Get on the AI train … or plan for the economy without you

The CEO of Palantir just tipped his hand on the future of work, and it’s chilling…

“We’re planning to grow our revenue … while decreasing our number of people… The goal is to get 10× revenue and have 3,600 people. We have now 4,100,” Alex Karp said.

Translation: more sales, fewer jobs.

Palantir’s own AI has already let it double revenue (+88% in two years) with only +12% headcount.

And AI is already biting into jobs, especially entry-level and routine work, fattening profit margins for those who wield it. If you think July’s weak jobs report was some fluke or a tariff blip, think again… An AI “asteroid” is hitting the labor market, and the only winning move is to go all-in on AI – as a worker and an investor.

AI Is Causing a Labor Recession – Not Politicians or Tariffs

July’s employment data was a shock: just 73,000 jobs added, vs. 110,000 expected, with massive downward revisions to May and June. The six-month average payroll gain has now sunk below 100k – historically, that’s when recessions hit.

In fact, one economist noted the report “is what entering a recession looks like.” It doesn’t take a rocket scientist to connect the dots: AI is taking jobs. Companies are using automation and large language models to do more with fewer people, and they’re pulling back on hiring, especially for roles AI can handle.

Consider new job postings: they’re collapsing fastest in high-AI-exposure roles and for junior positions. Data shows entry-level jobs with high AI exposure have seen postings plunge over 40% since early 2023. Even entry-level roles with low AI exposure are down ~33%. And non-entry roles aren’t immune (postings down 16%–27%, depending on AI exposure).

The takeaway? We’ve crossed a structural breakpoint in labor demand. AI is doing to office and service jobs what automation did to factory jobs decades ago – only faster.

This isn’t about one administration or tariffs or a union strike. The real force is technological. Every white-collar worker now faces an “AI Rubicon”: adapt and use AI as a force-multiplier, or watch your opportunities dry up.

As a professional, you must upskill with AI tools to stay in the game. As an investor, you must own the companies driving this change. In 2025, there’s an upper 80% of people and businesses who leverage AI – and a struggling bottom 20% who get left behind. Make sure you’re in that top camp.

AI “Haves” vs “Have-Nots” – Firms Using AI Are Pulling Away

We’re seeing a stark bifurcation through the lens of the stock market: the AI haves vs. the have-nots. If a business isn’t native to AI or at least aggressively applying it, Wall Street is yanking its money away.

Just look at two case studies in efficiency:

- Palantir (PLTR) – This is an AI-applier extraordinaire. Palantir just notched its first $1B revenue quarter (up 48% YoY) and raised guidance. Crucially, it did so with minimal headcount growth. The CTO (now a billionaire) noted Palantir applied its own AI to operations, and in two years revenue jumped 88% with only 12% more staff. That’s unheard-of leverage. Karp openly plans to shrink headcount while growing sales 10× – essentially using AI to replace hundreds of back-office roles. This is how AI “takes” jobs but boosts margins. No wonder Palantir’s stock has gone vertical. Be a buyer on pullbacks, because as enterprises adopt Palantir’s AIP (which I see as the Excel of the AI era), its growth runway extends for years.

- Lemonade (LMND) – This AI-native insurer is finally hitting its stride. In Q2, Lemonade’s in-force premiums jumped 29% and revenue 35%. Its AI chatbots handle onboarding and 27% of claims with no human needed. That’s slashed overhead and, importantly, improved underwriting. Lemonade’s gross loss ratio dropped to 67% – a 12-point improvement vs. last year – meaning its algorithms are getting better at pricing risk. This efficiency revolution is translating into revenue growth and narrowing losses. The stock has doubled off its lows. As long as it continues to compound its user base and refine its AI, be a disciplined buyer on dips. (Thesis breaks if loss ratios creep back up into the 80s.)

Meanwhile, firms without an AI angle are struggling. Many legacy software and internet names are reporting flat user growth and margin pressure. And on the industrial side, companies stuck with high labor costs (without AI to offset) are warning on earnings.

The market is starting to pay hyper-growth multiples for anything AI – and treating everything else like it’s the slow lane. Don’t chase non-AI “value traps” in this tape. Tilt your portfolio toward AI-forward businesses with visible operating leverage.

