Table of Links

Abstract/Zusammenfassung

Publications

Acknowledgements

CHAPTER 1: INTRODUCTION

-

Introduction

1.1 Overview of thesis contributions

1.2 Thesis outline

CHAPTER 2: BACKGROUND

2.1 Blockchains & smart contracts

2.2 Transaction prioritization norms

2.3 Transaction prioritization and contention transparency

2.4 Decentralized governance

2.5 Blockchain Scalability with Layer 2.0 Solutions

CHAPTER 3. TRANSACTION PRIORITIZATION NORMS

-

Transaction Prioritization Norms

3.1 Methodology

3.2 Analyzing norm adherence

3.3 Investigating norm violations

3.4 Dark-fee transactions

3.5 Concluding remarks

CHAPTER 4. TRANSACTION PRIORITIZATION AND CONTENTION TRANSPARENCY

-

Transaction Prioritization and Contention Transparency

4.1 Methodology

4.2 On contention transparency

4.3 On prioritization transparency

4.4 Concluding remarks

CHAPTER 5. DECENTRALIZED GOVERNANCE

-

Decentralized Governance

5.1 Methodology

5.2 Attacks on governance

5.3 Compound’s governance

5.4 Concluding remarks

CHAPTER 6. RELATED WORK

6.1 Transaction prioritization norms

6.2 Transaction prioritization and contention transparency

6.3 Decentralized governance

CHAPTER 7. DISCUSSION, LIMITATIONS & FUTURE WORK

7.1 Transaction ordering

7.2 Transaction transparency

7.3 Voting power distribution to amend smart contracts

Conclusion

Appendices

APPENDIX A: Additional Analysis of Transactions Prioritization Norms

APPENDIX B: Additional analysis of transactions prioritization and contention transparency

APPENDIX C: Additional Analysis of Distribution of Voting Power

Bibliography

APPENDIX C: Additional Analysis of Distribution of Voting Power

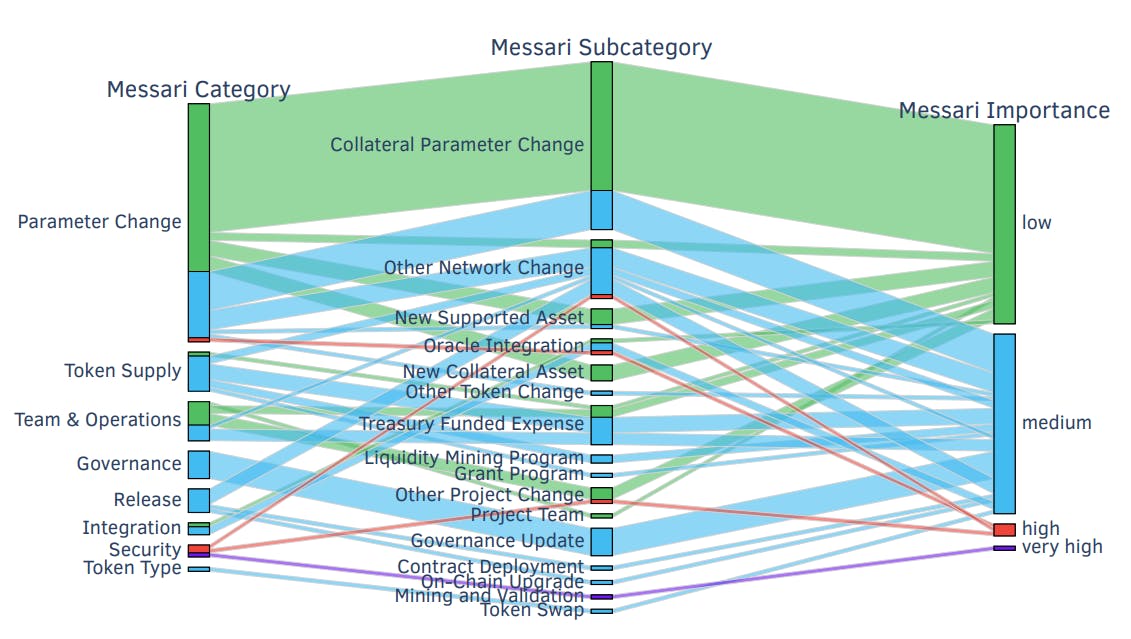

C.1 Compound proposals categorization

We gathered data from Messari (Messari, 2023) to determine the categories, subcategories, and the level of importance associated with each Compound proposal. Figure C.1 shows the distribution of 101 executed Compound proposals across different categories and subcategories. We show the degree of importance for each proposal according to Messari divided into “low”, “medium”, “high”, and “very high”. As a result, a few proposals categorized as “Parameter Change” and “Security” demonstrate a high level of importance. Furthermore, proposals with the highest level of importance are found within the “Security” category, specifically within the “Mining and Validation” subcategory. This refers to the proposal 64 that was created to fix a bug introduced by proposal #62 (Loewen, 2021a,b).

The majority of the proposals (61 proposals, accounting for 60.4%) are related to “Parameter Change” followed by “Team and Operations” and “Token Supply” accounting for 10 (9.9%) each, and “Governance” with 7 (6.93%) proposals. According to the level of importance reported by Messari, out of the total of 101 executed proposals, 51 proposals (50.5%) are classified as low importance, 46 proposals (45.54%) as medium importance, 3 proposals as high importance, and 1 proposal as very high importance.

C.2 Filtering events to construct our Compound data Set

This section describes the details required to filter and collect transactions data that triggered events of interest from any smart contract on the Ethereum blockchain. Before creating a filter, we need the address of our target contract and its Application Binary Interface (ABI). The ABI is a JSON file that specifies the functions available in the contract, their signatures, and the available events. We can retrieve this information by calling the Etherscan API (Etherscan, 2023a). Once we have the contract address and ABI, we can create a filter to track the contract’s activity on the Ethereum blockchain using an important Python library for interacting with Ethereum nodes called Web3.py (web3.py team, 2022) to facilitate the communication with our node’s API.

