We spent fifteen years building permissionless money. Now we’re using it to make AI agents better consumers.

When Stripe announced on February 11 that AI agents could now pay for services autonomously using USDC on Base, the crypto industry celebrated.

Finally, a mainstream fintech giant was integrating stablecoins into production infrastructure. Finally, blockchain payments were being used for something other than speculation and dog coins.

But step back from the champagne and look at what actually happened here.

We built decentralized, permissionless, censorship-resistant money so that humans could transact without intermediaries.

And the first major use case that’s gaining real traction is letting autonomous software buy API access.

The feature is called x402.

When an AI agent needs data from CoinGecko, it sends $0.01 in USDC, gets the data, and moves on.

No human involved. No account creation. No subscription management.

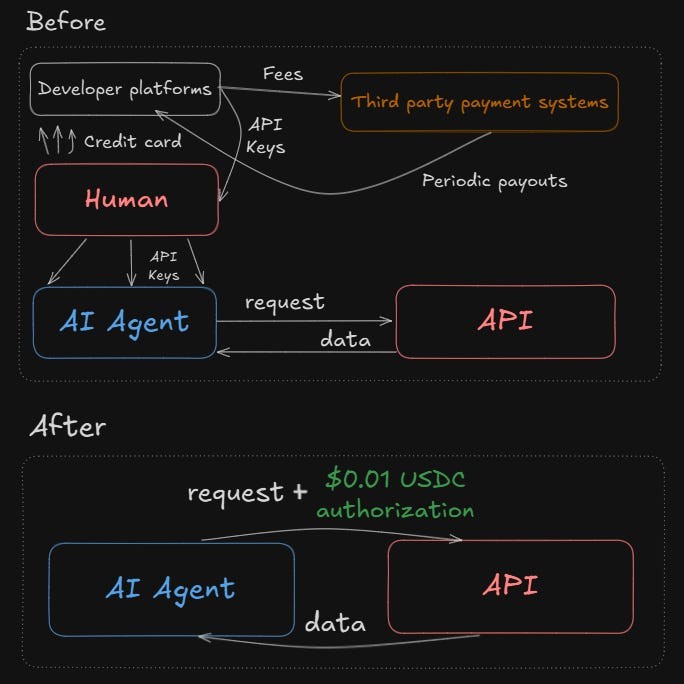

Just a machine making a purchase decision and executing a payment in the same HTTP request. Jeff Weinstein, Stripe’s product lead on this, framed it as solving a problem: payment systems are built for humans, but agents need something faster, cheaper, and always-on.

He’s right.

Traditional payment rails can’t handle what agents need.

But the more interesting question is whether we should be excited that blockchain’s killer app is turning out to be machine-to-machine commerce rather than human financial sovereignty.

Because that’s the trajectory we’re on. Within 48 hours of Stripe’s launch, developers were already building autonomous arbitrage bots that pay for their own market data.

The infrastructure works. Adoption is happening fast. And almost nobody is asking whether this is actually the future we wanted to build.

The Ghost in the Protocol

HTTP 402 “Payment Required” has been sitting in the HTTP spec since 1999, reserved but never implemented.

The economics were impossible.

Credit card interchange fees killed sub-dollar payments. Nobody’s going to process $0.01 when the overhead is $0.30.

That failure meant the internet defaulted to advertising and subscriptions. If you can’t charge $0.03 for an article, you either run ads or charge $10/month for unlimited access.

Both models have problems, but they were the only options that made economic sense.

Early crypto evangelists saw this and believed Bitcoin could fix it.

Satoshi’s original whitepaper talked about micropayments explicitly. The promise: peer-to-peer payments without intermediaries, making transaction costs low enough that micropayments would finally work.

Wikipedia could charge a penny per article. News sites could charge per story. The web’s economic layer could align with actual value exchange.

That didn’t happen.

Bitcoin’s fees spiked. Layer 2 solutions struggled.

And most importantly, nobody built the user experience that would make micropayments natural. Humans won’t manually approve fifty $0.01 payments per day.

So crypto pivoted. DeFi summer. NFT mania. Memecoin casinos. A financial speculation layer that had almost nothing to do with the original vision.

