In late 2024, Nvidia replaced Intel in the Dow Jones Industrial Average.

The Dow Jones Industrial Average is home to some of the most legendary, iconic American brands. Companies like Coca-cola, Disney, Home Depot, IBMAnd Walmart are just a handful of components of the index.

About a year ago, the Dow shook things up, replacing a longtime member Intel with semiconductor giant Nvidia (NVDA +2.79%). From a structural point of view, the change makes sense. In recent years, Intel has struggled to keep pace with its peers in chips. Meanwhile, Nvidia has essentially become the ultimate barometer of the latest stock market megatrend: the artificial intelligence (AI) revolution.

Today’s change

(2.79%)$5.20

Current price

$191.46

Key data points

Market capitalization

$4.653 billion

Day range

$188.44 -$191.77

Range of 52 weeks

$86.62 -$195.62

Volume

61K

Avg. full

173M

Gross margin

69.85%

Dividend yield

0.00%

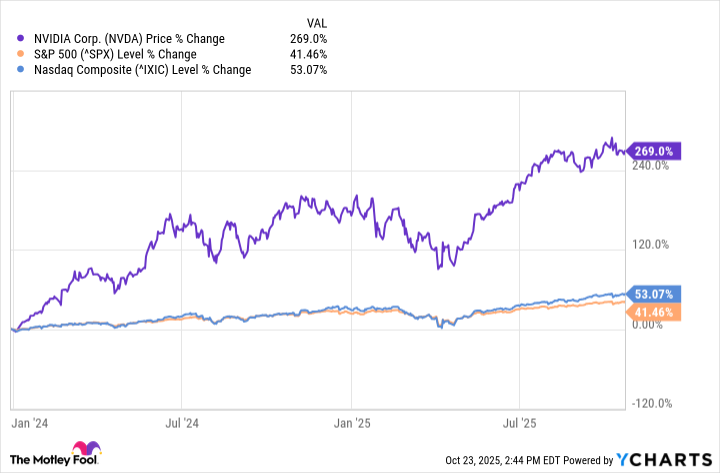

Since last January, Nvidia shares are up almost 270% at the time of writing (October 23). From a perspective perspective, this is more than five times the profits generated in the US Nasdaq Composite And S&P500.

While this kind of momentum might make you think the Nvidia train is headed to a speed bump, Wall Street analysts believe that’s not the case. Let’s explore some key factors that could boost Nvidia’s generation even further, and assess why now still seems like a good time for long-term investors to double down on their shares.

What catalysts does Nvidia have?

Over the past three years, Nvidia’s main source of revenue and profit has been its computing and networking business. This is the segment of the company responsible for selling high-performance AI accelerators, also known as graphics processing units (GPUs), and their associated data center services.

Right now, Nvidia’s next-generation chip architecture – called Blackwell – is in high demand among major tech hyperscalers such as Microsoft, Alphabet, Amazon, Metaplatforms, Oracleand OpenAI. What’s even more encouraging, however, is Nvidia’s pace of innovation. In the coming years, the company will release even more powerful successor chips, known as Blackwell Ultra and Vera Rubin.

This dense product roadmap raises an important question: why is Nvidia already planning next-generation hardware while it is currently scaling Blackwell?

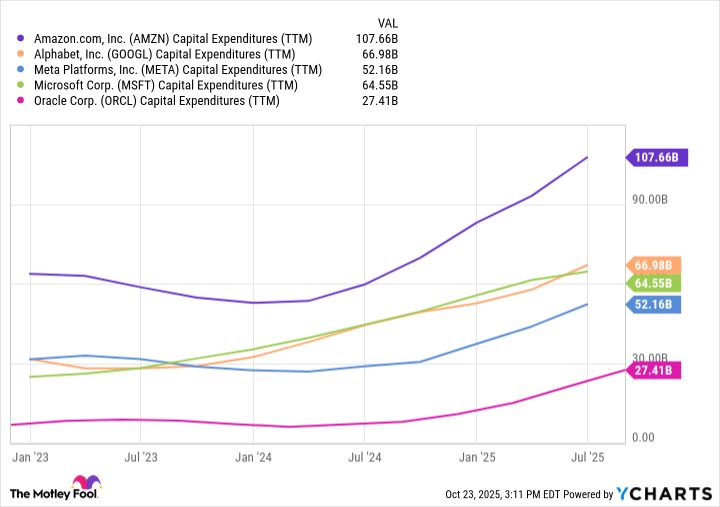

The answer to this can be summarized by looking at the long-term capital expenditure (capex) forecasts of the hyperscalers. In recent years, cloud hyperscalers and major tech titans have poured hundreds of billions of dollars into AI data centers, equipping these facilities with best-in-class GPU clusters and networking equipment.

