A 50% hike in telecom tariffs has propelled MTN and Airtel’s earnings in Nigeria, sending their combined average revenue per user (ARPU) up 31.6% in the second quarter of 2025. The gains are unlocking long-delayed network investments, but they are also squeezing consumers already battered by inflation and a collapsing currency.

Airtel’s ARPU grew 23.53% to $2.1 in Q2 2025 from $1.7 a year earlier, helping increase revenue by 29.69% year-on-year to $332 million. MTN fared even better, with ARPU rising 37.89% to $3.02 from $2.19, with revenue surging 67.88% to ₦1.32 trillion ($859.83 million).

ARPU measures how much telcos earn from each customer, indicating whether revenues are enough to cover operating costs and fund capital investments. For years, it has been under pressure. Despite subscriber growth, dollar revenues stalled as the naira collapsed from ₦471/$ in June 2023 to ₦1,534.93/$ by August 20, 2025.

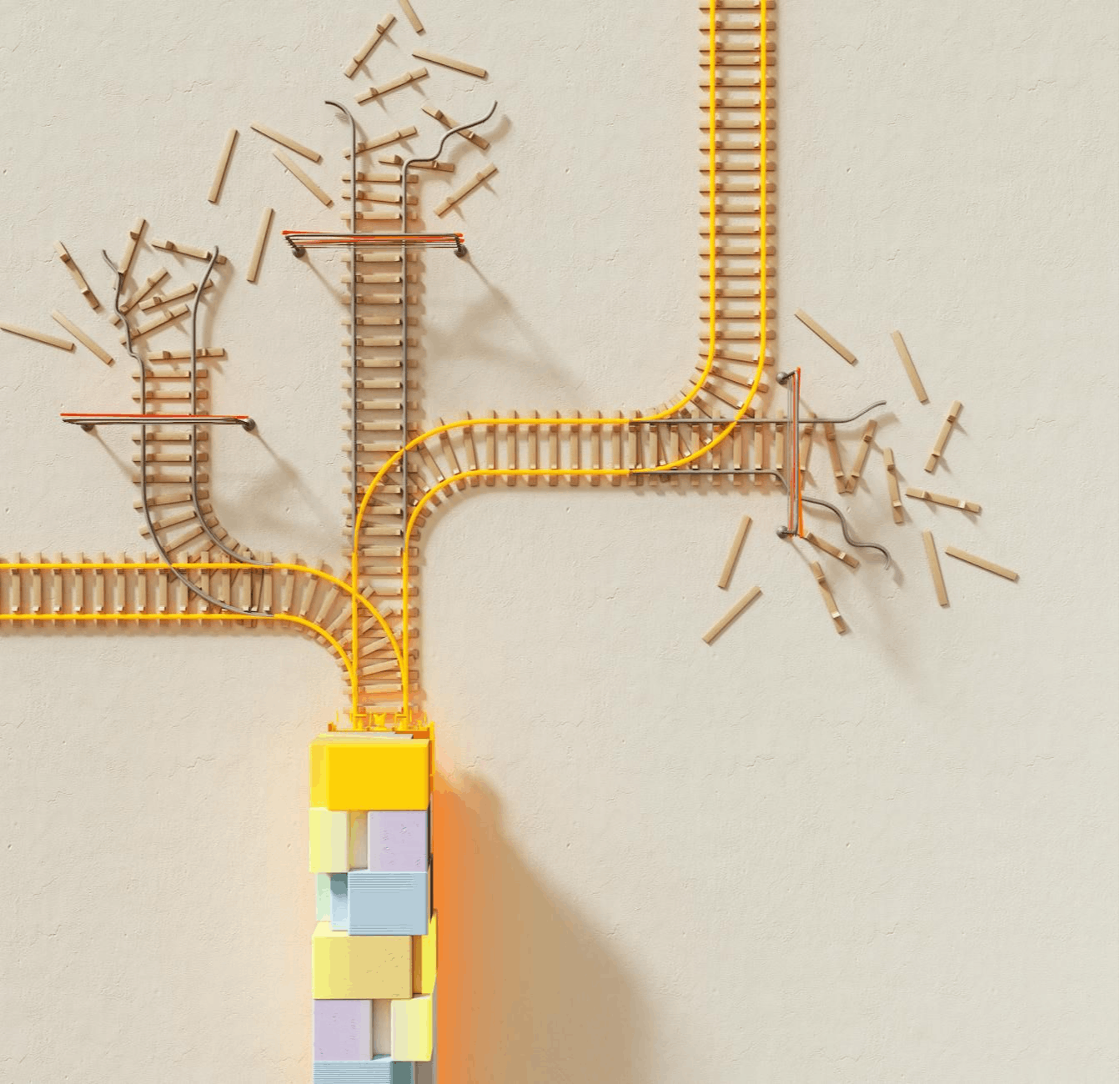

The tariff-driven recovery marks a turning point for Nigeria’s largest operators, who for years cut back on capital spending as naira devaluation made dollar-denominated investments unaffordable. MTN slashed core capex by 28% in the first nine months of 2024, while Airtel reduced spending by 37%, leaving customers with dropped calls and unreliable internet.

“Mobile service providers need to generate sufficient revenue to cover their operating costs… If this is not realised, they are likely to cut back on either capital or operating expenditure or both,” GSMA warned about Nigeria in 2024.

With new tariffs introduced, MTN and Airtel have turned the corner, with revenue increases in both naira and dollar terms. Airtel Nigeria’s ARPU is now only second to Airtel’s francophone operations in Africa.

MTN Nigeria remains one of the Group’s lower-earning markets, ranking 12th among its markets, well behind Ghana’s $5.60, MTN’s highest-earning market. However, Nigeria was a strong contributor to the Group’s 23.19% revenue growth to $5.94 billion in H1, 2025, from $4.82 billion in H1, 2024.

