We are witnessing a Commercial War Unprecedented while we try, as far as possible, understand how far you can go. The Trump administration maneuvers are being as drastic as unpredictable: in just one week, it has gone from imposing reciprocal tariffs on dozens of countries – without distinction between allies or competitors – to suspend them to open a negotiation period.

That turn has given some oxygen to the global economy, which was already noticing the consequences. But the case of China is different. There is no truce there. Beijing has seen how levies to their exports to the United States shot. And in the midst of this new scenario, the question is inevitable: what sectors are in the line of fire?

We have already talked about the technological, with Apple to the head. The company has begun to send thousands of iPhone from India to the United States to avoid part of the tariff impact. There are also indications that this situation could translate into an increase in the Price of the device in some markets. But there is another actor who enters the scene: Boeing.

Despite the setbacks of recent years – marked especially by the accidents of 737 Max – Boeing remains one of the United States industrial emblems. A heavyweight of the aerospace sector, whose airplanes are not only fundamental for global transport, but also a reflection of the technological and economic muscle of their country.

Now, the trade war threatens to erode part of its competitiveness and could give An advantage to its great European rival: Airbus. To better understand the scenario, it is convenient to review, in general, some tariffs between the United States and China. We start with the measures applied by the White House since the return of Donald Trump.

United States tariffs to China products

The sum of the aforementioned tariffs gives us 145% to imports from China. It should be noted that, as with the European Union, other tariffs have also been imposed over time. Let’s see.

China tariffs to United States products

- April 4, 2025: 34% of tariffs in response to the “reciprocal tariffs” of the United States to all American imported goods.

- April 8, 2025: 50% of tariffs in response to the increase in the “reciprocal tariffs” of the United States to all American imported goods.

In this case, the sum of both tariffs results in 84% of tariffs that exist at this time.

