🔍 Did You Know? 82% of small businesses fail, not because they’re unprofitable, but due to poor cash flow management. Even with booming sales, your business could still run into trouble if you’re not regularly forecasting your cash inflows and outflows.

So, how do you stay ahead of the chaos, plan for slow months, and dodge financial surprises before they hit?

Start with the right cash flow projection template—a high-impact tool that clarifies your financial runway, flags risks early, and helps you make smarter decisions.

Stick with us, we’ve rounded up the best free templates to keep your cash flow in check.

Free Cash Flow Projection Templates to Plan Your Finances

What Are Cash Flow Projection Templates?

Cash flow projection templates are ready-to-use financial tools that help you forecast how money moves in and out of your business over time. Use them to predict when cash hits your account, when payments go out, and how much liquidity you’ll have at any point.

Think of it as a financial GPS for your business. It gives visibility, reduces guesswork, and strengthens your expense management. Instead of starting from scratch every time, use these templates to:

- Turn scattered transactions into clear, time-based cash flow insights

- Match income and expenditures to avoid crunches and missed payments

- Monitor what’s helping or hurting your cash position in real time

- Make smarter calls on hiring, investments, or when to hold back

Top Cash Flow Projection Templates at a Glance

It’s evident that cash flow templates help you plan smarter, spend confidently, and stay liquid. But what separates a great one from the rest? Your specific needs!

Let’s break it down with a quick summary.

| Template Name | Download Template | Best Features | Visual Format |

| Finance Management Template | Get free template | Live dashboards, custom fields, transaction tracking, automations | List, Dashboard |

| Financial Analysis Report Template | Get free template | KPI tracking, auto-generated charts, benchmarking, comments | Doc, Dashboard |

| Break-Even Analysis Template | Get free template | Profit/loss scenarios, margin analysis, what-if planning | List, Doc |

| Sales Forecast Template | Get free template | Pipeline tracking, revenue forecasting, real-time updates | List, Board |

| Business Expenses and Report Template | Get free template | Daily/weekly/monthly tracking, receipts, audit-ready | List, Doc |

| Budget Template | Get free template | Budget scheduling, spend prioritization, automation | List, Doc |

| Balance Sheet Template | Get free template | Version history, review tasks, audit notes | List, Doc |

| Accounting Operations Template | Get free template | Recurring workflows, deadline reminders, cycle review | List, Doc |

| Accounts Payable Template | Get free template | Vendor tracking, deadline alerts, automation | List, Doc |

| Cost Analysis Template | Get free template | Cost mapping, projected vs. actual, inefficiency highlights | List, Doc |

| 12-Month Cash Flow Forecast Template by Coefficient | Download this template | 12-month timeline, editable fields, charts/dashboards | Google Sheets, Excel |

| Excel Cash Flow Forecast Template by GTreasury | Download this template | Multi-currency, netting/interest rules, policy compliance | Excel |

| Cash Flow Forecast Template by QuickBooks | Download this template | Real-time sync, auto-calc balances, seasonal flagging | Spreadsheet |

| Cash Flow Forecast Template by Conta | Download this template | Monthly columns, customizable, auto-calculations | Spreadsheet |

| Cash Flow Projection Template by NFF | Download this template | Funding source tracking, grant cycles, compliance | Excel |

What Makes a Good Cash Flow Projection Template?

A standout cash flow projection template does more than list numbers; it powers your financial strategy. The best ones combine simplicity with functionality, striking the right balance between ease of use and detailed insight.

Here’s what to look for in a template that works in the real world:

- Logical layout: Choose a template that organizes your projections on a quarterly, weekly, or monthly basis. A clear structure helps you map cash movement over time and quickly spot risky periods

- Scenario planning: Model different financial outcomes. Whether it’s a late payment or a new hire, the ability to test what-if scenarios makes capacity planning proactive, not reactive

- Automated calculations: Skip the manual math. A good template includes built-in formulas that automatically update totals, balances, and net cash flow to save time and reduce costly errors

- Custom categories: Tailor your cash flow template to reflect your cash flow sources and expenses. Add sections for client invoices, SaaS subscriptions, ad spend, or vendor payments—whatever mirrors how your business runs

- Performance tracking: Determine how your forecasts stack up against actual results. Use this to fine-tune your projections and monitor financial KPIs like burn rate, runway, and cash coverage ratio

- Visual insights: Turn raw numbers into clear trends. Add graphs or charts to identify cash shortfalls and spending spikes—great for internal reviews, investor decks, or sharing financials with lenders

📍 Best Practice: Choosing the right template is the start—building a repeatable system around it is where the real payoff begins. It helps you assess progress, stay on top of your month-to-month cash flow, and confidently plan.

