Moneda Invest Africa has partnered with meCash to reshape Africa’s financial ecosystem, particularly in payments and access to credit. The details of this strategic alliance and the “Musa” app were unveiled at the Moneda Experience, held on March 14, 2025, in Lekki, Lagos.

The event brought together key stakeholders, including Ejike Egbuagu, GCEO, Moneda, Modupe Diyaolu, Co-founder, meCash; Adebusola Adegbuyi, Co-founder and CTO, meCash; Precious Ehihamen, Ag Managing Director, Moneda Technologies, investors and members of the press to discuss the future of credit access for critical SMEs.

A Vision for Financial Inclusion

Moneda Invest Africa specialises in energy, agriculture and mining, providing alternative credit and execution expertise to critical SMEs in Africa’s natural resource value chains. meCash, a cross-border payments platform, complements this by enabling seamless financial transactions across global markets.

Together, they aim to provide credit for businesses executing contracts—without the need for collateral. The focus is on SMEs supplying materials or operating SMEs engaged in the natural resources sector, spanning energy, agriculture, and minerals.

“What will truly change the quality of our lives is ensuring that businesses get access to credit, empowering them to create value and transform industries thereby transforming the quality of our lives“ said Ejike Egbuagu, GCEO of Moneda.

For meCash, this partnership is a commitment to improving financial inclusion, secure and efficient payments and cross-border transactions. “SMEs are the bedrock of any economy, and we are excited to finance businesses that drive real impact,” said Modupe Diyaolu, Co-founder & CEO of meCash.

Addressing the Challenges of SME Financing

Financing SMEs in Africa comes with complex challenges, including high default rates and regulatory hurdles. meCash’s expertise in financial infrastructure helps mitigate these risks by ensuring efficient fund disbursement, secure payments, and regulatory compliance across multiple African markets.

“Compliance is the bedrock of financial services, and that’s what differentiates us,” said Diyaolu, emphasizing meCash’s role in ensuring seamless regulatory adherence and risk management for cross-border transactions.

MUSA is expected to redefine access to capital by providing a structured credit model tailored for Africa’s natural resource sectors. Compared to many fintech solutions that focus solely on digital and consumer lending, MUSA operates with the rigor and reliability of a traditional financial institution, ensuring structured financing and risk-managed disbursement for critical SMEs across Africa.

Technology-Driven Transparency

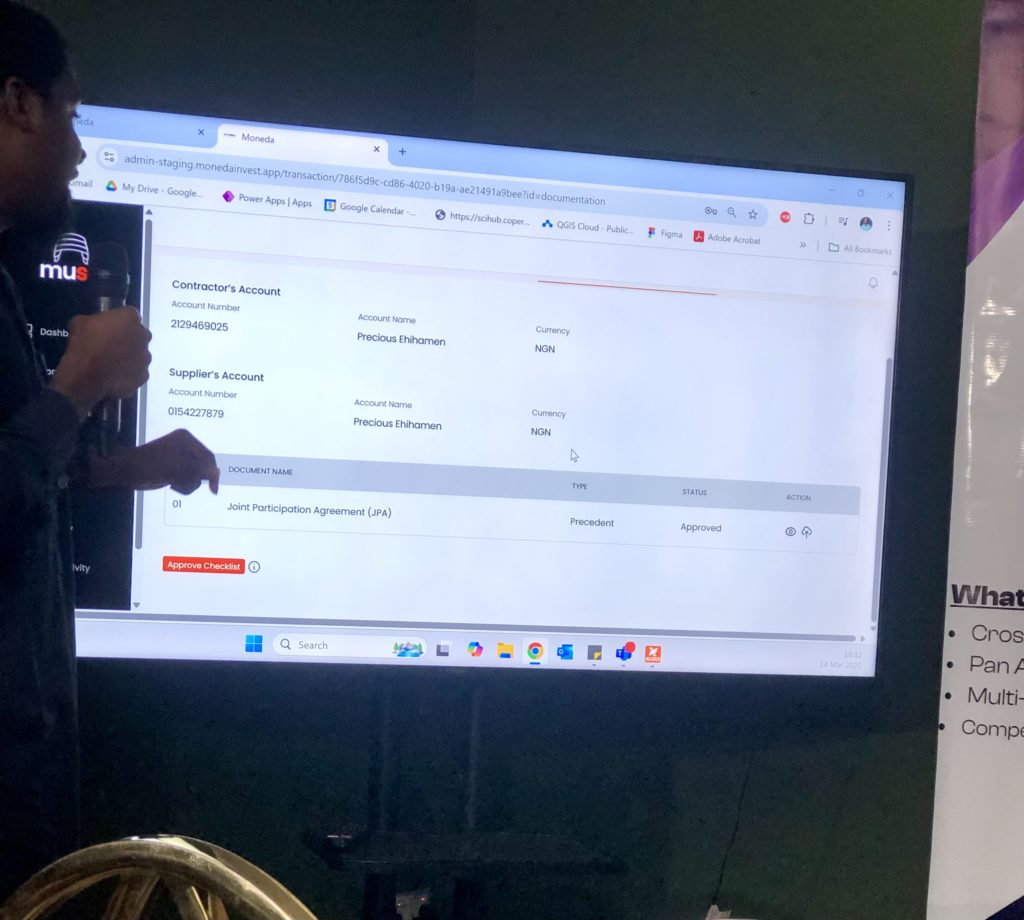

A major highlight of the event was the demo of “Musa”, an app designed to facilitate this partnership. Precious Ehihamen, Ag Managing Director, Moneda Technologies, demonstrated how the platform ensures real-time transparency, transaction monitoring, and risk-sharing. Musa was built to democratise access to finance for SMEs, offering flexible credit options that bypass conventional collateral requirements and lengthy application processes. “What we are doing is sharing the risk with SMEs, providing them with the financial infrastructure to execute contracts and receive payments without unnecessary roadblocks,“ he said.

With Musa, African critical SMEs will have access to global capital, providing a meeting point for suppliers, manufacturers and service providers. The app enables users to input contract details, including the nature of the contract, required supplies, funding needs, and risk assessment. It then calculates the associated risks and provides a real-time dashboard to track completed transactions., making it easy to monitor progress.

A Fireside Chat on the Future of SME Credit

The event concluded with a fireside chat featuring the CEOs of meCash and Moneda, moderated by Ugodre Obichukwu, CEO of Nairametrics. Key discussions centred around how this partnership overcomes traditional SME financing bottlenecks and the steps being taken to ensure sustainable credit repayment models.

With this partnership, Moneda and meCash are not just financing businesses—they are building a financial infrastructure that empowers African SMEs, enhances cross-border transactions, and drives economic growth across the continent.