Until Jumia introduced its first nationwide sales campaign after it launched in 2012, Black Friday was not a retail tradition in Nigeria. Since then, the once-foreign concept has grown into one of the country’s most anticipated online commerce moments.

Black Friday deals have now extended to online food delivery platforms like Chowdeck, which drove ₦1.4 billion ($975,909) in sales during its Black Friday event that ran from Friday, November 28, to Monday, December 1, according to data tracked on its live dashboard.

The company rolled out discounted meals, free delivery vouchers, and city-specific flash drops in prices across Lagos, Abuja, Ibadan, and other cities.

This year’s four-day event blew past its internal target to double orders from 2024 when it hosted its first Black Friday event. By 9:08 pm West African Time (WAT) on Friday, November 28, it had already fulfilled 51,000 orders, more than double its 2024 sales volume. At the end of the event on Monday, December 1, it recorded 182,74 orders generating ₦1.4 billion ($975,909) in revenue and covering over 727,000 kilometres, the highest the company has logged during a promotional window.

The performance reinforces the company’s recent momentum. In October, Chowdeck crossed over 1 million monthly orders across Nigeria. “Our daily order volumes in Nigeria has grown from an average of approximately 30,000 daily orders a few weeks ago to over 40,000 daily orders presently and still increasing day on day,” Femi Aluko, Chowdeck Co-founder and CEO posted on X in November 3 after the company reached the milestone. “This milestone reminds us of what is possible when people believe in what we’re building.”

Nigeria’s online food-delivery market was valued at $1.04 billion in 2024, with projections to reach $2.49 billion by 2033 at a CAGR of 10.3%, according to IMARC Group.

Chowdeck launched in October 2021, entering a market where food delivery was widely seen as unprofitable and difficult to scale. By 2023, regional competitors, like Bolt Food, Jumia Food, and OFood, either exited or downsized operations. But the company built a logistics-first model around geolocation, demand batching and rider incentives, allowing it to grow quickly in dense cities.

Two forces explain the acceleration. First, Nigeria’s digital access has reached critical mass. The country had about 107 million internet users at the beginning of 2025, nearly 45% of its population. This gives delivery apps enough scale to push user-acquisition, including campaigns during Black Friday.

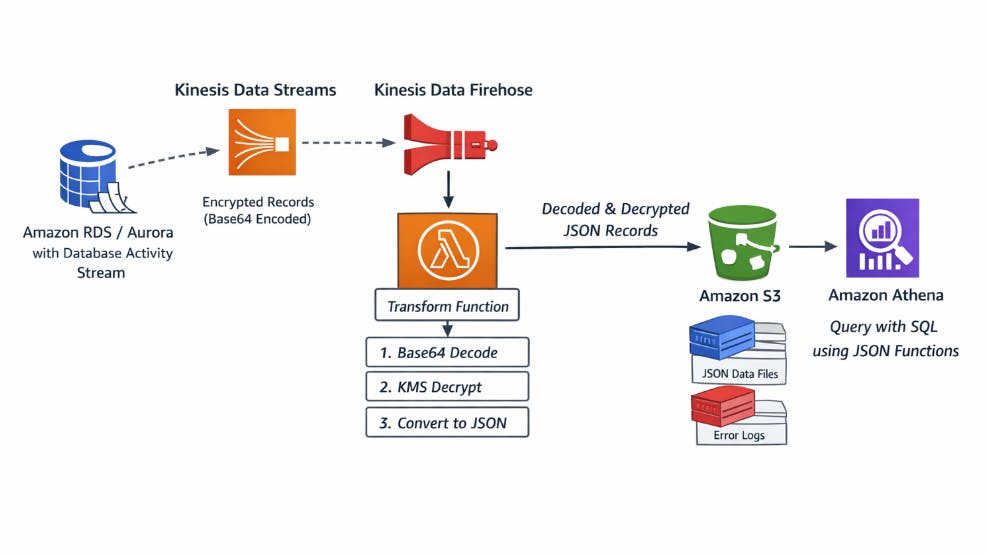

The second is continuous investment, which strengthened the platform infrastructure. In 2025, Chowdeck acquired point-of-sale startup Mira to integrate payments and merchant tools. In August, it raised $9 million Series A funding led by Novastar Ventures to expand quick-commerce offerings like groceries and essentials.

Chowdeck’s closest competitor, Glovo, also ran Black Friday deals from November 28 to 30, offering discounts and free delivery, though it did not disclose order volumes or revenue for the period.

Discounts appeal to residents in urban centres because it reduces the cost and effort of preparing meals or buying household essentials, providing a convenient alternative to grocery shopping and cooking. Delivery companies have also invested heavily in logistics, in-app navigation, and restaurant partnerships, enabling them to manage high order volumes efficiently. Together, these factors allow platforms like Chowdeck to turn temporary promotions into record-breaking sales.

Why food delivery is winning in Nigeria

When Jumia Food was the major player in the sector, Nigeria’s food-delivery sector had limited reach and inconsistent reliability. The COVID-19 lockdown exposed these gaps and created new demand, opening the door for a new wave of players that emerged from 2021, including Glovo and Chowdeck.

Chowdeck’s founding story underscores the moment. “I tested positive for COVID on the 31st of December, 2020,” Aluko shared on the company’s website. “I spent the entire January 1 looking for food vendors to deliver food to me but the available food delivery providers didn’t deliver during public holidays. I eventually found one after many hours and ended up paying 4x the regular amount.” His experience mirrored the frustrations of many urban Nigerians and signalled an opening for more reliable on-demand delivery services.

Online delivery has continued to thrive even as Nigerians lose more of their income to rising food, fuel, and living costs. However, urban realities: work, long traffic, unreliable power, and limited time are making cooking more inconvenient as city dwellers now see delivery as a time-saving option.

The current strides in the food delivery sector is evidence of this demand. Foodpod, citing Paystack data, notes that food delivery grew significantly at 187% CAGR between 2021 and 2024. New entrants that launched at the height of this boom quickly found traction by serving kitchens and restaurants. Alongside peers such as FoodCourt, Chowcentral, Heyfood, and MANO, they broadened consumer awareness and deepened demand for fast delivery.

From just 319 users at launch in October 2021, Chowdeck grew to 17,900 users in 2022, 250,000 in 2023, and over 1 million by 2024. Additionally, while Jumia Food once operated in three cities with roughly 80 couriers, Chowdeck alone now deploys more than 20,000 riders completing over 40,000 daily orders.

Recommended Reading: Nigeria’s ride-hailing graveyard and the network effect