AMZN Capital Expenditures (TTM) data by YCharts.

This dynamic has served as a benchmark for Nvidia during the AI boom. But according to Wall Street, the AI infrastructure revolution is just beginning.

An estimated $7 trillion is expected to be spent on AI infrastructure over the next five years, according to management consultancy McKinsey & Company. Research will be carried out in the short term Goldman Sachs indicates that the hyperscalers will spend almost half a trillion dollars on AI buildouts next year.

It is this rise in AI infrastructure that has technology analyst Beth Kindig of the I/O Fund calling for Nvidia to reach a valuation of $6 trillion by 2026 – implying an increase of more than 30% from its current market cap of around $4.5 trillion.

Image source: Nvidia.

What is Wall Street’s view on Nvidia?

According to data from Yahoo! Finance, a total of 64 sell-side analysts cover Nvidia shares. Of these researchers, 59 give a ‘buy’ rating or equivalent to Nvidia stock. Only one analyst rates Nvidia stock as a Sell.

Image source: Getty Images.

While the topics explored above provide some qualitative details about Nvidia’s bullish outlook, let’s dive into the numbers to add some quantitative color to why so many on Wall Street still see Nvidia stock as an attractive value.

Are Nvidia Stocks a Buy Now?

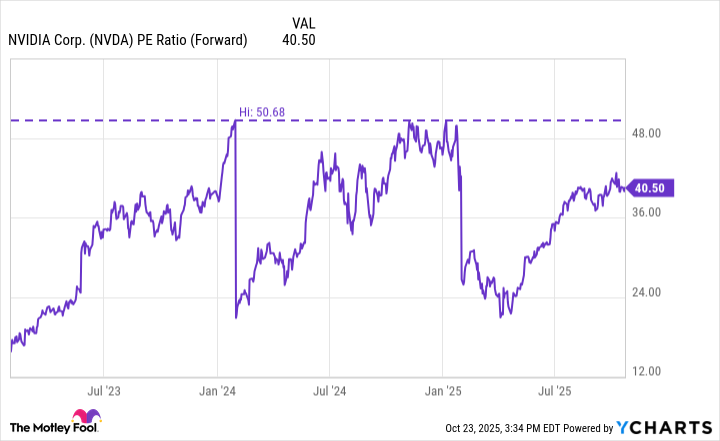

One valuation metric I like to look at is the forward price-to-earnings (P/E) ratio. This ratio accounts for a company’s expected earnings growth – potentially giving investors a glimpse into how optimistic Wall Street is about a company’s future earnings potential.

NVDA PE Ratio (Forward) data according to YCharts.

In the chart above, investors can see how Nvidia’s price-to-earnings ratio has fluctuated throughout the AI revolution. Two important details stand out from the above analysis.

First, Nvidia stock has clearly had outsized momentum in recent months, leading to an extended period of valuation expansion. That said, the company’s expected earnings of 40 are significantly lower than the previous peak of 51 early last year.

This is an important nuance to digest. What the above trends imply is that, despite now having more tailwinds behind them – and a greater ability to deliver even more record profits – Nvidia shares are actually cheaper today than they were at the beginning of 2024.

In this case, I’m aligned with Wall Street. I think Nvidia is poised to benefit from plenty of secular tailwinds as the AI infrastructure boom accelerates. While the stock isn’t cheap per se, it’s trading at a relative discount compared to earlier stages of the AI revolution. That makes it an attractive buy-and-hold opportunity for long-term investors right now.

Adam Spatacco holds positions at Alphabet, Amazon, Meta Platforms, Microsoft and Nvidia. The Motley Fool holds positions in and recommends Alphabet, Amazon, Goldman Sachs Group, Home Depot, Intel, International Business Machines, Meta Platforms, Microsoft, Nvidia, Oracle, Walmart and Walt Disney. The Motley Fool recommends the following options: a long call in January 2026 for $395 on Microsoft, a short call in January 2026 for $405 on Microsoft, and a short call in November 2025 for $21 on Intel. The Motley Fool has a disclosure policy.