The Web3.py library provides a filtering function called createFilter. This function can be used to filter transactions that triggered events of interest from a specific contract within a range of block numbers. We use this function to efficiently collect all transactions that triggered these events from the Compound (Leshner and Hayes, 2019) smart contract.

C.3 Inferring wallet addresses ownership

We aim to identify the ownership of public wallet addresses on the Ethereum blockchain. Due to the inherent anonymity of blockchain addresses, this proves to be a challenging task as we can only know the owners of an address if the owner chooses to disclose it. However, popular blockchain explorers such as Etherscan (Etherscan, 2023b) often provide information on the top holders of specific cryptocurrencies, which allows us to partially overcome this obstacle.

Then, we first obtained the lists of the top 10,000 Ether holders from which there are 290 (2.9%) identified addresses and the top 1000 COMP holders from which there are 82 (8.2%) identified addresses from Etherscan. By comparing these lists to our data set, we were able to identify most of the top COMP holder addresses in our sample. However, this method did not work for the top delegated accounts, as most of them were not included in the list of top COMP holders on Etherscan. This means that most of the delegated accounts does not hold many tokens. Further, we also used the list of top 100 delegated Compound addresses by voting weight available on the Compound website (Compound Labs, Inc., 2022b) from which there are 66 identified addresses.

Furthermore, to extend the available identified addresses in our analysis, we obtained the addresses of 2783 identified users from the Sybil-List (Sybil, 2023b), a project maintained by Uniswap that uses cryptographic proofs to verify wallet addresses ownership. By combining the identified addresses from both sources, we were able to obtain the ownership of 3191 inferred public wallet addresses to use in our analysis. We were able to infer 114 (3.41%) out of the 3341 unique addresses in our data set. Considering the top 10 most powerful voters for each proposal (refer to Figure C.3 in §C.5), we were able to infer 67 (50.37%) of the 133 unique addresses. Overall, our methodology allowed us to partially overcome the anonymity of public wallet addresses on the Ethereum blockchain and shed light on the ownership of these addresses in our data set. Finally, as an entity can control more than one address, we grouped the addresses we identified belonging to the same entity together to conduct our analysis.

C.4 Types of existing governance protocols

There are various smart contract applications that utilize decentralized governance protocols for decision-making, including those for lending, decentralized exchanges (DEXes), and stablecoins, among others. An example of such protocols can be found on the Ethereum blockchain, where a number of these applications are available. We have selected some of the most protocols that use decentralized governance for decisionmaking. Table C.1 presents 8 protocols, including Maker Executive and Maker Pooling, which are part of the MakerDAO (MakerDAO, 2023) stablecoin protocol responsible for the DAI token. These protocols use decentralized governance mechanisms, and we characterize them based on whether their votes are cast on- or off-chain, the delegation methods they use, how they aggregate the votes, and how the proposal outcome take effect.

C.5 How voters cast their votes

This section examines how each of the top-10 voters of Compound and Uniswap cast their votes. Some proposals may not have received any votes if they were cancelled before the voting period began. See §5.3.2 for details. Figure C.3 shows how each of the top-10 voters cast their votes in each of the 126 (94.74%) out of 133 Compound proposals.

Figure C.4 shows the all votes cast in chronological order per proposal. On average, voters took 1.4 days (with a standard deviation of 0.95 and a median of 1.34 days) to cast their votes after the voting period began.

C.6 Time until reaching the quorum in Compound

For a proposal to pass, it must receive a majority of in favor votes and at least 400,000 (4%) votes in favor from the total supply of Compound tokens. This minimum number of in favor votes is referred to as the quorum and is defined by the Compound Governor Bravo contract.

We analyzed how long it takes for these proposals to reach the required quorum. Figure C.2 shows the number of days it took each of the evaluated Compound proposals to reach the quorum. On average, it takes 1.64 days with a standard deviation of 0.72 days for the proposals to reach the quorum. The cumulative distribution function of our results, where 32% take more than 2 days to reach the quorum. The shortest and longest time it took was 0.11 and 3 days, respectively.

Bibliography

0x Protocol (2022). 0x: Powering the decentralized exchange of tokens on Ethereum. https://www.0x.org.

AAVE (2022). AAVE – Open Source Liquidity Pool. https://aave.com.

AAVE (2023). AAVE Economics – Governance. https://docs.aave.com/ aavenomics/governance. Accessed on May 25, 2023.

Adams, H., Zinsmeister, N., Salem, M., Keefer, R., and Robinson, D. (2021). Uniswap v3 core.

Amico, J. (2023). On crypto governance. https://a16z.com/2021/02/05/oncrypto-governance. Accessed on February 8, 2023.

Andrew Hinkes and Joe Ciccolo (2021). OFAC’s Bitcoin Blacklist Could Change Crypto. https://www.coindesk.com/goodbye-fungibility-ofacs-bitcoinblacklist-remake-crypto/.

Antonio Pierro, G., Rocha, H., Tonelli, R., and Ducasse, S. (2020). Are the gas prices oracle reliable? a case study using the ethgasstation. In 2020 IEEE International Workshop on Blockchain Oriented Software Engineering (IWBOSE), pages 1–8.

Antonopoulos, A. M. (2014). Mastering Bitcoin: unlocking digital cryptocurrencies. O’Reilly Media, Inc.

Antonopoulos, A. M. and Wood, G. (2018). Mastering ethereum: building smart contracts and dapps. O’Reilly Media, Inc.

AntPool (2022). Prioritize Transaction. https://www.antpool.com/user/ prioritiseTransaction.htm.

