You were probably short on cash, payday is still some days or a week away, and you were beating yourself up for the jollof rice and ice cream you “splashed” your money on three days after getting paid— and at that moment, an ad popped up on your screen while watching YouTube.

“Borrow ₦50,000 instantly! No collateral. Low interest rate. No paperwork.”

Sounded like a lifesaver, right? Millions of Nigerians feel the same way with loan apps like Fairmoney, Carbon, and Renmoney, promising fast, low-interest loans.

But here’s what the fine print doesn’t say: that “low 5% monthly interest rate” you saw on the ad is a marketing strategy, and the real cost becomes clear only after the full interest is calculated.

How Nigerian loan apps calculate short-term interest rates and APR

Short-term interest rates are the extra percentage you pay on the amount you borrow for between a few days and one month.

For example, if you borrow ₦50,000 at a 10% monthly interest rate, you will pay ₦5000 interest, making your total repayment ₦55,000 for that month.

APR shows the actual yearly cost of your loan, including all fees and charges.

In simple terms, APR is calculated by dividing the total cost of the loan (interest + fees) by the loan amount, adjusting for the loan term, and then converting it to a yearly percentage.

This means the longer your repayment cycle is, the higher your total loan interest. For instance, if you borrow ₦100,000 for 12 months at a 4% monthly interest rate, your loan calculation would be:

- The compound interest rate will make the APR 60.1%.

- Total amount to be repaid ₦160,103.22.

Note: Some loan apps in Nigeria are also notorious for charging high interest rates on short-term loans that last 3-7 days.

Loan apps interest rate comparison in Nigeria (2025 update)

Loan app interest rates are not uniform; they offer different packages, products, and services. Let’s look into some popular loan apps in Nigeria and how much they really charge as interest rates.

Fairmoney

Fairmoney is one of Nigeria’s leading fintech lenders, offering loans within minutes with minimal paperwork and no collateral.

Official monthly interest rate:

Fairmoney charges between 2.5% to 30% per month, depending on your credit score and loan duration.

Annual percentage rate:

That translates to an APR ranging from 30% to 260%.

User(s) experience:

