The introduction of US legislation on stablecoins, the GENIUS Act, has caused many countries to reflect. US-backed tokens will solidify their domination of global payments and, eventually, could even dominate some payment systems. Circle and Stripe, Visa and Mastercard are already worried. The European Central Bank has actually threatened monetary sovereignty loss and greater geopolitical dependence on the US. The countries have leaped at the chance to change or implement regulations to encourage issuance of their own stablecoins pegged to national currencies, including going so far as to restrict the use of foreign stablecoins.

Are stablecoins evil?

At minimum, stablecoins have proven the ubiquitous flaws of modern financial systems and how newer tech can fix them. They are popularizing because they enable quick and cheap payments and transfers, even across borders. This can be realized from the rate at which stablecoin turnover has doubled within the last 18 months. Transactions now amount to some $20-30 billion daily. But this is still only less than 1% of global cash flows. At the end of the first quarter in 2025, money transfers were 3% of the $200 trillion total figure of global cross-border payments. The value of capital market transactions (mostly settled in exchange for treasury bills, as well as bond, fund, and other security settlements) amounted to a little less than 1% of global capital market transactions. The value used to settle purchases of cryptocurrency amounted to nearly $20 trillion.

Legacy payment infrastructure handles between $5 trillion and $7 trillion of institutional, commercial, and consumer money transfers around the world every day (Swift and Bank for International Settlements data).

It is estimated by analysts that, on current growth patterns, stablecoin transaction volumes will surpass traditional payment volumes within less than 10 years. And even sooner, depending on how quickly adoption takes place.

The growing popularity of stablecoins is also reflective of a lack of trust in central banks and the currencies in many nations. Governments, regulators, and central banks need to solve the following deficits:

