eTranzact International Plc, a Nigerian payments and switching company, failed to hit its 2025 profit target despite posting a slight revenue increase, according to its unaudited results.

The company’s profit after tax fell by 15.68% to ₦2.97 billion ($2.14 million) in 2025. Revenue for 2025 rose marginally by 1.08% to ₦29.82 billion (21.45 million), while gross profit climbed 24.48%.

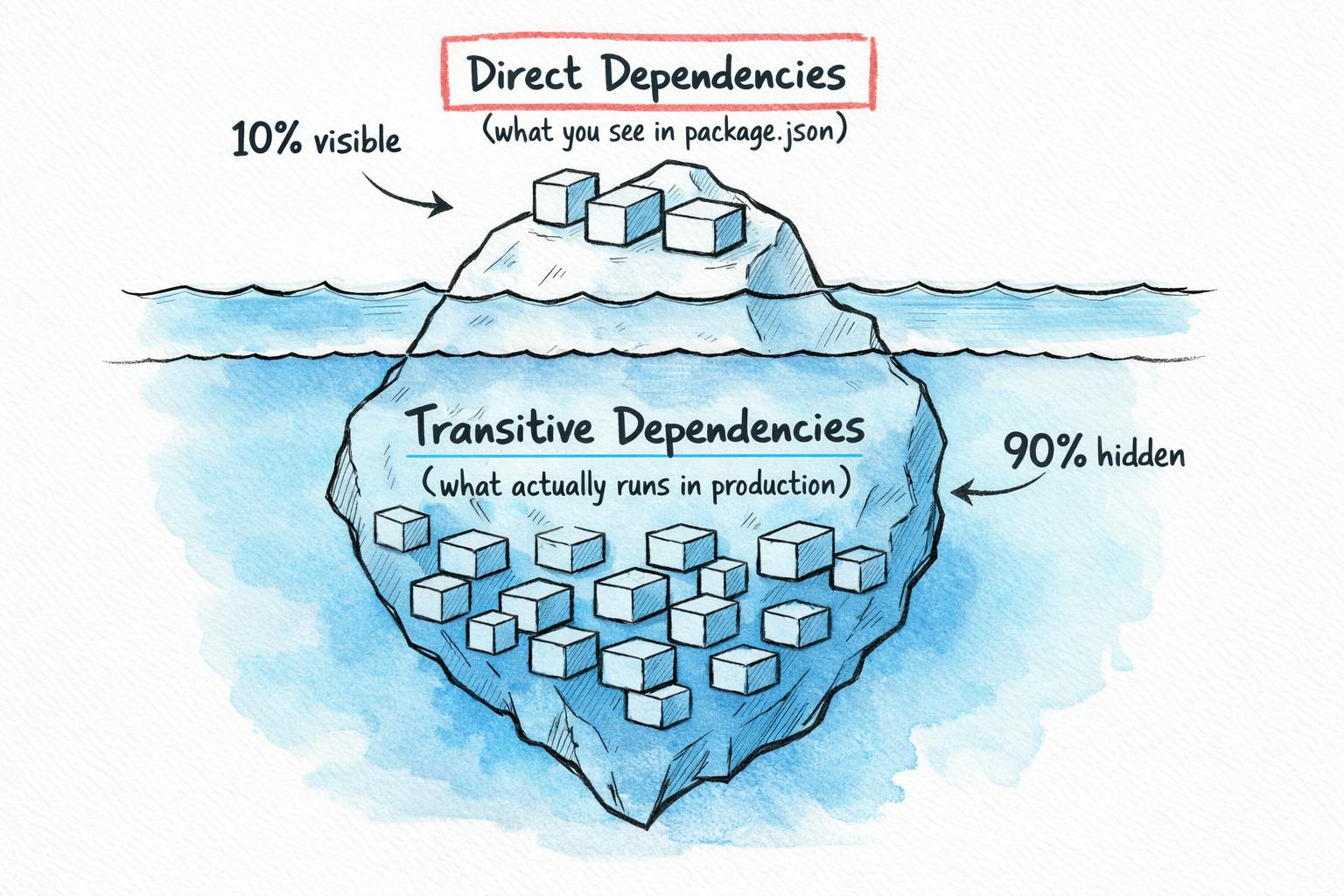

In an email to , the company said, “Major projects/mandates that were set to commence in Q4 2025, these projects are major drivers of the projected Q4 2025 revenue/earnings forecast, and drive revenue significantly during the quarter, were stalled due to some external dependencies.”