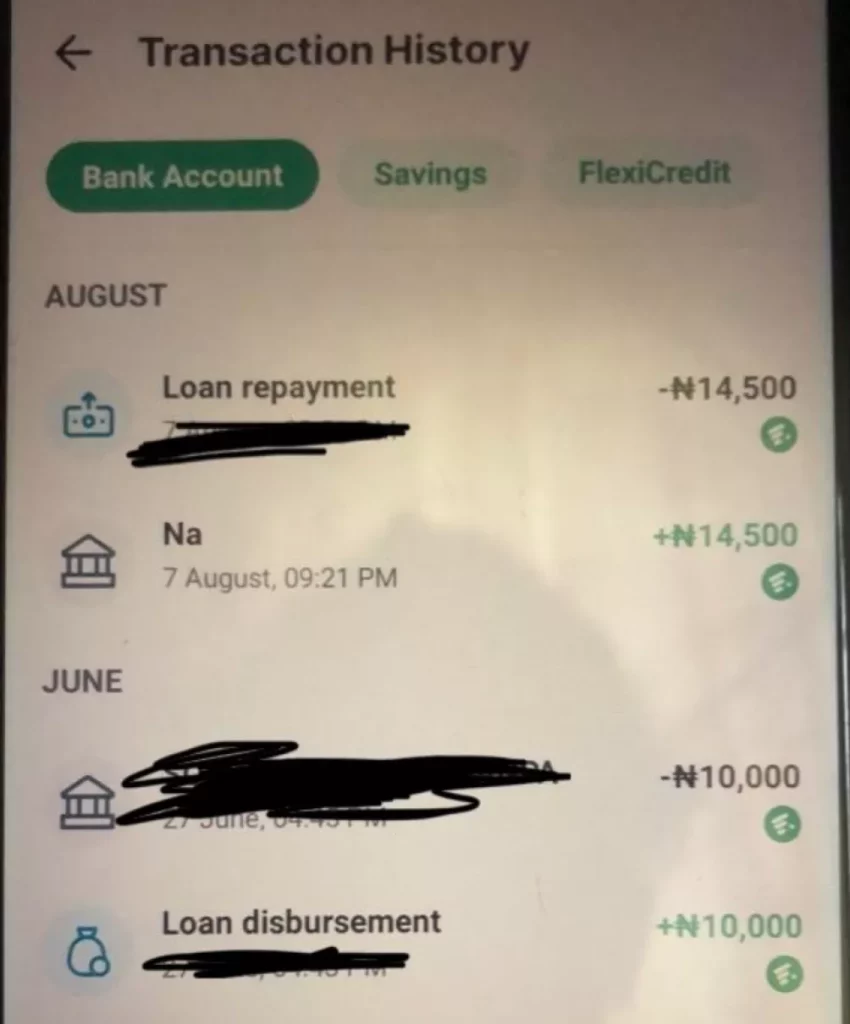

Ayomide* took a loan of ₦10,000 and repaid ₦14,500 after 30 days. Putting the total interest rate at 45%.

Carbon

Carbon (formerly Paylater) offers personal loans and rewards early payments with lower rates.

Official monthly interest rate:

Between 4.5% and 30% per month. The rate reduces as you build a repayment history.

Annual percentage rate:

Goes up to 195% per year for high-risk loans.

User(s) experience:

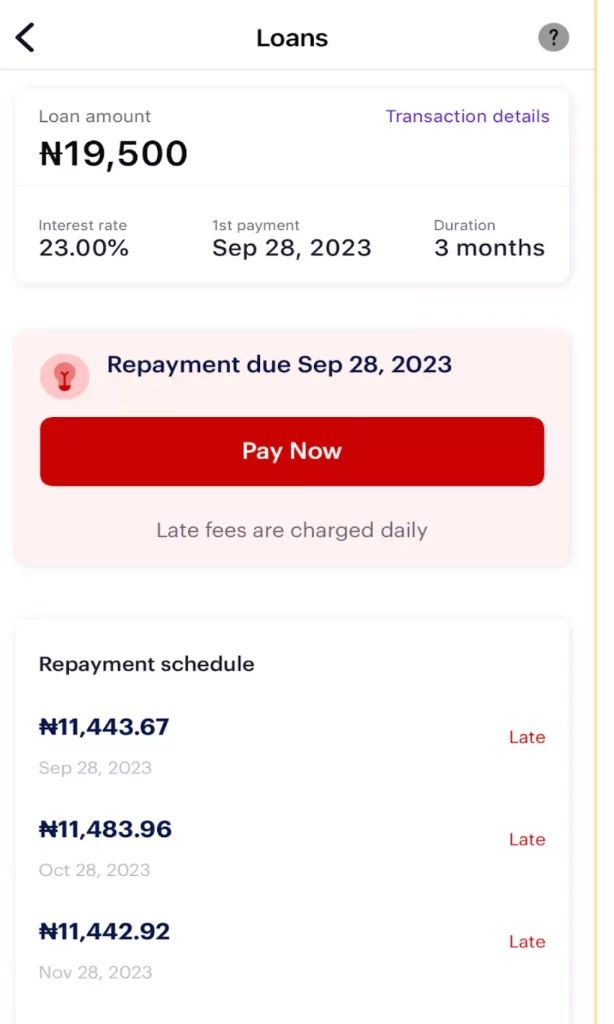

Sobur* took a loan of 19,500 with an interest of ₦4,485, making the total amount to be repaid ₦23,985 in 3 installments over 3 months. However, User H defaulted on his loan which has now increased to ₦34,370.59 after two years of default.

OPay (Easemoni)

Easemoni is a part of Opay’s ecosystem, which is financed by Blue Ridge Microfinance Bank. It is licensed by the Central Bank of Nigeria.

