Private equity and venture capital interest in healthtech has surged and activity shows no sign of abating this year.

But some investors are learning the hard way that a glossy pitch deck and polished paperwork are not enough to secure funding, especially when a company’s value hinges on access to sensitive health data, such as biometric scans, genetic profiles, mental health logs and daily activity tracking.

In the wake of high-profile failures, investors and acquirers are taking a more forensic approach to technical due diligence. A promising founder with a bold vision is no longer enough. What matters now is whether the product works, whether it can scale and, crucially, whether underlying data practices stand up to scrutiny.

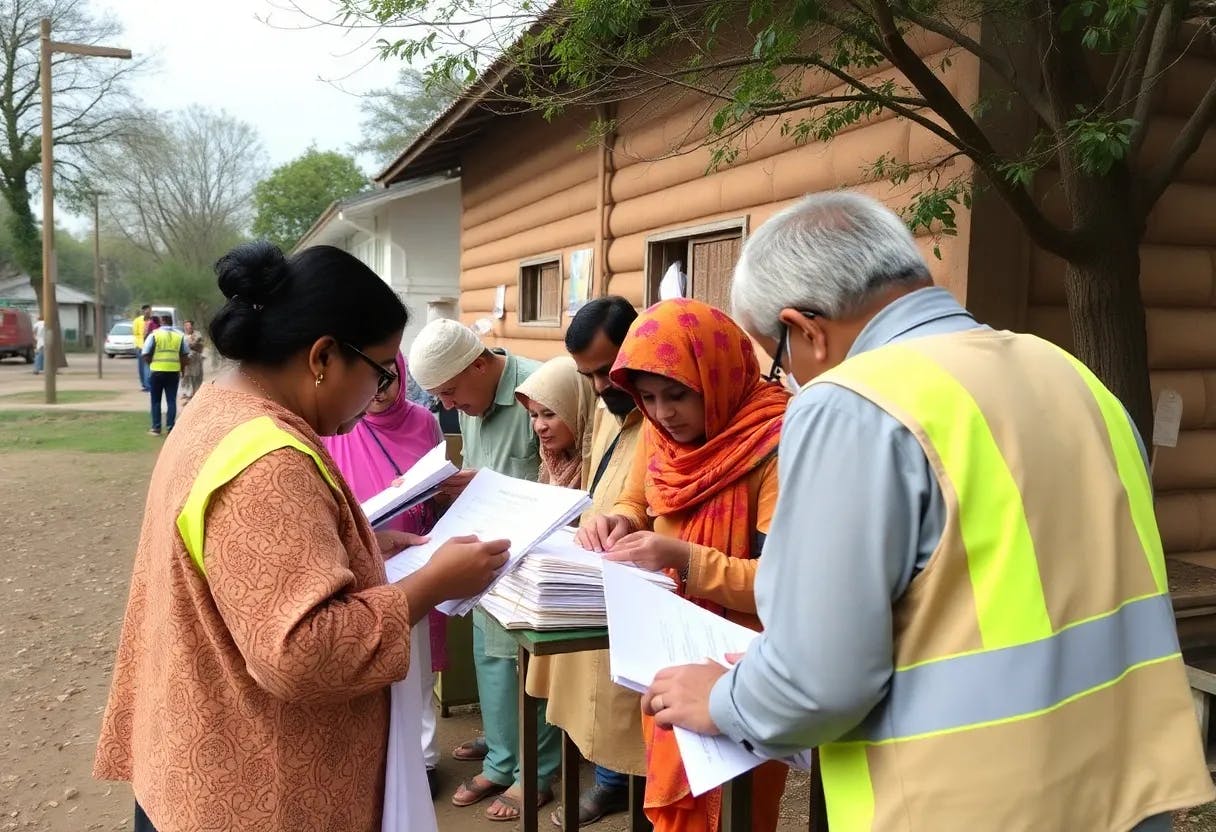

In high-growth, fast-moving sectors like healthtech, compliance can become a tick-box exercise: present on paper, but poorly embedded in practice. A company might present all the right documents, clear consent terms, GDPR-compliant policies and ISO certifications, but if those are not reflected in day-to-day operations, they won’t withstand scrutiny….