When individuals die, their bank accounts and credit histories often go dark – literally and by law. Banks in the majority of the world freeze accounts when someone dies, and credit bureaus flag them “deceased,” then erase them entirely after a period (seven years in the United States. In real life, this means the whole credit record of the deceased person just disappears from the books. No good payment history, no good credit score, and typically no simple system for beneficiaries to inherit whatever’s left. A survey found that while Americans treasure their digital money data (about ~$191,000 in “digital assets” on average), estate planning doesn’t always cover it. A mere 32% of American adults have any estate plan whatsoever, and fewer than half of those plans even refer to digital assets or online accounts. As a result, most leave behind a digital black box: loved ones might know money is out there, but don’t have the keys or clear title to access it.

The Vanishing Credit of the Departed

When John or Jane Doe passes away, their financial existence is effectively put into stasis. Accounts are closed or suspended by lenders and banks, and bureaus mark the credit file as deceased. Creditors are directed to stop issuing new loans and mortgages (a matter of law), but the suggestion is that the remaining heirs inherit no debt or credit. As the article puts it, “After someone dies, their credit file will be marked as ‘deceased’ and will eventually be deleted entirely.” Legall,y the clock starts ticking: during the following seven years, all the loan accounts on file are closed, and lastly, the credit report is deleted. When it’s deleted, the lender’s perception of the borrower also vanishes.

The gap has real-world consequences. Heirs can’t locate dozens of financial assets. Small bank accounts, insurance payments, or retirement funds that are unclaimed can be stuck in state or government accounts for years or be stolen. Even routine payments on bills and obligations become murky: without a credit file to tap, relatives can struggle to settle the estate. In effect, all good credit history that the deceased built up (timely payment of loans, responsible use of cards, etc.) is fated to vanish into thin air. In the age of paper wills and probate courts, a broad-ranging financial trail has a very real potential for being lost in the shuffle.

Scams and Lost Legacies in the Digital Age

Elderly citizens are frequent victims of inheritance theft. While genuine properties lie in limbo, criminals exploit uncertainty in death. Identity thieves make their move while the window between death and notification of authorities is open: prior to notification of bureaus, thieves can establish lines of credit or pilfer funds in the deceased’s name. In one recent example, an African syndicate based in Nigeria mailed targeted letters to hundreds of elderly Americans informing them they were due a multi-million dollar inheritance from a distant relative. Victims were asked to pay “taxes” and “fees” in order to claim the fortune – a scam that fleeced more than 400 seniors of more than $6 million. None of the money that was promised ever came through, of course. Such transnational inheritance scams thrive in the shadows of bad information: without a certain, readily accessible record, even real heirs can get bypassed.

They are not rare. Consumer protection agencies warn of “heir-hunters” and fraudulent wills that promise substantial estates. Meanwhile, hard statistics show average families unready: few Americans have any notion which of their online accounts are even assets at all. Less than a third even have a will, and of them, a scant majority (53%) make any disposition for their online financial accounts. The outcome is anticipated: when death occurs, rightful heirs too frequently find bank and brokerage accounts locked up, or worse yet – nothing, as online passwords were not remembered or accounts were closed. Without proactive planning, the financial legacies people created during life simply expire.

Blockchain’s Unkillable Ledger

Along came blockchain – technology born never to forget. Essentially, a blockchain is a distributed, unchangeable record book. Every transaction (loan, repayment, transfer of credit) is held on a network of nodes and cannot be altered or deleted subsequently. Blockchain networks are also trustless: no one institution holds the data, for only by concensus of many nodes is an entry valid. A borrower’s payment history on such a ledger is permanent and transparent: anyone authorized to do so can audit it end-to-end.