Official monthly interest rate:

The monthly interest rate ranges between 5% to 10% per month.

Annual percentage rate:

The APR ranges between 60% to 120% per year, depending on how long the loan lasts.

User(s) experience:

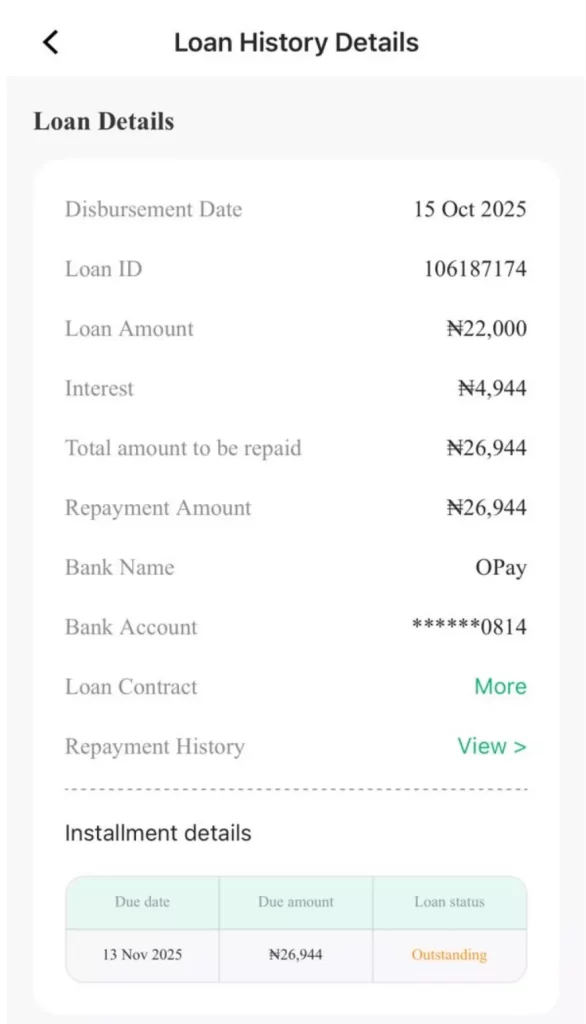

Temiloluwa* took a loan of ₦22,000 with an interest of ₦4,944, making the total repayment ₦26,944 after 28 days. Putting the interest rate at 22.42%.