Want to optimize your system? Start with these tips on how to organize finances like a pro:

- Review adequate cash outflows and inflows in one centralized place 🧾

- Run monthly check-ins to update forecasts and stay ahead of changes 📅

- Assign ownership to key financial tasks; no more follow-up chaos 👥

- Keep notes, assumptions, and invoices tied to real numbers 📌

for Finance brings it all together: cash flow tracking, budgeting, task management, and team collaboration. This way, you spend less time chasing numbers and more time making them count.

Best Cash Flow Projection Templates to Keep Your Finances Moving

Late client payments? Sudden expense spikes? We’ve all been there.

These cash flow projection templates fit the fast pace of real-world operations—whether you’re balancing freelance gigs, scaling a lean startup, or chasing your next funding round.

Let’s explore our top picks to turn unpredictable cash flow into a clear, confident strategy.

1. Finance Management Template

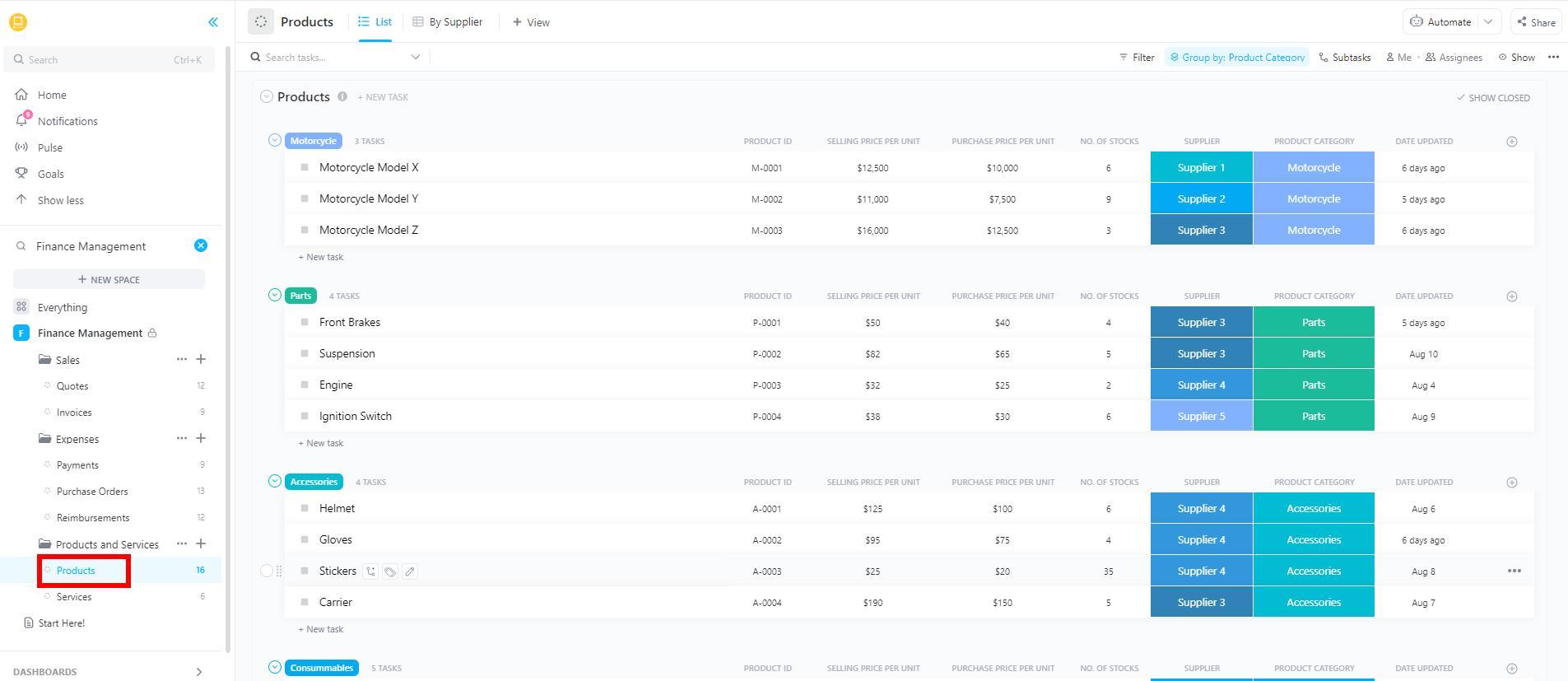

Running a small business means juggling multiple accounts, clients, and cost centers, often without a dedicated finance team. The Finance Management Template simplifies the chaos by centralizing everything into one clean, customizable dashboard.