“The approval of price adjustments in Nigeria, which were phased in during the period, largely benefiting Q2, boosted MTN Nigeria and the Group’s service revenue expansion,” said Ralph Mupita, Group President and CEO of MTN.

This rise in ARPU is encouraging long-overdue investments in telecom infrastructure, following years of underinvestment that limited network expansion and worsened service quality. Airtel’s capex spend rose to $39 million in Q2, 2025, from $38 million in Q2, 2024. MTN’s core capex spend is up 2679.0% to N363.25 billion ($236.66 million) in Q2, 2025.

The Nigerian Communications Commission (NCC) said January’s approval restored cost-reflective pricing, unlocking over $1 billion in new telecom investments for this year alone.

“The mere act of approving the increase has unlocked investment,” said Aminu Maida, NCC’s executive vice chairman. “Cumulatively, this year, we are already seeing over a billion dollars going into core infrastructure. This wasn’t happening in 2022, 2023, or 2024.”

However, this ARPU recovery has come at great cost to subscribers. “The hike has imposed untold hardship on many Nigerians already grappling with double-digit inflation,” said Adeolu Ogunbanjo, president of the National Association of Telecoms Subscribers (NATCOMS).

The average cost of 1GB of data has risen to ₦431.25 from ₦287.50. He argued that the only justification for this hardship must be better network services. According to Maida, this may take time, considering the process involved in turning capital into service improvements.

Operators are also rolling out upgrades in phases, prioritising areas in dire need before expanding nationwide. Service delivery will improve, Maida assured, but subscribers must be patient as operators invest heavily in their networks.

When the NCC approved tariff hikes, operators were well underwater as their core product—connectivity—struggled. Today, they are close to shore and no longer gasping for breath, but the service Nigerians are having to pay more for is yet to catch up.

Mark your calendars! Moonshot by is back in Lagos on October 15–16! Join Africa’s top founders, creatives & tech leaders for 2 days of keynotes, mixers & future-forward ideas. Early bird tickets now 20% off—don’t snooze! moonshot..com