-

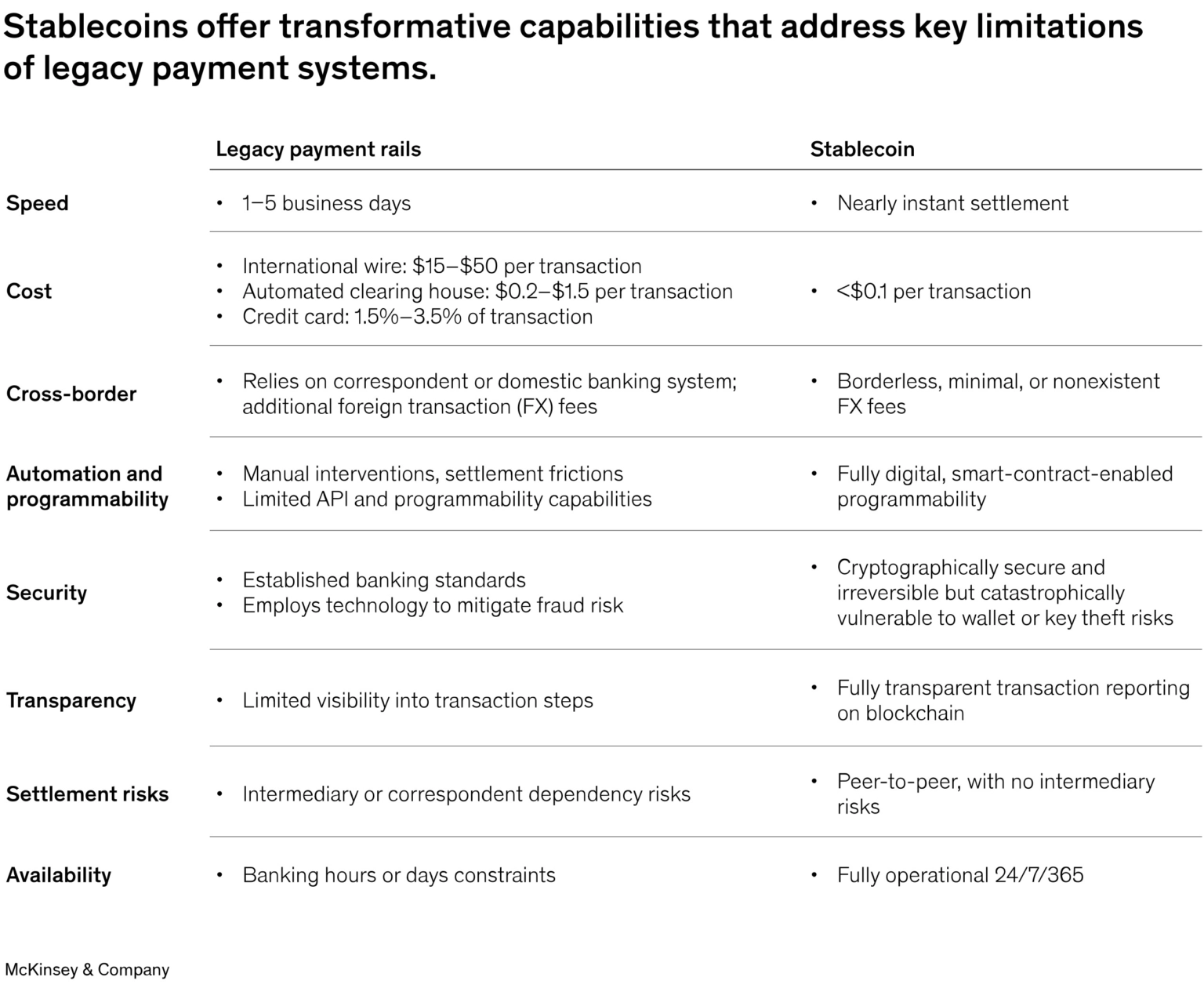

Speed. One to three business days’ delays in settling using traditional payment systems, especially for cross-border payments.

-

Cost. The traditional method of payment processing usually involves several intermediaries (e.g., clearing houses and correspondent banks) in between. Therefore, the process can result in several charges.

-

Transparency. Technology-intensive and aged infrastructure can conceal payments’ routing and status, especially for overseas transfers.

-

Accessibility. Payment systems founded on the traditional banking system are usually available only during normal business hours. Inclusivity. Due to the bank-centric nature of much of the legacy payment infrastructure, many individuals are excluded from, or underserved by, KYC obligations and face other barriers, such as needing government identification or more than one proof of residency.