Arruñada, B. and Garicano, L. (2018). Blockchain: The birth of decentralized governance. Pompeu Fabra University, Economics and Business Working Paper Series, 1608.

Asayag, A., Cohen, G., Grayevsky, I., Leshkowitz, M., Rottenstreich, O., Tamari, R., and Yakira, D. (2018). A fair consensus protocol for transaction ordering. In 2018 IEEE 26th International Conference on Network Protocols (ICNP).

at Berkeley, B. (2021). Compound proposal 89 – lower proposal threshold to 25k comp. https://compound.finance/governance/proposals/89. Accessed on May 22, 2023.

Atzori, M. (2017). Blockchain technology and decentralized governance: Is the state still necessary? Journal of Governance and Regulation/Volume, 6(1).

Babel Finance (2021). Economic Daily: Babel Finance Launches Ethereum Mining Pool.

Bahack, L. (2013). Theoretical Bitcoin Attacks with less than Half of the Computational Power (draft). CoRR, abs/1312.7013.

Baird, L. (2016). The swirlds hashgraph consensus algorithm: Fair, fast, byzantine fault tolerance. Technical Report SWIRLDS-TR-2016, Swirlds, Inc.

Balancer.fi (2023). Governance – Balancer. https://docs.balancer.fi/ ecosystem/governance. Accessed on May 25, 2023.

Balancerl (2022). Balancer AMM DeFi protocol. https://balancer.fi.

Bancor (2022). Bancor: Grow your ETH. https://bancor.network.

Basu, S., Easley, D., O’Hara, M., and Sirer, E. G. (2019). Towards a Functional Fee Market for Cryptocurrencies. CoRR, abs/1901.06830.

Beck, R., Müller-Bloch, C., and King, J. L. (2018). Governance in the blockchain economy: A framework and research agenda. Journal of the Association for Information Systems, 19(10).

Behrens, J. (2017). The origins of liquid democracy. The Liquid Democracy Journal, 5(2).

Binance (2023). https://www.binance.com. Accessed on May 25, 2023.

Bitcoin Abuse (2020). Bitcoin Abuse. https://www.bitcoinabuse.com/reports. Accessed on March 19, 2020.

Bitcoin Wiki (2023a). getblocktemplate. https://en.bitcoin.it/wiki/ Getblocktemplate. Accessed on May 26, 2023.

Bitcoin Wiki (2023b). Script. https://en.bitcoin.it/wiki/Script. Accessed on August 3, 2023.

BitcoinAbuse (2021). Recently Reported Addresses. https://www.bitcoinabuse. com/reports.

bitcoin.org (2023). Bitcoin Core. https://bitcoin.org/en/bitcoin-core. Accessed on May 26, 2023.

Blockchain.com (2021). Ethereum Explorer. https://www.blockchain.com/ explorer?view=eth.

Blockchair (2023). Ethereum Explorer. https://blockchair.com/ethereum. Accessed on May 25, 2023.

BloXroute Labs (2022). BloXroute Labs. https://bloxroute.com.

Blum, C. and Zuber, C. I. (2016). Liquid democracy: Potentials, problems, and perspectives. Journal of political philosophy, 24(2).

Braiins (2021a). Stratum mining protocol V1. https://braiins.com/stratum-v1. Accessed on May 26, 2023.

Braiins (2021b). Stratum mining protocol V2. https://braiins.com/stratum-v2. Accessed on May 26, 2023.

Breidenbach, L., Cachin, C., Chan, B., Coventry, A., Ellis, S., Juels, A., Koushanfar, F., Miller, A., Magauran, B., Moroz, D., et al. (2021). Chainlink 2.0: Next steps in the evolution of decentralized oracle networks. Chainlink Labs.

BTC.com (2022). BTC.com Transaction Accelerator. https://pushtx.btc.com.

Buterin, V., Conner, E., Dudley, R., Slipper, M., Norden, I., and Bakhta, A. (2019a). “EIP-1559: Fee market change for ETH 1.0 chain,” Ethereum Improvement Proposals.

Buterin, V., Hitzig, Z., and Weyl, E. G. (2019b). A flexible design for funding public goods. Management Science, 65(11).

Capital, P. (2021). Compound proposal 60 – address whitelist for submitting proposals. https://compound.finance/governance/proposals/60. Accessed on May 22, 2023.

Carlsten, M., Kalodner, H., Weinberg, S. M., and Narayanan, A. (2016). On the instability of bitcoin without the block reward. In Proceedings of the 2016 ACM SIGSAC Conference on Computer and Communications Security, CCS ’16.

Carroll, L. (1884). Principles of parliamentary representation.

Chainlink (2022). Decentralized Data Feeds. https://data.chain.link.

Chainlink Foundation (2023). What Is Layer 2? https://chain.link/educationhub/what-is-layer-2. Accessed on August 22, 2023.

Chapman, J. W. (1971). Rawls’s theory of justice.

Chen, X., Papadimitriou, C., and Roughgarden, T. (2019). An axiomatic approach to block rewards. In Proceedings of the 1st ACM Conference on Advances in Financial Technologies, AFT ’19.

Chen, Y., Richter, J. I., and Patel, P. C. (2021). Decentralized governance of digital platforms. Journal of Management, 47(5).

City, S. (2023). Swarm city. https://swarm.city. Accessed on February 2, 2023.

Coin Dance (2021). Bitcoin Nodes Summary. https://coin.dance/nodes.

Coinbase (2021). What are miner fees and does Coinbase pay them? https: //help.coinbase.com/en/coinbase/trading-and-funding/pricingand-fees/what-are-miner-fees-and-does-coinbase-pay-them.html.

CoinGecko (2023). Compound Tokenomics. https://www.coingecko.com/en/ coins/compound/tokenomics. Accessed on February 2, 2023.