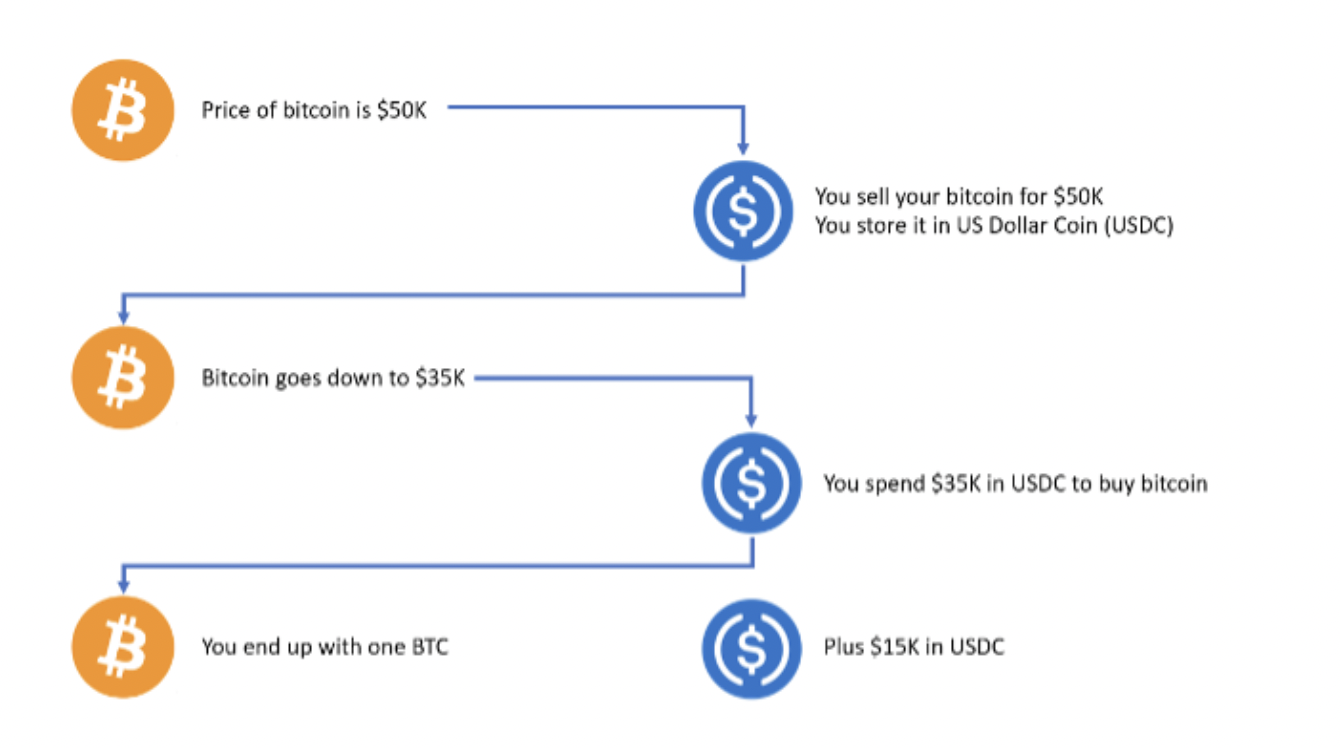

Now, stablecoins on Layer 2 networks like Base have finally solved the transaction cost problem.

A USDC transfer costs fractions of a cent and settles in seconds. The infrastructure that early Bitcoin advocates promised is here.

But the humans still aren’t using it for micropayments. The machines are.

