If you’ve ever held an Apple Card in your hand, then you’ll know what I mean when I say that it feels more like sleek technology than just another piece of plastic. The titanium build, the clean design, the way it ties seamlessly into the iPhone’s Wallet app — everything about it features that trademark Apple polish. In some ways, it feels like the company reinvented what a credit card could be, stripping away hidden fees and the confusing fine print we’ve come to expect from the credit card industry.

Don’t get me wrong, though: After using Apple Card for a while, I’ve run into a nagging issue that keeps bugging me more and more, particularly as the cost of travel continues to rise. It’s that, for all its elegance, the Apple Card doesn’t offer much in the way of meaningful rewards. Travel hackers and points collectors will no doubt agree with me here: Apple nailed the design, but didn’t finish the job when it comes to rewards and perks.

What we like about Apple Card

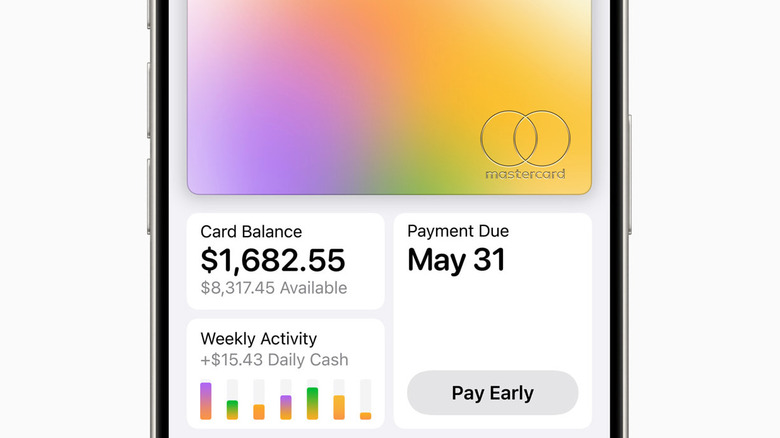

Let me start with the positives. More specifically, these are among the actual reasons I’ve stuck with Apple Card as long as I have. First and foremost is its simplicity. Unlike other cards that hit you with things like late fees, foreign transaction fees, or annual fees, Apple Card makes a point of staying fee-free. That alone is pretty refreshing when other cards are all about nickel-and-diming you. I also love the Wallet integration, which is a fantastic way to constantly keep tabs on where your money is going. With as many cards as I’ve had over the years, I can’t believe I’ve never seen an issuer make it this simple to get a daily, weekly, and monthly snapshot of your spending.

More important, given that this is Apple we’re talking about, the privacy aspect is probably my favorite thing about this card. The physical card itself doesn’t have your number stamped on it, and Apple also lets you generate new card numbers instantly — even, if you want, changing the three-digit security code (CVV) on the fly, right from inside the Wallet app. If you value ease of use and peace of mind, Apple Card is a winner on both scores.

Where Apple Card needs to improve

Here’s the flip side, though: As much as I’m a big fan of the clean design and the lack of fees, I can’t shake the feeling that I’m leaving money on the table by using this card.

The perks, to be blunt, are almost non-existent compared to what you’ll find with competitors. Sure, you get Daily Cash — 1% on purchases with the physical card, 2% with Apple Pay, and 3% at select partners. But that’s pretty much it. Meanwhile, other cards are practically throwing rewards at you, with points that can be transferred to airlines, sign-up bonuses worth hundreds of dollars or more, rotating cashback categories, and travel perks like lounge access.

For those reasons, as much as I love my Apple Card, I feel like I’m nevertheless at a crossroads. I for sure don’t want to give up the simplicity and security it offers. But unless Apple beefs up the perks — whether through better cashback rates, travel rewards, or partnerships beyond Apple’s own ecosystem — I’m probably going to start looking elsewhere. Apple, your card feels premium in the hand. The problem is, it most definitely doesn’t feel premium in my wallet.