CoinMarketCap (2023). Cryptocurrency Prices by Market Cap. https:// coinmarketcap.com. Accessed on May 23, 2023.

CoinStaker (2018). Bitcoin CPFP Experience—Bitcoin Child Pays for Parent. https: //www.coinstaker.com/bitcoin-cpfp/.

Compound (2022). Compound. https://compound.finance.

Compound Labs, Inc. (2022a). Compound Governance. https://docs.compound. finance/governance. Accessed on Dec 10, 2022.

Compound Labs, Inc. (2022b). Compound Leaderboard. https://compound. finance/governance/leaderboard. Accessed on Dec 2, 2022.

Compound Labs, Inc. (2022c). User Distribution. https://compound.finance/ governance/comp. Accessed on Dec 10, 2022.

Convex (2023a). Convex Finance Proposals. https://vote.convexfinance.com/. Accessed on May 25, 2023.

Convex (2023b). Voting and Gauge Weights. https://docs.convexfinance.com/ convexfinance/general-information/why-convex/voting-and-gaugeweights. Accessed on May 25, 2023.

Curve (2022). Curve.fi. https://curve.fi.

Curve (2023). Curve.fi Governance. https://gov.curve.fi. Accessed on April 2, 2023.

Daian, P., Goldfeder, S., Kell, T., Li, Y., Zhao, X., Bentov, I., Breidenbach, L., and Juels, A. (2020). Flash boys 2.0: Frontrunning in decentralized exchanges, miner extractable value, and consensus instability. In 2020 IEEE Symposium on Security and Privacy (SP).

Daian, P., Kell, T., Miers, I., and Juels, A. (2018). On-Chain Vote Buying and the Rise of Dark DAOs. https://hackingdistributed.com/2018/07/02/on-chainvote-buying. Accessed on December 15, 2022.

David Siegel (2013). Understanding The DAO Attack. https://www.coindesk.com/ learn/understanding-the-dao-attack. Accessed on February 16, 2023.

Easley, D., O’Hara, M., and Basu, S. (2017). From Mining to Markets: The Evolution of Bitcoin Transaction Fees. SSRN.

Easley, D., O’Hara, M., and Basu, S. (2019). From mining to markets: The evolution of bitcoin transaction fees. Journal of Financial Economics.

Eden Network (2022). Eden Network. https://www.edennetwork.io/.

EigenPhi (2022). EigenPhi Crypto & DeFi Analytics. https://eigenphi.io.

Ekblaw, A. and Azaria, A. (2017). MedRec: Medical Data Management on the Blockchain. Viral Communications.

Eskandari, S., Moosavi, S., and Clark, J. (2020). Sok: Transparent dishonesty: Frontrunning attacks on blockchain. In Bracciali, A., Clark, J., Pintore, F., Rønne, P. B., and Sala, M., editors, Financial Cryptography and Data Security. Springer International Publishing.

Ethereum Foundation (2022a). Proof-of-Stake (PoS). https://ethereum.org/en/ developers/docs/consensus-mechanisms/pos.

Ethereum Foundation (2022b). The Merge. https://ethereum.org/en/upgrades/ merge.

Ethereum Foundation (2023a). ERC-20 token standard. https://ethereum.org/en/ developers/docs/standards/tokens/erc-20. Accessed on April 10, 2023.

Ethereum Foundation (2023b). ERC-721 Non-Fungible token standard. https:// ethereum.org/en/developers/docs/standards/tokens/erc-721.

Ethereum Foundation (2023d). Optimistic Rollups. https://ethereum.org/en/ developers/docs/scaling/optimistic-rollups. Accessed on August 23, 2023.

Ethermine (2022). Ethermine MEV-Relay. https://ethermine.org/mev-relay.

Etherscan (2023a). Etherscan apis documentation – contracts. https://docs. etherscan.io/api-endpoints/contracts. Accessed on May 25, 2023.

Etherscan (2023b). Etherscan (ETH) Blockchain Explorer. https://etherscan.io. Accessed on May 25, 2023.

Eyal, I. and Sirer, E. G. (2018). Majority is not enough: Bitcoin mining is vulnerable. Commun. ACM.

F2Pool (2022). Pushtx. https://www.f2pool.com/pushtx.

Feichtinger, R., Fritsch, R., Vonlanthen, Y., and Wattenhofer, R. (2023). The hidden shortcomings of (d)aos – an empirical study of on-chain governance.

Fiat, A., Karlin, A., Koutsoupias, E., and Papadimitriou, C. (2019). Energy equilibria in proof-of-work mining. In Proceedings of the 2019 ACM Conference on Economics and Computation, EC ’19.

Fisher, R. A. (1992). Statistical Methods for Research Workers. Springer New York.

Flashbots (2022a). Flashbots Blocks API. https://blocks.flashbots.net.

Flashbots (2022b). Flashbots Docs. https://docs.flashbots.net.

Flashbots (2022c). How much hashrate is currently on Flashbots Auction? https://docs.flashbots.net/flashbots-auction/searchers/ faq#how-much-hashrate-is-currently-on-flashbots-auction.

Francisco Rodrigues (2022). Maintaining decentralization: Are custody services a threat to DeFi protocols? https://cointelegraph.com/news/maintainingdecentralization-are-custody-services-a-threat-to-defiprotocols. Accessed on April 2, 2023.

Fritsch, R., Müller, M., and Wattenhofer, R. (2022). Analyzing voting power in decentralized governance: Who controls daos?

Gauntlet (2021). Compound proposal 40 – compound grants program. https:// compound.finance/governance/proposals/40. Accessed on May 25, 2023.

