Authors:

(1) Burak Oz, Technical University of Munich;

(2) Jonas Gebele, Technical University of Munich;

(3) Parshant Singh, Technical University of Munich;

(4) Filip Rezabek, Technical University of Munich;

(5) Florian Matthes, Technical University of Munich.

Table of Links

Abstract and 1. Introduction

- Background

- Related Work

- MEV Discovery

- MEV Extraction

- Conclusion and References

Abstract

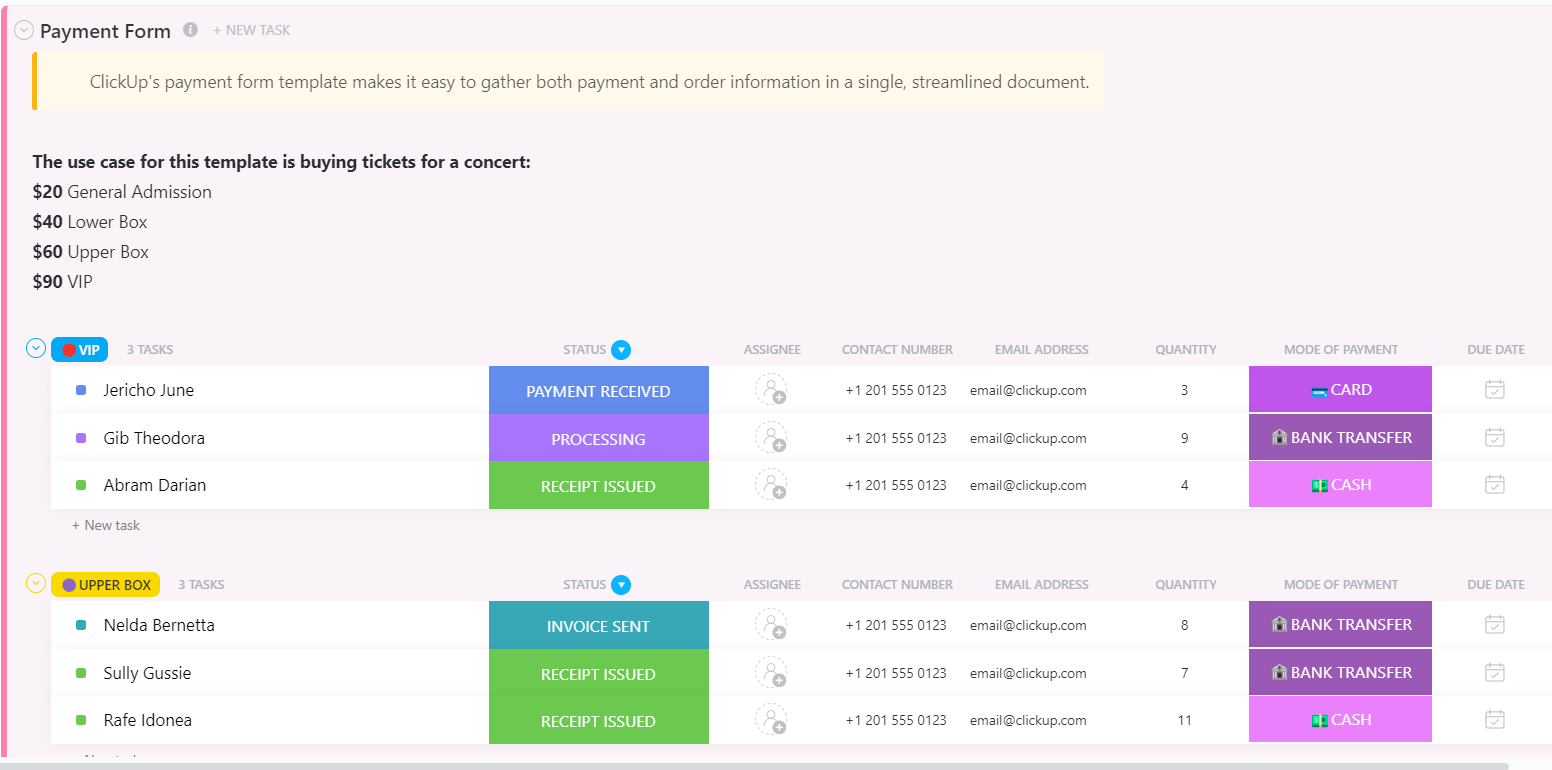

Maximal Extractable Value (MEV) searching has gained prominence on the Ethereum blockchain since the surge in Decentralized Finance activities. In Ethereum, MEV extraction primarily hinges on fee payments to block proposers. However, in First-Come-First-Served (FCFS) blockchain networks, the focus shifts to latency optimizations, akin to High-Frequency Trading in Traditional Finance. This paper illustrates the dynamics of the MEV extraction game in an FCFS network, specifically Algorand. We introduce an arbitrage detection algorithm tailored to the unique time constraints of FCFS networks and assess its effectiveness. Additionally, our experiments investigate potential optimizations in Algorand’s network layer to secure optimal execution positions.

Our analysis reveals that while the states of relevant trading pools are updated approximately every six blocks on median, pursuing MEV at the block state level is not viable on Algorand, as arbitrage opportunities are typically executed within the blocks they appear. Our algorithm’s performance under varying time constraints underscores the importance of timing in arbitrage discovery. Furthermore, our network-level experiments identify critical transaction prioritization strategies for Algorand’s FCFS network. Key among these is reducing latency in connections with relays that are well-connected to high-staked proposers.

1 Introduction

Blockchain networks offer profitable opportunities for various parties involved. While default economic incentives for consensus participants include block rewards and transaction fees, the recent surge in Decentralized Finance (DeFi) activities (with daily trading volumes on Decentralized Exchanges (DEXs) exceeding multi-billion USD [3]) has led to the emergence of a new incentive for strategically acting players, which we know as Maximal Extractable Value (MEV) [9]. While this term generally refers to the value that can be captured by entities like block proposers, who have the privilege to determine transaction inclusion, exclusion, and ordering, value extraction is not limited to them, as MEV activity dashboards such as libMEV [2] reflect a total of 64 million USD made by profit-seeking entities operating on the mempool, known as MEV searchers, since the merge on Ethereum in September 2022.

