You’ve probably heard it somewhere: some media or financial personality claiming that cryptocurrencies have no intrinsic or inherent value, and this, apparently, is some kind of scam or damning mistake. For instance, Jamie Dimon, chief of the financial multinational JP Morgan Chase, has said it with complete confidence: “Bitcoin itself has no intrinsic value.” Which is pretty ironic, because his company handles billions in assets that don’t have intrinsic value either. We mean dollars (USD).

No, fiat money (dollars, euros, any national currency) doesn’t have intrinsic value. Precious metals, then? Still no. Here’s a funny thing: if you ask five people to define “intrinsic value,” you’ll get five very different answers, none of which really hold up when you dig a little deeper. In reality, no asset (fiat, gold, crypto) has value unless we humans agree it does. So maybe the question isn’t whether crypto has intrinsic value, but whether anything ever really has and why this matters —or not.

What Is Intrinsic Value, Anyway?

Economists, philosophers, and investors have debated this for centuries, and the answers range from unsatisfying to downright contradictory. Classical economics tried to define it as the labor put into making something. , Austrian economists like Ludwig von Mises argued that value is purely subjective: an object is only worth what someone is willing to give for it.

In any case, the idea of intrinsic value suggests that certain things have worth in and of themselves, regardless of what people think or do. But is that really how value works? Think about something like gold. Many argue it’s valuable because of its physical properties, like durability and scarcity. But if no one cared about gold, would it still hold value? Probably not.

Value isn’t something that exists inside an object; it comes from people’s desires and choices. If everyone stopped wanting gold tomorrow, its price would collapse, no matter how rare or shiny it is. This shows that value isn’t an inherent trait but rather something we assign based on our preferences.

History reveals how easily people confuse intrinsic value with other concepts, like usefulness or tradition. And value can be derived from usefulness or tradition, indeed, but it’s none of those things. The truth is, value isn’t stored in objects like some hidden ingredient; it’s created by supply and demand. People want things, and scarcity makes them more desirable. That’s why air (essential but abundant) is free, while gold (less essential but scarce) is expensive.

Intrinsic Value vs. Intrinsic Properties

So, does intrinsic value exist? The answer seems to be no. Value is always tied to human judgment. Even something as universally prized as gold only holds worth because people agree on its importance. This doesn’t mean gold isn’t useful or historically significant, but its value depends on our choices, not some unchangeable law. On the other hand, its value can come, at least partially, from its own properties.

Here’s where a lot of people get tangled up: they confuse an asset’s intrinsic properties (the things it really is) with its value, which lives entirely in our heads. People often say that gold has “intrinsic value”, but what it really has are intrinsic properties. Gold is shiny, malleable, scarce, and it doesn’t rust. Those traits are part of its nature. And because of them, humans have always found it appealing for jewelry, prestige, and yes, money.

Those properties alone don’t automatically make it valuable, though. Properties are the canvas; the value is the story we paint on it. It comes from us deciding that those properties matter enough to trade for. Salt, too, is a great example. It preserves food and seasons meals, but its usefulness only translates into value when people actually want or need it. We can stretch this idea to modern tech and money as well.

Cryptos Have Intrinsic Properties

When critics say, “Cryptocurrencies have no intrinsic value,” what they often miss is that cryptos do have intrinsic properties, and those properties are pretty remarkable. Unlike fiat money, which is just paper or pixels on a screen controlled by governments, cryptocurrencies are designed to be portable, autonomous, resistant to censorship (no frozen accounts), and accessible anywhere in the world.

You can send Bitcoin, Ether, GBYTE, or another crypto to someone on the other side of the globe in minutes, often without needing a bank, documents, or paying hefty fees. That’s something neither gold nor fiat money can do with the same efficiency.

Gold does have some impressive traits and a historic perception of value, but try paying your rent with a gold coin or mailing some to a friend overseas. Not exactly practical. On the flip side, fiat currencies are easy to spend, but they’re vulnerable to inflation and political manipulation. Governments can print more at will (just like that, backed by nothing), which erodes your savings over time. Governments can also freeze accounts or prevent you from using your money the way you like, e.g. sending abroad or to “undesirable” entities.

Many cryptocurrencies, by design, limit how many coins can exist, which can help protect against inflation. And thanks to decentralization (a system where no single authority controls the network), depending on their level of it, these coins and their networks can keep running even if a government or big corporation tries to shut them down, and keep processing all transactions even if a government tries to censor them.