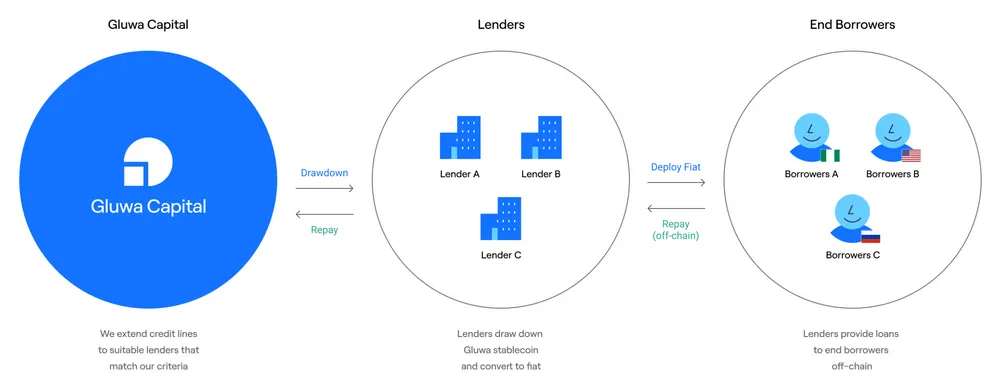

This is precisely the vision actualized through initiatives like Gluwa and Creditcoin. Rather than individual lenders holding separate, siloed records, they bind loan data to a public ledger. Creditcoin is a blockchain “for real-world assets,” designed to record loans on-chain. Its creators boast millions of transactions and over $80 million USD in recorded loans to date. When operating, fintech lenders like Aella (for developing markets) utilize Creditcoin’s API (called Credal) to document every loan and payment. According to Creditcoin documentation, “loan repayments are also made through Creditcoin, which creates a public ledger of each recipient’s history.” Therefore, even the borrower who has no traditional credit history can “build up a financial reputation and establish a credit history on the blockchain”.

Practically, this means that credit is sticky and portable. Instead of one score tied to the closed system of one bank, each borrower possesses a decentralized credit history in the blockchain. Financial institutions (with permission) can view the entire on-chain transaction history of a consumer, which gives them confidence to lend to the once “credit invisible.” Because lenders indicate loans on Creditcoin, investors and banks “are better informed” by the built-in transparency and immutability of a blockchain-based credit bureau. Furthermore, Creditcoin is multichain: it can record loans from networks like Ethereum or Bitcoin and connect fragmented crypto economies. In short, it’s a borderless, interoperable credit rail where each loan is a cryptographically signed fact.

Key technical highlights of Creditcoin’s approach are:

-

Trustless, immutable record book. Loan and repayment details are verified by many blockchain nodes. A record cannot be modified or erased from existence after it has been written, meaning your credit record is tamper-proof. No government or bank can erase or rewrite it.

-

Public visibility. All transactions are published on a public blockchain. It provides full credit history transparency to market participants. In effect, any qualified lender can view a borrower’s complete payment record on chain, strongly discouraging fraud or double-counting loans.

-

Cross-chain integration. Creditcoin already carries loans denominated on many platforms (Ethereum, Bitcoin, etc.), so it is a highly compatible ledger. For example, through Creditcoin’s Credal API, a Nigerian fintech has written 5 million+ loan transactions on-chain, although those borrowers use local currencies.

These abilities capture a borrower’s credit life record in a way paper records never could. And while with the system as it exists today, on-chain reputations perish upon death – in reality, if not theory.

Gluwa & Creditcoin: Building a Perennial Credit Profile

Gluwa is the software development firm behind Creditcoin, and its mission is financial inclusion through crypto. A concrete example explains how Gluwa worked with Aella, a Nigerian microlender: by listing Aella’s loans on Creditcoin, the lender can track credits, give more loans, and offer more credit to those who are trustworthy. In practice, all of Aella’s loans are tokenized on Creditcoin (as a stablecoin pegged to the local currency), and each repayment is recorded. This trust machine has already attracted international investors: for example, the Credal API has already enabled over $80 million worth of on-chain loans as of early 2024.

With the help of Gluwa/Creditcoin, today, there are thousands of lenders globally with actual, verifiable credit histories greater than any single bank. Financial institutions, when approved, can see the recipient’s full ledger, including payment history on Creditcoin, essentially giving the underbanked a public credit reference. More than 3 million credit transactions have been registered on Creditcoin as of summer 2025, reports Gluwa – a quantitative witness to just how robust these decentralized books have become.

If our traditional credit rating vanishes with death, a Gluwa/Creditcoin record would not. In theory, even once the original borrower has died, anyone (with crypto permission) can verify the existence and quality of those past repayments. This raises an interesting question: might that record itself be inherited?

Inheriting an Immutable Credit Ledger

Imagine a world where your financial legacy is an immortal digital heirloom. Gluwa/Creditcoin’s concept may allow individuals to designate inheritors of their blockchain identity. Individuals could identify heirs by storing wallet addresses or Decentralized Identifiers (DIDs) in a smart contract. At death, an on-chain will could be triggered – for example, through a death oracle that validates a notarized death certificate – automatically transferring control.