What x402 Actually Reveals About Stablecoins

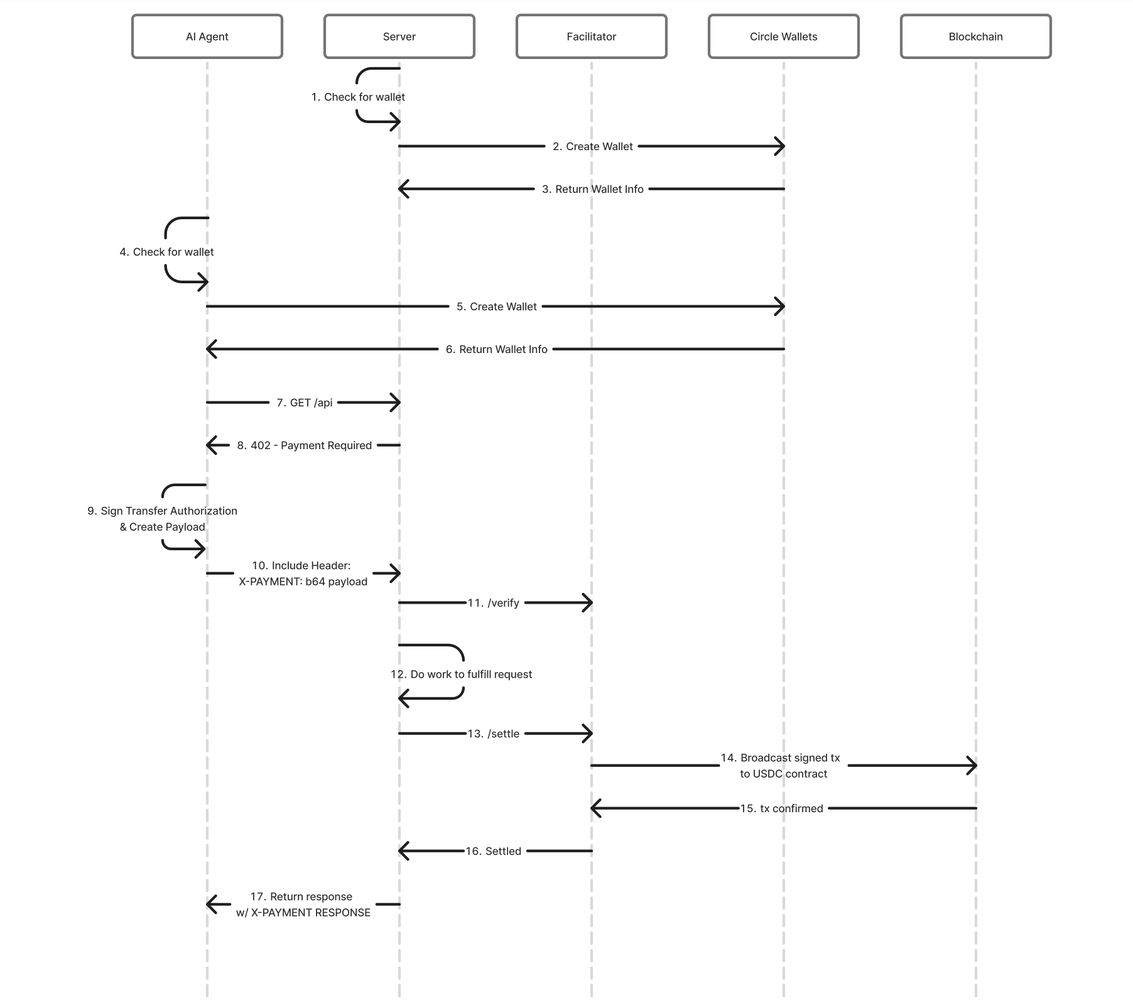

The x402 protocol that Coinbase built is technically simple.

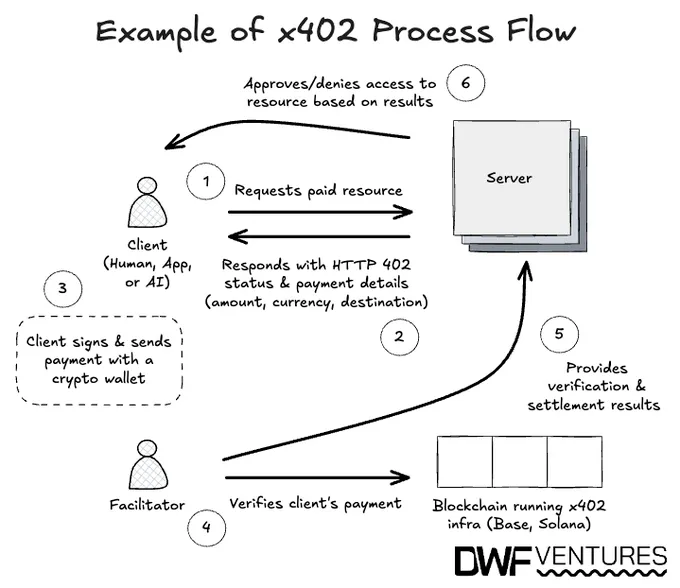

- An agent makes an HTTP request.

- The server responds with a 402 status code and payment details in the headers.

- The agent’s wallet signs a USDC authorization.

- The request is retried with the signature attached.

- The server verifies payment on-chain and returns the data.