On top of that, many cryptos support clever features like smart contracts: self-executing agreements written into code. These let people create investments, games, decentralized apps, marketplaces, and even loans without intermediaries. However, as with any other asset, all of these brilliant properties still need people to recognize and use them. The prices are set by what others are willing to pay —driven by trust, demand, and human choice.

Where Value Really Lives

So, what can we take away from all this? Maybe the whole idea of intrinsic value has been a red herring all along. We humans have always assigned value to things based on trust, utility (which itself is subjective), and our collective stories about what’s important. The fact that cryptos need belief to function doesn’t make them any different from gold bars locked in Fort Knox, or from the paper bills in your wallet. Now, it doesn’t mean they can’t be useful or have actual properties, either. There’s a reason why millions of people have found them appealing enough to thrust and use.

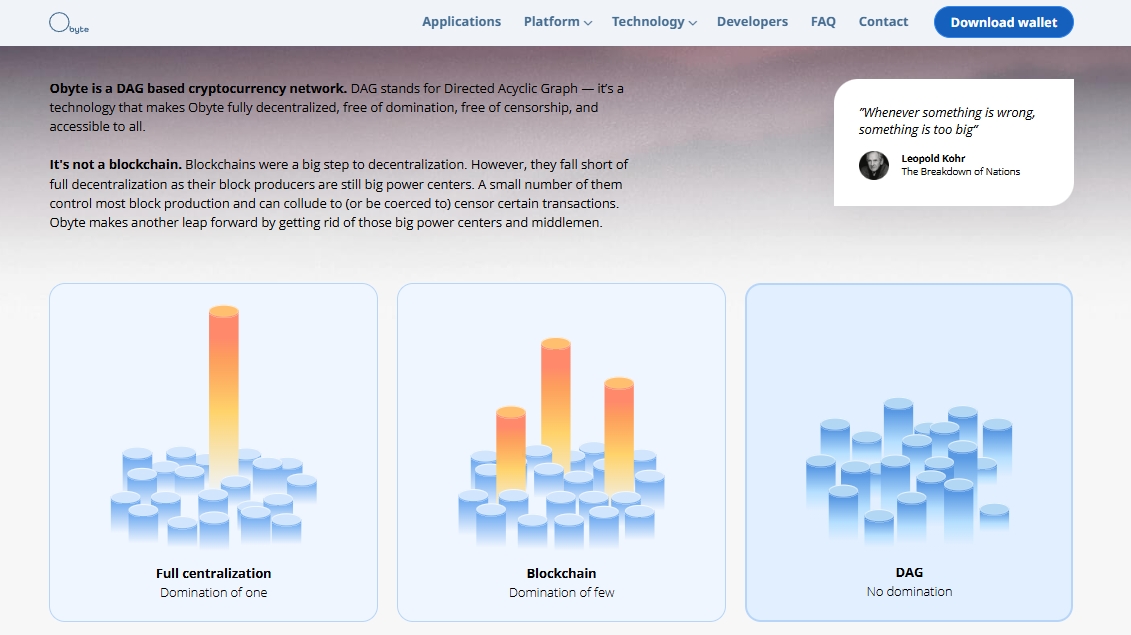

Obyte is a good example of a crypto ecosystem with useful properties that set it apart from both traditional assets and many other coins. Like Bitcoin, it’s decentralized and scarce, but it goes further by eliminating miners and “validators” completely, so there’s no middlemen. Instead of a blockchain, Obyte uses a Directed Acyclic Graph (DAG), which means it’s more censorship-resistant than many other systems.

Besides, Obyte doesn’t just offer a store of value; it’s an entire platform for decentralized applications, smart contracts, tokenization, and tamper-proof data storage. Unlike other cryptos, which either focus only on money or only on apps, Obyte combines both. And because it doesn’t rely on energy-hungry mining or a central authority, it’s more resilient than others. All of these intrinsic properties, combined with the trust from its community, are what makes it valuable.

In the end, remember: value lives where we decide it lives, whether that’s in gold dust, salty crystals, lines of code, or even a shiny digital token with a dog’s face on it. Whether that value is useful for you, is solely for you to decide.

Featured Vector Image by Freepik

n