OAK Family Advisors, LLC has completely exited its position in the company NICE (NASDAQ:NICE) during the fourth quarter, selling 28,021 shares in a transaction valued at $4 million based on average quarterly prices, according to a Feb. 3, 2026 SEC filing.

According to an SEC filing dated February 3, 2026, OAK Family Advisors, LLC eliminated its entire stake in NICE and sold 28,021 shares. The estimated transaction value, calculated based on the average share price in the fourth quarter, was approximately $4 million. The fund reported zero remaining shares in NICE at the end of the quarter, with a total position write-down of $4 million.

-

The NICE stake was fully liquidated and now represents n/a of reported 13F assets.

-

Top positions after filing:

-

NYSE:TSM: $17.7 million (4.9% of assets under management)

-

NYSE:BA: $14.5 million (3.9% of assets under management)

-

NYSE:NVO: $13.9 million (3.8% of assets under management)

-

NASDAQ:QCOM: $13.9 million (3.8% of assets under management)

-

NASDAQ:AZN: $13.2 million (3.6% of assets under management)

-

-

On February 2, 2026, shares of NICE were trading at $109.37, down 34.2% over the past year and underperforming the S&P 500 by 49.66 percentage points.

|

Metric |

Value |

|---|---|

|

Yield (TTM) |

$2.88 billion |

|

Net income (TTM) |

$561.06 million |

|

Price (as of market closing 2/2/26) |

$109.37 |

|

One year price change |

-32.82% |

-

Provides cloud-native platforms for AI-driven customer experience (CX), digital self-service, journey orchestration, compliance and financial crime prevention, including flagship products such as CXone, Enlighten and X-Sight.

-

Generates revenue through cloud, analytics, digital evidence management and compliance offerings.

-

Serves a global customer base of enterprises, contact centers, public safety agencies and financial institutions seeking advanced automation and compliance solutions.

NICE is a leading provider of cloud and AI-powered software solutions that enable organizations to optimize customer engagement, automate processes and ensure regulatory compliance at scale. The company leverages a robust SaaS business model and extensive analytics capabilities to meet complex customer experience and financial crime prevention needs.

With a diversified set of platforms and a global footprint, NICE maintains a competitive advantage by integrating advanced AI and automation into its product ecosystem to drive digital transformation for enterprise customers.

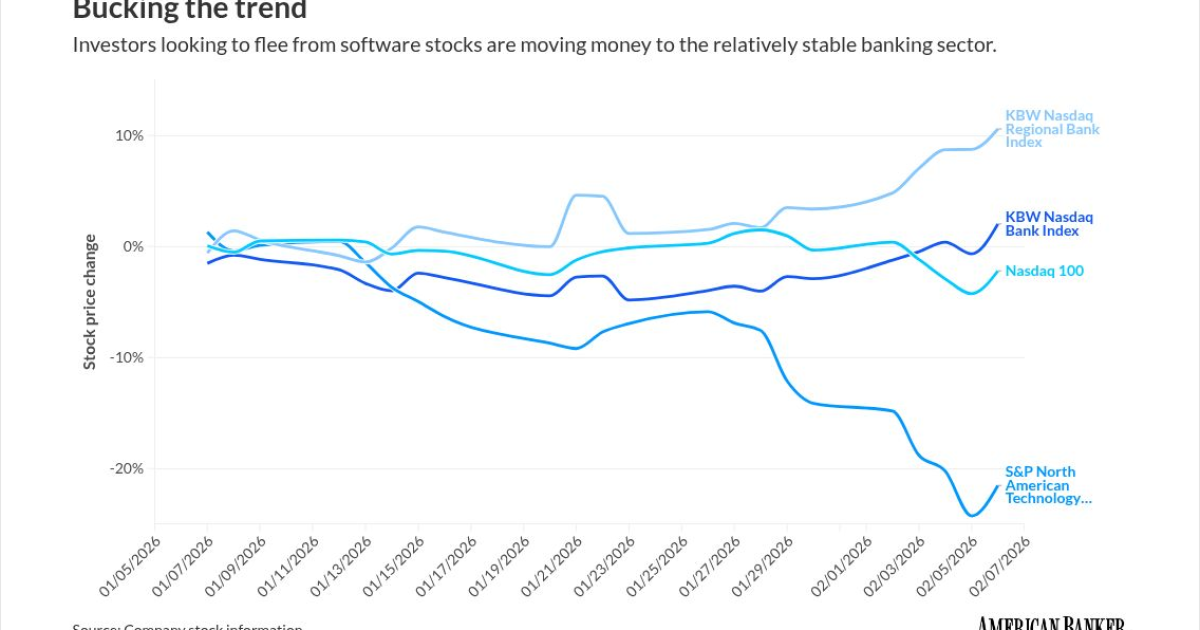

Fund managers routinely adjust their investments to reflect changing market conditions and return expectations for different companies. NICE plans to invest aggressively in the coming years to leverage the demand for artificial intelligence (AI)-based software. This prompted investors to revise their earnings expectations, leading to a re-rating of the company’s valuation.