Cost of sales dropped 13.62%, suggesting an improvement in unit economics. But a 50.08% increase in administrative expenses to ₦9.24 billion ($6.65 million) wiped out those gains, dragging full-year profit below 2024 levels.

FY 2025: Annual Efficiency vs. Operational Friction

A comparative look at eTranzact’s pivot success and its administrative cost challenges.

The baseline performance before the shift to high-margin revenue lines.

Shows the 13.8% drop in Cost of Sales alongside the 50% admin cost surge.

The company explained that key drivers of this increase include a rise in depreciation based on the acquisition of assets, and investment in the company’s manpower to meet business needs and drive business growth.

eTranzact’s results reveal a company growing top line, but struggling to convert that growth into profit as costs surge amid a shift away from its major revenue line, airtime sales.

While the company is yet to reveal the full breakdown of its revenue line, it told , “The percentage of mobile airtime revenue to total gross revenue reduced in 2025. Further disclosures will be available in the 2025 audited financial statements.”

The company beat its fourth quarter 2025 revenue forecast, but a jump in cost of sales and overheads crushed margins, leaving it far short of its full-year profit projection.

In October 2025, the company projected ₦8.19 billion ($5.89 million) in Q4 2025, and ₦1.87 billion ($1.35 million) in profit after tax. This would have taken its full-year revenue to ₦28.30 billion ($20.35 million) and profit to ₦4.28 billion ($3.08 million).

Instead, eTranzact beat its fourth-quarter revenue target, posting ₦9.86 billion ($7.09 million) in revenue, but profits fell sharply. Costs surged well beyond projections, compressing margins and dragging profit after tax down to just over ₦561.66 million ($403.97 million), far below the company’s expectations.

Composition of 2025 Financial Projections

A breakdown of how eTranzact arrived at its full-year targets.

“The increase in cost of sales is mainly because of an increase in technology cost and the direct impact of an increase in revenue lines with high direct cost components/low margins,” the company said

“The actual revenue achieved for those lines exceeded what was projected, and this increased the direct cost accordingly. Major drivers of the Q4 revenue were high-margin revenue lines with little to no direct cost components.”

The company told in October that its projections reflected a strategic shift away from airtime sales, historically one of its biggest but lowest-margin revenue lines. Over the years, a significant part of eTranzact’s revenue has been value-added services such as airtime, which it describes as very low margin.

eTranzact noted at the time that it was prioritising other business lines, such as switching, which includes funds transfer, bill payments, payment gateway, and its financial inclusion business.

The company operates across switching, merchant acquiring, and consumer solutions, offering products including PocketMoni, a fintech app, Corporate Pay, for salary disbursements, PayOutlet, for merchant payments, SwitchIT, for transaction processing, and Credo, a social commerce payment gateway.

Despite the profit miss, eTranzact’s cash position improved over the period, pointing to stronger operating momentum. Cash receipts from customers rose by 0.62%, and cash paid to suppliers and employees fell by 82.80%, leaving a net positive cash movement of ₦23.78 billion ($17.10 million).

Corrected Cash Flow Dynamics (2024–2025)

A precise breakdown of eTranzact’s shift from a ₦4.46B deficit to a ₦23.78B surplus.

| Metric (Billions ₦) | 2024 (Actual) | 2025 (Unaudited) | Change (%) |

|---|---|---|---|

| Customer Receipts | 29.42 | 29.60 | +0.61% |

| Supplier/Emp. Payments | 33.88 | 5.83 | -82.79% |

| Net Operating Cash Flow | -4.46 | 23.78 | +633.18% |

In its forecast for Q1, 2026, eTranzact expects revenue to fall by 42.69%, and an 18.98% drop in profit to ₦672.72 million ($483,846).

The company expects airtime’s contribution to continue shrinking as it doubles down on digital payments and enterprise platforms. It is also betting on growth from its approval by the Federal Inland Revenue Service (FIRS) to support Nigeria’s e-invoicing rollout, a government initiative aimed at digitising tax and business processes.