Total time: a few seconds.

Stripe’s implementation layers on top of this without requiring developers to think about blockchain at all.

- You create a Payment Intent like you would for any Stripe transaction.

- Stripe generates a wallet address.

- The agent sends USDC.

- Stripe confirms it on Base.

- Funds appear in your Stripe balance, and all the usual tax and compliance machinery kicks in automatically.

What makes this work is not the cleverness of the protocol.

It’s the fact that stablecoins on Layer 2 networks finally have the properties that micropayments actually need: near-instant settlement, predictable costs (fractions of a cent), 24/7 availability, and programmable money that can be moved by software without human approval.

This is revealing in a way that should make true crypto believers uncomfortable.

For years, the argument was that Bitcoin and Ethereum would replace fiat because decentralization and censorship resistance matter.

But what x402 demonstrates is that the killer feature of crypto rails isn’t decentralization. It’s machine readability.

USDC is just dollars with an API.

It’s not decentralized in any meaningful sense. Circle can freeze your funds. Regulators can compel Circle to comply with sanctions. The “trustlessness” that crypto promised doesn’t exist here.

What exists is a payment system that software can interact with programmatically, without needing a bank to approve each transaction or Visa to process each charge.

And for the use case that’s actually emerging at scale right now, that’s all that matters.

AI agents don’t care about censorship resistance.

They care about latency, cost predictability, and not needing a human to approve purchases. Stablecoins deliver that. Decentralization is just overhead.