The cash flow template uses Custom Fields to tag transactions, group costs by category, and monitor cash flow by project or date. Set automations to alert your team when cash paid falls short, an invoice goes overdue, or cash outflows exceed budget.

📈 Here’s why you’ll like this template

- Build live financial dashboards using rollups and formulas

- Tie tasks, files, and approvals directly to your financial workflows

- Track every transaction for clean reports and audit-ready records

🔑 Ideal for: Founders without a CFO, agencies managing multiple budgets, and startup teams coordinating budget responsibilities.

2. Financial Analysis Report Template

60% of small businesses that review their financials regularly see higher profitability. But digging through disjointed data and building reports from scratch is a time-killer.

The Financial Analysis Report Template allows you to analyze income, expenses, and financial KPIs faster and smarter.

Track trends, compare performance, and auto-generate charts and variance reports without leaving your workspace. Additionally, add comments, assign follow-ups, and export investor (or lender)- ready summaries.

📈 Here’s why you’ll like this template

- Zero in on key performance indicators to guide growth decisions

- Benchmark results against previous months or industry targets

- Highlight profit drains and double down on what drives profitability

🔑 Ideal for: Small business owners, startup teams, and freelancers who need fast, actionable financial insights without the manual effort.

💡 Pro Tip: Simplify your financial review with AI. Brain surfaces what matters: cash trends, cost spikes, risks, and high-impact insights. Whether you’re prepping for a review or forecasting, it’s like having a real-time analyst on demand.

3. Break-Even Analysis Template

Not sure if your pricing is sustainable or scraping by? You’re not alone. This question keeps most founders up at night.

The Break-Even Analysis Template is a focused cash flow forecast template built to show exactly when revenue covers costs and when profit kicks in. It allows you to plug in your fixed and variable costs, try different pricing strategies, and test what-if scenarios in one place.

The best part? You can customize views and fields to match your business model and keep insights clear and decision-ready.

📈 Here’s why you’ll like this template

- Assess if your product or service will actually turn a profit or break even

- Spot razor-thin margins or delayed ROI before they hit your bottom line

- Collaborate by tagging teammates, adding notes, and tracking key assumptions

🔑 Ideal for: Small business owners and early-stage startups testing new markets, pricing strategies, or figuring out if their business model leads to real profit.

💡 Pro Tip: Block one ‘Cash Flow Day’ each month on your calendar. Use it to update your projections, compare present value vs. forecasts, and tweak your strategy. It’s a simple habit that helps you stay proactive, so cash surprises don’t catch you off guard.

4. Sales Forecast Template

Sales planning isn’t about hitting quotas; it’s about staying ahead of demand, resources, and growth targets. The Sales Forecast Template links your pipeline to real outcomes, helping you monitor revenue, deals, and conversion metrics in one place.

Track lead sources, sales targets, and fulfillment costs using Custom Fields. Visualize forecasts by rep, product, or region and tweak assumptions as the market shifts. Everything updates in real time, so your projections always reflect reality.

📈 Here’s why you’ll like this template

- Forecast revenue to align with your cash flow strategy

- Uncover pipeline shifts before they disrupt planning

- Pinpoint gaps between projections and actuals to course-correct early

🔑 Ideal for: Sales directors and revenue operations teams who need to tie sales goals directly to cash flow planning.

Here’s how Muhammad Asif Iqbal, Product Manager, Dubizzle Group, has used to handle finances effectively:

5. Business Expenses and Report Template

Cash flow problems often start on the expense side. Unexpected costs are one of the biggest financial disruptors for small businesses, and without structured tracking, even the best cash flow projections can fall apart.

The Business Expenses and Report Template brings order to the chaos. Track and control your spending in real time so you stay on budget, spot savings, and keep every dollar accounted for.

📈 Here’s why you’ll like this template

- Track spending daily, weekly, or monthly by category or department

- Centralize receipts and approvals for easy, audit-ready tracking

- Discover trends and long-term cost-saving opportunities

🔑 Ideal for: Finance teams managing daily expenses, small businesses syncing cash flow projections with real-time spend, and anyone mapping costs to the general ledger.

🧠 Fun Fact: 33.19 million small businesses power 99.9% of the U.S. economy, but most run on tight margins. That’s why cash flow forecast templates aren’t just helpful; they’re the secret weapon for staying afloat and scaling smart.