Gencer, A. E., Basu, S., Eyal, I., van Renesse, R., and Gün Sirer, E. (2018). Decentralization in Bitcoin and Ethereum Networks. In Financial Cryptography and Data Security 2018.

Gervais, A., Karame, G. O., Wüst, K., Glykantzis, V., Ritzdorf, H., and Capkun, S. (2016). On the security and performance of proof of work blockchains. In Proceedings of the 2016 ACM SIGSAC Conference on Computer and Communications Security, CCS ’16.

Goldreich, O. and Oren, Y. (1994). Definitions and properties of zero-knowledge proof systems. Journal of Cryptology, 7(1):1–32.

Goldwasser, S., Micali, S., and Rackoff, C. (2019). The knowledge complexity of interactive proof-systems. In Providing sound foundations for cryptography: On the work of shafi goldwasser and silvio micali, pages 203–225.

Goren, G. and Spiegelman, A. (2019). Mind the mining. In Proceedings of the 2019 ACM Conference on Economics and Computation, EC ’19.

Guidi, B., Michienzi, A., and Ricci, L. (2021). A graph-based socioeconomic analysis of steemit. IEEE Transactions on Computational Social Systems, 8(2).

Haig, S. (2022). Balancer ends long governance battle with whale. https:// thedefiant.io/balancer-ve-tokenomics-whale. Accessed on April 28, 2023.

Hassan, S. and De Filippi, P. (2021). Decentralized autonomous organization. Internet Policy Review, 10(2).

Helen Partz (2021). Second-largest Ethereum mining pool to suspend all operations. Cointelegraph.

Hobbes, T. (1651). Leviathan. Project Gutenberg.

Huberman, G., Leshno, J. D., and Moallemi, C. (2021). Monopoly without a Monopolist: An Economic Analysis of the Bitcoin Payment System. The Review of Economic Studies.

Huillet, M. (2020). Report: Hamas, Iran-Tied Militants Intensify Bitcoin Fundraising Action. https://cointelegraph.com/news/report-hamas-iran-tiedmilitants-intensify-bitcoin-fundraising-action. Accessed on August 2, 2023.

Jeff Kauflin and Emily Mason (2022). How Did Sam Bankman-Fried’s Alameda Research Lose So Much Money? https://www.forbes.com/sites/jeffkauflin/ 2022/11/19/how-did-sam-bankman-frieds-alameda-research-loseso-much-money. Accessed on December 2, 2022.

Jota Missias (2021). Jota Missias. https://pt.wikipedia.org/wiki/Jota_ Missias.

Judmayer, A., Zamyatin, A., Stifter, N., Voyiatzis, A. G., and Weippl, E. (2017). Merged mining: Curse or cure? In Data Privacy Management, Cryptocurrencies and Blockchain Technology.

Karame, G. (2016). On the security and scalability of bitcoin’s blockchain. In Proceedings of the 2016 ACM SIGSAC Conference on Computer and Communications Security, CCS ’16.

Kelkar, M., Zhang, F., Goldfeder, S., and Juels, A. (2020). Order-fairness for byzantine consensus. In Micciancio, D. and Ristenpart, T., editors, Advances in Cryptology – CRYPTO 2020, pages 451–480, Cham. Springer International Publishing.

Kharif, O. (2017). Cryptokitties mania overwhelms ethereum network’s processing. https://www.bloomberg.com/news/articles/2017-12-04/ cryptokitties-quickly-becomes-most-widely-used-ethereum-app.

Kiayias, A., Koutsoupias, E., Kyropoulou, M., and Tselekounis, Y. (2016). Blockchain mining games. In Proceedings of the 2016 ACM Conference on Economics and Computation, EC ’16.

Kiayias, A. and Lazos, P. (2023). Sok: Blockchain governance.

Kiffer, L., Levin, D., and Mislove, A. (2017). Stick a fork in it: Analyzing the ethereum network partition. In Proceedings of the 16th ACM Workshop on Hot Topics in Networks, pages 94–100.

Kursawe, K. (2020). Wendy, the good little fairness widget: Achieving order fairness for blockchains. In Proceedings of the 2nd ACM Conference on Advances in Financial Technologies, AFT ’20.

kybx86 (2020). Compensation proposal: Distribute comp to affected users in the dai liquidations. https://www.comp.xyz/t/compensation-proposal-distributecomp-to-affected-users-in-the-dai-liquidations. Accessed on February 9, 2023.

Labs, C. (2020). Compound proposal 7 – distribute comp to users. https://compound. finance/governance/proposals/7. Accessed on May 22, 2023.

Labs, C. (2021). Compound proposal 42 – migration to governor bravo. https:// compound.finance/governance/proposals/42. Accessed on May 22, 2023.

Labs, P. (2023a). Ipfs powers the distributed web. https://ipfs.tech. Accessed on February 2, 2023.

Labs, S. (2023b). Snapshot. https://snapshot.org. Accessed on February 2, 2023.

Lalley, S. P. and Weyl, E. G. (2018). Quadratic voting: How mechanism design can radicalize democracy. AEA Papers and Proceedings, 108.

Lavi, R., Sattath, O., and Zohar, A. (2019). Redesigning bitcoin’s fee market. In The World Wide Web Conference, WWW ’19.

Lee Mathews (2017). How WannaCry Went From A Windows Bug To An International Incident. https://www.forbes.com/sites/leemathews/2017/05/ 16/wannacry-ransomware-ms17-010.

Leshner, R. and Hayes, G. (2019). Compound: The money market protocol.

Lev-Ari, K., Spiegelman, A., Keidar, I., and Malkhi, D. (2020). Fairledger: A fair blockchain protocol for financial institutions. In 23rd International Conference on Principles of Distributed Systems (OPODIS 2019). Schloss Dagstuhl-Leibniz-Zentrum für Informatik.

