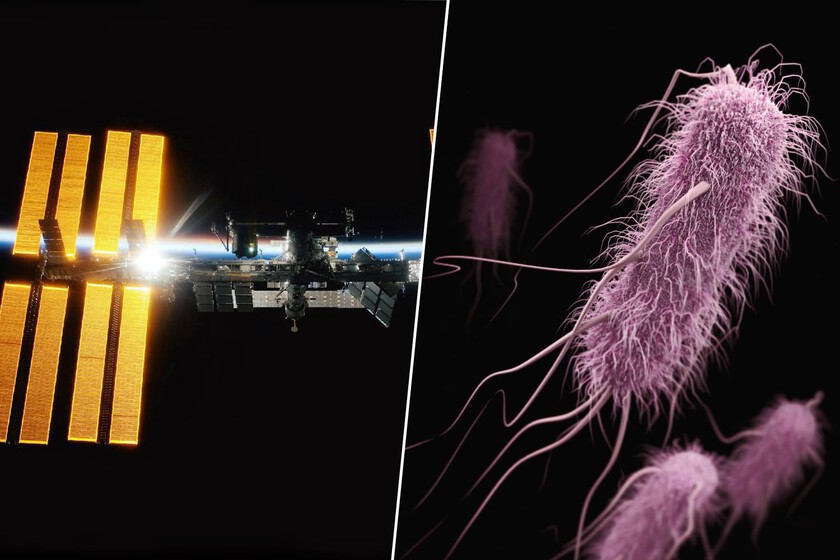

The computer market has a large problem. The colossal data center infrastructures necessary to feed the insatiable AI models and the unbridled battle for global control of these technologies threaten to collapse the customer segment, both consumer and professional and business. Simply put, AI models cannot stop learning and their use consumes resources like never before in any industry,

Especially affected by this situation are computer memories, which are key in any type of computer or device. Large manufacturers such as Micron, SK hynix and Samsung have committed the massive supply of wafers for memories used in servers such as the high-bandwidth HBM and have even announced their exit from the consumer market. The managers have not hidden when it comes to explaining it: they simply They focus on a more profitable market where the AI giants pay whatever they are asked for in astronomical contracts in unit volume and prices.

The consequence is a worrying lack of supply and an astronomical Price increase that, for example, in DDR5 memory modules reaches 440% from July 2025 to January 2026. And it is just an example, because memory chips are used for everything and in all types of components and changes in supply affect storage units such as SSD or microSD, as well as other components such as graphics cards that use dedicated memory.

Jeff Clarke, Dell’s chief operating officer, who will take over the leadership of the company’s PC division in 2025, stated in the last November conference call what is a general sentiment of large manufacturers: «although other crises have happened in the past, Current supply shortages are unprecedented. We have never seen costs fluctuate at the rate we have seen. And by the way, it’s not exclusive to DRAM. It is also from NAND. These are also hard drives, cutting-edge nodes in the semiconductor network.”.

Higher prices and lower hardware levels

The shortage of components directly affects any electronic device, but especially personal computers that depend directly on the capacity of the installed memory. IDC research manager Jitesh Ubrani explained that the market will not find price stability until the end of 2027.

Another consequence will be the average level drop in hardware, something unheard of which can cause the aforementioned decline in the PC market. Users are thinking about using older standards (such as DDR4 and DDR3) to lower memory prices and manufacturers will promote equipment with lower memory capacity.

TrendForce, an analysis firm specialized in the production channel, assures that large PC manufacturers such as Dell and Lenovo They are lowering the RAM specifications on their laptops up to 8 GB to try to control prices and maintain sales that are feared will be drastically reduced.

The problem here is that 8 GB of RAM is, today, absolutely insufficient in the real world to do more than just web browsing or media playback. It was established in 2023 as the ‘minimum standard’ to do more than just “walk” the laptop and as soon as you have a few tabs open in your browser you will see what we are talking about. Let’s not say anything about playing and in the professional field of creating content or using virtual machines.

Ironically, Microsoft defined 16 GB of RAM as the standard for its AI laptops, the Copilot. And the 8 GB is insufficient to execute local AI loads. And Windows 11, the leading desktop operating system, has increased memory consumption, both in essential services and those that live in the background and also for Copilot’s AI, even if you do not use it.

“You could see cases where a system is not 16GB and is still promoted as an AI PC, but it would use that hybrid AI approach, where some of the AI can be done on the device, but most of it in the cloud”explains the IDC researcher. “Marketing to end users may not say it, and consumers may not notice the difference, but in the enterprise space, you will see a shift in messaging away from the AI on-device tagline.”.

With all this on the table, IDC predicts that the PC market will be very different in 12 months, given the rapid evolution of the memory crisis. «In addition to the obvious pressure on system prices, already announced by some manufacturers, we could also see a reduction in PC memory specifications to preserve available inventory. 2026 is shaping up to be extremely volatile«says Jean Philippe Bouchard, vice president of research.

Although average selling prices (ASP) will rise sharply in 2026, large vendors expect to maintain revenue numbers as they prioritize mid- and high-end systems to offset higher component costs, especially memory. The revenue opportunities in a tight supply environment are obvious, but Concerns that consumers will ‘hold on’ to their equipment until prices stabilize or opt for cheaper components, even from previous standards that were in clear retreat, causing a decline in the PC market unknown in this century.

The seriousness of the situation due to the lack of supply is not exclusive to the PC market and the problems in industrial sectors like the automotive. This expected shortage will not be as dramatic as the 2021 crisis, which prevented more than 10 million cars from being manufactured that year, but it is just as concerning as it is for personal computers.