6. Budget Template

Managing a growing business means balancing ambition and affordability. The Budget Template helps you strike the right balance by providing a flexible, real-time view of your finances.

Break budgets down by team, category, or timeline. Assign owners, set limits, and trigger automations when crossing thresholds. From fixed costs to campaign spend, everything lives in one collaborative space, keeping teams aligned and your cash flow stable.

📈 Here’s why you’ll like this template

- Schedule budget releases to match your projected cash flow

- Prioritize spend based on impact, urgency, and liquidity

- Share visibility across departments without losing central control

🔑 Ideal for: Finance managers, operations leads, and cross-functional teams who need to align budgets with cash flow while scaling fast.

7. Balance Sheet Template

Your cash flow tells you how money moves, and your balance sheet shows where you stand. The Balance Sheet Template gives you a pre-built, customizable layout to track assets, liabilities, and equity without the clutter.

Easily separate current vs. long-term assets and liabilities, add opening balances, and see how your financial position evolves. Use Custom Fields to tag transactions, group by account type, and attach supporting docs where needed.

Best of all? Your balance sheet updates as you work, so you always have an updated view of your business’s net worth.

📈 Here’s why you’ll like this template

- Track changes over time with version history and task comments

- Assign review tasks to team members with built-in due dates and reminders

- Attach audit notes or approvals directly to individual line items

🔑 Ideal for: Accountants, financial analysts, and business owners who need a reliable and dynamic balance sheet integrated with their general ledger.

8. Accounting Operations Template

Month-end close, reconciliations, journal entries—project accounting is full of repeatable tasks that demand precision. One delay throws your entire cash flow forecast off track.

The Accounting Operations Template keeps things tight and on schedule. From daily logs to quarterly reviews, it turns recurring accounting steps into trackable workflows with assignees, deadlines, and checklists.

Set automated reminders, assign approvals, and keep every stakeholder in sync so nothing slips, your reporting stays clean and clear, and cash flow is aligned.

📈 Here’s why you’ll like this template

- Get deadline reminders before critical tasks fall behind

- Assign and share tasks so every handoff stays visible

- Review past cycles to spot delays and improve your close process

🔑 Ideal for: Controllers, accounting teams, and finance leads who need structure, accuracy, and speed in project accounting and close operations.

9. Accounts Payable Template

When vendor invoices pile up across emails and spreadsheets, it’s easy to lose track of what’s due until it hits your cash flow. The Accounts Payable Template centralizes every invoice, due date, and payment term so you can prioritize outflows.

Customize fields to track vendor contracts, payment cycles, and approval status. Filter by urgency, department, or project to plan payouts around your available cash. With built-in automations and reminders, this cash flow projection template helps you stay in control.

📈 Here’s why you’ll like this template

- Digitize your payables to cut down on manual entry and scattered tracking

- Automate deadline alerts to avoid missed payments and late penalties

- Use real-time data to enhance cash flow forecasting and make informed decisions

🔑 Ideal for: Finance teams, accountants, and business owners who want tighter AP controls, fewer missed payments, and better alignment between payables and cash flow strategy.

💡 Pro Tip: Closing your books is step one. What you do with that data drives smarter forecasting. The best cash flow projection template uses the right reporting granularity: daily for tight liquidity control, weekly for forecasting your operational runway.

10. Cost Analysis Template

Budget overruns don’t usually come from one big expense; they creep in through small, unchecked costs across teams and timelines. The Cost Analysis Template helps you catch them early.

Use it to track every cost line by project, department, or initiative. Compare projected vs. actual spending, evaluate ROI, and surface underperforming areas in real time.

Whether you’re planning next quarter’s spending or justifying a new investment, this cash flow projection template gives you the visibility you need.

📈 Here’s why you’ll like this template

- Map costs to outcomes to guide smarter budget allocation

- Compare actual vs. expected spend to stop overruns before they scale

- Highlight inefficiencies across campaigns, departments, or vendors

🔑 Ideal for: Financial analysts, project managers, and business owners seeking a comprehensive view of costs and benefits to drive strategic decisions.

11. 12-Month Cash Flow Forecast Template by Coefficient

Looking to map out your monetary movement for the year, without complex tools or a steep learning curve? This 12-month Cash Flow Projection Template from Coefficient offers a clear, spreadsheet-based way to plan your income and expenses month by month in Google Sheets or Excel.