Before private relays such as Flashbots[1] emerged on Ethereum, offering an off-chain sealed-bid auction for inclusion, MEV searching bots competed in Priority Gas Auctions (PGAs) on the public mempool to extract value [9]. As Ethereum is a blockchain where fees can influence the transaction ordering of proposers, while latency still played a role in being competitive in PGAs (e.g., to ensure your latest bid reaches the proposer on time), the primary determinant of the winner was the fee offered.

In blockchains where block proposers arrange transactions in the order received, known as FirstCome-First-Served (FCFS), the dynamics for MEV searching differ, as demonstrated in [7, 20]. Unlike fee-based blockchains like Ethereum, in an FCFS network, the only way to prioritize is by propagating a transaction before competitors. Consequently, the available runtime for an MEV searching algorithm in FCFS networks is limited by the anticipated arrival time of a competing transaction, as opposed to almost the entire block time available to the searcher on a fee-based network.

This paper explores how the MEV game can be strategically played on an FCFS network, using Algorand as the case study, building on the initial research by Oz et al. [20]. Our methodology comprises two stages: discovery and extraction. The discovery stage employs a cyclic arbitrage detection algorithm. We focus on arbitrages, as they are shown to be a feasible MEV strategy on FCFS networks [7, 20]. We assess our algorithm’s performance using historical Algorand data, considering the runtime constraints of FCFS networks. In the next stage, similar to High-Frequency Trading in Traditional Finance, MEV extraction in FCFS networks is about outpacing others in latency. We run experiments on a private Algorand network to identify key factors for prioritizing transaction propagation. Our research contributes to understanding MEV in FCFS networks, showcasing how algorithms can exploit profitable opportunities and highlighting the critical network characteristics for ensuring prioritized execution.

[1] Flashbots Auction: https://docs.flashbots.net/flashbots-auction/overview