Li, J., Yuan, Y., Wang, S., and Wang, F.-Y. (2018). Transaction queuing game in bitcoin blockchain. In 2018 IEEE Intelligent Vehicles Symposium (IV).

Liu, C., Liu, H., Cao, Z., Chen, Z., Chen, B., and Roscoe, B. (2018). Reguard: Finding reentrancy bugs in smart contracts. In Proceedings of the 40th International Conference on Software Engineering: Companion Proceeedings, ICSE ’18.

Liu, F., Wang, X., Li, Z., Xu, J., and Gao, Y. (2020). Effective gasprice prediction for carrying out economical ethereum transaction. In 2019 6th International Conference on Dependable Systems and Their Applications (DSA), pages 329–334.

Liu, Z., Li, Y., Min, Q., and Chang, M. (2022). User incentive mechanism in blockchainbased online community: An empirical study of steemit. Information & Management, 59(7).

Loewen, T. (2021a). Compound proposal 62 – split comp rewards distribution and bug fixes. https://compound.finance/governance/proposals/62. Accessed on May 16, 2023.

Loewen, T. (2021b). Compound proposal 64 – fix comp accrual bug. https:// compound.finance/governance/proposals/64. Accessed on May 16, 2023.

Lombrozo, E., Lau, J., and Wuille, P. (2015). BIP-141: Segregated Witness (Consensus layer). https://github.com/bitcoin/bips/blob/master/bip-0141. mediawiki. Accessed on May 26, 2023.

Luu, L., Velner, Y., Teutsch, J., and Saxena, P. (2017). Smartpool: Practical decentralized pooled mining. In 26th USENIX Security Symposium (USENIX Security 17).

MakerDAO (2023). Governance Module – Maker Protocol Technical Docs. https:// docs.makerdao.com/smart-contract-modules/governance-module. Accessed on April 2, 2023.

Mars, R., Abid, A., Cheikhrouhou, S., and Kallel, S. (2021). A machine learning approach for gas price prediction in ethereum blockchain. In 2021 IEEE 45th Annual Computers, Software, and Applications Conference (COMPSAC), pages 156–165.

Martin Ruubel (2018). World’s First Blockchain Platform for Marine Insurance Now in Commercial Use. https://guardtime.com/blog/world-s-firstblockchain-platform-for-marine-insurance-now-in-commercialuse.

Matter Labs (2023). zkSync Era basics. https://era.zksync.io/docs/ reference/concepts/zkSync.html. Accessed on August 22, 2023.

McCorry, P., Shahandashti, S. F., and Hao, F. (2017). A smart contract for boardroom voting with maximum voter privacy. In Financial Cryptography and Data Security, FC ’17

Messari (2023). Messati: Crypto research, data, and tools. https://messari.io. Accessed on May 16, 2023.

Messias, J. (2023a). Data sets and scripts used to analyze governance protocols in the Ethereum blockchains. https://github.com/johnnatan-messias/ blockchain-governance.

Messias, J. (2023b). Data sets and scripts used to analyze the contention and prioritization transparency in both Bitcoin and Ethereum blockchains. https://github.com/ johnnatan-messias/blockchain-transaction-ordering.

Messias, J., Alzayat, M., Chandrasekaran, B., and Gummadi, K. P. (2020). On blockchain commit times: An analysis of how miners choose bitcoin transactions. In KDD Workshop on Smart Data for Blockchain and Distributed Ledger, SDBD ’20.

Messias, J., Alzayat, M., Chandrasekaran, B., Gummadi, K. P., Loiseau, P., and Mislove, A. (2021). Selfish & opaque transaction ordering in the bitcoin blockchain: The case for chain neutrality. In Proceedings of the 21st ACM Internet Measurement Conference, IMC ’21, page 320–335, New York, NY, USA. Association for Computing Machinery.

Messias, J., Pahari, V., Chandrasekaran, B., Gummadi, K. P., and Loiseau, P. (2023a). Dissecting Bitcoin and Ethereum Transactions: On the Lack of Transaction Contention and Prioritization Transparency in Blockchains. In Proceedings of the Financial Cryptography and Data Security (FC’23).

Messias, J., Pahari, V., Chandrasekaran, B., Gummadi, K. P., and Loiseau, P. (2023b). Understanding blockchain governance: Analyzing decentralized voting to amend defi smart contracts.

Mike Dalton (2022). Build Finance DAO Suffers Governance Takeover Attack. https://cryptobriefing.com/build-finance-dao-suffersgovernance-takeover-attack. Accessed on February 2, 2023.

Mosteller, F. and Fisher, R. A. (1948). Questions and answers. The American Statistician.

Nakamoto, S. (2008). Bitcoin: A Peer-to-Peer Electronic Cash System.

Nick Martitsch (2021). Compound Treasury Updates, COMP Bug Fix, Dynamic Risk Parameters. https://compound.substack.com/p/compoundtreasury-updates-comp-bug. Accessed on April 10, 2023.

Nikhilesh De (2021). US Treasury Blacklists Bitcoin, Litecoin Addresses of Chinese ‘Drug Kingpins’. https://www.coindesk.com/markets/2019/08/21/ustreasury-blacklists-bitcoin-litecoin-addresses-of-chinesedrug-kingpins/.

Noda, S., Okumura, K., and Hashimoto, Y. (2020). An economic analysis of difficulty adjustment algorithms in proof-of-work blockchain systems. In Proceedings of the 21st ACM Conference on Economics and Computation, EC ’20.

Offchain Labs (2023). A gentle introduction to Arbitrum. https://docs.arbitrum. io/intro. Accessed on August 22, 2023.

Omni Layer (2020). Omni Protocol Specification. https://github.com/OmniLayer/ spec/blob/master/OmniSpecification.adoc. Accessed on August 3, 2023.

