Ethereum (ETH) remains the backbone of the decentralized finance revolution, hosting everything from lending protocols to NFTs. Yet, the network faces a fundamental challenge—token inflation and scalability—impacting the potential for meme coins to gain serious institutional traction.

Enter

The Inflation Problem Ethereum and Meme Coins Face

Ethereum’s growing ecosystem has brought explosive innovation but also growing pains. Native ETH inflation, coupled with meme coins like Pepecoin (PEPE) having uncapped supplies, dilutes value and raises concerns among institutional investors who prioritize economic discipline and long-term stability.

DeFi Integration and Institutional Appeal

Beyond tokenomics,

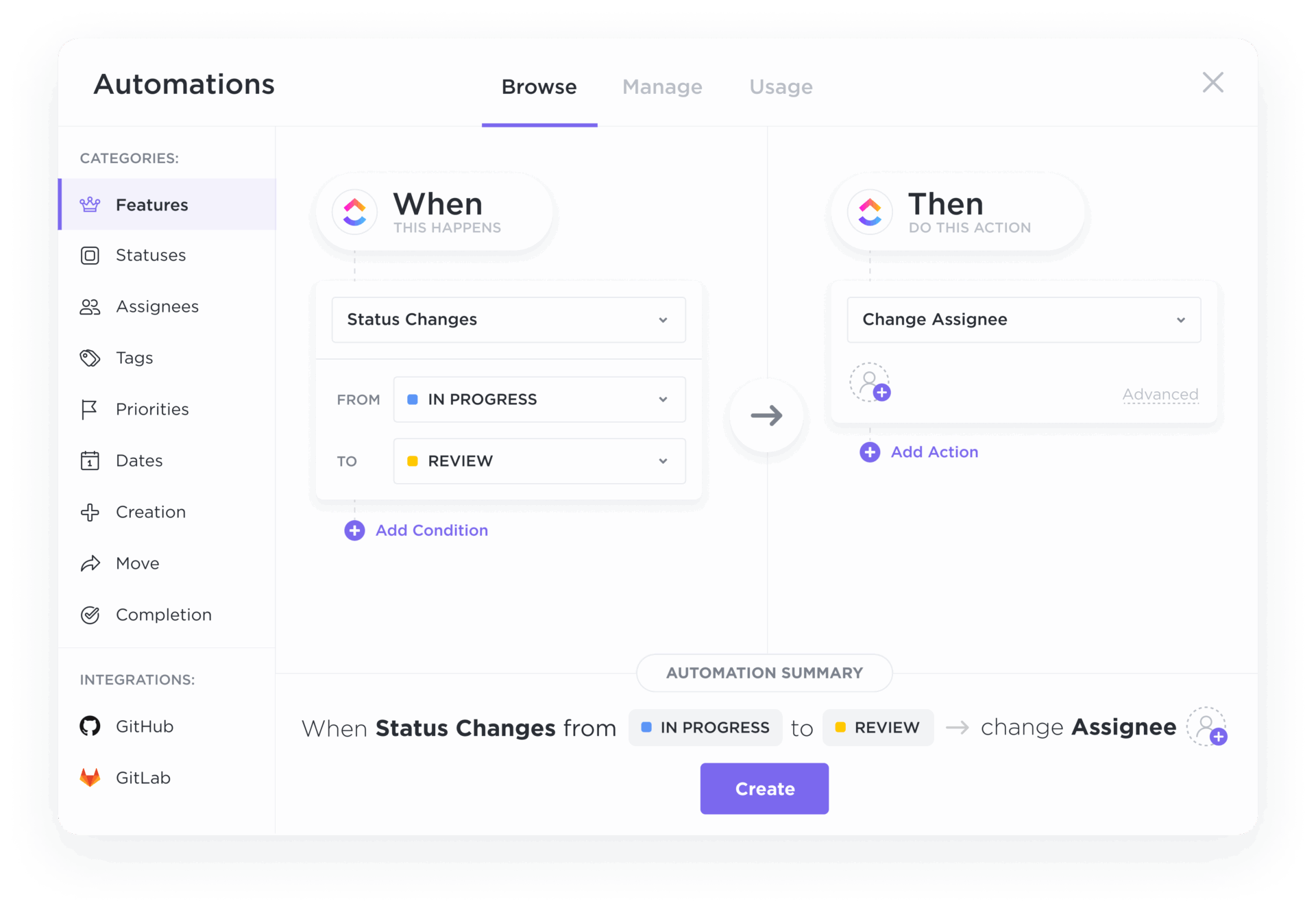

- Staking and Yield: Token holders can stake PEPD for rewards, aligning incentives with ecosystem growth and investor returns.

- PayFi Payments: Combining decentralized finance with user-friendly payment infrastructure, Pepe Dollar enables real-world, censorship-resistant transactions.

- On-Chain Governance: Institutions favor projects where governance is transparent and community-driven, and PEPD’s roadmap includes voting mechanisms empowering holders.

These utilities set Pepe Dollar apart from meme coins like Pepecoin (PEPE), which remain largely speculative without layered financial products.

Layer-2 Scaling and Cross-Chain Readiness

Ethereum’s congestion and gas fees are notable barriers for institutional adoption.

Additionally,

Why Institutions Are Eyeing Pepe Dollar Over Pepecoin and Ethereum

- Fixed Supply vs. Inflation: Institutions prize predictable supply economics. PEPD’s capped supply contrasts with Ethereum’s native inflation and Pepecoin’s (PEPE) uncapped tokens.

- Real Use Cases vs. Hype: Pepe Dollar combines meme culture with payment infrastructure and DeFi tools, making it a practical asset rather than just a viral token.

- Community & Transparency: Robust tokenomics and audited contracts elevate trust, crucial for institutional capital.

Get Involved with Pepe Dollar Today

Investors seeking exposure to the future of meme-driven institutional DeFi should act now. The