Tariffs will make the manufacture of airplanes

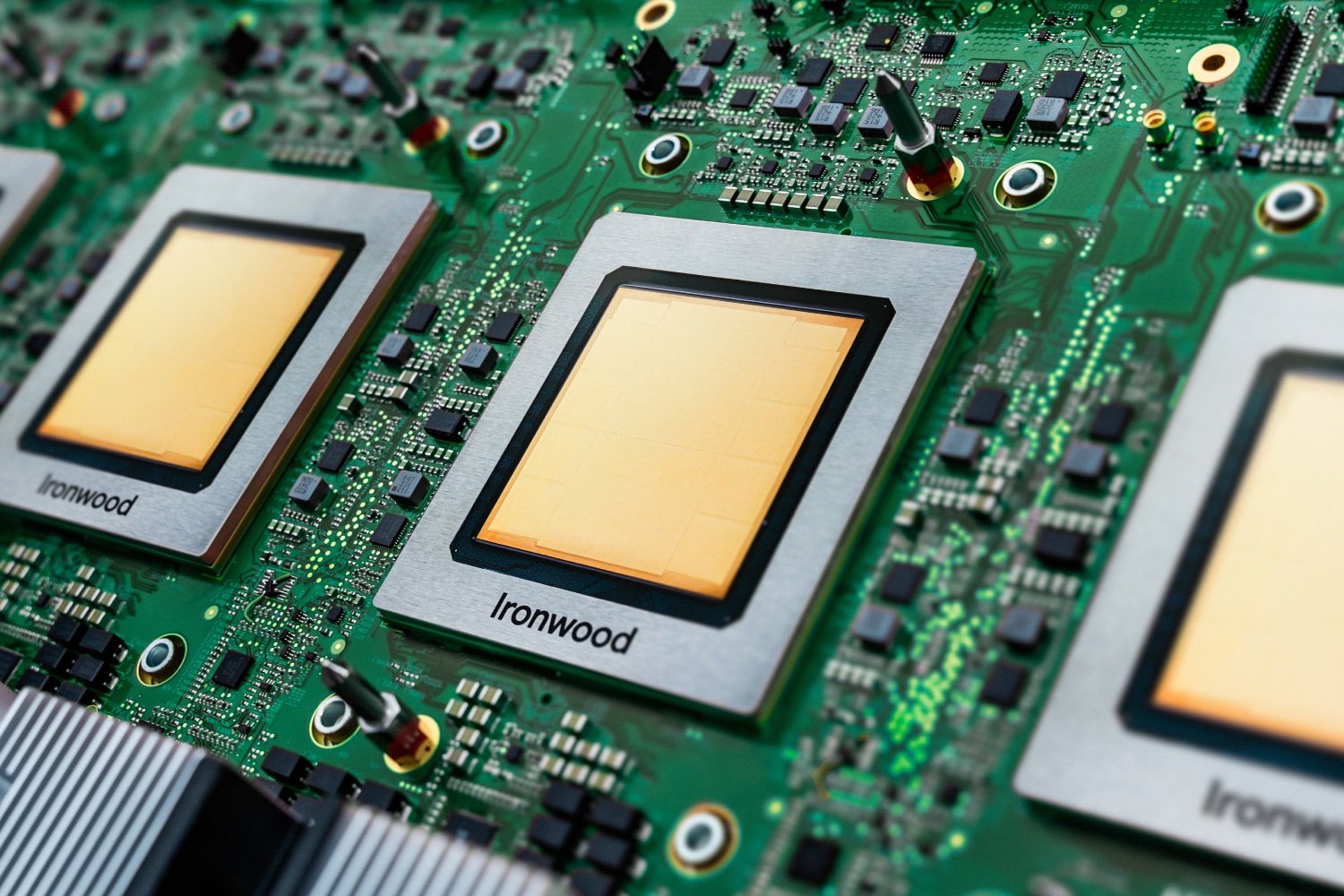

As we have seen, tariff barriers are high on both sides of the board. If we focus on the aviation industry, the impact on supply chains It can be significant. Although most of Boeing’s production is concentrated in the United States, many of the components and materials they use come from suppliers distributed throughout the world.

That is where companies such as Shandong Nanshan aluminum come into play, which supplies aluminum to aerospace firms such as Spirit Aerosystems. The latter, based in Wichita, produces fuselage sections for both Airbus and Boeing, including more than 70% of the structure of 737. In that context, tariffs can make aluminum more expensive from China.

Although both Boeing and Airbus began to diversify their supply chain after the outbreak of the first tariff war during Trump’s initial mandate, a recent analysis of the Leeham firm and public official documentation suggest that Chinese aluminum is still present in the manufacture of some parts. That puts on the table the possibility of a price increase.

Airbus’s case – a European manufacturer based in Blagnac, France – makes clear to what extent the supply chains are interconnected. Spirit Aerosystems not only works with Boeing, he also collaborates with his great European rival. And it is not the only example: Boeing also imports high -tech components made in Sheffield, the United Kingdom.

Airbus tactical advantage

From the point of view of the supply chain, the manufacturer that depends most on raw materials or components affected by tariffs will be, logically, The most harmed. With the available data, it is not easy to determine which of the two large manufacturers is at a greater disadvantage, but if we take the case of aluminum as a reference, the advantage will be those who manage to import it at the best price and with the lowest tariff load.

The scenario, however, is more complex than it seems. Changing supplier not only implies a logistic and operational reconfiguration, but also the global context is so volatile that it is difficult to make structural decisions. Not only China is subject to tariffs: dozens of countries are still reached by a base tax of 10%, although the White House has granted a 90 -day extension to the toughest tariffs.

Where does Airbus’s supposed advantage come here? According to Reuters, the European manufacturer could benefit in the Chinese market by not being subject to the 84% tariffs that affect US planes. Although China promotes its own models, such as the C919, it remains one of the world’s largest aircraft buyers. And both Airbus and Boeing have many deliveries committed.

Chinese airlines could bow up by Airbus if their airplanes are cheaper than those of Boeing. Although the American manufacturer could try to absorb part of the impact by reducing margins, current tariffs – and the possibility of rising again – make that option hardly sustainable. Airbus, meanwhile, would face a challenge nothing less: increase its production capacity and comply with delivery deadlines.

Images | FASYAH HALIM | Sven Piper | Lukas Souza

In WorldOfSoftware | The European Union reacts after the unexpected US turn: suspends its tariffs, although it keeps its finger in the trigger