The cash flow projection template is ideal for teams that need long-term visibility but want to avoid building from scratch. With editable categories, automatic calculations, and integrated charts, it helps you simplify cash flow projections while keeping reports accurate and shareable.

📈 Here’s why you’ll like this template

- Break down projected income and expenses across a 12-month timeline

- Customize fields to match your revenue model, seasonality, or cash cycle

- Spot trends quickly with integrated visual charts and dashboards

🔑 Ideal for: Founders, finance teams, and small business owners who want a no-frills way to monitor and forecast adequate cash flow over the next 12 months.

12. Excel Cash Flow Forecast Template by GTreasury

Need more structure for your high-volume financial operations? This Excel-based Cash Flow Project Template is built for precision. It lets you map actual vs. forecasted inflows and outflows on a weekly or monthly basis, giving you full financial visibility over time.

Easily adapt it to your internal reporting requirements, whether you’re tracking tax liabilities, intercompany transfers, or dividend schedules. It’s flexible, formula-ready, and designed for teams that live in spreadsheets but demand enterprise-level clarity.

📈 Here’s why you’ll like this template

- Monitor cash across multiple currencies and zero-balance accounts

- Add netting, interest, or adjustment rules without breaking formulas

- Focus on treasury-specific workflows like bank-level cash consolidation

🔑 Ideal for: Corporate teams, finance controllers, and enterprises that need a tailored, policy-compliant Excel-based cash flow template.

13. Cash Flow Forecast Template by QuickBooks

If you’re already using QuickBooks Online, this Cash Flow Forecast Template completes your forecasting. It automatically pulls profit and loss and balance sheet data, generating a forward-looking view based on real trends.

No manual data dumps. Just a clean, spreadsheet-style layout that flags runway gaps, seasonal shifts, and cash shortfalls before they catch you off guard.

📈 Here’s why you’ll like this template

- Sync real-time cash flow data directly from QuickBooks Online

- Categorize cash flow and auto-calculate balances, all in a clean, ready-to-use format

- Spot seasonal slowdowns and low-cash periods before they disrupt your plans

🔑 Ideal for: Small business owners and bookkeepers already using QuickBooks who want quick, built-in cash flow forecasting without switching tools.

14. Cash Flow Forecast Template by Conta

Freelancers and solo operators need a no-frills tool to track incoming invoices and recurring expenses. This Cash Flow Forecast Template from Conta offers a practical, monthly layout that makes it easy to map out invoices, retainer payments, and recurring expenses in one view.

With editable fields and built-in calculations, short-term cash planning is more predictable, even without a dedicated finance team.

📈 Here’s why you’ll like this template

- Use monthly columns to spot income gaps and timing issues

- Customize rows to reflect freelance-specific inflows and costs

- Keep things lean with a single-sheet format and auto-calculations

🔑 Ideal for: Solopreneurs, consultants, and solo business owners who need a simple, reliable way to stay cash-positive month by month.

15. Cash Flow Projection Template by NFF

Running a nonprofit often means managing tight cash flow, complex funding streams, and time-bound grants, all while staying focused on your mission. This Excel-based Cash Flow Projection Template from NFF is purpose-built to help nonprofits plan and remain sustainable.

It offers a clear monthly view of income, expenses, and available cash, segmented by funding source and restriction type. Whether you’re awaiting a grant disbursement or mapping spending to a program timeline, it keeps your finances forecast-ready.

📈 Here’s why you’ll like this template

- Track income and expenses by funding source, including restricted and unrestricted grants

- Forecast cash availability based on donor cycles or grant disbursement schedules

- Align spending with program milestones and compliance requirements

🔑 Ideal for: Nonprofits, foundations, and community orgs that need a reliable cash flow template to plan around variable funding and stay mission-aligned.

🔍 Did You Know? MSMEs in the U.S. software industry are 1.7x more productive than peers in other advanced economies due to strong capital, talent, and customer ecosystems built around large firms. It’s a reminder that even small teams can punch above their weight, especially when they back great ideas with strong cash flow planning.

Build a Stronger Business—One Cash Flow Projection at a Time With

Cash flow isn’t just a metric—it’s a necessity for your business. The right cash flow projection template turns uncertainty into strategy, giving you the clarity, control, and reliability to make smarter financial moves.

gives you all-in-one visibility, from budgets and expenses to automated workflows and approvals. The best part? ’s Free Forever Plan lets small businesses and solopreneurs access these powerful tools without stretching their budgets.

✅ Try for free—plan smarter, move faster, and keep your financial planning clear!

Everything you need to stay organized and get work done.