[Ad]

Hyper-Growth Picks: How to Play the “AI or Bust” Market

Let’s cap it off with a rapid-fire look at some exponential stock ideas I’m excited about right now. Some are pure AI plays, others are beneficiaries of related trends (like “trade-down” or thrift). All have momentum and a compelling story:

- Reddit (RDDT) – The best social growth story out there. Since going public, Reddit has surged over 500%, thanks to booming user engagement and ad innovations. The stock recently traded around $212, closing in on its all-time high near $230. Yet I see still more room to run – analysts are hiking targets to ~$225, and Reddit’s developer ecosystem (for third-party apps and bots) is unlocking new revenue streams. Be a buyer on any pullback toward the mid-$100s. Because as the de facto home of online communities (and with unique data that AI models crave), Reddit could be the sleeper of the social media space. (Just watch volatility around earnings – this one’s not for the faint of heart.)

- AppFolio (APPF) – A 20% annual grower that just had a breakout. AppFolio makes software for property management, and it’s firing on all cylinders: revenue up 19% YoY last quarter, with expanding margins and AI features (they’ve infused AI into their platform for things like smart maintenance requests). The stock blasted to all-time highs around $320 after earnings. It’s a classic Stage-2 breakout after a long consolidation. I like it on a trend-follow basis – be a buyer as long as it holds above the breakout level (roughly $275–$280). If the housing rental market stays strong and IPO markets re-open (AppFolio benefits as more real estate startups go public and become customers), this could have more upside. Thesis only breaks if revenue growth dips under ~15%, which I don’t foresee near-term.

- Wingstop (WING) – An under-the-radar AI-applier in fast food. Wingstop introduced an AI-powered “smart kitchen” system in 1,000 restaurants, and it’s a game changer. Ticket times plunged about 40% within a month of installation – meaning orders get out in ~10 minutes instead of 18+. Faster service = more sales per store and happier customers (indeed, same-store sales growth is outperforming in stores with Smart Kitchens). This tech is cutting wait times to under 30 minutes even for delivery, versus 40+ min before. Net result: Wingstop is boosting throughput (which should lift margins) without extra labor. The stock quietly hit new highs this year. I love Wingstop’s business (asset-light, 95% franchised, “chicken wings-as-a-service”), and the AI angle gives it a fresh catalyst. I recommend accumulating on market dips – this is a secular growth story in restaurants. (One caveat: wing prices can be volatile; a spike in chicken costs could weigh on margins short-term, but their pricing power has been solid.)

- Workiva (WK) – A sleeper pick that’s levered to the IPO cycle. Workiva’s cloud platform is the gold standard for SEC filings and reporting (they help companies file S-1s, 10-Ks, etc., with collaborative software). If IPOs heat up in late 2025 into 2026, Workiva’s customer base and usage will soar. The stock has been range-bound, but I see optionality here: as soon as a few high-profile tech IPOs hit the market, sentiment on WK will flip. Be a buyer before the IPO wave hits. Downside is limited by Workiva’s sticky existing customer base (even without IPOs, every public firm still needs 10-K software). Upside, though, is a volume spike in new filings. It’s a picks-and-shovels play on a better equity market. (I’d turn skeptical only if we go into a deep recession that freezes all IPO activity into 2026, which seems unlikely given the pipeline of unicorns eager to list.)

- ThredUp (TDUP) – The thrifting boom is real, and ThredUp has ridden it to a 500%+ stock gain in the past year. Tariffs on new apparel (reimposed by the current administration) are pushing cost-conscious shoppers into secondhand clothes. Gen Z’s obsession with sustainable fashion doesn’t hurt either. ThredUp’s Q2 revenue popped ~16%, and the company actually hit positive free cash flow. The stock just hit a 52-week high around $9.50. Importantly, management is using AI for operational efficiency – things like AI-driven pricing and image search, which expand margins and improve the user experience. Despite that, I’d say ThredUp doesn’t have a pure “AI story” to the degree others here do – it’s primarily a resale marketplace play. The valuation, even after the run, is not extreme (EV/Sales is reasonable for a 20%+ grower). If you believe in the circular economy trend, you can hold this one. Just be aware retail-oriented stocks can swing with consumer spending. I like it, but I wouldn’t marry it – consider trailing stops to lock in gains, because a shift in tariffs or fashion trends could always cool the momentum.

- Dollar Tree (DLTR) – A quiet breakout stock that benefits from the great American “trade-down.” With inflation and economic uncertainty, more consumers are trading down to dollar stores for everyday items. Dollar Tree (and its Family Dollar segment) is seeing steady growth – last quarter same-store sales were up 5.4%, and it’s expanding multi-price offerings (no longer just $1 items). The stock has rallied off 2024 lows and is setting up nicely. I like DLTR as a defensive growth holding: it’s not flashy, but it tends to outperform when consumers get stretched. Plus, any resolution on tariffs (many dollar store goods are imported) could remove a margin headwind. Be a buyer on any weakness into the high $90s. Just don’t expect fireworks – this is a “grind higher” name. (If you want more juice in retail, I prefer thrift plays like TDUP or specialty brands leveraging AI-driven marketing.)