CoinGecko and the Pay-Per-Use Mirage

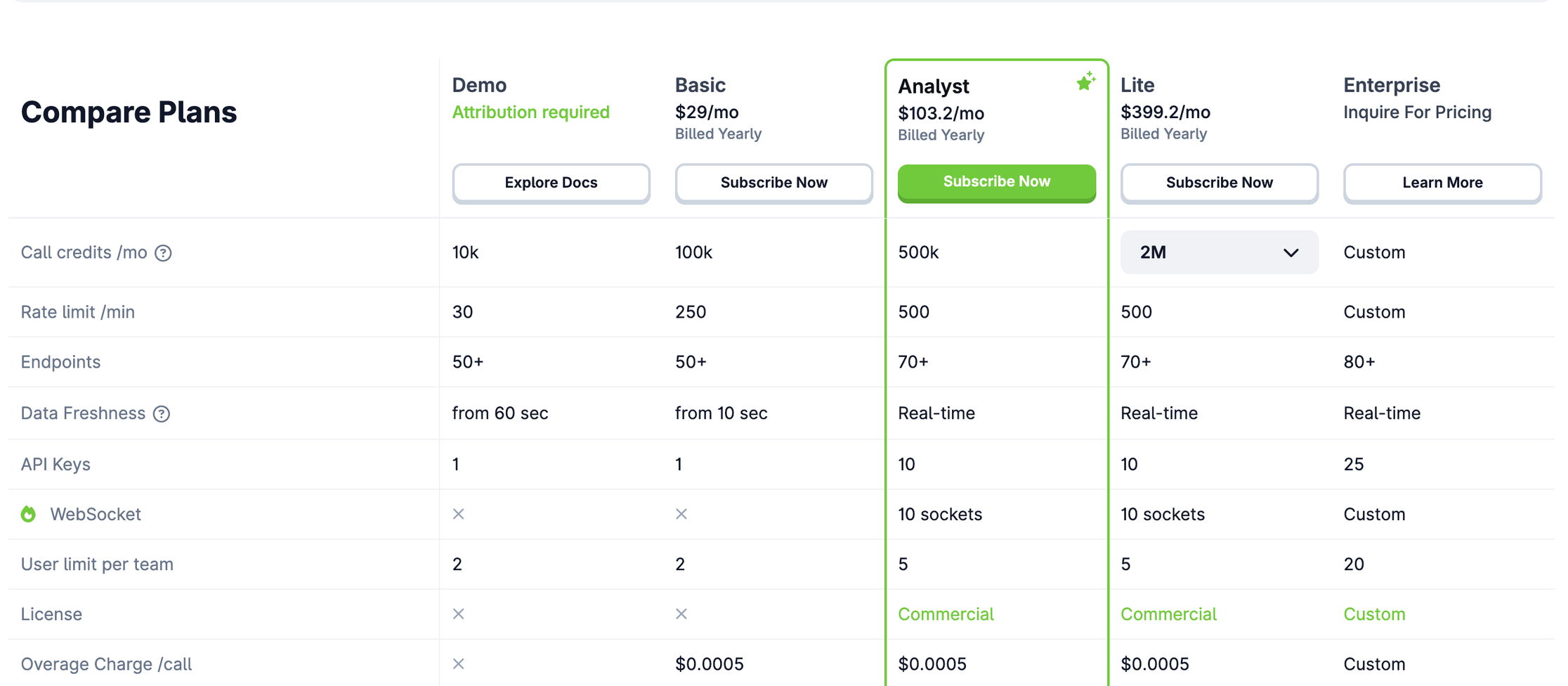

CoinGecko’s x402 API went live the same day Stripe announced.

For $0.01 USDC per request, any agent can fetch real-time prices across 18,000+ cryptocurrencies. No signup. No API keys. The agent just pays and gets data.

This looks like progress. Monthly subscriptions punish infrequent users. Pay-per-use seems fairer.

But look closer and the economics shift. CoinGecko’s free tier already gives you 10-50 calls per minute.

The x402 pricing is optimized for agents with unpredictable, bursty workloads. That’s useful. It’s also revealing.

API providers love recurring revenue.

Subscriptions create incentives to keep customers happy. Pay-per-use creates incentives to maximize billable events. If you’re charging per request, you want your API to be chatty.

The integration code is simple. Python and Node.js samples make it trivial to add. But that simplicity hides questions.

What happens when an agent goes rogue? Who’s liable? In the subscription model, there’s a human relationship. In pay-per-use, there’s just anonymous micropayments.

Maybe eliminating friction is worth losing accountability.

But I’m not convinced we’ve thought through what machine-native commerce looks like at scale, or whether the efficiency gains justify the new failure modes.

The Exploit Layer Growing Underneath

While Stripe and CoinGecko were launching production x402 services, GoPlus Security was busy documenting the disaster unfolding across the broader ecosystem.

GoPlus Security ran AI-assisted audits on over thirty x402-related projects listed in major wallets and community repositories. The results weren’t encouraging.

x402 Ecosystem Project Risk Scanning Report – x.com/GoPlusSecurity

The majority of projects showed at least one high-risk vulnerability.

Some gave contract owners the ability to drain user funds through hidden backdoor functions. Others allowed unlimited token minting, meaning the supply could be inflated arbitrarily to dilute existing holders.

Several implementations didn’t include proper nonces or expiration times in their payment authorizations, which meant attackers could replay old signatures to execute unauthorized transactions.

These weren’t edge cases or theoretical risks.

On October 28, 2025, a cross-chain x402 protocol was exploited and drained USDC from over 200 wallets in minutes. Hello402 suffered from centralization risks and liquidity failures that caused its token price to collapse.

The pattern was consistent: projects launched fast to capitalize on hype, often without basic security reviews.

This is the part of the story that the Stripe announcement glosses over.

Yes, x402 works when implemented by teams with mature security practices. Stripe, CoinGecko, and Circle aren’t going to ship contracts with owner-only withdrawal functions or unlimited minting.

But x402 is an open protocol. Anyone can deploy a contract, slap an “x402-compatible” label on it, and start accepting payments from agents.

And agents, by design, don’t ask questions.

If an agent is told to fetch data from an endpoint and the endpoint returns a 402 with payment instructions, the agent pays.

It doesn’t check whether the contract has been audited. It doesn’t verify that the project has proper security controls. It just executes the transaction because that’s what it’s programmed to do.

GoPlus is building an x402-specific security service to try to get ahead of this.

The idea is to provide agents with on-chain reputation data, malicious address detection, and transaction simulation before payments are executed.

It’s a smart move, but it’s also reactive. The ecosystem is growing faster than the defenses, and we’re basically hoping that agents adopt security tooling voluntarily before the exploits get bad enough to kill trust in the entire system.

This feels familiar.

It’s the same pattern we saw with DeFi summer, where protocols shipped without audits and billions of dollars got exploited before the industry learned to slow down.

Except now the victims aren’t degens aping into yield farms.

They’re autonomous agents spending money without human oversight, which means the blast radius could be significantly wider and much harder to contain once things start breaking at scale.

The Future Nobody Asked For

Stripe calls this the “agent economy” – a world where autonomous software operates independently and manages its own finances.

