The global financial system, often described as a house of cards, is entering an era of profound shift, one that clearly reveals that trust in debt-laden sovereign currencies and obsolete financial instruments is at an all-time low. However, in the face of all the visible signs of an ailing system, one ancient relic– as old as humanity itself–is being aggressively re-monetized: gold.

In 2024 alone, central banks accumulated over 1136 tonnes of gold, the highest in seven decades and the most aggressive acquisition ever recorded since the collapse of Bretton Woods in 1971. The reason for this is simple: the loss of trust in the fiat system and the need to secure verifiable, de-risked collateral on their balance sheets.

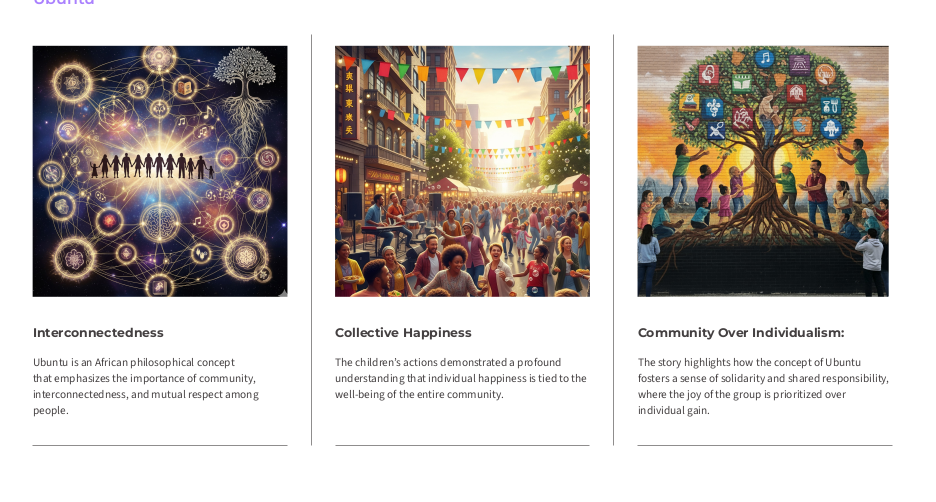

The “Gold For All Report,” published by Ubuntu Tribe and prefaced by Wall StreetBets Founder Jaime Rogozinski, is not merely an excursus. On the contrary, it is a meticulously detailed exposé of the fragile “paper gold” market and a blueprint for a new system anchored by transparency, technology, and the African philosophy of Ubuntu(“I am because we are”).

This simple guide breaks down the report’s core arguments, from the systemic fragility of the current gold market to the proposed solution anchored on a tokenized allocated asset designed to bring verifiable collateral and financial freedom to sovereigns, institutions, and households alike.

The Cracking Foundation of Trust

The key thesis of this report is that the existing global financial system, created after former American President Richard Nixon ended the gold standard in 1971, is nothing more than an unstable, over-leveraged house of cards. Finance, the report reminds us, rests on two simple pillars: information and collateral. In the gold market today, each of these is fundamentally broken. It, therefore, warns of a dire consequence:

“the pressure points, if left unattended, will lead to the collapse of the financial system”.

The Illusion of “Paper Gold”

The report shows that most gold holdings today are not real gold, but “paper gold,” which is a web of claims, contracts, and promises that are much more than the actual physical ounces that are in existence. This systemic mismatch is neither a bug nor a glitch; it is simply how the system is designed. The illusion of paper gold, which points to the fragility of the gold market, can technically be viewed through COMEX’s overleverage and London’s OPacity.

COMEX Leverage

On the COMEX exchange, the marketplace for US gold derivatives dubbed as “paper gold,” the over-leveraged positions established on gold are staggering and a clear indicator of systemic instability. The report says that open interest was 52 million ounces in December 2024, while only 3.2 million ounces were registered. This means that there are more than 16 claims for every ounce of gold that could be delivered. This over-leveraging makes the system more risky, and if only a small number of contract holders demand physical delivery, such a demand system would trigger a severe liquidity crisis.

The London Opacity

The London OTC market, which is mostly made up of unallocated accounts, isn’t much better. These accounts work like a fractional reserve banking system, where more than one person can claim the same gold bar at the same time. Estimates say that there are 7 to 9 claims per bar in these unallocated pools. The current players say this is “efficiency,” but the report sees it as just a hidden layer of leverage.

Regulations make these systems even less clear. Ironically, efforts to clean up the market have caused an estimated 400 tons of gold to leave Africa each year and enter shady, illegal smuggling routes. This has made legal trade more concentrated among a small number of trusted gatekeepers. As a result, the asset that was supposed to stabilize the system is now inheriting its fragility.