Omni Layer (2023). Omni Layer: An open-source, fully-decentralized asset platform on the Bitcoin Blockchain. https://www.omnilayer.org. Accessed on August 1, 2023.

OpenZeppelin (2023). Security audits – compound. https://blog.openzeppelin. com/?s=compound. Accessed on May 22, 2023.

Optimism Foundation (2023). Optimism. https://www.optimism.io. Accessed on August 22, 2023.

Orda, A. and Rottenstreich, O. (2019). Enforcing fairness in blockchain transaction ordering. In 2019 IEEE International Conference on Blockchain and Cryptocurrency (ICBC).

Pass, R., Seeman, L., and Shelat, A. (2017). Analysis of the blockchain protocol in asynchronous networks. In Advances in Cryptology – EUROCRYPT 2017.

Pass, R. and Shi, E. (2017). Fruitchains: A fair blockchain. In Proceedings of the ACM Symposium on Principles of Distributed Computing, PODC ’17.

Paul R. La Monica (2019). Bitcoin’s march to $10,000 propelled by Facebook and the Fed. https://edition.cnn.com/2019/06/21/investing/bitcoinprice-increase/.

Perez, D., Werner, S. M., Xu, J., and Livshits, B. (2021). Liquidations: Defi on a knife-edge. In Financial Cryptography and Data Security, FC ’21.

Philipp Schmidt (2015). Certificates, Reputation, and the Blockchain. https: //medium.com/mit-media-lab/certificates-reputation-and-theblockchain-aee03622426f.

Pilkington, M. (2016). Blockchain Technology: Principles and Applications. In Research handbook on digital transformations. Available at SSRN: https://ssrn.com/abstract=2662660.

Poolin (2022). Transaction Accelerator. https://pushtx.com.

Provenance (2015). Blockchain: the solution for transparency in product supply chains. https://www.provenance.org/whitepaper.

Qin, K., Zhou, L., and Gervais, A. (2022). Quantifying blockchain extractable value: How dark is the forest? In 2022 IEEE Symposium on Security and Privacy (SP).

Qin, K., Zhou, L., Livshits, B., and Gervais, A. (2021). Attacking the DeFi Ecosystem with Flash Loans for Fun and Profit. In Financial Cryptography and Data Security, FC ’21.

Reijers, W., O’Brolcháin, F., and Haynes, P. (2016). Governance in blockchain technologies & social contract theories. Ledger, 1.

Research, A. (2020a). Compound proposal 13 – set wbtc collateral factor to 65%. https: //compound.finance/governance/proposals/13. Accessed on May 22, 2023.

Research, A. (2020b). Compound proposal 14 – set wbtc collateral factor to 65%. https: //compound.finance/governance/proposals/14. Accessed on May 22, 2023.

Research, A. (2020c). Compound proposal 16 – set wbtc collateral factor to 40%. https: //compound.finance/governance/proposals/16. Accessed on May 22, 2023.

Rikken, O., Janssen, M., and Kwee, Z. (2019). Governance challenges of blockchain and decentralized autonomous organizations. Information Polity, 24(4).

Robert Hackett (2017). Walmart and 9 Food Giants Team Up on IBM Blockchain Plans. http://fortune.com/2017/08/22/walmart-blockchainibm-food-nestle-unilever-tyson-dole.

Romiti, M., Judmayer, A., Zamyatin, A., and Haslhofer, B. (2019). A deep dive into bitcoin mining pools: An empirical analysis of mining shares.

Roughgarden, T. (2021). Transaction fee mechanism design for the ethereum blockchain: An economic analysis of eip-1559. In Proceedings of the 2021 ACM Conference on Economics and Computation, EC ’21.

Rousseau, J.-J. (1920). The social contract: & discourses. Number 660. JM Dent & Sons.

Sam Kessler (2022). Binance Becomes Second-Largest Voting Entity on Uniswap DAO. https://www.coindesk.com/tech/2022/10/19/binance-becomessecond-largest-voting-entity-on-uniswap-dao. Accessed on April 2, 2023.

Sasson, E. B., Chiesa, A., Garman, C., Green, M., Miers, I., Tromer, E., and Virza, M. (2014). Zerocash: Decentralized anonymous payments from bitcoin. In 2014 IEEE symposium on security and privacy. IEEE.

Scam Alert (2020). Scam Alert – Cryptocurrency Crime Fighters. https://scamalert.io. Accessed on March 19, 2020.

Scikit Learn (2023). Cosine Similarity. https://scikit-learn.org/stable/ modules/generated/sklearn.metrics.pairwise.cosine_similarity. html. Accessed on April 10, 2023.

Sharma, T., Kwon, Y., Pongmala, K., Wang, H., Miller, A., Song, D., and Wang, Y. (2023). Unpacking how decentralized autonomous organizations (daos) work in practice.

Shaurya Malwa (2022). Binance Denies Allegations It Intends to Use Users’ Uniswap Tokens for Voting. https://www.coindesk.com/tech/2022/10/20/binancedenies-allegations-that-it-intends-to-use-users-uniswaptokens-for-voting.

Sheera Frenkel and Nathaniel Popper and Kate Conger and David E. Sanger (2020). A Brazen Online Attack Targets V.I.P. Twitter Users in a Bitcoin Scam. https://www.nytimes.com/2020/07/15/technology/twitterhack-bill-gates-elon-musk.html.

Sheera Frenkel, Mark Scott and Paul Mozur (2017). Mystery of Motive for a Ransomware Attack: Money, Mayhem or a Message? https: //www.nytimes.com/2017/06/28/business/ramsonware-hackerscybersecurity-petya-impact.html.

Siddiqui, S., Vanahalli, G., and Gujar, S. (2020). Bitcoinf: Achieving fairness for bitcoin in transaction fee only model. In Proceedings of the 19th International Conference on Autonomous Agents and MultiAgent Systems, AAMAS ’20.