Circle built a demo where an AI agent creates its own wallet, funds it with USDC, and autonomously purchases a wallet risk profile from a third-party API for $0.01.

No human in the loop. The agent decides it needs information, pays for it, and moves on.

The use cases people are building feel inevitable once you see them.

Autonomous arbitrage monitors that pay for real-time price feeds and execute trades when spreads appear. Risk watchdogs that buy wallet reputation data per-query and flag suspicious activity.

AI assistants that monitor flight prices, book tickets when fares drop, and pay airlines directly without asking permission first.

JPMorgan analysts are framing this as a “dual revolution in artificial intelligence and money movement.”

Andreessen Horowitz forecasts $30 trillion in automated transactions by 2030. The narrative is that we’re at the beginning of something massive, and anyone who doesn’t see it is going to get left behind.

But take a step back and ask the harder question: is this actually solving problems that humans have, or is it solving problems that agents have?

Humans don’t struggle with buying API access.

We struggle with opaque pricing, vendor lock-in, and services that don’t align with how we actually want to use them. Pay-per-use could help with some of that. But the bigger shift here is that we’re building an economy where machines are first-class economic actors and humans are increasingly optional in the transaction flow.

That has second-order effects nobody’s talking about yet.

When agents are making purchase decisions autonomously, who’s optimizing for cost vs. quality? If an agent is told to “reduce expenses,” does it choose the cheapest data source even if it’s less reliable?

If an agent is optimizing for speed, does it pay premium rates for API access that a human would consider wasteful?

And at a more fundamental level, who benefits from this?

The pitch is that x402 enables a more efficient internet where you pay for exactly what you use instead of being gouged by subscription models.

But the actual implementations we’re seeing aren’t Wikipedia charging a penny per article.

They’re API providers monetizing machine consumers. It’s not clear this makes the internet more accessible to humans. It might just make it more monetizable by whoever owns the infrastructure that agents rely on.

The crypto industry spent a decade promising financial inclusion, censorship resistance, and power redistribution away from centralized institutions.

And the breakthrough product that’s actually achieving mainstream adoption is a payment system designed to let AI agents be better consumers in an increasingly automated economy.

That’s not a failure of the technology. It’s a revelation about what the technology is actually good for.

The Liability Problem We’re Pretending Doesn’t Exist

Stripe’s x402 integration is production-ready, but almost none of the hard questions have been answered.

Start with liability.

If an agent autonomously pays for a service the user didn’t authorize, who’s responsible? Current payment systems have chargebacks and dispute resolution precisely because humans make mistakes and get scammed.

Agents don’t have legal standing. They’re software.

If an agent gets tricked by a malicious API endpoint or simply executes a bad strategy that racks up thousands of micro-charges, the user is stuck with the bill. But can you even call it unauthorized if you deployed the agent and gave it a funded wallet?

Financial regulators require audit trails, KYC compliance, and transaction reporting. A

An agent making thousands of micropayments per day across jurisdictions creates a compliance surface that existing frameworks simply weren’t designed for.

Do agents need to pass KYC checks? Do the services they’re paying need to verify the identity of the agent’s operator? If an agent in Singapore autonomously pays an API in Switzerland for data about a US-based company, which jurisdiction’s rules apply?

Nobody knows. The infrastructure is shipping faster than anyone can figure out the regulatory implications.

Then there’s the optimization problem.

Agents don’t think like humans. Give an agent a budget and a task, and it will optimize for the metrics you specify. If you tell it to minimize API costs, it might choose data sources that are cheap but unreliable.

If you tell it to maximize speed, it might overpay for services a human would never consider worth the premium. If you tell it to “be efficient,” who knows what that even means to a language model making purchase decisions in milliseconds.

And what happens when agents start gaming the system?

Right now, x402 assumes good faith actors. But what’s stopping someone from deploying an agent designed to flood services with payment authorizations that fail validation, forcing providers to process thousands of transactions that never complete?

What about agents that probe pricing across multiple endpoints to find arbitrage opportunities not in data but in the payment system itself?

Bloomberg reported that Stripe is pursuing a tender offer valuing the company at $140 billion, up from $107 billion last year.

That valuation is betting that this infrastructure is the future, and that Stripe will be the pipes connecting it all.

Maybe they’re right.