The Quiet Revolution and Re-Monetization

The 70 page report highlights that the gold market is already undergoing a dramatic regime shift away from paper claims and toward verifiable physical ownership, noting how “ trust migrated from bars to paper and from gold windows to central bank decrees” in the 20th century. By describing gold as “collateral of last resort”, the report shows that it is “being remonetized not by theory” but by the quiet actions of the world’s most powerful institutions: Central Banks.

The Sovereign Buying Spree

At a rate not seen since the 1960s, central banks are buying physical gold. The most obvious indication that sovereigns are losing trust in the current debt-based reserve and fiat systems is this aggressive accumulation. This is evident in the following indices:

Record High Purchases: Together, central banks bought more than 1,136 tonnes of gold in 2024, which is about 31% of the world’s yearly mine supply. This was the second year in a row that accumulation exceeded the 1,000-ton threshold.

Shifting Power Dynamics: With countries like China (buying up 220 tonnes) and Russia (crossing 2,300 tonnes in total reserves) setting the pace, the East and South are largely responsible for the accumulation. According to the report, Singapore, Poland, and Turkey have also been active purchasers.

The Brutal Contrast: Central banks are accumulating gold at the same time Western-based investors are selling it. For example, Western ETFs collectively sold off 200 tonnes of gold in 2024. This amounts to a brutal divergence, which shows that governments are quietly stockpiling the yellow metal because they believe the global financial system is fundamentally unstable, while mainstream investors are selling their paper promises for short-term market returns.

The Looming Crisis in Washington

The report also identifies a significant, but frequently disregarded, financial fault line in the US. The statutory, decades-old price of $42.22 per ounce is used to value the 8,133.5 tonnes of gold that the U.S. government owns. The true value is much higher than the report’s estimated price of over $3,540/oz, resulting in a revaluation gap of $863 billion. According to the report, this denial of current value is a component of the “choreography” leading up to a crisis that will eventually necessitate an official revaluation, which will probably set off a chain reaction of structural change in global finance.

Tokenized Allocated Gold

Central to the report’s thesis is a proposed solution to the recurring fragility of the gold paper market. The solution seeks to re-engineer gold ownership, moving it from a fragile paper-promise system to a verifiable digital asset based on the African philosophy of Ubuntu (“I am because we are”). Ubuntu Tribe has a name for it: “tokenized allocated gold”.

At its core, this approach is aimed at addressing the two core challenges of the current system: opacity and exclusion. According to the report, the major problem of “paper gold” (like ETFs or unallocated accounts) is that multiple claims exist for the same physical bar, the result of which is the creation of a massive, hidden leverage.

Conversely, tokenized allocated gold seeks to solve this problem by being 100% physically backed and allocated, and by being a fractional, digital claim on a specific, serialized gold bar held in audited, insured vaults (Zurich, Copenhagen, Dubai, etc.). With the help of blockchain technology, real-time cryptographic proofs and transparency are guaranteed, making gold ownership records immutable and publicly verifiable as well as eliminating the need to trust middlemen or opaque bank balance sheets.

Most importantly, the report clearly illustrates that physical redemption is the ultimate test of the system by describing it as the “system’s fulcrum” and by showing how the digital value of tokenized allocated gold tracks the physical asset itself. By emphasizing the significant role of blockchain technology in driving financial inclusion, the report also shows that Ubuntu Tribe’s philosophy is rooted in the principle of shared wealth and community. The solution democratizes access: it requires only a smartphone, not a bank account, thus becoming a powerful wealth preservation tool for the billions in emerging economies locked out of traditional finance.

Gold for All

A consistent theme in this report is that true change must extend beyond sovereign vaults to household wallets in line with the philosophy of Ubuntu, which is another term for collective well-being. It also directly addresses ongoing attempts by traditional finance (e.g., the World Gold Council) to create digital tokens like Pooled Gold Interests (PGIs), warning that if these PGIs are backed by unallocated accounts, they are simply a “digital echo of the same unallocated problem“.

A Playbook for the Coming Golden Age

The “Gold For All Report” predicts that the next three years will be defined by these three questions: who owns physical gold, how it is recorded, and what rail system transmits it, showing how narrow the window for preparation is increasingly becoming.

It serves as a “field manual,” advising all participants—sovereigns, institutions, and families—to prepare playbooks now. It advises sovereigns to recognize that gold is being re-monetized not as a stagnant reserve, but as living collateral of last resort; institutions are advised to move beyond paper claims and embrace allocated, verifiable tokens to make their bullion work harder and clearer; and households are advised to recognize the fragility of the paper system and utilize accessible, fractionalized, and verifiable collateral to protect and grow their savings.

Humanity, it says, has a stark choice: to continue to believe in promises that crack under stress, or build a system where nature and transparency create shared prosperity for all. The era of borrowed trust is ending, it proclaims!