Grafana Labs Inc., a startup focused on commercializing the open-source Grafana observability platform, is reportedly in talks to raise new capital.

The Information today cited sources as saying Singapore’s GIC sovereign wealth fund is expected to lead the round. It’s unclear how much funding Grafana Labs’ hopes to raise. However, the insiders did reveal that the deal is set to boost the company’s valuation from $6.6 billion to $9 billion.

GCI previously backed a $270 million funding round for Grafana Labs in August 2024. The deal also included the participation of Alphabet Inc.’s CapitalG, Lightspeed, Sequoia and others. Large late-stage funding rounds almost always include contributions from a startup’s existing investors, which suggest at least some of Grafana Labs’ high-profile backers may join the new raise that it’s reportedly negotiating.

Grafana Labs sells an observability platform based on the open-source Grafana project. The latter software can collect telemetry from a company’s infrastructure and turn it into monitoring dashboards. An online retailer, for example, could create a dashboard that tracks the performance of its e-commerce website and detects downtime.

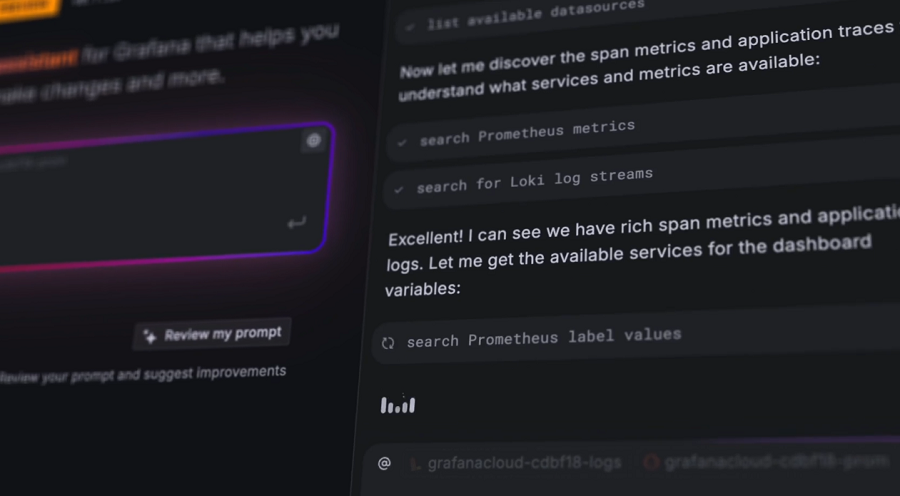

Grafana Labs’ platform extends Grafana’s feature set with artificial intelligence capabilities. A tool called Sift Investigation can automatically analyze telemetry from a Kubernetes cluster to find potential technical issues. Additionally, there’s a built-in chatbot that can provide new users with pointers on how to use the platform. A developer could explain how a data analysis task is performed in a competing tool and have the chatbot explain how to replicate the workflow.

Grafana Labs’ platform also lends itself to certain other use cases besides monitoring. It includes an implementation of k6, an open-source tool that tests applications’ reliability by generating a large amount of simulated traffic. Developers can use it to determine whether a newly deployed workload will perform as expected during usage spikes.

According to The Information, Grafana Labs’ annual recurring revenue topped $400 million in September. That number stood at $250 million in August 2024.

The reported fundraising push hints that Grafana Labs has no plans to go public in the near future. That’s seemingly reaffirmed by the $150 million tender offer the company reportedly completed last year. Tender offers enabled employees and early investors to access liquidity without waiting for a stock market listing.

If the round closes, it may also decrease the chance of an acquisition. Only a handful of companies and private equity firms have the resources to purchase a startup valued at $9 billion. However, its rapid growth could nevertheless draw investor interest. Two years ago, Grafana Labs rival New Relic was taken private by Francisco Partners and TPG for about $6.5 billion.

Image: Grafana Labs

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

- 15M+ viewers of theCUBE videos, powering conversations across AI, cloud, cybersecurity and more

- 11.4k+ theCUBE alumni — Connect with more than 11,400 tech and business leaders shaping the future through a unique trusted-based network.

About News Media

Founded by tech visionaries John Furrier and Dave Vellante, News Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.