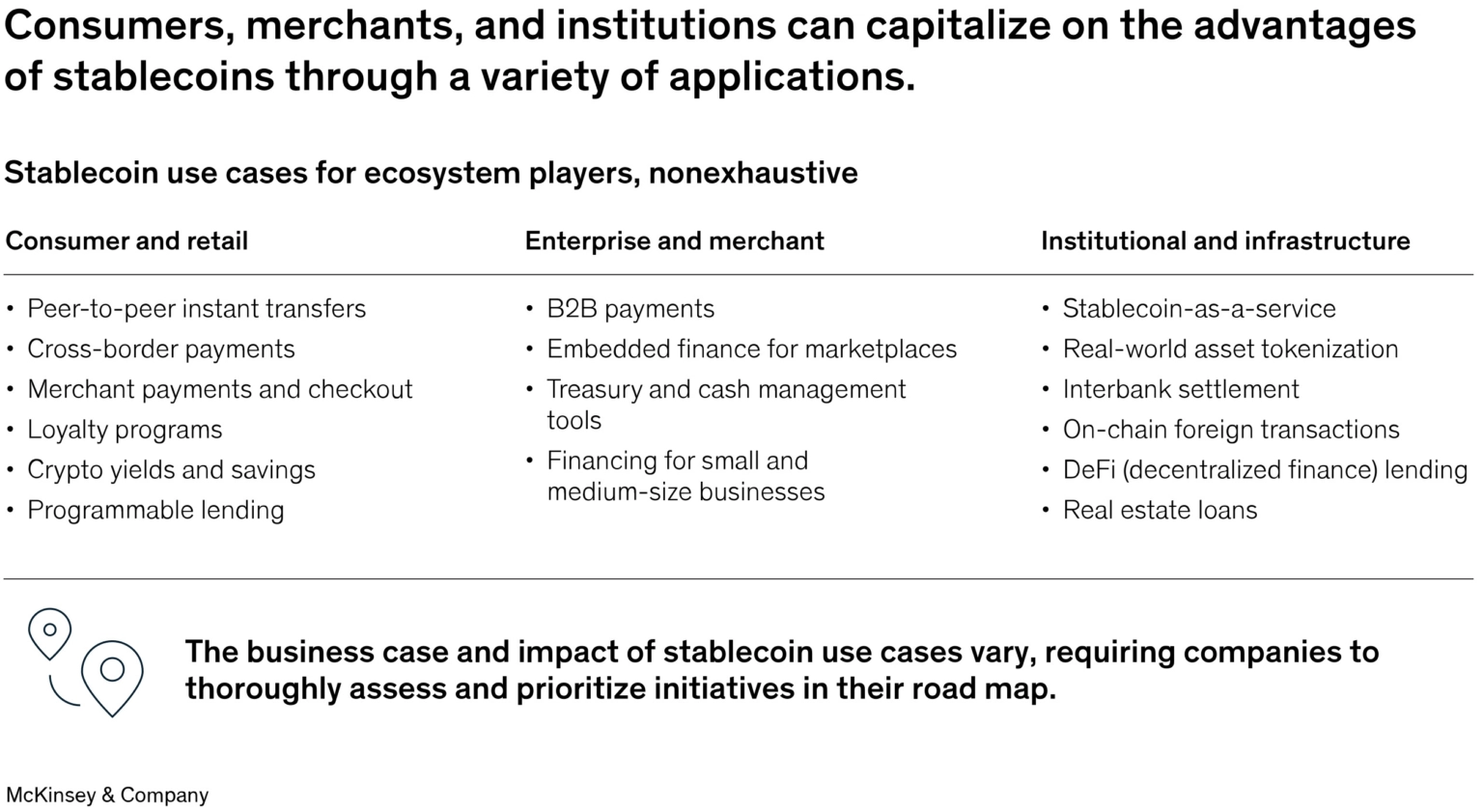

There is also more demand for business-to-business payments, cross-border payments, retail money remittances, and automated payments (e.g., by the government). As a result, there has been greater demand for more responsive, adaptive, low-cost, secure, and inclusive global payment solutions over the past decade. And stablecoins are now the only ones to offer most of these.

Eurozone vs. US

The Eurozone has a common currency — the euro — and tightly managed financial markets but no common payment system. The European Central Bank is in the process of constructing a digital euro. Countries that lack economic and financial authority and whose currencies their own people don’t trust have even greater apprehensions of being substituted by dollar-backed stablecoins.

In 2023, the very first large-scale regulatory guidelines were implemented, including the European Union’s Markets in Crypto-assets Regulation (MiCA) for stablecoins, the United Kingdom’s Financial Services and Markets Act, and similar licensing regulations in Hong Kong, Japan, and Singapore.

China and India possess excellent domestic payment systems. Both countries do suffer, though, from occasional loss of confidence in their currencies and central banks by foreign investors, and both still possess currency restrictions. Stablecoins such as these in these countries not only risk choking the growth of national currencies, but could ultimately replace bank deposits as well, targeting commercial banks.

Several advantages, but with threats as well

Most banks have already started to “tokenize” their deposits, so it is simple to employ them for blockchain transactions and reduce international payment fees. That is, the new competitor is forcing traditional systems to become more efficient if they are going to retain their clients. Banks and governments are not yet playing catch-up. The total value of stablecoins issued has doubled in 18 months, hitting $250 billion from $120 billion. This is also projected to reach over $400 billion by December 2025 and $2 trillion in 2028, based on estimates.

At the same time, some income-generating tokens equivalent to cash have come to market, usually reflecting investments in underlying short-term government debt, including BlackRock USD Institutional Digital Liquidity Fund ($2.9 billion); Franklin OnChain US Government Money Fund (whose share is represented by the BENJI token) ($0.8 billion); and Ondo Short-Term US Treasuries Fund ($0.7 billion).

Such tokens are not stablecoins in nature but dollar-denominated, and that becomes the potential for a new payment form that can be used at the point of sale and even generate real-time revenues.

Commercial banks will not be able to survive if they relinquish their position as payment intermediaries. They will have to learn to compete. Stablecoins play a helpful role in catalyzing better financial markets and forcing commercial and central banks to raise their game.

Large financial institutions are already taking on a more central role in tokenizing cash. One example is JPMorgan’s JPM Coin, which uses tokenized bank deposits for real-time settlements on an institutional-level network (more than $1 billion per day). There is a blockchain asset platform called Canton Network that is experimenting with tokenized deposits and cash (Citibank, Goldman Sachs, UBS). Banks tokenize commercial bank money to transfer value in real time across in-house registries and geographic regions, especially for intraday liquidity positioning (Partior).

Central bank and interbank tests also include:

- Project Guardian, trying to tokenize cash in cross-border foreign exchange and securities trade (Monetary Authority of Singapore with Standard Chartered, HSBC, and DBS).

- Project mBridge uses tokenized central bank money for cross-border settlement (United Arab Emirates, Thailand, Hong Kong, and China central banks).

- Project Helvetia is researching the settlement of tokenized financial assets with tokenized central bank money (Bank for International Settlements, SIX, and Swiss National Bank).

Stablecoin use is still dangerous, nonetheless. Decoupling from the unit of currency is feasible, mainly due to unknowns with reserves. Additionally, as with all digital currencies, secure storage protects keys from theft.

Stablecoin holders are not owners or have rights over the underlying assets, even when there are redemption assurances from the issuers. Even when the stablecoin itself will remain secure on the blockchain, upon bankruptcy, holders can be considered as unsecured creditors and may not enjoy full rights of access to reserves. Lacking legal protection, stablecoin investors are completely reliant on the good faith and integrity of the private issuer, with no protection afforded by a central bank or government.