This article explores a conservative looping strategy on Fluid using USDe/USDT on Arbitrum. With ~8.9% APY and a liquidation buffer of ~12%, the strategy prioritizes liquidity and risk-adjusted returns over maximum yield. Break-even is reached after ~6–8 weeks.

Assets

Use reliable stablecoins from trusted issuers, where the probability of a depeg is very low. The final choice is always yours.

Personally, I’d start with:

- USDC

- USDT

- USDe

, this list of reliable stablecoins can be expanded.

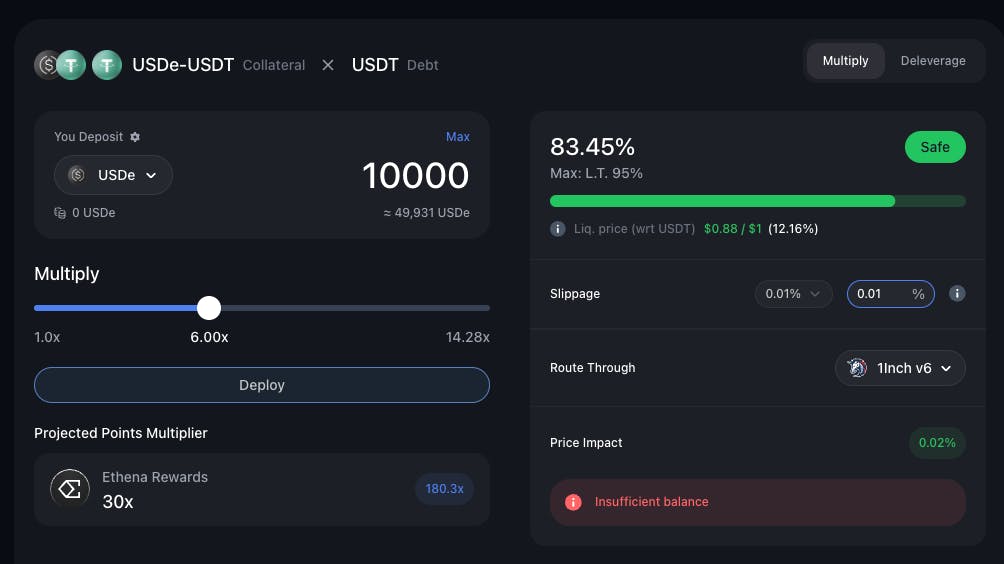

Fluid strategy: USDe / USDT

Fluid is a relatively new protocol, but it’s built on a robust system under the hood. Its oracle doesn’t rely on spot exchange prices; instead, it values assets based on their underlying collateral— important for more consistent pricing. This strategy currently offers ~8.93% APY on Arbitrum. USDe and USDT are “direct” stablecoins—neither wrapped tokens nor yield-bearing/staked variants. In general, deeper liquidity can help reduce slippage and may support more stable pricing during stressed market conditions.

:::info

Disclaimer: This article is for informational purposes only and does not constitute financial, investment, or legal advice. DYOR!

:::

Strategy payback period

In looping strategies, it is crucial to estimate how long it takes to recover the costs of opening and closing a position.

Due to leverage, multiple swap operations are required, and it may turn out that the strategy needs to run for at least 2–3 weeks before it becomes profitable.

During this period, your stablecoins are effectively locked in the strategy, and exiting early may result in a net loss.

Gas costs are negligible compared to swap-related execution costs.

Basic Cost Estimation

-

Position size:

$10,000 × 6 = $60,000 (6× leverage)

-

Price impact per swap:

0.02%

-

Number of swaps:

6 swaps to enter + 6 swaps to exit

-

Total swap cost per side:

6 × 0.02% = 0.12%

-

Cost per entry or exit:

0.12% of $60,000 = $72

-

Total round-trip cost (entry + exit):

2 × $70 = $140

-

Cost relative to initial capital:

$140 / $10,000 = 1.4%

Profitability breakdown

-

Final APY: ~8**.93%** (see screenshot)

-

Annual yield: ≈ $893

-

Break-even time:

~$140 is recovered in ~56 days

After the first two months, the strategy starts generating net positive returns.

Gas costs

Opening or closing a complex leveraged position typically consumes 600k–1M gas.

Typical values on Arbitrum:

L2 gas price: 0.1–0.3 gwei

ETH price: ~$3,300

At these levels:

1M gas ≈ $0.30–$0.90

To stay conservative, it’s reasonable to assume:

Entry / Exit gas cost: $1–2

Risk Assessment

As shown in the interface, with 6× leverage, the position remains in the safe zone.

Liquidation would only begin if the price of the assets deviates by approximately 12.16%, which is a significant move for stablecoins.

On Fluid, liquidations are gradual rather than instantaneous, meaning the position is reduced step by step instead of being fully liquidated at once.

The liquidation penalty is up to 2%.

While a 12% deviation is unlikely under normal conditions, extreme market stress or systemic stablecoin events may cause temporary dislocations. As with any leveraged strategy, tail risks cannot be fully eliminated.

Conclusion

This strategy is suitable for users comfortable with leveraged DeFi positions and who do not require immediate liquidity. It is not suitable for short-term capital or risk-averse investors.

A strategy like this typically turns net positive only after at least three weeks. During this period, your stablecoins are effectively tied up in the position and not readily available.

Recommendation: consider opening the position during “quiet” market conditions, when execution costs (slippage/price impact and other entry costs) are significantly lower.

The strategy favors capital preservation and predictable returns over aggressive yield optimization.