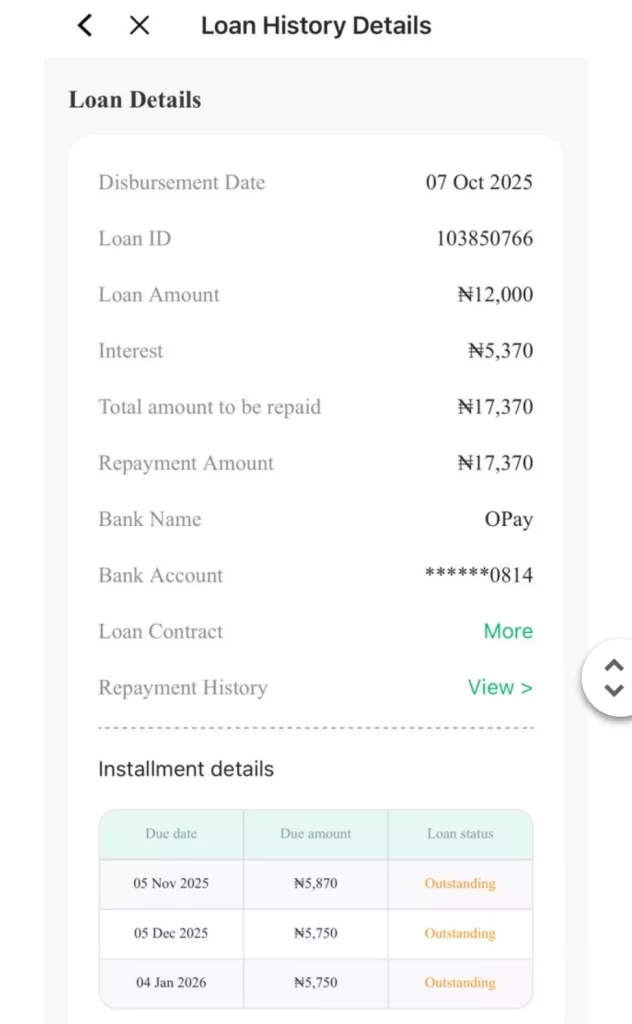

Temiloluwa* took another loan of ₦12,000 with an interest of ₦5,370, making his total repayment ₦17,370 in three installment payments with a 3-month timeframe. Putting the interest rate at 44.75%, and the monthly interest rate at 14.9%.

PalmPay (Flexi)

PalmPay offers credit through Flexi, a loan product provided by Blooms Microfinance.

How PalmPay loans work

- Flexi cash: offers loans with daily interest rates ranging from 0.6% and 1.5%, depending on the loan amount. The loan period is from 7 days to 4 months.

- Flexi BNPL (buy now pay later): this allows users to make purchases within the app and pay later with 0% interest.

User(s) experience:

Moyo has a due loan of ₦16,000 with an interest of ₦2,352 and a service fee of ₦1,280 for a 21-day loan. After calculating, Moyo will pay a daily interest of 0.70% and a cumulative of 14.7%.

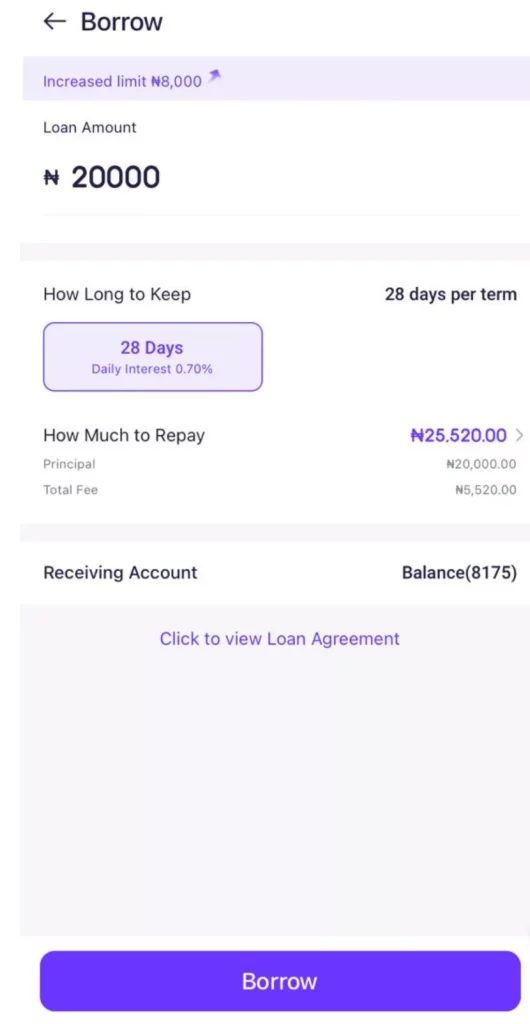

When Alex tried to take a loan of ₦20,000 for 28 days, the interest on the loan was pegged at ₦5,520, bringing his total repayment to 25,520. After calculating, Alex will pay a daily interest of 0.98% and a cumulative of 27.6%.

Conclusion

Every “instant loan” comes with a price tag, and a 5-minute approval can turn into months of repayments and a debt profile that becomes hard to manage.

To keep a low debt profile, look beyond marketing hype, correctly calculate your APR, compare lenders, don’t take a loan you can’t repay, and don’t engage in loan stacking.

As a thumb rule, know that; the smartest borrowers are the ones who pause, calculate, and borrow with a feasible repayment plan.

Lastly, loan app interest rates are not uniform; a lot of variables, such as loan amount, loan term, and credit history, affect the final interest rate.