Solidity Team (2023). Solidity programming language. https://soliditylang.org. Accessed on January 18, 2023.

Sompolinsky, Y. and Zohar, A. (2015). Secure high-rate transaction processing in bitcoin. In Financial Cryptography and Data Security, FC ’15.

SparkPool (2021). Taichi Network. https://taichi.network.

Strehle, E. and Ante, L. (2020). Exclusive mining of blockchain transactions. In In Scientific Reports 2020-Conference proceedings of the Scientific Track of the Blockchain Autumn School 2020.

Sukernik (2021). Auditing Compound Protocol. https://www.comp.xyz/t/ auditing-compound-protocol/2543. Accessed on April 10, 2023.

SushiSwap (2022). Decentralized Exchange Made For Everybody. https://www. sushi.com.

Sybil (2023a). Introducing Sybil. https://blog.uniswap.org/sybil. Accessed on May 19, 2023.

Sybil (2023b). Sybil – Top delegated addresses. https://sybil.org. Accessed on February 2, 2023.

team, T. T. (2022). Compound proposal 84 – trueusd market upgrades. https:// compound.finance/governance/proposals/84. Accessed on February 2, 2023.

Tether (2023). Tether USDT token. https://tether.to/en. Accessed on August 2, 2023.

Thurman, A. (2022). Tron’s justin sun accused of ‘governance attack’ on defi lender compound. https://www.coindesk.com/tech/2022/02/04/trons-justinsun-accused-of-governance-attack-on-defi-lender-compound. Accessed on February 2, 2023.

Torres, C. F., Camino, R., and State, R. (2021). Frontrunner jones and the raiders of the dark forest: An empirical study of frontrunning on the ethereum blockchain. In 30th USENIX Security Symposium.

TrueUSD (2023). Trueusd. https://www.trueusd.com. Accessed on February 2, 2023.

Tsabary, I. and Eyal, I. (2018). The gap game. In Proceedings of the 2018 ACM SIGSAC Conference on Computer and Communications Security, CCS ’18.

Turksonmez, K., Furtak, M., Wittie, M. P., and Millman, D. L. (2021). Two ways gas price oracles miss the mark. In 2021 IEEE International Conference on Omni-Layer Intelligent Systems (COINS), pages 1–7.

Uniswap (2022). Uniswap Protocol. https://uniswap.org.

Uniswap (2023). Uniswap Decentralized Trading Protocol. https://uniswap.org. Accessed on May 23, 2023.

Uniswap Labs (2023). Governance – Uniswap Protocol. https://uniswap.org/ governance. Accessed on April 2, 2023.

Van Saberhagen, N. (2013). Cryptonote v2.0.

Vasek, M., Thornton, M., and Moore, T. (2014). Empirical analysis of denial-of-service attacks in the bitcoin ecosystem. In Financial Cryptography and Data Security, FC ’14.

ViaBTC (2022). Transaction Accelerator. https://www.viabtc.com/tools/ txaccelerator.

web3.py team, T. (2022). Web3.py documentation. https://web3py.readthedocs. io/en/v5. Accessed on December 12, 2022.

Weintraub, B., Torres, C. F., Nita-Rotaru, C., and State, R. (2022). A Flash(bot) in the Pan: Measuring Maximal Extractable Value in Private Pools. In Proceedings of the ACM Internet Measurement Conference (IMC’22).

Whale Alert (2021). Scam Alert – Cryptocurrency Crime Fighters. https://scamalert.io.

Wood, G. (2016). Polkadot: Vision for a heterogeneous multi-chain framework.

Wood, G. et al. (2014). Ethereum: A secure decentralised generalised transaction ledger. Ethereum project yellow paper.

Xia, P., Zhang, L., and Li, F. (2015). Learning similarity with cosine similarity ensemble. Information sciences, 307.

Yahoo Finance (2023a). Ethereum USD (BTC-USD), Price, Value, News, and History. https://finance.yahoo.com/quote/BTC-USD/history?p=BTC-USD. Accessed on August 3, 2023.

Yahoo Finance (2023b). Ethereum USD (ETH-USD), Price, Value, News, and History. https://finance.yahoo.com/quote/ETH-USD/history?p=ETH-USD. Accessed on January 17, 2023.

Zack Voell and William Foxley (2020a). https://www.coindesk.com/markets/ 2020/09/04/alameda-research-claimed-nearly-70-of-wrappedbitcoin-minted-in-august. Accessed on April 10, 2023.

Zack Voell and William Foxley (2020b). Alameda Research Claimed Nearly 70% of Wrapped Bitcoin Minted in August. https://www.coindesk.com/markets/ 2020/09/04/alameda-research-claimed-nearly-70-of-wrappedbitcoin-minted-in-august.

Zhang, R. and Preneel, B. (2019). Lay down the common metrics: Evaluating proof-ofwork consensus protocols’ security. In 2019 IEEE Symposium on Security and Privacy (SP).

Zhou, L., Qin, K., Torres, C. F., Le, D. V., and Gervais, A. (2021). High-frequency trading on decentralized on-chain exchanges. In 2021 IEEE Symposium on Security and Privacy (SP), pages 428–445.

Zhou, L., Xiong, X., Ernstberger, J., Chaliasos, S., Wang, Z., Wang, Y., Qin, K., Wattenhofer, R., Song, D., and Gervais, A. (2023). Sok: Decentralized finance (defi) attacks. In 2023 IEEE Symposium on Security and Privacy (SP).

Zwitter, A. and Hazenberg, J. (2020). Decentralized network governance: blockchain technology and the future of regulation. Frontiers in Blockchain, 3.

Author:

(1) Johnnatan Messias Peixoto Afonso