Not every retail stock is a winner here. Some mall apparel names – think American Eagle (AEO) or Abercrombie & Fitch (ANF) – have had big pops, but those are cyclical trades (get in, get out). Don’t marry a teen retailer in this environment.

One potential exception in apparel is On Holding (ONON) – the premium shoe brand with a cult following – it’s executing well and might transcend the cycle. And I’d be remiss if I didn’t mention Crocs (CROX), a personal favorite that’s trading at a bargain valuation; it’s not an AI play, but the brand strength and earnings power are underrated (sometimes, the best investment thesis is simply “people love the product”). Still, keep these non-AI plays as smaller positions or tactical trades. The core of your portfolio should ride structural tailwinds like AI.

The Bottom Line: “AI with AI” or Get Left Behind

We’re at an inflection point. Wall Street has crossed the AI Rubicon, and there’s no going back. The macro data, the earnings, the market winners and losers – all tell the same story. Jobs are cracking because AI is automating away the routine. Stocks are splitting into AI haves and have-nots. And whether you’re a worker or an investor, the only winning move now is to go all-in on AI.

As a worker, that means using AI to amplify your output – becoming the person who’s 10× more productive with an AI assistant, not the one replaced by it. As an investor, it means owning the companies building and applying AI, and avoiding those in denial about it. In practice: overweight tech and growth names with real AI products or adoption; underweight firms clinging to legacy business models. Be a skeptic of any CEO on an earnings call still blaming “macro headwinds” without an AI plan – they might be roadkill in two to three years.

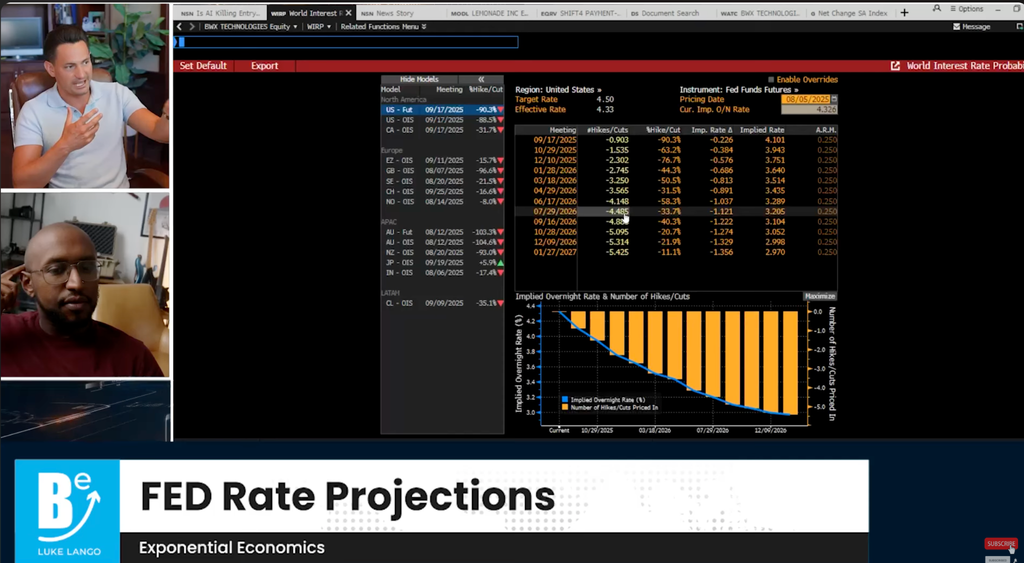

One more thing: lower interest rates on the horizon will only widen the gap. Cheap capital rewards the innovators (AI startups, growth companies) and punishes the stagnators (debt-laden industrials, low-growth stalwarts). So position yourself accordingly before the rate cuts hit.

I’ll leave you with a simple mantra: “AI with AI.” Leverage AI in your career and portfolio, with the tools of AI. Let ChatGPT turbocharge your productivity.

Let data-centric AI exchange-traded funds (ETFs) or stocks form the backbone of your investments. Because those who adopt these tools will dramatically outperform those who don’t.

In this new era, you don’t get extra points for doing it the old way. As investors, we must adapt or die. My playbook is clear – I’m a buyer of the future, and the future is AI.

Come join me on the right side of the “AI Rubicon,” and let’s hyper-grow our way to the new highs.

“Adopt the AI tools and own the AI stocks – or get left behind.”