Table Of Links

Abstract

1. Introduction

2. Constant function markets and concentrated liquidity

- Constant function markets

- Concentrated liquidity market

3. The wealth of liquidity providers in CL pools

- Position value

- Fee income

- Fee income: pool fee rate

- Fee income: spread and concentration risk

- Fee income: drift and asymmetry

- Rebalancing costs and gas fees

4. Optimal liquidity provision in CL pools

- The problem

- The optimal strategy

- Discussion: profitability, PL, and concentration risk

- Discussion: drift and position skew

5. Performance of strategy

- Methodology

- Benchmark

- Performance results

6. Discussion: modelling assumptions

- Discussion: related work

7. Conclusions And References

Discussion: Modelling Assumptions

This section summarises our modelling assumptions and discusses their implications, strengths, and weaknesses.

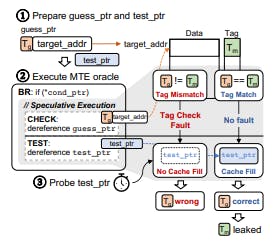

Continuous trading. Our model assumes continuous repositioning of the LP’s position. However, when interacting with blockchains, updates occur at the block validation frequency. For instance, the Ethereum network’s blocks are validated every 13 seconds, on average.

Moreover, within each block, the transactions form a (random) queue that determines the priority with which they are executed. Finally, price formation in Ethereum blockchains leads to sandwich attacks; see Capponi et al. (2023b) for more details. Our model can be extended to include delays inherent to blockchains and we refer the reader to the work in Cartea and Sanchez-Betancourt ´ (2021) and Cartea et al. (2021).

Rebalancing. Continuous repositioning requires rebalancing the LP’s assets which incurs costs as discussed in Section 3.3. To model this aspect, we assume that the LP pays costs that are proportional to the quantity of asset Y held in the pool. In practice, the exact costs depend on variations in the holdings between two consecutive liquidity positions.

Thus, liquidity provision strategies should balance large variations in the holdings with fee revenue, PL, and concentration cost. However, the nonlinearity in the CL constant product formula complicates the mathematical modelling of this aspect of trading costs. Moreover, rebalancing costs depend on the cost structure of the trading venue where rebalancing trades are executed.

Gas fees. Our model assumes that gas fees paid by the LP to interact with the blockchain are flat and constant. In practice, gas fees are stochastic and depend on exogenous factors such as the price of electricity and network congestion. These could be included in our model by considering a stochastic gas fee that is observed by the LP.

Also, our model is optimal when the spread of liquidity position is continuously adjusted to account for changes in the stochastic drift and

profitability of liquidity taking according to (23). Thus, profitable liquidity provision using our strategy requires a large initial wealth to overcome gas fees from continuous trading.

However, we expect the strategy to remain profitable in discrete time when the stochastic drift µ and the stochastic profitability π remain stable, so the LP only rebalances her liquidity position when either the drift µ or the pool fee rate π undergo large changes.

Concentration costs. The specific microstructure of CL markets features a new type of investment risk which we refer to as concentration risk. To capture the losses due to concentration risk in a continuous-time framework, we introduced an instantaneous cost which is inversely proportional to the spread of the LP’s position, and we showed that it captures the losses due to concentration risk accurately. In practice, LPs must tailor the estimation of the concentration cost parameter γ in (12) to the rebalancing frequency and to the volatility of the marginal rate Z.

Asymmetry. Our model assumes a fixed relation between the asymmetry of the LP’s position and the drift in the marginal rate. This relation fits observed data but also leads the LP to skew the position to capture more LT trades and to profit from expected rate movements. Future work will consider a richer characterization of the asymmetry because it may be desirable for LPs to adjust the asymmetry of their position as a function of other state variables or as a controlled variable

Fee dynamics. Our model assumes that the distribution of fee revenue π among LPs is stochastic and proportional to the size of the pool to reflect that large pools attract more trading flow because trading is cheaper. We also make the simplifying assumption that fees are uncorrelated to the price. In practice, the dynamics of fee revenue may be correlated to those of the volatility of the rate, which is also related to the concentration cost parameter γ. Future work will consider more complex relations among these variables.

Profitability condition. We impose specific dynamics for the fee rate π such that it satisfies a profitability condition (19) that allows us to obtain an admissible strategy. While we use this constraint to solve the optimal liquidity provision problem, it also represents an adequate and natural measure for LPs to assess the profitability of liquidity provision in different pools before depositing their assets.

Constant volatility. At present, CFMs with CL mainly serve as trading venues for crypto-assets which are better described with a diffusion model with stochastic volatility. It is straightforward to extend our strategy to this type of models.

Market impact. Finally, our analysis does not take into account the impact of liquidity provision on liquidity taking activity, however, we expect liquidity provision in CPMs with CL to be profitable in pools where the volatility of the marginal rate is low, where liquidity taking activity is high, and when the gas fee cost to interact with the liquidity pools is low. These conditions ensure that the fees paid to LPs in the pool, adjusted by gas fees and concentration cost, exceed PL so liquidity provision is viable.

6.1. Discussion: related work

Closest to this work are the strategic liquidity provision models proposed in Fan et al. (2021) and Fan et al. (2022) which also consider CL markets. Both models allow LPs to compute liquidity positions over different intervals centered around the marginal rate within a given time horizon; Fan et al. (2021) only consider static LP strategies which do not use of reallocations, and Fan et al. (2022) reposition liquidity whenever the price is outside of the position range.

Both approaches only focus on maximising fee revenue and rely on approximations of the LP’s objective and use Neural Networks to obtain context-aware approximate strategies. In contrast, our model leads to closed-form formulae that explicitly balance fee revenue with concentration risk, predictable loss, and rebalancing costs, while allowing LPs to use price signals (potentially based on exogenous information) to improve trading performance.

:::info

Authors:

- Alvaro Cartea ´

- Fayc¸al Drissia

- Marcello Monga

:::

:::info

This paper is available on arxiv under CC0 1.0 Universal license.

:::