There has been recent work that explains how one might do this. A “digital will” agreement founded on blockchain might use threshold cryptography: the testator splits their private key into shares and distributes them to some trusted parties (family members, lawyers, executors) using Shamir’s Secret Sharing. Asset release can be initiated only when a quorum (e.g., 3-of-5 heirs) combines their shares and restores the key. Similarly, a W3C-style DID would bind an on-chain credit address to off-chain legal identities in the world. The heir’s DID may include credential hashes (e.g., death certificate), whereupon the smart contract reads to confirm the death event.

In practice, this means: upon death, his Creditcoin account can automatically be moved to his children or to a specified entity. Their successors would not only receive any on-chain savings or tokens, but also the loan and payment history of transactions. Future lenders would be able to look up “Grandpa’s credit score” (recorded on block) when making loans to the clan, or simply settle outstanding assets. The blockchain would maintain a public, unchangeable record that says “John Doe was this trustworthy,” which is passed down with cryptography-backed guarantees. No court filing or paper probate is necessary on-chain: the rules are coded into the smart contract day one.

There are lots of details, of course. Does an heir immediately have sole control over the account, or do they co-sign with it? Can parties add privacy (zero-knowledge proofs) so sensitive data is revealed only under particular conditions? There are bullet-list scenarios one could imagine for such a system:

-

Heirs by design. The DID or smart contract of the deceased lists allowed beneficiaries (by wallet or identity).

-

Death triggers. Oracles (e.g., notary services or Chainlink feeds) confirm the death, which initiates the will contract.

-

Threshold decryption. The private key controlling the credit record is split between the heirs or trustees. On a consensus of k-of-n of them, the blockchain address is decrypted.

-

Automatic probate. The contract automatically distributes any remaining on-chain assets or retires obligations to the beneficiaries with zero human interference.

Such a programmable legacy would remedy the “black box” affliction of today. In effect, your credit history (once locked in stone on the blockchain) is as inheritable as a house or stock portfolio, only with better guarantees. In contrast to today’s estate courts or Social Security reports, a blockchain never loses sight of the facts or forgets the information. And with decentralized identities, only the rightful heirs (vetted off-chain and on-chain) can fill the shoes of the deceased.

Legal and Social Hurdles

The technology is intriguing, but the law is behind. Credit history and financial reputation are not typically treated as inheritable assets under current law. Probate statutes typically address bank accounts and real estate, not intangible information or reputation. A blockchain credit report is a headache: is it personal information (covered by privacy statutes) or an asset that can be inherited? Some jurisdictions have begun to put “digital inheritance” into code, but more or less for things like email boxes or NFT accounts – not credit scores.

There are also regulatory issues. Credit bureaus and banks would need to recognize a blockchain credit report as valid. Data protection legislation (such as the EU’s “right to be forgotten”) is incompatible with an immutable ledger: how does one delete data that must by definition remain forever? Identity verification is another problem: correlating the death of an actual person to a blockchain DID involves secure, possibly government-run oracles or notarization.

Even at a cultural level, people will need to be prepared to put their trust (and their own information) into blockchain. The majority are still anxious or unfamiliar with digital wealth, according to surveys. It would start incrementally: some foreign aid agencies or microfinance cooperatives might experiment with “inheritance mode” on Creditcoin, or forward-thinking nations could make blockchain wills legal. Insiders maintain that a well-designed system of digital wills can “make up for” outdated laws and ensure orderly passing of digital assets. However, mass dissemination would require new standards and potentially new laws.

Conclusion

For the time being, the concept of crypto-anchored credit inheritance is hypothetical – but the building blocks are there. Gluwa and Creditcoin have proven it is possible to construct stable, decentralized credit records now. It remains to connect those records to the human life cycle. If done, this would make everyone’s financial reputation no longer pass away with them. Rather, it would survive – an open, non-forgable record that heirs can draw upon.

And in a sense, Gluwa/Creditcoin are already rendering “invisibility” (off-grid credit) visible and permanent. The payoff could be enormous: no more totally lost estates, fewer inheritance scams, and a more efficient world credit market. Gluwa/Creditcoin is aiming to bring the world’s vast untapped economy on-chain. Add in smart wills and DIDs, and even deceased people’s credit might become an option – an inheritance of trust after death.