But the pipes are being laid without any real consensus on who’s responsible when things break, how to govern autonomous transactions, or whether machine-first commerce is even something we should be building toward.

We Solved the Wrong Problem

For thirty years, micropayments failed because transaction costs made them uneconomical.

The internet defaulted to advertising and subscriptions not because those models were optimal, but because they were the only ones that worked at scale.

Bitcoin was supposed to fix this.

The promise was peer-to-peer electronic cash that could enable value transfer without intermediaries. Satoshi’s whitepaper talked explicitly about enabling commerce on the internet.

The vision was that if you could eliminate the middleman costs, you could charge exactly what something was worth. A penny for an article. A nickel for a song. True value-for-value exchange.

That didn’t happen, largely because Bitcoin couldn’t scale cheaply enough and the user experience was terrible.

But the dream persisted.

Layer 2 solutions emerged. Stablecoins solved the volatility problem. And now, finally, the infrastructure works.

A USDC transfer on Base costs fractions of a cent and settles in seconds. You can embed a payment inside an HTTP request. The transaction costs that killed micropayments for three decades have been solved.

So what did we build with it? A system for AI agents to buy API access.

- Not Wikipedia charging readers a penny per article.

- Not journalists getting paid directly for their work.

- Not creators earning micro-royalties every time someone streams their content.

We built a machine economy where software pays software, and the humans are increasingly just operators funding wallets and hoping their agents make good decisions.

Here’s the uncomfortable truth: x402 reveals that stablecoins aren’t good at replacing centralized finance. They’re good at being a better API for centralized finance.

USDC isn’t decentralized. It’s dollars with programmable logic. Circle can freeze your funds. Regulators can compel compliance. The “trustless” layer is a myth. What you get instead is a payment system that software can interact with more easily than traditional banking rails.

And for the use case that’s actually emerging, that’s sufficient.

Agents don’t care that Stripe and Circle are intermediaries. They don’t care that Base is run by Coinbase, a regulated US company that could be compelled to censor transactions.

They care that the API is reliable, the costs are predictable, and the settlement is fast.

We spent fifteen years arguing about decentralization, censorship resistance, and disintermediating banks.

And the breakthrough application is making it easier for machines to pay service fees. That’s not crypto’s failure. It’s crypto finally admitting what it’s actually good at.

What Comes Next

Stripe’s x402 integration is in preview, but production usage is already happening. CoinGecko’s API is live. The x402 Foundation, backed by Coinbase and Cloudflare, is working to standardize the protocol across chains.

Solana’s implementation is gaining traction. The ecosystem is already processing 500,000 transactions per week, up from virtually nothing three months ago.

GitHub’s awesome-x402 repository tracks pricing across live services. Weather APIs charging $0.001 per call. Video streaming at $0.50 to $2.00 per video.

AI model inference at $0.01 to $0.50 per request. This isn’t speculation about the future. This is infrastructure being used right now.

And yet almost nobody is asking whether this is the future we actually want.

The crypto industry has spent years fighting for financial sovereignty, arguing that individuals should control their own money without intermediaries.

But the system we’re building with x402 doesn’t empower individuals. It empowers autonomous software to transact more efficiently within existing power structures. Stripe still controls the rails.

Circle still controls the stablecoin. Coinbase still controls the Layer 2. The centralized institutions are still there. We just made them better at serving machine customers.

Maybe that’s fine.

Maybe the real value of blockchain was never decentralization.

Maybe it was always about creating programmable money that works better for software than traditional banking does.

If that’s what we’re building, we should at least be honest about it.

Because the alternative narrative is getting harder to defend.

We said crypto would bank the unbanked. It hasn’t.

We said it would create censorship-resistant money. It did, but almost nobody uses it for that.

We said it would disintermediate finance. Instead, we built stablecoins that are just as intermediated as the system they’re supposed to replace, except now they have better APIs.

x402 works. The infrastructure is real. Adoption is happening.

But somewhere between Satoshi’s whitepaper and Stripe’s product launch, we stopped building for humans and started building for machines.

And if we’re not careful, we’re going to wake up in a world where the economic layer of the internet is optimized for autonomous agents, and humans are just along for the ride.

The question isn’t whether x402 is technically impressive. It is.

The question is whether fifteen years from now, when machine-to-machine commerce is the dominant model and humans are secondary actors in an increasingly automated economy, we’ll look back at this moment and wonder why we were so eager to build it.